Market Dynamics

Introduction

Connected cars are vehicles equipped with internet connectivity and communication technologies that enable them to interact with other devices, vehicles, infrastructure, and networks. These vehicles integrate advanced hardware and software solutions to support features such as real-time navigation, remote diagnostics, telematics, infotainment, vehicle-to-everything (V2X) communication, and over-the-air (OTA) updates. By leveraging sensors, embedded modules, and smartphone integration platforms, connected cars enhance driver convenience, passenger safety, and overall vehicle efficiency while laying the foundation for autonomous mobility.

The connected cars market has witnessed rapid growth in recent years, driven by rising consumer demand for smart mobility, increasing regulatory mandates for safety and telematics, and the growing adoption of 4G and 5G technologies. Automakers are increasingly partnering with technology providers to integrate connected platforms, while mobility service operators are utilizing connected solutions to optimize ride sharing, fleet management, and usage-based insurance models. Furthermore, the rise of electric vehicles (EVs) and autonomous driving technologies is accelerating the deployment of connected systems, making them a central element of the automotive industry’s digital transformation. With advancements in IoT, artificial intelligence, and cloud computing, the market is poised to expand significantly, offering new revenue streams for OEMs, suppliers, and service providers.

Recent Market JVs and Acquisitions:

A large number of strategic alliances, including M&As, JVs, etc., have been performed over the past few years:

- In 2020, TVS Motor Company acquired Intellicar Telematics, a fleet management and connected mobility solutions provider. The acquisition supports TVS in building advanced digital mobility services, expanding its telematics capabilities, and improving connected two-wheeler offerings in India.

- In 2022, Stellantis acquired aiMotive, a Hungary-based autonomous driving technology company specializing in AI and vision-based solutions. This acquisition strengthens Stellantis’ STLA AutoDrive platform and accelerates its roadmap for connected and autonomous mobility.

- In 2022, Spinny, an Indian used-car retail platform, acquired Scouto, a connected car startup offering real-time vehicle diagnostics and performance dashboards. The deal allows Spinny to enhance its data-driven ownership experience and strengthen aftermarket services.

- In 2023, as part of a strategic move to enhance their connected car platforms and mobility solutions in India, Hyundai and Kia acquired less than 5% shareholding in Ola and its subsidiary OEMPL. This partnership focuses on fleet operations, the development of electric vehicles, and the e-mobility business in India.

- In 2024, [Maruti Suzuki and Bharti Airtel] established a strategic alliance called SmartDrive to expand connected car services across rural and urban markets, leveraging cellular connectivity infrastructure and IoT-based vehicle management solutions.

Recent Product Development:

The companies are focusing their product development efforts on AI-powered voice assistants in regional languages, predictive maintenance systems adapted for driving conditions, advanced vehicle tracking solutions for fleet management, and digital payment integration for fuel and toll services. Some of the recent product developments are:

- In 2024, Tata Motors launched the Harman Ignite Platform in its passenger vehicles. This platform is fully compliant with the Android Automotive Operating System (AAOS) standard, connecting original equipment manufacturers (OEMs) with developers to provide consumers with unique in-vehicle digital experiences. The platform aims to enhance user experience by integrating advanced infotainment and connectivity features.

- In 2024, Kia Motors confirmed the expected launch of the EV9 electric SUV and the new-generation Carnival 2024. The EV9 will be equipped with features such as a Level 2 Advanced Driver Assistance Systems (ADAS) suite, dual digital screens, connected car technology, electrically adjustable seats for the second row, a powered tailgate, and multi-zone climate control, among other features.

- In 2024, Stellantis rolled out connected services including a ChatGPT-powered virtual assistant, an AppMarket for in-vehicle subscriptions, and e-Routes for battery-electric vehicles. These innovations improve driver-vehicle interaction, optimize EV routing, and expand digital offerings in their connected car ecosystem.

- In 2024, Huawei launched the AITO M5 Ultra electric SUV with advanced driver assistance systems (ADS 3.3), 192-line LiDAR, and multiple mmWave radars. This development enhances autonomous driving capabilities and accelerates LiDAR adoption in non-luxury vehicles.

- In 2024, WirelessCar introduced a cloud-based Digital Key Management system, enabling secure, smartphone-based vehicle access. This product complies with Car Connectivity Consortium standards and enhances both convenience and security for vehicle owners.

- In 2024, Harman International launched its Ready Upgrade Base and Advanced domain controllers, modular hardware and software units designed to keep in-vehicle systems up to date over long vehicle lifecycles, enhancing infotainment and instrument cluster performance.

Segments Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High-Growth Opportunity

|

|

Service Type Analysis

|

Telematics, Navigation, Remote Diagnostics, Multimedia Streaming, OTA Updates, eCall & Emergency Assistance, Other Services

|

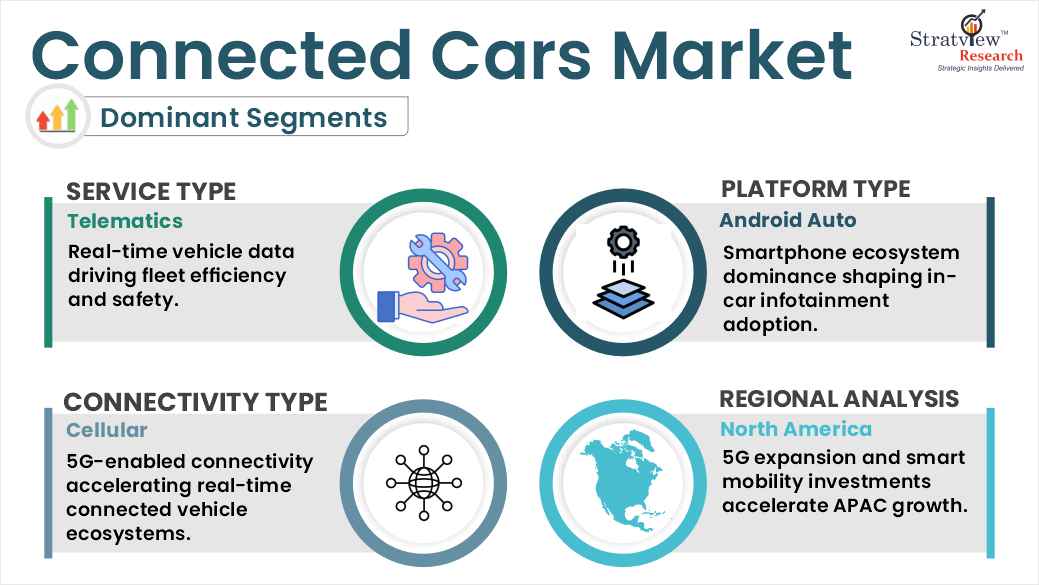

Telematics currently dominates the market, while OTA Updates are expected to witness the highest growth.

|

|

Form Factor-Type Analysis

|

Embedded, Integrated, Tethered

|

Embedded solutions hold the largest market share, whereas Integrated systems are anticipated to grow fastest.

|

|

Platform-Type Analysis

|

Android Auto, Apple CarPlay, MirrorLink, Other Platforms

|

Android Auto dominates due to widespread Android smartphone adoption, while Apple CarPlay is expected to experience significant growth.

|

|

Connectivity-Type Analysis

|

Cellular, DSRC, Satellite

|

Cellular connectivity is expected to lead the connected car market throughout the forecast period.

|

|

Region Analysis

|

North America, Europe, Asia-Pacific, and The Rest of the World

|

North America holds a significant share of the dairy enzymes market, whereas the Asia-Pacific region is likely to grow at the fastest rate.

|

By Service Type

“The Telematics segment is expected to witness continued market leadership during the forecast period.”

Based on service, the market is segmented into telematics, navigation, remote diagnostics, multimedia streaming, OTA updates, eCall & emergency assistance, and other services.

Telematics is currently the dominant service segment, as it provides real-time monitoring of vehicle health, predictive maintenance, fuel efficiency tracking, fleet management solutions, and insurance telematics. Fleet operators, logistics companies, and insurance providers are increasingly using telematics to optimize operational efficiency, reduce costs, and enhance safety standards.

Whereas OTA Updates represent the fastest-growing service segment, driven by automakers’ need to remotely upgrade vehicle software, improve infotainment systems, fix security vulnerabilities, and introduce new features without requiring dealership visits. The rapid adoption of OTA services is also fueled by the increasing integration of advanced driver assistance systems (ADAS) and smart infotainment systems in both passenger and commercial vehicles, reflecting a shift toward smarter and more connected mobility. Ride-sharing services also contribute to connectivity growth, as platforms leverage vehicle connectivity for dynamic fleet management, route optimization, and real-time data sharing with passengers and drivers.

By Form Factor

“Embedded solutions are expected to maintain market dominance while Integrated systems will experience the fastest growth during the forecast period.’’

The connected cars market is segmented by form factor into Embedded, Tethered, and Integrated solutions. Embedded systems dominate the market because they are pre-installed by automakers into vehicles’ hardware, offering seamless connectivity without relying on external devices. These systems enable uninterrupted access to telematics, navigation, infotainment, safety alerts, and vehicle diagnostics, making them highly reliable for both passenger and commercial vehicles.

Integrated systems are emerging as the fastest-growing segment, combining multiple functions such as navigation, infotainment, vehicle diagnostics, and smartphone integration into a single platform. These systems appeal to consumers looking for a unified, high-tech in-car experience. Tethered systems, which rely on external devices like smartphones for connectivity, have a smaller market share due to limited convenience, but they remain popular in entry-level vehicles due to low costs. The growth of integrated systems is further accelerated by increasing consumer demand for premium and mid-range vehicles equipped with advanced features, as well as the rise of smart mobility solutions in urban areas.

By Platform Type

“Android Auto dominates due to widespread Android smartphone adoption, while Apple CarPlay is expected to experience significant growth.”

Connected car platforms include Android Auto, CarPlay, and MirrorLink. Android Auto currently dominates the market due to the widespread adoption of Android smartphones, broad app compatibility, and ease of integration with vehicle infotainment systems. This platform allows users to access navigation, music, communication apps, and other features directly from the car’s dashboard, improving convenience and safety.

CarPlay, Apple’s platform, is the fastest-growing segment, fueled by the rising penetration of iPhones and the growing preference among consumers for iOS-compatible vehicles. MirrorLink, though still present in select models, has limited adoption due to its smaller smartphone compatibility and slower market uptake. The popularity of multi-platform infotainment systems in new vehicles reflects automakers’ efforts to cater to diverse consumer preferences, enhance in-car user experience, and drive differentiation in the competitive automotive market.

Want to get more details about the segmentations? Register Here

By Connectivity Type

“Cellular connectivity remains the dominant technology in the connected cars market, whereas DSRC is expected to experience the most rapid expansion.”

The connectivity segment is divided into cellular and DSRC. Cellular connectivity dominates the market, leveraging the widespread availability of 4G networks and the ongoing rollout of 5G technology. Cellular networks allow vehicles to communicate in real-time with cloud services, navigation platforms, fleet management systems, and infotainment apps, enabling smart, connected mobility across cities and highways.

DSRC is the fastest-growing connectivity segment, supported by government initiatives to promote vehicle-to-everything (V2X) communication and intelligent transport systems (ITS). DSRC offers low-latency, high-speed communication between vehicles, roadside infrastructure, and pedestrians, which is critical for traffic safety, congestion management, and the development of autonomous driving technologies. The growth of DSRC is expected to accelerate as smart city projects and automotive safety regulations increasingly mandate V2X-enabled infrastructure and vehicles.

Regional Analysis

“North America holds a significant share of the connected cars market, whereas the Asia-Pacific region is likely to grow at the fastest rate.”

North America currently holds the largest share of the connected cars market, supported by strong technology adoption, robust automotive infrastructure, and regulatory initiatives promoting vehicle safety. The presence of leading automakers such as General Motors, Ford, and Tesla, combined with collaborations with technology giants like Google, Apple, and Qualcomm, has created a mature connected mobility ecosystem. The U.S. is at the forefront of deploying advanced telematics, over-the-air (OTA) updates, and autonomous driving trials, fueled by extensive 4G and 5G network coverage. Additionally, government mandates such as eCall and vehicle safety standards further drive adoption across both passenger and commercial vehicles.

Asia-Pacific is emerging as the fastest-growing region in the connected cars market, with rapid growth driven by large-scale automotive production, rising consumer demand for smart mobility, and government initiatives supporting intelligent transportation systems. China, Japan, South Korea, and India are at the center of this expansion, with strong contributions from automakers like Toyota, Hyundai, Honda, and SAIC, alongside technology players such as Huawei and Baidu. The rising penetration of 5G networks, growing investments in electric vehicles (EVs), and increasing adoption of ride-sharing and mobility-as-a-service (MaaS) platforms are accelerating connected car deployments. Furthermore, supportive policies around smart cities and V2X communications are strengthening the region’s leadership in next-generation mobility.