Market Insights

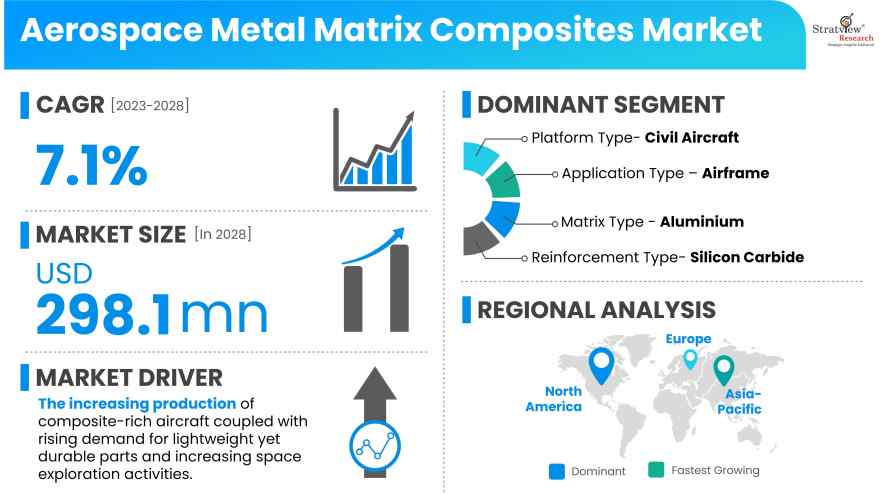

"The global aerospace metal matrix composites market is projected to grow at a healthy 7.1% CAGR over the next five years to reach US$ 298.1 million by 2028."

Want to get a free sample? Register Here

Metal matrix composite (MMC) is a type of advanced material that consists of a metal matrix (such as aluminum or titanium) reinforced with particles, fibers, or whiskers to create a composite material with enhanced properties. These reinforcements significantly enhance the mechanical, thermal, and electrical properties of the composite material.

The insistent need for lightweight materials to augment the performance of civil, military, and spacecraft is constantly driving the development of high-performance structural materials. Composite materials have earned significant traction in the aerospace industry, owing to their excellent track record of more than five decades. However, the inadequacy of a single or group of materials to fulfill all the stringent requirements of the aerospace industry, along with keeping a check on both economy and performance, has led to an increased focus on new materials, including metal matrix composites.

|

Aerospace Metal Matrix Composites Market Report Overview

|

|

Market Size in 2028

|

USD 298.1 Million

|

|

Market Growth (2023-2028)

|

CAGR of 7.1%

|

|

Base Year of Study

|

2022

|

|

Trend Period

|

2017-2021

|

|

Forecast Period

|

2023-2028

|

Market Dynamics

Market Drivers

Increasing production of composite-rich aircraft coupled with rising demand for lightweight yet durable parts and increasing space exploration activities are the prime drivers for the sustainable demand for metal matrix composites in the aerospace industry.

MMCs have an excellent track record in the aerospace industry as the material offers numerous advantages, such as a high strength-to-weight ratio, excellent corrosion resistance, excellent fatigue strength, lightweight, and excellent durability, over its rivals including cast iron. The material is a suitable claimant addressing many challenges of industry including lightweight products, thus attracting the stakeholders of the aerospace industry to invest in this unique material. MMCs are increasingly witnessing greater penetration in not only the airframe parts of next-generation aircraft but also in other critical applications, such as landing gears and fan exit guide vanes.

In the last two decades, researchers and manufacturers in the aerospace industry have paid significant attention and interest to MMCs, owing to their exceptional properties and performance. The metal matrix composites offer an outstanding strength-to-weight ratio, making them particularly well-suited for aerospace applications where weight reduction is of paramount importance to enhance fuel efficiency and overall operational performance.

COVID-19 Impact

The COVID-19 pandemic led to a sharp decline in air travel, reducing demand for new aircraft and high-performance structural materials like MMCs. The aerospace metal matrix composites market, being substantial in scale, was not immune to these prevailing circumstances and experienced a substantial downturn (24%+ in 2020). In 2021, the market experienced a recovery due to an increase in air passenger traffic, followed by excellent growth in 2022.

Segments Analysis

|

Segmentations

|

List of Sub-Segments

|

Dominant and Fastest-Growing Segments

|

|

Application Type

|

Airframe, Engine Components, Landing Gears, Avionics, and Others

|

Airframe occupies the forefront as the predominant application, whereas avionics is anticipated to demonstrate the fastest growth in the market.

|

|

Platform Type

|

Civil Aircraft, Military Aircraft, and Space

|

Civil aircraft is anticipated to remain the dominant platform and is also expected to experience the fastest growth in the market.

|

|

Matrix Type

|

Aluminum, Titanium, and Others

|

Aluminium holds a predominant position as the primary matrix in the market.

|

|

Reinforcement Type

|

Silicon Carbide, Aluminum Oxide, and Others

|

Silicon Carbide maintains a leading role as the primary reinforcement in the market.

|

|

Reinforcement Form Type

|

Continuous, Discontinuous, and Others

|

Continuous stands out as the prevailing reinforcement form type in the market.

|

|

Process Type

|

Solid State Processing, Liquid State Processing, and Others

|

Solid-state processing is expected to remain the most preferred process in the market.

|

|

Regional Analysis

|

North America, Europe, Asia Pacific, and The Rest of the World

|

North America is expected to remain the dominant market over the next five years, whereas Asia-Pacific is likely to grow at the fastest rate.

|

By Application Type

“Airframe segment dominates the market during the forecast period.”

