Attractive Opportunities

Global Demand Analysis & Sales Opportunities in Aerospace Battery Market

-

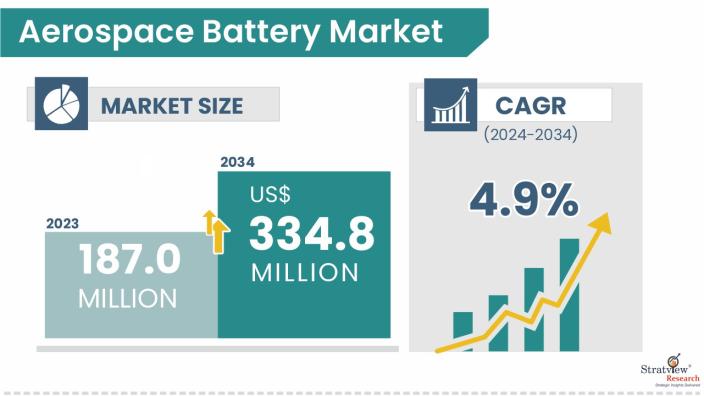

The annual demand for aerospace battery was USD 207.0 million in 2024 and is expected to reach USD 246.8 million in 2025, up 19.2% than the value in 2024.

-

During the forecast period (2025-2034), the aerospace battery market is expected to grow at a CAGR of 3.4%. The annual demand will reach USD 334.8 million in 2034.

-

During 2025-2034, the aerospace battery industry is expected to generate a cumulative sales opportunity of USD 2984.4 million, which is almost 3 times the opportunities during 2019-2024.

Want to get a free sample? Register Here

High-Growth Market Segments:

-

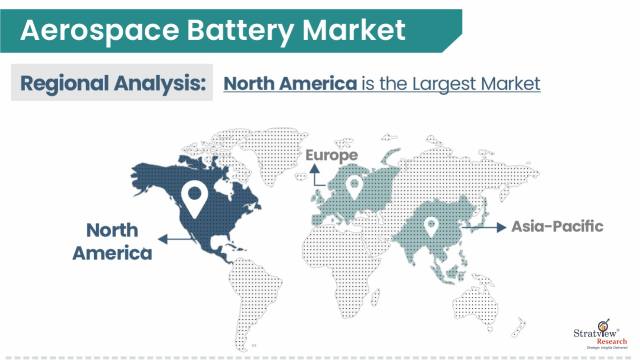

North America remains the manufacturing hub of the industry. Asia-Pacific, particularly in China and India, is gaining more traction.

-

By platform type, Narrow-body aircraft remain the biggest demand generator. In the long run, wide-body aircraft are likely to exhibit the highest growth.

-

By battery type, Nickel-cadmium batteries are the preferred battery type over the forecasted period, whereas lithium-ion batteries are gaining momentum in new aircraft programs.

-

By sales channel type, Direct sales are dominant, whereas distributor sales are becoming gradually more popular.

Market Statistics

Have a look at the sales opportunities presented by the aerospace battery market in terms of growth and market forecast.

|

Aerospace Battery Market Data & Statistics

|

|

|

Market Statistics

|

Value (in USD Billion)

|

Market Growth (%)

|

|

Annual Market Size in 2023

|

USD 187.3 million

|

-

|

|

Annual Market Size in 2024

|

USD 207.0 million

|

YoY Growth in 2024: 10.5%

|

|

Annual Market Size in 2025

|

USD 246.8 million

|

YoY Growth in 2025: 19.2%

|

|

Annual Market Size in 2034

|

USD 334.8 million

|

CAGR 2025-2034: 3.4%

|

|

Cumulative Sales Opportunity during 2025-2034

|

USD 2984.4 million

|

-

|

|

Top 10 Countries’ Market Share in 2024

|

USD 165.6 million +

|

> 80%

|

|

Top 10 Company’s Market Share in 2024

|

USD 103.5 million to USD 144.9 million

|

50% - 70%

|

Market Dynamics

What is an aerospace battery?

An aerospace battery refers to advanced energy storage systems designed specifically for aviation, space, and defense applications. These batteries power everything from aircraft systems (avionics, auxiliary power) to unmanned aerial vehicles (UAVs) and emerging electric vertical takeoff and landing (eVTOL) platforms. They must deliver high energy density, lightweight design, safety, and reliability under extreme conditions.

Aerospace batteries typically use lithium-ion, solid-state, lithium-sulfur, and specialized chemistries optimized for aerospace performance, balancing weight, power output, and safety.

Market Drivers:

Electrification of the Aircraft Fleet

-

The electrification of the aircraft fleet is a major growth driver for the aerospace battery market, propelled by OEM investments in electric and hybrid propulsion and global sustainability commitments.

-

The aircraft electrification market was estimated at USD 8.5 billion in 2024 and is projected to grow at a 14% CAGR to reach USD 24.4 billion by 2032, driven by demand for fuel efficiency and emissions reductions.

-

Moreover, the aviation sector’s aim for net-zero carbon emissions by 2050, increasing adoption of electric and hybrid-electric systems that rely on advanced aerospace batteries to support cleaner, more sustainable flight operations.

Increasing Adoption of UAVs/Drones

-

Expanding deployment of unmanned aerial vehicles across agriculture, logistics, infrastructure monitoring, and military surveillance is accelerating demand within the aerospace battery market.

-

As drones require lightweight power systems with extended flight endurance and rapid recharge capability, manufacturers are increasingly adopting advanced lithium-based aerospace batteries.

-

With global drone usage rising sharply across commercial and defense missions, high-energy, reliable battery solutions have become essential to support long-duration and high-performance aerial operations.

Market Challenges:

Safety and certification barriers

-

Safety and certification barriers remain a major challenge for the aerospace battery market, as strict FAA and EASA regulations require extensive testing for thermal stability, energy containment, and electromagnetic compatibility.

-

Lengthy approval timelines and high compliance costs delay battery integration into new aircraft platforms. Even advanced electric aviation programs continue to face certification hurdles, slowing commercialization and limiting the pace of innovation across aerospace battery technologies.

Thermal management and extreme environment performance

-

Aerospace batteries must operate reliably under extreme temperature fluctuations, pressure variations, and continuous vibration during flight operations. These harsh conditions increase the risk of thermal runaway and performance degradation, requiring advanced cooling technologies and sophisticated battery management systems that add system complexity, weight, and higher integration costs for aircraft manufacturers.

Market Opportunities:

Advancements in Battery Chemistries

-

Next-generation battery chemistries represent a major growth opportunity for the aerospace battery market, particularly solid-state and lithium-sulfur technologies. Solid-state batteries can deliver nearly 2–3 times higher energy density than conventional lithium-ion cells while improving thermal stability and operational safety, directly enhancing aircraft range and system reliability.

-

Meanwhile, lithium-sulfur batteries offer significantly higher specific energy with lighter weight, enabling longer-endurance UAVs, electric aircraft, and advanced defense platforms. Together, these innovations support the shift toward high-performance, lightweight, and sustainable aerospace power solutions.

Emergence of Urban Air Mobility and eVTOL

-

Urban air mobility and eVTOL aircraft represent a high-growth opportunity for the aerospace battery market as aviation shifts toward electric vertical flight solutions for regional and urban transportation.

-

Aircraft manufacturers are integrating high-performance, lightweight battery systems to enable efficient takeoff, extended flight endurance, and low-emission operations, significantly expanding demand for advanced aerospace energy storage technologies.

Segment Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High Growth Opportunity

|

|

Platform Type Analysis

|

Narrow-body Aircraft, Wide-Body Aircraft, Regional Aircraft, General Aviation, Helicopters, Military Aircraft, and UAV.

|

Narrow-body aircraft remain the biggest demand generator. In the long run, wide-body aircraft are likely to exhibit the highest growth.

|

|

Battery Type Analysis

|

Nickel-Cadmium Battery, Lithium-Ion Battery, and Lead-Acid Battery.

|

Nickel-cadmium batteries are the preferred battery type over the forecasted period, whereas lithium-ion batteries are gaining momentum in new aircraft programs.

|

|

Sales Channel Type Analysis

|

Direct Sales and Distributor Sales.

|

Direct sales are dominant, whereas distributor sales are becoming gradually more popular.

|

|

Regional Analysis

|

North America, Europe, Asia-Pacific, and Rest of the World

|

North America remains the manufacturing hub of the industry. Asia-Pacific, particularly in China and India, is gaining more traction.

|

By Aircraft Type

“Narrow-body aircraft continue to dominate as the primary drivers of demand, while wide-body aircraft are expected to show the strongest growth potential over the long term.”

-

The aerospace battery market is segmented into narrow-body aircraft, wide-body aircraft, regional aircraft, general aviation, helicopters, military aircraft, and unmanned aerial vehicles (UAVs), each contributing uniquely to overall market demand.

-

Narrow-body aircraft continue to dominate the aerospace battery market, driven by their high utilization across short- and medium-haul routes. These aircraft offer lower operating costs, operational flexibility, and strong demand from low-cost carriers and regional airlines, making them the primary contributors to global air traffic volume and battery system adoption.

-

Meanwhile, wide-body aircraft are expected to see the fastest long-term growth due to rising international travel, fleet modernization for fuel efficiency, expanding air cargo demand, and technological improvements that lower operating costs and support next-generation aircraft systems.

By Battery Type

“Nickel-cadmium batteries remain the preferred choice for many applications. Meanwhile, lithium-ion batteries are rapidly gaining traction, securing the momentum in the market.”

-

The aerospace battery market is segmented into nickel-cadmium (Ni-Cd) batteries, lithium-ion batteries, and lead-acid batteries, reflecting the industry’s transition toward higher-performance energy storage solutions.

-

Nickel-cadmium batteries continue to dominate the aerospace battery market due to their proven durability, resistance to extreme temperatures, and long operational life across commercial, military, and general aviation aircraft.

-

Meanwhile, lithium-ion batteries are expected to register the fastest growth, driven by their high energy density, lightweight design, faster charging capability, and growing adoption in modern aircraft and electric aviation platforms.

Regional Analysis

“North America remains the manufacturing hub of the industry. Meanwhile, Asia-Pacific, particularly in China and India, is gaining more traction.”

-

The aerospace battery market is geographically segmented into North America, Europe, Asia-Pacific, and the Rest of the World.

-

North America continues to dominate the aerospace battery market, supported by its strong aerospace manufacturing base, high defense spending, and early adoption of advanced battery technologies across commercial and military aircraft platforms.

-

In contrast, the Asia-Pacific region is expected to register the fastest growth, driven by expanding aircraft manufacturing capacity and rising regional air travel demand. Major programs such as China’s C919 commercial aircraft, alongside Airbus and Boeing assembly operations in China and growing OEM production shifts toward India and Southeast Asia, are strengthening long-term demand for aerospace batteries across the region.

Want to get a free sample? Register Here

Competitive Landscape

The aerospace battery market is highly consolidated with the presence of a handful of players. Most of the major players compete in some of the governing factors, including price, service offerings, and regional presence, etc. The following are the key players in the aerospace battery market.

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Please write to us at sales@stratviewresearch.com

Recent Market JVs and Acquisitions:

A handful of strategic alliances, including M&As, JVs, etc., have been performed over the past few years:

-

In August 2025, Lyten announced a binding agreement to acquire Northvolt’s remaining battery manufacturing assets in Sweden and Germany, including facilities with existing capacity and R&D infrastructure, strengthening its global battery footprint.

-

In June 2025, Safran Electrical & Power and Saft partnered to co-develop a high-voltage battery system for aviation electrification, delivering scalable, high-performance lithium-ion energy solutions to support advanced electric and hybrid aircraft and reduce aviation emissions.

-

In May 2025, Amprius Technologies announced a contract manufacturing agreement with a leading South Korean battery producer to expand its global production capacity. The partnership supports large-scale manufacturing of high-performance SiCore® lithium-ion cells, strengthening supply capabilities to meet growing demand across advanced energy storage applications.

Report Features

This report provides market intelligence most comprehensively. The report structure has been kept so that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market.

The following are the key features of the report:

-

Market structure: Overview, industry life cycle analysis, supply chain analysis.

-

Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

-

Market trend and forecast analysis.

-

Market segment trend and forecast.

-

Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

-

COVID-19 impact and its recovery curve.

-

Attractive market segments and associated growth opportunities.

-

Emerging trends.

-

Strategic growth opportunities for the existing and new players.

-

Key success factors.

|

Market Study Period

|

2019-2034

|

|

Base Year

|

2024

|

|

Forecast Period

|

2025-2034

|

|

Trend Period

|

2019-2023

|

|

Number of Tables & Figures

|

>100

|

|

Number of Segments Analysed

|

4 (Aircraft Type, Battery Type, Sales Channel Type, and Region)

|

|

Number of Regions Analysed

|

4 (North America, Europe, Asia-Pacific, Rest of the World)

|

|

Countries Analysed

|

15 (The USA, Canada, Mexico, Germany, France, Italy, The UK, China, Japan, India, Brazil, Saudi Arabia, Rest of Europe, Rest of APAC, and Rest of the World)

|

|

Free Customization Offered

|

10%

|

|

After Sales Support

|

Unlimited

|

|

Report Presentation

|

Complimentary

|

|

Market Dataset

|

Complimentary

|

|

Further Deep Dive & Consulting Services

|

10% Discount

|

Market Segmentation

The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The aerospace battery market is segmented into the following categories:

Aerospace Battery Market, by Aircraft Type

-

Narrow-Body Aircraft

-

Wide-Body Aircraft

-

Regional Aircraft

-

General Aviation

-

Helicopters

-

Military Aircraft

-

UAV

Aerospace Battery Market, by Battery Type

-

Nickel-Cadmium Batteries

-

Lithium-Ion Batteries

-

Lead-Acid Batteries

Aerospace Battery Market, by Sales Channel Type

-

Direct Sales

-

Distributors Sales

Aerospace Battery Market, by Region

-

North America (Country Analysis: The USA, Canada, and Mexico)

-

Europe (Country Analysis: Germany, France, The UK, Russia, Spain, and Rest of Europe)

-

Asia-Pacific (Country Analysis: Japan, China, India, and Rest of Asia-Pacific)

-

Rest of the World (Sub-Region Analysis: The Middle East, Latin America, and Others)

Research Methodology

-

This strategic assessment report from Stratview Research provides a comprehensive analysis that reflects today’s aerospace battery market realities and future market possibilities for the forecast period.

-

The report segments and analyzes the market in the most detailed manner to provide a panoramic view of the market.

-

The vital data/information provided in the report can play a crucial role for market participants and investors in identifying the low-hanging fruits available in the market and formulating growth strategies to expedite their growth process.

-

This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools.

-

More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data.

-

We conducted more than 15 detailed primary interviews with market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

Competitive Benchmarking

-

Benchmarking of key players on the following parameters: Service portfolio, geographical reach, regional presence, and strategic alliances.

Custom Research: Stratview Research offers custom research services across industries. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to sales@stratviewresearch.com.