Across every aircraft, antennas guide navigation, enable cockpit communication, deliver transponder data, link satellites, power weather radar, and now, even stream entertainment to passengers. They sit exposed to harsh winds, lightning, temperature shifts, and aerodynamic forces, yet they must deliver flawless signal integrity every second of flight.

Backed by rising fleet connectivity, growing SATCOM adoption, and increasing aircraft production, the global aircraft antenna market is set to grow from USD 537.6 million in 2024 to USD 747.8 million by 2034 at a steady 3.4 percent CAGR.

Who Uses the Most Antennas?

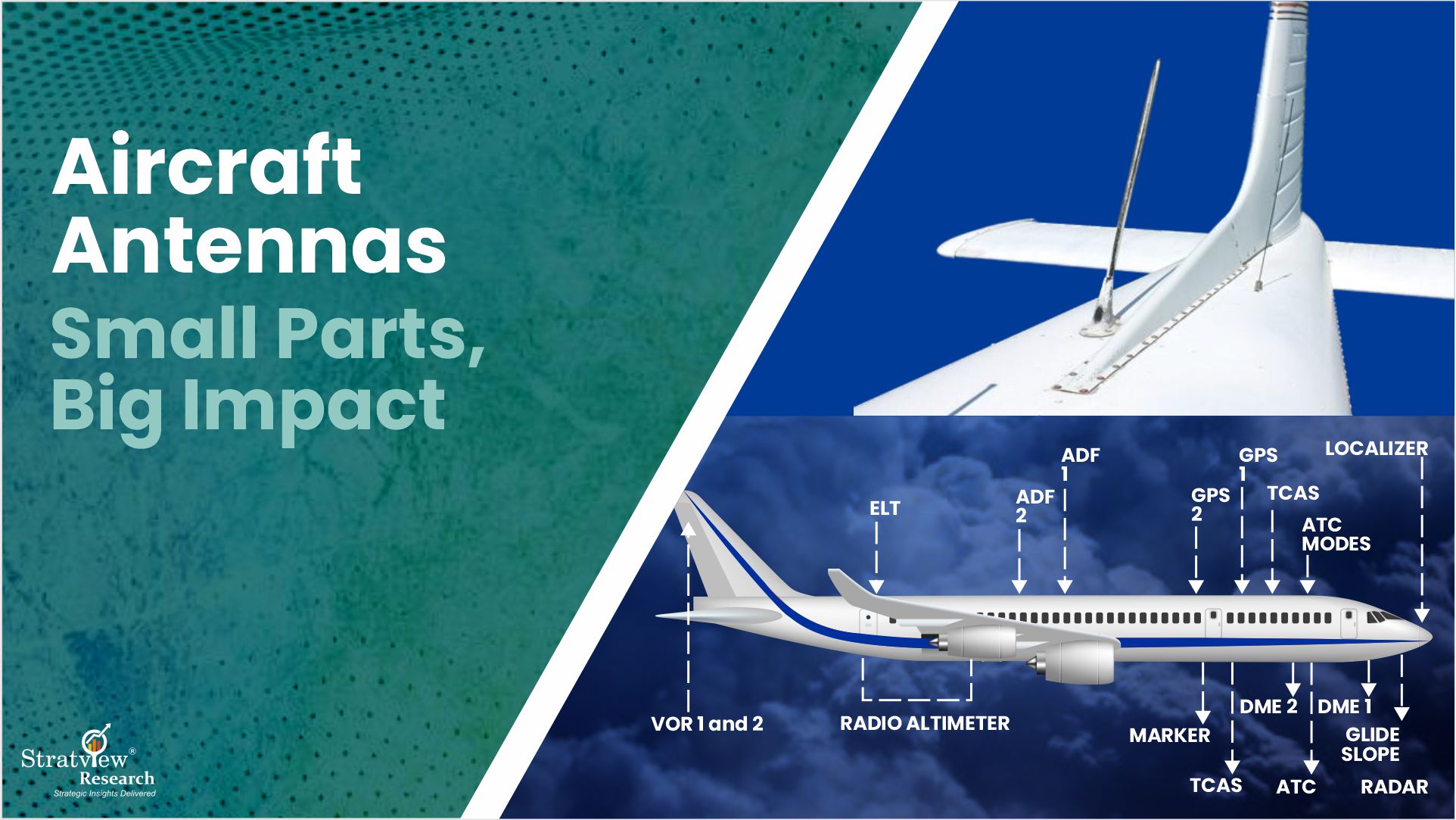

Commercial aircraft remain the backbone of antenna demand, accounting for more than 60% of the market in 2024. A single jet now carries over 20 antennas - managing everything from VHF communication and GPS to in-flight Wi-Fi and real-time health monitoring. This expanding digital load is reshaping how antennas are placed and designed.

Fuselage-mounted antennas maintain an unshakeable lead across the global market, as airlines increasingly rely on SATCOM, weather radar, and multi-band communication systems that require aerodynamic stability and large-format housing.

At the design level, blade antennas capture the segment’s strongest position by far. Their streamlined form, structural compatibility with composite fuselages, and ability to support next-gen connectivity make them the preferred choice across both commercial and defense fleets. Together, these shifts show a market moving decisively toward smarter, integrated, and aerodynamically efficient antenna architectures.

Inside the Antenna Demand Shift

Modern aircraft operate as always-connected platforms, relying on continuous data flow for cockpit decisions, fleet coordination, and passenger connectivity. This makes communication antennas the natural frontrunners in the application mix. As demand for seamless links grows, SATCOM, VHF, UHF, and GPS systems are rapidly shifting toward smarter, higher-bandwidth architectures built to keep today’s digital skies running smoothly.

Since antennas are integrated directly into the aircraft build, OEMs naturally dominate the end-use segment. Most systems are installed during production, giving manufacturers a clear edge over the aftermarket, which steps in only for upgrades and replacements.

Regional Edge, North America Leads, but Asia Pacific is Accelerating

North America holds a commanding lead in the aviation antenna market, capturing nearly half the global share with its strong aerospace base, robust MRO capabilities, and innovation-driven players such as Honeywell Aerospace, Collins Aerospace, and Cobham Aerospace Communications. Meanwhile, the Asia Pacific is gaining speed with rapid fleet expansion, defense upgrades, and rising adoption of satellite-based systems, turning it into the fastest-growing region.

Looking ahead, antenna technology has evolved from cracked housings to sleek, multi-band, digitally intelligent systems built for precision and reliability. These components will shift from passive components to adaptive, self-optimizing communication hubs. As connectivity becomes the backbone of modern aviation, these advanced systems will power a safer, smarter, and more seamlessly connected future in the skies.

TAGS: Aerospace & Defence