Market Insights

The automotive gasoline direct injection tubing market size was USD 334 million in 2023 and is likely to grow at a CAGR of 1.5% during 2024-2030 to reach USD 401 million in 2030.

Wish to get a free sample? Register Here

Market Dynamics

Introduction

Gasoline Direct Injection (GDI) tubing is a critical component used in modern automotive engines equipped with GDI technology. GDI engines directly inject fuel into the combustion chamber at high pressure, offering advantages such as improved fuel efficiency, increased power output, and reduced emissions compared to traditional fuel injection systems. GDI tubing is designed to withstand high pressures and temperatures, ensuring efficient fuel delivery and system integrity.

These tubes are typically made from high-grade materials like stainless steel to resist corrosion and wear, ensuring durability and longevity. The automotive GDI tubing market is poised for significant growth over the coming decade, driven by advancements in GDI technology, increasing adoption in vehicles, and regulatory pressures to reduce emissions.

With continuous innovation and expansion into new markets, the demand for high-performance GDI tubing will likely continue to rise, offering opportunities for manufacturers and suppliers in the automotive industry. The rise in electric vehicle adoption could limit the growth of GDI technology in the long term. However, for the foreseeable future, GDI remains a critical technology for traditional ICE vehicles and hybrid vehicles.

Market Drivers

Several factors are propelling the growth of the automotive GDI tubing market:

- The automotive industry's shift towards more fuel-efficient and high-performance engines is driving the demand for GDI technology. GDI engines are becoming increasingly popular in passenger vehicles and light commercial vehicles due to their ability to reduce fuel consumption and emissions, directly impacting the demand for high-quality GDI tubing.

- The global rise in vehicle production, especially in emerging economies, is boosting the demand for GDI engines and their components. As automotive manufacturers increasingly adopt GDI technology to meet consumer demand for more efficient and powerful vehicles, the market for GDI tubing is expected to grow significantly.

- The rising trend of high-end car usage, higher power output, and enhanced dynamics of car driving is driving GDI Systems.

- Rapid urbanization, rising disposable income, and increasing motorization in developing economies, coupled with the rising trend of high-end cars with higher power output, are driving the demand for GDI technology, ultimately fueling the automotive GDI tubing market.

- Hybrid and plug-in hybrid vehicles are being fitted with GDI technology; hence, opening new opportunities in the ever-evolving applications of GDI systems from just gasoline cars.

Segments Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High Growth Opportunity

|

|

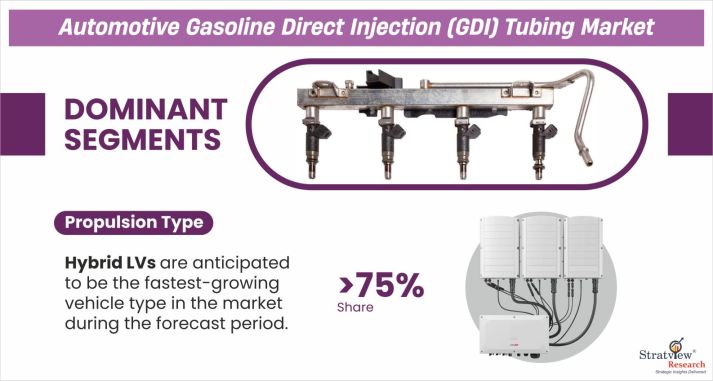

Propulsion-Type Analysis

|

ICE Light Vehicles and Hybrid Light Vehicles

|

Hybrid LVs are anticipated to be the fastest-growing vehicle type in the market during the forecast period.

|

|

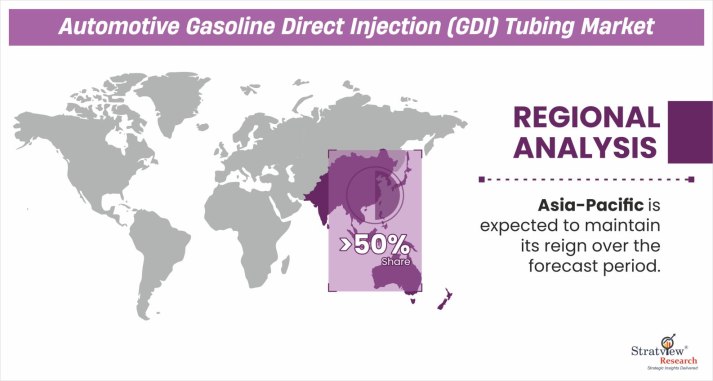

Regional Analysis

|

North America, Europe, Asia-Pacific, and The Rest of the World

|

Asia-Pacific is expected to maintain its reign over the forecast period.

|

By Propulsion Type

“ICE Light Vehicles are anticipated to hold the major share of the market. Hybrid Light Vehicles are expected to be the fastest-growing vehicle type during the forecast period.”

