Market Insights

Batteries are used in a variety of space applications, such as satellites, launch vehicles, crew return vehicles, landers, rovers, astronomers’ equipment, and International Space Station. It may be used either as an energy storage device or as an instant source of power. Satellite is the most dominant application as the world has been gripped by what is being termed as ‘The CubeSat Revolution’. As a result of this, space battery manufacturers are facing increased demand for satellite batteries. The challenge, which the battery manufacturers face while designing satellite batteries is limiting its size. it is a parameter which is of paramount significance in the context of satellites as there is a humongous cost associated with launching anything into the orbit and satellite batteries may take up to 50% of the payload weight. Battery manufacturers are therefore relentlessly innovating to develop batteries with higher specific energy so that it may support greater payload, which, in turn, will generate higher revenues for the satellite manufacturers.

However, the catch is that higher specific energy usually comes with the sacrifice of specific power, a parameter, which is of utmost importance to launch vehicles. Thus, space battery manufacturers have to find a right balance between these two. The bottom line is that space battery manufacturers need to maintain value as well as to generate the maximum returns; thus, wanting a battery that is not only as light as possible but also having sufficient power as well. Battery manufacturers have to undergo tedious qualification and certification process since there is no margin of error for these batteries. There is no one to replace them if they get damaged and they have to sustain in extreme environmental conditions, such as extreme fluctuating temperatures, hard vacuum, shocks, and radiations.

Space batteries have witnessed an impactful, significant evolvement over the past five decades in which lithium-based batteries have acted as a disruptive agent. Lithium, being the lightest and the most electropositive metal, offers significant weight savings compared to traditionally used metals, such as silver and nickel. Due to this, lithium-based batteries have become a perennial choice in battery manufacturing. Further, it also offers longer life cycle and lower self-discharge rate.

In an era, where the space industry is rapidly shifting towards miniaturization of spacecraft components, the demand for miniaturized space battery is increasing. The space industry is moving today with the purpose of reduction of SWaP, i.e. Size, Weight, and Power consumed by the battery. Some of the most noticeable movements are the gradual replacement of nickel-based batteries with lithium counterparts. Another movement is increasing the dominance of satellite platforms in the space industry marked by the CubeSat Revolution.

The global space battery market is projected to grow at a healthy rate over the next five years to reach US$ 146.1 million in 2023. Organic growth of the satellite industry is the primary driver of the sustainable demand for batteries in the spacecraft. One Web, a satellite constellation, has projected to launch 648 satellites in the future, which is expected to start at 2018. Space X, another satellite constellation, is working towards high-speed internet facilities across the world by deploying dedicated satellites. The company plans to launch 4,425 satellites by 2024 with an aim of deploying most of them by 2019. The launch is expected to provide super-fast internet facilities with reduced latency as compared to existing broadband services. Such developments are likely to create high-growth opportunities for both existing as well as new players in the space battery market.

The projected increase in the global government expenditures in space is further propelling the growth of the space battery market. Also, the space industry enters a new investment cycle after some years of sluggish growth. Increase in space budgets of governments will be mainly due to increasing civil space programs and high focus on human space flight. Increasing space budget of emerging Asian countries with an aim to have their own independent space programs will also play a crucial role in setting the dynamics of the future space industry.

Growing global private sector companies in the space community are acting as a catalyst towards the growth of the space battery market. There were over 150 new firms identified which increased investment in the space-based activities. Space X, One Web satellites LLC, Planet Labs Inc., Kymeta corporation, and Spire are some of the major private players in the industry.

Technological advancement in space batteries is another factor that is boosting the demand for advanced batteries in the industry. Existing market players are striving hard for continuous innovation, which has resulted in the development of batteries with a specific energy of 500 Wh/kg. The futuristic outlook of space battery technology would seek ways to reduce associated disadvantages of existing batteries like poor performance of lithium-ion batteries in extremely low temperatures and a phenomenon associated with it called Thermal Runaway, which is caused by overcharging.

Segments' Analysis

Wish to get a free sample? Register Here

Space Battery Market Share by Platform Type

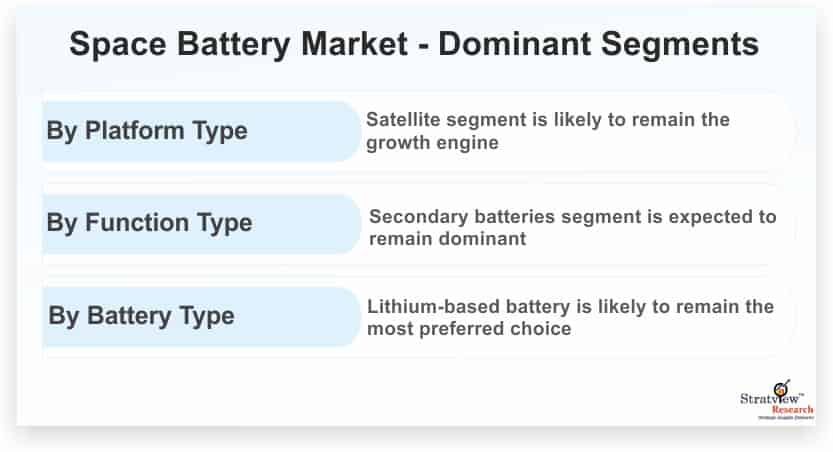

The global space battery market is segmented based on the platform type as Satellite, Launch Vehicle, and Others. Satellite segment is likely to remain the growth engine of the market during the forecast period. Increasing participation of private space companies, such as Space X, OneWeb Satellites, and Sky and Space Global Ltd, and an expected launch of more than 4,000 satellites during 2018-2023 would propel the demand for batteries in the satellite segment in years to come.

Space Battery Market Share by Function Type

Based on the function type, the space battery market is segmented into Primary Batteries, Secondary Batteries, and Reserve Batteries. Secondary batteries segment currently dominates the market and is likely to maintain its growth momentum over the next five years as well, driven by a continuous innovation towards lithium-ion chemistry. Secondary battery has significant applications in satellite platforms as it is the only source of power for the latter during eclipses. Thus, increase in a number of satellites being launched into space is another significant driver of growth of this segment. Both primary lithium and secondary Lithium-ion are poised to remain the most popular batteries in their respective segments.

Space Battery Market Share by Battery Type

Based on the battery type, the space battery market is segmented into Lithium-based Battery, Nickel-based Battery, Silver-Zinc Battery, and Others. Others exclusively consist of Reserve (Thermal) batteries. The lithium-based battery is likely to remain the most preferred choice of the space industry during the forecast period, driven by innovation towards the production of highly reliable, high performing, and cost-effective technology by reducing SWaP of the battery. It is likely to exhibit the highest growth rate during the forecast period as well.

Space Battery Market Share by Platform Mission Type

Based on the platform mission type, space battery used in platform deployed for military surveillance is the most dominant segment, driven by a rising demand to monitor and to combat the increasing terrorist activities and importance of surveillance system in the fourth-generation warfare. Navigation, another promising segment, is likely to grow at the highest rate in the market during the forecast period, driven by an increasing consumption of global navigation system like GPS, especially in emerging Asian countries.

Regional Insights

Based on regions, North America is projected to remain the largest market during the forecast period, driven by the presence of major spacecraft OEMs and tier players. The USA is the growth engine of the region’s market and its space budget is the highest across the world, which is almost six times of the country with second highest space budget. Also, NASA is the largest space agency in the world, which is largely involved in space-related activities located in the USA. It also has the presence of major spacecraft OEMs, such as Orbital ATK, Lockheed Martin, and Honeywell International.

Know which region offers best growth opportunities. Register Here

Europe and Asia-Pacific are also likely to offer good growth opportunities in the coming years. Europe will be driven by space investments by ESA and Russia. Asia-Pacific is likely to be the fastest-growing region, driven by a host of factors, including the emergence of India and China in the space sector, investments in small satellite projects, and an increased number of start-ups involved in space activities across the region.

Market Scope & Segmentation

|

Research Scope

|

|

Trend & Forecast Period

|

2012-2023

|

|

Size in 2023

|

US$ 146.1 million

|

|

Regions Covered

|

North America, Europe, Asia-Pacific, Rest of the World

|

|

Countries Covered

|

The US, Canada, Mexico France, Germany, the UK, Spain, Russia, China, Japan, India, Middle East, Latin America and Others

|

|

Figures & Tables

|

>150

|

|

Customization

|

Up to 10% customization available free of cost

|

The global space battery market is segmented into the following categories:

Space Battery market Size, Share & Forecast, By Platform Type

- Satellite (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

- Launch Vehicle (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

- Others (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

Space Battery market Size, Share & Forecast, By Function Type

- Primary Batteries (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

- Secondary Batteries (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

- Reserve Batteries (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

Space Battery market Size, Share & Forecast, By Battery Type

- Nickel-based Battery (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

- Lithium-based Battery (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

- Silver-Zinc Battery (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

- Others (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

Space Battery market Size, Share & Forecast, By Platform Mission Type

- Communication (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

- Earth Observation (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

- Military Surveillance (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

- Science (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

- Navigation (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

- Others (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

Space Battery market Size, Share & Forecast, By Specific Energy Type

- <100 Wh/kg (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

- 100-150 Wh/kg (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

- >150 Wh/kg (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

Space Battery market Size, Share & Forecast, By Region

- North America (Country Analysis: The USA, Canada, and Mexico)

- Europe (Country Analysis: France, Germany, the UK, Spain, Russia, and Rest of Europe)

- Asia-Pacific (Country Analysis: China, Japan, India, and Rest of Asia-Pacific)

- Rest of the World (Country Analysis: Latin America, the Middle East, and Others)

Want to know the most attractive market segments? Register Here

Key Players

The supply chain of this market comprises raw material suppliers, space battery manufacturers, distributors/part brokers, and End users which include spacecraft OEMs, space agencies, and space research institutes.

Major space battery manufacturers are-

- Saft Groupe S.A.

- Eagle-Picher Technologies LLC

- GS Yuasa Corporation

- Enersys

- Mitsubishi Electric Corporation.

Key end users are-

- NASA

- Orbital ATK

- European Space Agency

- Lockheed Martin

- ISRO

- Roscosmos

- Space X

- JAXA etc.

Research Methodology

This report offers high-quality insights and is the outcome of detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders and validation and triangulation with Stratview Research’s internal database and statistical tools. More than 1,000 authenticated secondary sources, such as company annual reports, fact book, press release, journals, investor presentation, white papers, patents, and articles have been leveraged to gather the data. We conducted more than 10 detailed primary interviews with the market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Report Features

This report, from Stratview Research, studies the space battery market over the trend period of 2012 to 2017 and forecast period of 2018 to 2023. The report provides detailed insights into the market dynamics to enable informed business decision making and growth strategy formulation based on the opportunities present in the market. The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, product portfolio, product launches, etc.

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors.

Report Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

- Detailed profiling of additional market players (up to 3 players)

- SWOT analysis of key players (up to 3 players)

Market Segmentation

- Current market segmentation of any one of the application by composites type

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Product portfolio, geographical reach, regional presence, and strategic alliances

Custom Research: Stratview Research offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry at sales@stratviewresearch.com