The aerospace metal matrix composites market is segmented into airframes, engine components, landing gears, avionics, and others. Airframe is expected to remain the largest application type in the market, whereas avionics is likely to remain the fastest during the forecast period.

The airframe is subject to repetitive loading and unloading cycles, which can lead to fatigue failure over time. MMC has demonstrated good fatigue resistance, extending the operational lifespan of aircraft. MMC also offers a high strength-to-weight ratio, high structural integrity, excellent corrosion resistance, and high-temperature performance, which makes it highly attractive for airframe applications.

By Platform Type

“Civil aircraft is anticipated to remain the largest and fastest-growing aircraft type in the market during the forecast period.”

The market is segmented into civil aircraft, military aircraft, and space. Increasing the production rate of key aircraft programs, the introduction of fuel-efficient aircraft, the entry of new aircraft programs, and growing fleet size are key factors fuelling market growth during the forecast period.

Landing gears are manufactured using metal matrix composites in the best-selling aircraft B787. Also, the growing utilization of metal matrix composites in the space industry is poised to stimulate market expansion. Key applications in this category include space shuttle orbiters, Hubble space telescopes, communication systems, and spacecraft structures.

By Matrix Type

“Aluminum dominates the market during the forecast period.”

The market is segmented into aluminum, titanium, and others. Aluminum is expected to persist as the foremost matrix type in the market during the forecast period. It is often favored in the aerospace industry due to its low weight and cost-effectiveness properties.

Titanium is expected to remain the fastest-growing matrix type in the market during the forecast period owing to its numerous advantages, such as its high-strength-to-weight ratio, high tensile and compressive strength, low coefficient of thermal expansion, and high fatigue resistance.

By Reinforcement Type

“Silicon carbide dominates the market during the forecast period.”

The market is segmented into silicon carbide, aluminum oxide, and others. Silicon carbide is poised to uphold its prominent status as the dominant reinforcement type in the market during the forecast period owing to its lightweight, high strength and stiffness, high-temperature resistance, abrasion, fatigue, and corrosion resistance properties.

By Reinforcement Form Type

“Continuous reinforcement dominates the market during the forecast period.”

The market is segmented into continuous, discontinuous, and particulate. Continuous reinforcement is projected to remain dominant in the market during the forecast period, as it provides a high level of strength and stiffness to the composite material, which is crucial for structural components in aircraft that need to withstand high loads and stresses.

Regional Analysis

“North America is expected to remain the dominant market for aerospace metal matrix composites during the forecast period.”

The USA is likely to remain the growth engine of the region’s market as it is the manufacturing hub of the aerospace industry with the presence of raw material suppliers, metal matrix composite suppliers, tier players, OEMs, airlines, space agencies, private space companies, aircraft leasing companies, and MRO players.

Asia-Pacific is estimated to remain the fastest-growing market for metal matrix composites in the foreseeable future. Emerging economies, such as China and India, in the region are investing heavily in the aerospace industry.

Want to get a free sample? Register Here

Key Players

The market is moderately populated, with the presence of some regional and global players. Most of the major players compete on some of the governing factors, including price, regional presence, etc.

The following are the key players in the aerospace metal matrix composites market (arranged alphabetically).

- 3M

- AMETEK, Inc.

- CPS Technologies Corporation

- DWA Aluminium Composite USA, Inc.

- Materion Corporation

- Plansee SE

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Write to us at [email protected]

Report Features

This report provides market intelligence most comprehensively. The report structure has been kept such that it offers maximum business value. It provides critical insights into the market dynamics and will enable strategic decision-making for the existing market players as well as those willing to enter the market.

What Deliverables Will You Get in this Report?

|

Key questions this report answers

|

Relevant contents in the report

|

|

How big is the sales opportunity?

|

In-depth analysis of the Aerospace Metal Matrix Composites Market

|

|

How lucrative is the future?

|

The market forecast and trend data and emerging trends

|

|

Which regions offer the best sales opportunities?

|

Global, regional, and country-level historical data and forecasts

|

|

Which are the most attractive market segments?

|

Market Segment Analysis and Forecast

|

|

Who are the top players and their market positioning?

|

Competitive landscape analysis, Market share analysis

|

|

How complex is the business environment?

|

Porter’s five forces analysis, PEST analysis, Life cycle analysis

|

|

What are the factors affecting the market?

|

Drivers & challenges

|

|

Will I get the information on my specific requirements?

|

10% free customization

|

Research Methodology

This strategic assessment report, from Stratview Research, provides a comprehensive analysis that reflects today’s aerospace metal matrix composites market realities and future market possibilities for the forecast period. The report segments and analyzes the market in the most detailed manner to provide a panoramic view of the market. The vital data/information provided in the report can play a crucial role for market participants as well as investors in the identification of the low-hanging fruits available in the market as well as formulate growth strategies to expedite their growth process.

This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools.

More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data. We conducted more than 15 detailed primary interviews with market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Customization Option

With this detailed report, Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

- Detailed profiling of additional market players (up to three players)

- SWOT analysis of key players (up to three players)

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Product portfolio, geographical reach, regional presence, and strategic alliances

Custom Research: Stratview Research offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected].

Recent Market News

- In March 2021, Alvant, a prominent expert in the production of metal matrix composite (MMC) materials, entered into a Memorandum of Understanding (MoU) aimed at advancing a strategic partnership with the advanced materials technology firm 3M. This collaboration is intended to expedite the enhancement of Alvant's capabilities and the discovery of practical applications in real-world scenarios.