Market Insights

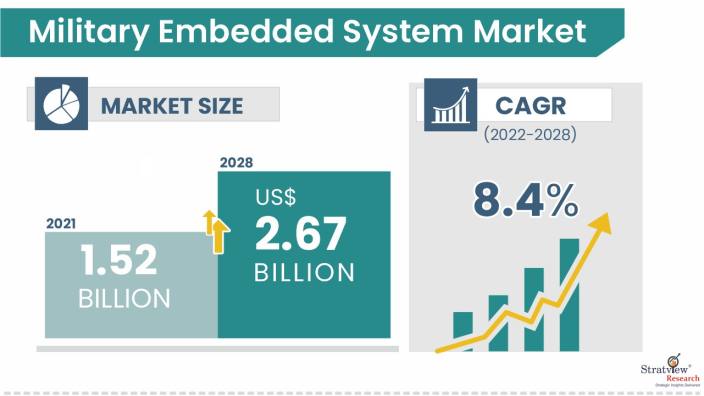

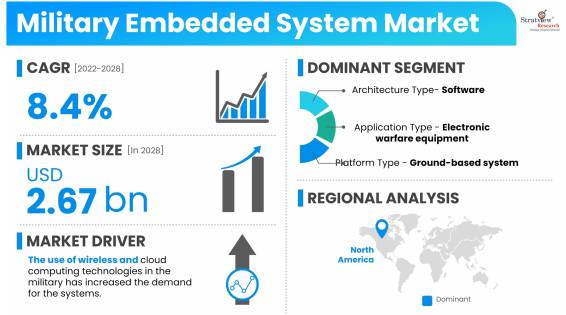

The military embedded system market was estimated at USD 1.52 billion in 2021 and is likely to grow at a CAGR of 8.4% during 2022-2028 to reach USD 2.67 billion in 2028.

Want to know more about the market scope? Register Here

Market Dynamics

Introduction

An embedded system is an amalgamation of hardware and software designed to perform specific computing tasks, unlike a general-purpose computer, which is engineered to manage a wide range of processing tasks. A typical embedded system is engineered to perform explicit tasks requiring fewer resources. Therefore, engineers may optimize size, cost, and power consumption while increasing the system's ruggedness, performance, use, and reliability.

Embedded systems have numerous military applications, as these systems are typically designed to real-time time constraints that ensure response deadlines, which are crucial for military operations. The military’s embedded systems include intelligence, surveillance, reconnaissance, communication, remote operations, and cyber security.

Market Drivers

The market is driven by a host of factors, some of which are noted below:

- Technological advancement in military-embedded systems is a major factor contributing to the market during the forecast period.

- Rising research and development in hardware for embedded systems and System-on-chip (SoC) design.

- Research and development in wireless communication technologies that support military communications (tactical communication).

- For instance, software-defined radio is a radio communication technology in which components are implemented using software instead of hardware on a computer or embedded system. It offers secured wireless nodes, allowing different military devices to communicate with each other in a protected location.

- System design certification for system upgradation is a major factor restraining the market.

- The expansion of the military embedded systems is intensified with multi-core processors and wireless technologies due to increased modern electronic warfare and network-centric operations.

- The use of wireless and cloud computing technologies in the military has increased the demand for the systems.

- A huge cost is incurred for obtaining certification for systems design after systems upgrades are made by manufacturers. This is due to the increased complexity of designs with technology advancements and stiff regulations concerning system design certifications.

Want to have a closer look at this market report? Click Here

According to Phys.org (a science, research, and technology news website), advanced embedded systems rarely consist of a single microcontroller. Instead, these consist of computing systems with several processors, accelerators, memories, hardware, peripherals, and buses. It provides high performance as well as high efficiency to military equipment.

According to the Linux Information Project (LINFO), embedded systems are a crucial part of control systems for military and defense equipment. Increasing military and defense expenditure and research and development in military equipment majorly contribute to the growth of the global military embedded systems market during the forecast period.

According to the Open Innovations Framework Program (FRUCT), under the European Space Agency project, the Space Wire standard ECSS-E-50-12A was developed through international efforts. It aims to develop embedded system hardware with requirements such as reliability, low power consumption, compact implementation in chips, EMC, etc.

Segment Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High Growth Opportunity

|

|

Architecture Type Analysis

|

Hardware and Software

|

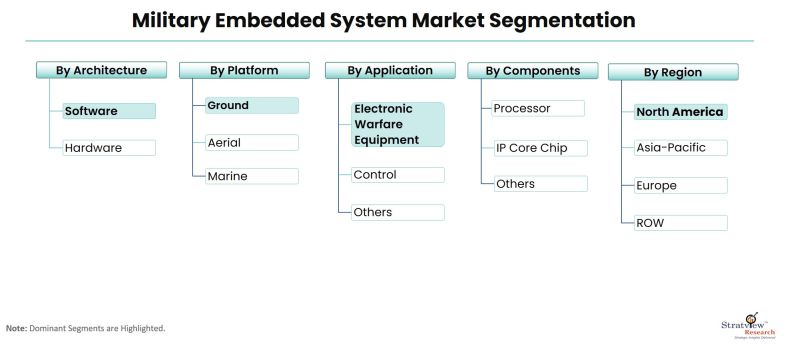

The software segment dominated the market share in 2021 and is expected to remain the largest market for military embedded systems during the forecast period.

|

|

Application Type Analysis

|

Combat/Vetronics, Command, and Control, Communication Equipment, Computer & Consoles, Cyber/Networking, Electronic Warfare Equipment, ISR (Intelligence, Surveillance, and Reconnaissance)

|

Electronic warfare equipment registered the highest growth in the market in 2021 and is expected to maintain its dominance during the forecast period

|

|

Platform Type Analysis

|

Ground, Aerial, and Marine

|

Ground-based system accounts for the largest market share in 2021 and is expected to remain the most dominant as well as the fastest-growing segment during the forecast period.

|

|

Regional Analysis

|

North America, Europe, Asia-Pacific, and Rest of the World

|

North America accounted for a significant market share in 2021 and is likely to maintain its supremacy in the market throughout the forecast period.

|

By Architecture Type

"Software segments dominated the market share in 2021."

The market is classified into hardware and software. Under these, the software segment dominated the market share in 2021 and is expected to remain the largest market for military embedded systems during the forecast period. A combination of computer hardware and software that is intended to carry out a certain task is known as an embedded system.

An embedded system might also function as a component of a larger system. It's possible that the system can be programmed to carry out particular tasks solely. The software controls the hardware and the system. The main objective of embedded system software is to control the operation of a collection of hardware parts without compromising their intended performance or effectiveness.

Software-embedded systems are more portable and suitable for mass production of embedded systems since they are smaller than conventional computers. A notable trend in the electronic testing of military systems is the employment of synthetic instruments (SI).

By Application Type

"Electronic warfare equipment registered the highest growth in the market in 2021."

The market is bifurcated into combat/vetronics, command & control, communication equipment, computers & consoles, cyber/networking, electronic warfare equipment, and ISR (intelligence, surveillance, and reconnaissance). Electronic warfare equipment registered the highest growth in the market in 2021 and is expected to maintain its dominance during the forecast period. The growth is mainly attributed to ongoing technological developments in the potentiality of anti-stealth radars, air defense, cruise missiles, munitions, and next-generation aircraft.

By Platform Type

"Ground-based system accounts for the largest market share in 2021."

The market is segmented into ground, aerial, and marine. Ground-based systems account for the largest market share in 2021 and are expected to remain the most dominant as well as the fastest-growing segment during the forecast period. The developments in ground-based systems, such as armored vehicles, soldier systems, weapon systems, and other autonomous systems, immensely depend on embedded systems.

They are a major driving factor for the highest revenue share of the ground-based systems. These ground-based systems can be used for defensive as well as offensive purposes. These developments will fetch investments for the modernization of the military, ultimately leading to the growth of the global market.

Regional Insights

"North America accounted for a significant market share in 2021."

North America accounted for a significant market share in 2021 and is likely to maintain its supremacy in the market throughout the forecast period. The growth of this region is driven by a host of factors, some of which are noted below:

- The high military investment by the United States government is expected to facilitate the adoption of military-embedded systems in the defense sector of the US.

- The increasing investment in institutional reforms increased funding for acquiring defense equipment and advanced military capabilities that use embedded systems.

- The U.S. government provides military aid to countries like Japan and South Korea and stringent policies laid down by the US government to cope with terrorism and internal security threats.

Concurrently, Asia Pacific is expected to witness the fastest growth in the market during the forecast period. The growth of this region is driven by a host of factors, some of which are noted below:

- The key factors responsible for the swift growth are the continuous up-gradation in the military and defense sector by upgrading warfare platform technologies.

- Major countries, including China, India, and Japan, are investing a huge amount in the up-gradation and advancement of the military sector by introducing advanced communication devices and related platforms in defense.

As per the Center of the International Maritime Security (Maryland), countries such as the Philippines, Singapore, Vietnam, Taiwan, Japan, and Korea are proactively increasing their vigilance to grab an overall situational awareness with the deployment of optimized intelligence, surveillance, and reconnaissance (ISR) systems for sea, air, and land domains. The government's increasing focus on deploying intelligent systems boosts market growth.

Know the high-growth countries in this report. Register Here

Key Players

The following are the key players in the military embedded system market:

There is stiff competition in the market. The growth of the companies is directly dependent on industry conditions and government support. These companies differentiate their military robot offerings based on their quality and penetration in the target and emerging markets.

Some major mergers and acquisitions in the industry recently have significantly influenced the competitive dynamics. For example:

- In February 2020, Mouser Electronics signed an agreement with Kontron AG for company COMs. Comprising COM Express modules cantered on the Celeron processor N3350, Pentium processor N4200, and Intel Atom E3900 series.

- In January 2019, Curtiss-Wright’s (US) partnered with Elma Electronic (Switzerland) to develop a 3U OpenVPX merging improvement platform to support the C4ISR CMOSS.

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Write to us at [email protected]

Research Methodology

This strategic assessment report, from Stratview Research, provides a comprehensive analysis that reflects today’s military embedded system market realities and future market possibilities for the forecast period of 2022 to 2028. After a continuous interest in our military embedded system market report from the industry stakeholders, we have tried to further accentuate our research scope to the military embedded system market to provide the most crystal-clear picture of the market. The report segments and analyses the market in the most detailed manner to provide a panoramic view of the market. The vital data/information provided in the report can play a crucial role for the market participants as well as investors in the identification of the low-hanging fruits available in the market as well as to formulate the growth strategies to expedite their growth process.

This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools. More than 1000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data. We conducted more than 15 detailed primary interviews with the market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Report Features

This report provides market intelligence in the most comprehensive way. The report structure has been kept such that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market. The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

- COVID-19 impact and its recovery curve

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors

Market Segmentation

This report studies the market, covering a period of 12 years of trends and forecasts. The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The military embedded system market is segmented into the following categories:

By Architecture Type

By Platform Type

By Application Type

- Combat/Vetronics

- Command

- Control

- Communication Equipment

- Computers & Consoles

- Cyber/Networking

- Electronic Warfare Equipment

- ISR (Intelligence, Surveillance, and Reconnaissance)

By Components Type

- Digital Signal Processor Market (DSP)

- Graphical Processing Unit (GPU)

- IP Core Chip

- Processor

- Others

By Region

- North America (Country Analysis: The USA, Canada, and Mexico)

- Europe (Country Analysis: Germany, France, The UK, Russia, and the Rest of Europe)

- Asia-Pacific (Country Analysis: China, India, Australia, South Korea, and the Rest of Asia-Pacific)

- Rest of the World (Country Analysis: Saudi Arabia, Brazil, and Others)

Click Here, to learn the market segmentation details.

Report Customization Options

Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

- Detailed profiling of additional market players (up to three players)

- SWOT analysis of key players (up to three players)

Competitive Benchmarking

Benchmarking of key players on the following parameters: Product portfolio, geographical reach, regional presence, and strategic alliances

Custom Research: Stratview Research offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected].