Attractive Opportunities

Global Demand Analysis & Sales Opportunities in Automotive Brake System Market

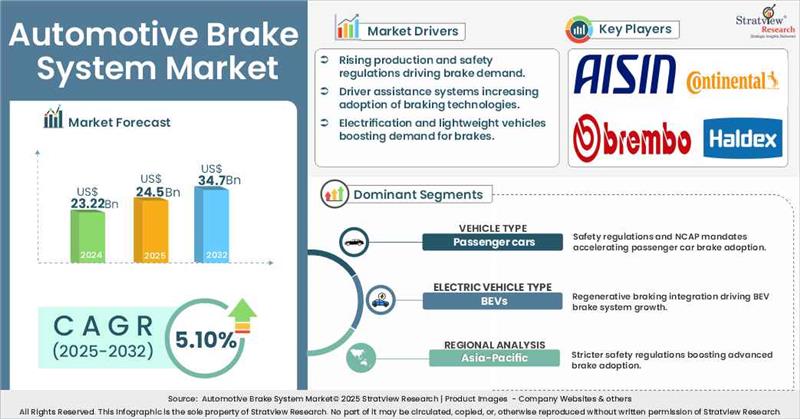

- The annual demand for automotive brake system market was USD 23.22 billion in 2024 and is expected to reach USD 24.5 billion in 2025, up 5.5% than the value in 2024.

- During the next 8 years (forecast period of 2025-2032), the automotive brake systemmarket is expected to grow at a CAGR of 5.10%. The annual demand will reach of USD 34.7 billion in 2032, which is almost 1.42 times (~42% up) of the demand in 2025.

- During 2025-2032, the automotive brake system industry is expected to generate a cumulative sales opportunity of USD 235.54 billion which is almost 2 times the opportunities during 2019-2024.

Want to get a free sample? Register Here

High-Growth Market Segments:

- Asia Pacific generated the highest demand in 2024, with high vehicle production rates, rapid urbanization, and government initiatives as the key growth drivers in the region.

- By vehicle type, passenger cars segment is projected to be the fastest-growing segment during the forecast period.

- By electric vehicle type, Battery Electric Vehicles (BEVs) segment is projected to be the dominant segment during the forecast period.

Market Statistics

Have a look at the sales opportunities presented by the automotive brake system market in terms of growth and market forecast.

Automotive Brake System Market Data & Statistics

|

Market Statistics

|

Value (in USD Billion)

|

Market Growth (%)

|

|

Annual Market Size in 2023

|

USD 22.18 billion

|

|

|

Annual Market Size in 2024

|

USD 23.22 billion

|

YoY Growth in 2024: 4.7%

|

|

Annual Market Size in 2025

|

USD 24.5 billion

|

YoY Growth in 2025: 5.5%

|

|

Annual Market Size in 2032

|

USD 34.7 billion

|

CAGR 2025-2032: 5.10%

|

|

Cumulative Sales Opportunity during 2025-2032

|

USD 235.54 billion

|

|

|

Top 10 Countries’ Market Share in 2024

|

USD 18.58 billion +

|

> 80%

|

|

Top 10 Company’s Market Share in 2024

|

USD 11.61 billion to USD 16.25 billion

|

50% - 70%

|

Market Dynamics

Introduction

What is automotive brake system systems?

Brake systems are a critical component of vehicle safety, providing control and ensuring reduced stopping distances in both passenger and commercial vehicles. As governments worldwide implement mandates for technologies such as Anti-lock Braking Systems (ABS), Electronic Stability Control (ESC), and Automatic Emergency Braking (AEB), The automotive brake system market is poised for substantial growth driven by rising vehicle production, stringent safety regulations, and growing consumer demand for advanced driver-assistance systems (ADAS). As OEMS are integrating electronic and regenerative braking solutions into their product lines, the surge in Battery Electric Vehicles (BEVs) and hybrid models will also accelerate the demand for regenerative and brake-by-wire systems.

Market Drivers:

Stringent Government Regulations regarding road safety:

- Government mandates to improve braking efficiency in both light- and heavy-duty vehicles are a key driver of the automotive brake systems market. For example, under ideal conditions, a passenger car traveling at 65 mph requires approximately 316 feet to stop, while a fully loaded truck requires around 525 feet. To address such disparities, the National Highway Traffic Safety Administration (NHTSA) introduced regulations in 2009 requiring heavy trucks to reduce stopping distances by 30%, ensuring they stop within 250 feet at 60 mph.

- Also, in April 2024, the Federal Motor Vehicle Safety Standard (FMVSS No. 127) introduced new requirements for Automatic Emergency Braking (AEB) systems in passenger cars and light trucks, with compliance effective from September 2029. These regulations, aimed at speeds up to 62 mph, are accelerating the adoption of advanced braking technologies across vehicle segments.

Market Challenges:

High Costs of implication:

- The cost of developing and maintaining advanced braking systems remains a major restraint. Regular maintenance involves expensive replacements such as brake pads, rotors, calipers, brake fluid, and other components. For example, ABS sensor replacement can cost between USD 150 to USD 400, while brake fluid replacement ranges from USD 90 to USD 200.

- In price-sensitive markets like India and Brazil, the high cost limits adoption of electronic braking technologies to premium vehicles. The additional expenses for upkeep deter wider usage, particularly in entry-level and economy models.

Market Opportunities:

Global Push for Mandatory AEB Systems:

- The market is witnessing strong growth opportunities as governments worldwide mandate Advanced Emergency Braking (AEB) systems. The UNECE has enforced new AEB standards for trucks and coaches since February 2023, and Regulation No. 152 now includes stricter vehicle-to-pedestrian performance requirements.

- Countries such as Japan have already mandated AEB for new cars from November 2021, with full compliance required by December 2025. The European Union followed with mandates for new models from May 2022, and for all vehicles by May 2024. In China, over 12 leading automakers had integrated AEB into nearly all vehicles by late 2021.

- With growing demand for safety features, increasing vehicle production, and the rise of autonomous and semi-autonomous driving, the AEB market is expected to expand rapidly, particularly in Asia-Pacific economies like China and India.

Segment Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High-Growth Opportunity

|

|

Brake Type Analysis

|

Disc Brake and Drum Brakes

|

Disc Brakes is projected to be the fastest growing segment during the forecast period.

|

|

Technology Type Analysis

|

ABS, ESC, TCS, EBD and AEB

|

Traction control system (TCS) is estimated to be the fastest growing segment during the forecast period.

|

|

Vehicle Type Analysis

|

Passenger Cars, Light Commercial Vehicles, Trucks, Buses

|

Passenger cars are anticipated to be the fastest-growing segment for the Automotive Brake System market during the forecast period.

|

|

Electric Vehicle Type Analysis

|

Battery Electric Vehicles (BEVs), Plug-in Hybrid Electric Vehicles (PHEVs)

|

BEVs are expected to be the dominant segment in the market during the forecast period.

|

|

Regional Analysis

|

North America, Europe, Asia-Pacific, South America, Middle East & Africa, and The Rest of the World

|

Asia-Pacific is expected to be the dominant and fastest-growing region over the forecasted period.

|

By Vehicle Type

“Passenger cars segment is projected to be the fastest-growing segment during the forecast period.”

- The automotive brake system market is segmented by vehicle type into passenger cars, light commercial vehicles, trucks, buses.

- Passenger cars segment is projected to be the fastest-growing segment during the forecast period. This dominance is primarily driven by government regulations mandating the adoption of safety technologies in compliance with UNECE standards, leading to increased integration of systems such as anti-lock braking systems (ABS) and electronic stability control (ESC) in passenger vehicles.

- In addition, global and regional New Car Assessment Programs (NCAPs) are compelling OEMs to equip vehicles with advanced braking systems such as ABS, electronic brakeforce distribution (EBD), and ESC. These initiatives aim to standardize braking technologies even across economy segments (below Class C), expanding the scope of brake system deployment.

By Electric Vehicle Type

“Battery Electric Vehicles (BEVs) segment to register highest CAGR during the forecast period.”

- The automotive brake system market is segmented by electric vehicle type into battery electric vehicles (BEVs), plug-in hybrid electric vehicles (PHEVs).

- Battery Electric Vehicles (BEVs) segment is projected to be the dominant segment during the forecast period. BEVs are universally equipped with regenerative braking systems, a key component for enhancing energy efficiency and maximizing driving range.

- BEVs also exhibit a higher penetration of connected and autonomous technologies, particularly in the luxury EV segment, supported by advancements in high-voltage batteries and fast-charging infrastructure. Leading brands such as Tesla, Mercedes-Benz, and Audi are expanding their EV portfolios with models incorporating cutting-edge regenerative braking systems.

Want to get more details about the segmentations? Register Here

Regional Analysis

“Asia Pacific is expected to be the dominant and fastest-growing region over the forecasted period.”

- Based on region, the automotive brake system market has been segmented into North America, Europe, Asia Pacific, and the Rest of the world.

- Asia Pacific is expected to be the dominant and fastest-growing region over the forecasted period. To enhance safety and attract safety-conscious consumers, OEMs such as Toyota, Hyundai, Honda, and Suzuki are now offering four-disc brake configurations with ABS in many of their new Class C models. There is also growing demand for premium and luxury vehicles equipped with advanced braking technologies, further fueling market growth.

- The use of air disc brakes is expanding in heavy commercial vehicles, especially in Japan and China. Regulatory frameworks across the region such as India’s mandate for ABS in minibuses and passenger cars since April 2019, promote the adoption of electronic safety systems, including ESC and traction control systems (TCS).

Competitive Landscape

Top Players

Most of the major players compete in some of the factors, including price, service offerings, regional presence, etc. The following are the key players in the automotive brake system market -

- Aisin Seiki Co, Ltd. (Japan)

- Brembo S.p.A (Italy)

- Continental AG (Germany)

- Haldex AB (Sweden)

- Hitachi Astemo, Ltd. (Japan)

- Knorr-Bremse AG (Germany)

- Mando Corporation (South Korea)

- Robert Bosch GmbH (Germany)

- ZF Friedrichshafen AG (Germany)

Note: The above list does not necessarily include all the top players in the market.

Are you a leading player in this market? We would love to include your name. Please write to us at sales@stratviewresearch.com

Recent Developments/Mergers & Acquisitions:

- In 2024, Brembo launched its PRO and PRO+ Brake Packages, with the PRO+ featuring a T-Drive finned disc and GP4 billet aluminum caliper, offering improved stiffness and braking performance.

- October 2024, Toyota Motor Corporation (Japan) announced a partnership with Suzuki Motor Corporation to jointly develop a new model designed exclusively as a battery electric vehicle (BEV).

- In October 2024, Akebono released its EURO and Severe Duty Ultra-Premium Disc Brake Pads, including new part numbers such as EUR1838, SDF1377A/B, and others, aimed at enhancing durability and braking efficiency across a wide range of vehicles.

- In early 2025, Haldex introduced ABS 4.0, a modular anti-lock braking system for trailers, enhancing safety and regulatory compliance with features like RollOver Control (ROC) and full TPMS support as required by R141 regulations effective May 2024.

Report Features

This report provides market intelligence most comprehensively. The report structure has been kept so that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market.

The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

- COVID-19 impact and its recovery curve.

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors.

|

Market Study Period

|

2019-2032

|

|

Base Year

|

2024

|

|

Forecast Period

|

2025-2032

|

|

Trend Period

|

2019-2023

|

|

Number of Tables & Figures

|

>100

|

|

Number of Segments Analysed

|

5 (Brake Type, Technology Type, Vehicle Type, Electric Vehicle Type and Region)

|

|

Number of Regions Analysed

|

4 (North America, Europe, Asia-Pacific, Rest of the World)

|

|

Countries Analysed

|

15 (The USA, Canada, Mexico, Germany, France, Italy, The UK, China, Japan, India, Brazil, Saudi Arabia, Rest of Europe, Rest of APAC, and Rest of the World)

|

|

Free Customization Offered

|

10%

|

|

After Sales Support

|

Unlimited

|

|

Report Presentation

|

Complimentary

|

|

Market Dataset

|

Complimentary

|

|

Further Deep Dive & Consulting Services

|

10% Discount

|

Market Segmentation

This report studies the market, covering a period of 15 years of trend and forecast. The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The automotive brake system market is segmented into the following categories:

By Brake Type

By Technology Type

- Anti-lock Braking System (ABS)

- Electronic Stability Control (ESC)

- Traction Control System (TCS)

- Electronic Brakeforce Distribution (EBD)

- Automatic Emergency Braking (AEB)

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Trucks

- Buses

By Electric Vehicle Type

- Battery Electric Vehicles (BEVs)

- Plug-in Hybrid Electric Vehicles (PHEVs)

By Region

- North America (Country Analysis: The USA, Canada, and Mexico)

- Europe (Country Analysis: Germany, France, The UK, Russia, and the Rest of Europe)

- Asia-Pacific (Country Analysis: China, Japan, India, and Rest of Asia-Pacific)

- Rest of the World (Country Analysis: Brazil, Saudi Arabia, and Others)

Research Methodology

- This strategic assessment report from Stratview Research provides a comprehensive analysis that reflects today’s automotive brake system market realities and future market possibilities for the forecast period.

- The report segments and analyzes the market in the most detailed manner to provide a panoramic view of the market.

- The vital data/information provided in the report can play a crucial role for market participants and investors in identifying the low-hanging fruits available in the market and formulating growth strategies to expedite their growth process.

- This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools.

- More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data.

- We conducted more than 15 detailed primary interviews with market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Report Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respected clients:

Company Profiling

- Detailed profiling of additional market players (up to three players)

- SWOT analysis of key players (up to three players)

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Service portfolio, geographical reach, regional presence, and strategic alliances

Custom Research: Stratview Research offers custom research services across industries. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to sales@stratviewresearch.com