- The automotive GDI tubing market is segmented into ICE Light Vehicles and Hybrid Light Vehicles.

- GDI technology is specifically designed for gasoline engines; the large installed base of ICE vehicles directly contributes to sustained demand for GDI tubing.

- However, the market share of ICE light vehicles is expected to decline steadily as the adoption of hybrids and battery electric vehicles accelerates. While ICE vehicles currently dominate the global automotive business, projections show their share will decrease over the coming years, resulting in lower demand for GDI-related components like tubing.

- The global automotive business is transitioning towards electrified powertrains, with hybrid vehicles acting as an intermediary between traditional ICE vehicles and fully electric vehicles (EVs).

- As the production of hybrid light vehicles continues to increase worldwide, the demand for GDI technology in these vehicles is also growing.

- Major markets, such as Asia-Pacific, Europe, and North America, are experiencing growth in hybrid vehicle sales, further contributing to the expansion of the GDI technology for this propulsion. This, in turn, is fueling the growth of the GDI tubing market.

Want to get more details about the segmentations? Register Here

Regional Insights

“Asia-Pacific is expected to remain the largest market for automotive GDI tubing during the forecast period.”

- Asia-Pacific, particularly countries like China, India, Japan, and South Korea, is the largest automotive market in the world, accounting for a significant share of global vehicle production.

- GDI technology is gaining popularity in the Asia-Pacific region due to its ability to improve fuel efficiency and lower emissions. As countries in the region implement stricter fuel economy regulations and emission standards, automakers are incorporating GDI systems to meet these requirements.

- Asia-Pacific is home to some of the world's largest automotive manufacturers, including Toyota, Honda, Hyundai, Kia, Nissan, Suzuki, and several major Chinese automakers. The presence of a large manufacturing base ensures a steady and robust demand for GDI components, including tubing.

Know the high-growth countries in this report. Register Here

Key Players

The following are the key players in the market (arranged alphabetically):

- Alleima (formerly Sandvik Materials Technology)

- Centravis

- Fischer Group

- Mannesmann Stainless Tubes GmbH

- Maruichi Stainless Tube Co., Ltd.

- Nippon Steel Corporation

- Plymouth Tube Company

- Shanghai Kechun Precision Seamless Tube Co., Ltd.

- Tris Tube Co., Ltd.

- Usui International Corporation

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Write to us at [email protected]

Research Methodology

This strategic assessment report, from Stratview Research, provides a comprehensive analysis that reflects today’s automotive gasoline direct injection tubing market realities and future market possibilities for the forecast period of 2024 to 2030. After a continuous interest in our automotive gasoline direct injection tubing market report from the industry stakeholders, we have tried to further accentuate our research scope to the automotive gasoline direct injection tubing market to provide the most crystal-clear picture of the market. The report segments and analyses the market in the most detailed manner to provide a panoramic view of the market. The vital data/information provided in the report can play a crucial role for the market participants as well as investors in the identification of the low-hanging fruits available in the market as well as to formulate the growth strategies to expedite their growth process.

This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools. More than 1000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data. We conducted more than 15 detailed primary interviews with the market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Report Features

This report provides market intelligence in the most comprehensive way. The report structure has been kept such that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market. The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

- COVID-19 impact and its recovery curve

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors

Market Segmentation

This report studies the market, covering a period of 12 years of trends and forecasts. The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The automotive gasoline direct injection tubing market is segmented into the following categories:

By Propulsion Type

- ICE Light Vehicles

- Hybrid Light Vehicles

By Region

- North America (Country Analysis: the USA, Canada, and Mexico)

- Europe (Country Analysis: Germany, France, the UK, Russia, Spain, and Rest of Europe)

- Asia-Pacific (Country Analysis: China, Japan, India, South Korea, and Rest of Asia-Pacific)

- Rest of the World (Sub-Region Analysis: Latin America, the Middle East, and Others)

Report Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

- Detailed profiling of additional market players (up to three players)

- SWOT analysis of key players (up to three players)

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Service portfolio, geographical reach, regional presence, and strategic alliances.

Custom Research: Stratview Research offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected].