Market Insights

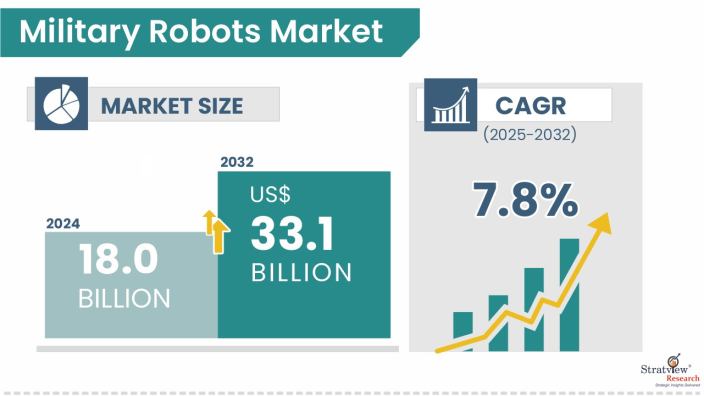

The military robots market was estimated at USD 18.0 billion in 2024 and is likely to grow at a CAGR of 7.8% during 2025-2032 to reach USD 33.1 billion in 2032.

Wish to get a free sample? Click Here

Market Dynamics

Introduction

Military robots include airborne, land and marine robots majorly deployed for the defense field of combat support, explosive ordnance disposal (EOD), firefighting, intelligence, surveillance and reconnaissance (ISR), mine clearance, search and rescue, transportation, and others. Military robots are very useful for reducing human death risk to an extent.

In adverse cases of war, there are numerous human casualties, such as suicidal missions. Robots have capabilities of advanced detection and sensors, as well as capabilities of autonomous decision-making. The capability of developing and programming the robot for a specific task. Military robots can be equipped with heavy weapons and can control these weapons much more efficiently than human soldiers.

Market Drivers

The military robots market is driven by a host of factors, some of which are noted below:

- Increasing military budgets across the globe have significantly contributed to the growth of military robots in the market.

- They are increasing military expenditure in developing and developed countries, including the US, Europe, Germany, China, and Japan.

- An increase in military and defense spending is expected to result in an overall increase in adopting advanced technologies in the military sector.

- Rising concern for strengthening the defense and military sector is expected to facilitate the deployment of robots in the security surveillance and army sectors.

- Advanced detection capabilities and sensors help robots in autonomous decision-making; this increases operation efficiency.

- Military robots can be equipped with heavy weapons and can control them much more efficiently than human soldiers, making them a choice for defense personnel for deployment in times of crisis.

- Assisting combat operations and a decline in casualties due to replacing soldiers with robots.

However, Stringent Technology-Sharing Regulations and Rising Skepticism Regarding the Use of Automated Weaponized Robots are growth-restricting factors present in the market.

Government investments and funding to uplift military and defense capabilities are responsible for adopting advanced military and defense equipment that utilizes embedded systems. This contributes to the growth of the military embedded system market during the forecast period.

According to the government of the United States, the United States Department of Defense (DOD) invests heavily in streamlining Foreign Military Sales (FMS). Tactical Autonomous Combatant, ACER, Excalibur unmanned aerial vehicle, PETMAN, and Syrano are some of the military robots currently used in the military and defense sector.

The investment is majorly aimed at manufacturing and developing advanced and innovative products and weapons at reasonable prices for the military and defense sectors of the United States. According to the United States Department of Defense (DOD), the government of the United States spends more than 50% of its total budget annually on the military and defense sectors.

Key Players

The following are the key players in the military robots market (arranged alphabetically):

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Write to us at [email protected]

Segment Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High Growth Opportunity

|

|

Application Type Analysis

|

Combat support, explosive ordnance disposal (EOD), firefighting, intelligence, surveillance and reconnaissance (ISR), mine clearance, search and rescue, transportation, and others

|

Intelligence, surveillance, and reconnaissance (ISR) account for the largest market share in 2024 and will remain the biggest market for military robots in the forecast period.

|

|

Platform Type Analysis

|

Airborne robots, land robots, and marine robots

|

Land robots account for the largest market share in 2024, increasing the demand for military robots in warfare.

|

|

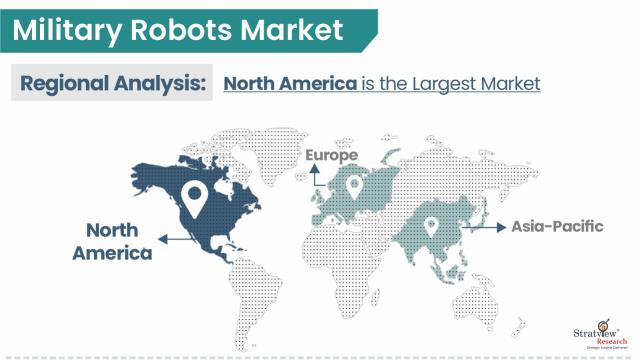

Regional Analysis

|

North America, Europe, Asia-Pacific, and Rest of the World

|

North America will likely maintain its supremacy in the market throughout the forecast period.

|

By Application Type

"Intelligence, surveillance, and reconnaissance (ISR) account for the largest market share in 2024."

The market is bifurcated into combat support, explosive ordnance disposal (EOD), firefighting, intelligence, surveillance, and reconnaissance (ISR), mine clearance, search and rescue, transportation, and others. Intelligence, surveillance, and reconnaissance (ISR) account for the largest market share in 2024 and will remain the biggest market for military robots in the forecast period.

AUVs, UGVs, USVs, UAVs, and ROVs are widely utilized in ISR applications. Moreover, increasing UAV adoption by the military globally is increasing the demand for military robots, which is expected to intensify.

By Platform Type

"Land robots account for the largest market share in 2024."

The market is segmented into airborne, land, and marine robots. Land robots account for the largest market share in 2024, increasing the demand for military robots in warfare. Due to the rising demand for land robots in counter-IED operations, warfare platforms are replaced by unmanned systems.

At the same time, marine robots are expected to experience the highest growth during the forecast period. The high growth is mainly attributed to the rising use of marine robots in detection, anti-submarine warfare, mine countermeasures, undersea surveillance, security, and inspection.

Regional Insights

"North America will likely maintain its supremacy in the market throughout the forecast period."

North America will likely maintain its supremacy in the market throughout the forecast period. The high military investment by the United States government is expected to facilitate the adoption of military robots in the defense sector of the US, which in turn is expected to contribute to the growth of the market in the North American region over the forecast period. Concurrently, Europe is expected to witness the fastest growth in the market during the forecast period. The key factors responsible for the swift growth are the continuous up-gradation in the European military and defense sector by upgrading warfare platform technologies. Major countries, including the U.K., Germany, and France, are investing a huge amount in the up-gradation and advancement of the military sector by introducing robotics and related platforms in defense.

Know the high-growth countries in this report. Register Here

Recent Developments

Several investments in the defense industry have been directed at military robots in recent years, which would boost the overall market. Some of them are:

- As per the Stockholm International Peace Research Institute, in April 2022, global military expenditure rose from 0.7% in 2021, which is expected to reach $2,113 billion. The 5 largest defense spenders in 2021 were the United States, the United Kingdom, India, China, and Russia, accounting for around 62% of total expenditure.

- According to the Department for Promotion of Industry and Internal Trade (DPIIT), from April 2020 to June 2021, the Foreign Direct Investment (FDI) equity flow in the Indian Defense sector was valued at $10.15 million.

- In August 2021, Milanion Group signed an MOU (memorandum of understanding) with the Ukrainian Armor, granting the distribution rights for an unmanned ground vehicle named Agema.

- In May 2021, The US armed forces planned to acquire 600 Centaur unmanned ground vehicles (UGV) valued at around $70 million from FLIR Systems.

- In July 2021, L3Harris Technologies delivered 122; T7 explosive ordnance disposal machines under project STARTER to the UK Ministry of Defence (MOD).

Research Methodology

This strategic assessment report, from Stratview Research, provides a comprehensive analysis that reflects today’s military robots market realities and future market possibilities for the forecast period of 2025 to 2032. After a continuous interest in our military robots market report from the industry stakeholders, we have tried to further accentuate our research scope to the military robots market to provide the most crystal-clear picture of the market. The report segments and analyzes the market in the most detailed manner to provide a panoramic view of the market. The vital data/information provided in the report can play a crucial role for the market participants as well as investors in the identification of the low-hanging fruits available in the market as well as to formulate the growth strategies to expedite their growth process.

This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools. More than 1000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data. We conducted more than 15 detailed primary interviews with the market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Report Features

This report provides market intelligence in the most comprehensive way. The report structure has been kept such that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market. The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

- COVID-19 impact and its recovery curve

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors

Market Segmentation

This report studies the market, covering a period of 12 years of trends and forecasts. The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The military robots market is segmented into the following categories:

By Application Type

- Combat support

- Explosive ordnance disposal (EOD)

- Firefighting

- Intelligence

- Intelligence, Surveillance and reconnaissance (ISR)

- Mine clearance

- Search and rescue

- Transportation

- Others

By Platform Type

- Airborne robots

- Land robots

- Marine robot

By Mode of Operation Type

- Autonomous

- Human-operated

By Region

- North America (Country Analysis: The USA, Canada, and Mexico)

- Europe (Country Analysis: Germany, France, The UK, Russia, and the Rest of Europe)

- Asia-Pacific (Country Analysis: China, India, Australia, South Korea, and the Rest of Asia-Pacific)

- Rest of the World (Country Analysis: Saudi Arabia, Brazil, and Others)

_78132.webp)

Click Here, to learn the market segmentation details.

Report Customization Options

Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

- Detailed profiling of additional market players (up to three players)

- SWOT analysis of key players (up to three players)

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Product portfolio, geographical reach, regional presence, and strategic alliances.

Custom Research: Stratview Research offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected].