.jpg)

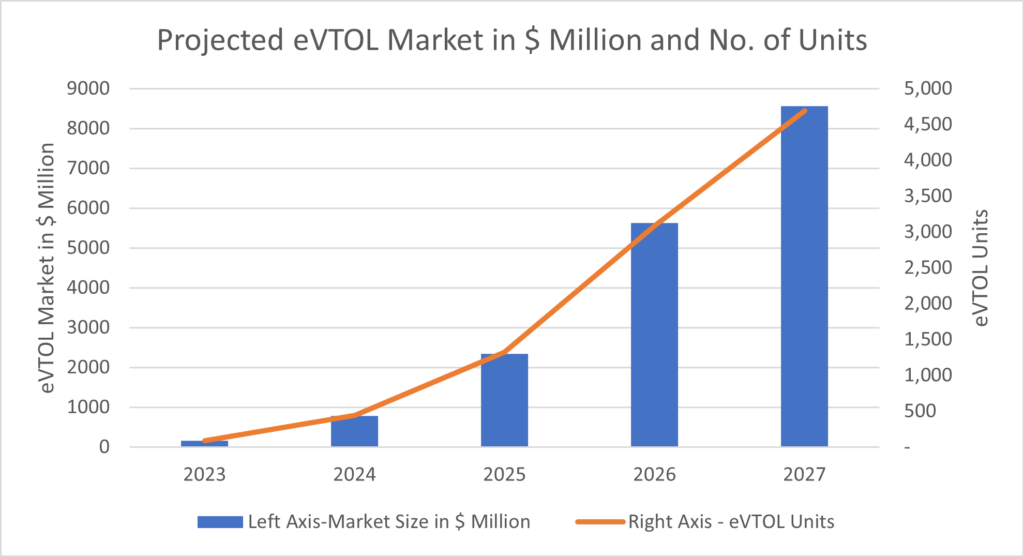

According to Stratview Research, the market is set for explosive growth, rising from under $500 million in 2023 to over $8 billion by 2027. This surge represents a staggering CAGR of more than 100% between 2023 and 2027, marking a rapid acceleration in adoption and investment.

Lost hours due to traffic congestion is a problem that worsens each year, and in fact, according to the United States Department of Transportation, highways in the United States operated in congested conditions for an average of 3 hours and 47 minutes each day in 2019.

Not to mention the fact that the transport sector accounted for almost 24% (7.7 gigatons) of global CO₂ emissions in 2021, of which >75% (5.8 gigatons) came from road transport. Many have already ceded the responsibility for reducing emissions to electric vehicles (EVs), and while these can reduce CO₂ emissions (hopefully), they won't do much to solve the congestion problem. Ultimately, removing congestion is a Herculean task in itself, because wherever there is a buoyant economy, there will eventually be congestion.

Fig. 1: XPeng AeroHT Flying Car

So a more logical goal should be to improve access and connectivity within large cities in the greenest way possible, and that is precisely the task electric vertical take-off and landing (eVTOL) aircraft have been given. eVTOLs are one of those aerospace industry innovations that have never left the headlines since the idea of ??making one was floated. But right now, the eVTOL industry as a whole has a blind curve ahead. Therefore, we are going to try to anticipate everything that could be on the other side of the curve.

eVTOL Differences

Not all eVTOLs are created equal, and depending on the intended application, ease of design, and design advantages, OEMs choose the one that best suits their needs. The most widely accepted eVTOL configurations are Thrust Vectoring, Lift + Cruise, Wingless/Multirotor, and Hoverbikes/Personal Flying Devices. Some advantages of each configuration are the following:

- Thrust Vectoring: Currently the preferred configuration in the industry, as it is efficient in both hovering and cruising, can support higher payloads, and can travel at high speeds. Joby, Lilium, Vertical Aerospace, Archer and many other key players have chosen thrust vectoring for their programs.

- Lift+Cruise: Just as efficient in hovering and cruising as the thrust vectoring configuration, but contains separate motors for hovering and cruising, adding to its weight. Eve Air Mobility, Embraer's eVTOL subsidiary, plans to enter the market with a Lift+Cruise model.

- Wingless/Multirotor: Efficient at lift but less efficient at cruise, these configurations have several small rotors that produce maximum thrust in the vertical direction. They are ideal for intra-city trips with fewer passengers, since the cargo capacity is comparatively less. Example: Volocopter Velocity.

- Hoverbikes: They are ideal for patrol and search operations, since they are more similar to the flying version of a motorcycle and have capacity for a single passenger. Ex: Xturismo Hoverbike.

Could Evtols Be the Elixir of Modern Transportation Problems?

Emissions, congestion and noise are undoubtedly those three magic words that keep automotive engineers on their toes at all times. The main reason why eVTOLs have gained such popularity in multiple sectors is not because of their strong resemblance to the fighter jets of science fiction movies, but because of their potential to solve the most critical problems in intercity and intracity transportation today.

Mentioned below are some of the claims made by some of the major OEMs in terms of time savings, CO2 and noise emissions.

|

MODE |

CO2/ Passenger-Kilometer (in grams) |

Average Speed (km/h) |

Avg. Cost/Passenger (in $US) |

|

Gasoline |

142 |

40-50 |

2.5 |

|

Electric Cars |

31 |

40-50 |

0.03 |

|

Trains |

18 |

100-130 |

1.38 |

|

Helicopters |

60-75 |

250-200 |

15 |

|

eVTOLs |

10-30 |

200-240 |

3.3 |

Table 1 : Cost, Speed and CO2 Emissions for Different Modes of Transportation

|

|

Average Noise Footprint (in dMB) |

|

Normal Speech |

60 |

|

Road noise exposure in cities (NY, Tokyo) |

78 |

|

Heavy truck travelling in 50kmph |

85 |

|

Lawn Mower |

95 |

|

Bell 407 Flyover |

87 |

|

eVTOL Flyover |

60-65 |

Table 2: Noise Footprint Comparison of eVTOLs

From Tables 1 and 2 it can be seen that if we only consider the cost per passenger mile, electric cars and trains have an advantage, but the limiting factor in the case of electric cars will be congestion and in the case of trains, the connectivity. Also keep in mind that the degree of connectivity can be identical for helicopters and eVTOLs, since both can use the same vertical port networks, but the cost of the trip would be more than four times higher in the case of a helicopter. and it also has the largest noise footprint. Noise and cost are the main reasons why no one has envisioned helicopters being used as air taxis despite having the potential to achieve the same connectivity as eVTOLs.

So even though they are slightly more expensive than road taxis, eVTOLs will catch on quickly because of the time savings they are expected to offer. According to the time forecasts presented by different manufacturers, traveling in an eVTOL would be at least three times faster than by road, and up to ten times faster.

A Closer Look at the Status Quo

Everyone familiar with the term eVTOL or “air taxi” hopes that this innovation will revolutionize urban transportation. The opportunity looks so lucrative that while "none" of the original equipment manufacturers have yet received regulatory approval to start commercial flights, some $7 billion worth of investments have already poured in.

All OEMs see a sky full of opportunities, which has motivated several people to try to enter the market. In fact, as of December 2022, over 700 eVTOL programs from over 350 different entities were listed in the Vertical Flight Society's eVTOL directory. But the interesting thing is that most of them are in the concept or prototype phase. So while the numbers indicate that the sector is already a red ocean, if you dive deeper you will discover that it is still blue. In fact, according to a recent eVTOL analysis by Stratview Research, of the more than 700 programs listed in the VFS directory, <5% aspire to commercialized flights by 2030.

A significant amount of capital has already been invested in eVTOLs, the certification schedule is tentative, and so is commercialization. But another proof of how eagerly everyone is waiting for this innovation to enter the market is the number of pre-orders.

According to the aforementioned analysis, in December 2022, the eVTOL industry had more than 6,000 units on pre-order. Although conditional, this high number of pre-orders is a relief for both OEMs and investors. Listed below are some of the major OEMs with their funding, certification goals, number of pre-orders, etc.

|

Company |

Funding (in $ Millions) |

Certification Target |

Pre-Orders |

Primary Applications |

Configuration |

|

Joby |

1904 |

2024 |

Not Disclosed |

Passenger Transport |

Vectored Thrust |

|

Lilium |

938 |

2025 |

483 |

Passenger Transport |

Vectored Thrust |

|

Airbus |

- |

2025 |

- |

Passenger Transport |

Vectored Thrust |

|

Verticle Aerospace |

333 |

2025 |

1,450 |

Passenger Transport |

Vectored Thrust |

|

Archer |

856 |

2025 |

300 |

Passenger Transport |

Vectored Thrust |

|

Beta Technologies |

796 |

2024 |

410 |

Passenger Transport |

Lift+Cruise |

|

Wisk |

775 |

- |

30 |

Passenger Transport |

Vectored Thrust |

|

Volocopter |

579 |

2024 |

260 |

Passenger Transport |

Multirotor |

|

Eve Air Mobility |

377 |

2026 |

2,770 |

Passenger Transport |

Lift+Cruise |

|

Pipistrel |

- |

2023 |

1,005 |

Cargo |

Lift+Cruise |

|

Elroy Air |

50 |

2023 |

900 |

Cargo |

Lift+Cruise |

Table 3: Mapping of Key Parameters for Some of the Leading eVTOLs, OEMs (Source: AAM Reality, Index, Composights)

Joby and Lilium are the only major operators to have received a certification base from their respective regulatory authorities, so they can be expected to be among the first operators in the market. Pipistrel and Elroy Air are early candidates for certification, and since both are in the business of cargo rather than passenger transportation, the certification process will be slightly less stringent for both. Wisk Aerospace, a joint venture between Boeing and KittyHawk, has not announced anything about its certification goals.

Another thing that can be seen from the table above is that more than 80% of OEMs are planning to go ahead with passenger transportation as their primary application because it is more profitable than the freight business. Between freight and passenger transport, the largest share (>50%) will always belong to passenger transport, according to forecasts. In addition, programs such as the 7-seater Lilium Jet have been designed in such a way that they can be used for both passenger and cargo transport.

How Fast Will the Sector Take Off?

From 2024 the eVTOL sector will take off. This is the time when most of the key players are planning to enter the market and therefore those with the capital, manufacturing capacity and some entries on their order book will start manufacturing immediately. Since these planes are much smaller than business jets, the existing manufacturing capacity in the aerospace industry is enough to produce a few thousand of them without a problem. This would also imply that the figures would grow beyond exponential expressions during the first years of commercialization. The growth rates that OEMs envision may also seem unrealistic to many. For example, Vertical Aerospace mentioned in one of its presentations to investors that during its first year of commercialization it intends to manufacture only 50 aircraft per year, but that in just two years it will increase the volume to 1,000 aircraft per year. That is, 20 times the volume in just two years. Similarly, according to one of Joby's presentations to investors, Joby's plan is to go from

The market will be huge and according to Stratview Research, by 2027 the global eVTOL fleet will be around 5,000 units.

Fig. 2 : Projected eVTOLs Market in $Million and No. of Units

From less than $500 million in 2023, the market will make the proverbial quantum leap, to be worth more than $8 billion in 2027, thus exhibiting a compound annual growth rate of more than 100% during 2023-2027.

The predicted growth trend is impressive, but there are also a number of obstacles capable of altering the trajectory of this industry. Some apparent obstacles that could slow down the growth of this industry are:

1. Certification: This is currently the hardest part of being in the eVTOL business. The eVTOL certification process works as follows:

Stage 1: Basis of Certification

Stage 2: Receipt of Means of Compliance Document

Stage 3: Reporting of Compliance

Stage 4: Verification of Compliance

As of December 2022, only Joby and Lilium have their certification base confirmed with the respective authorities.

1. Infrastructure: Not all cities will have the necessary infrastructure to support UAM and modifying the infrastructure of an entire city is another challenge. Therefore, the lack of supporting infrastructure will limit the expansion of UAM to different cities.

2. Training: Although many eVTOLs will be autonomous in the future, the initial phase will only feature the piloted versions. Therefore, both OEMs and fleet owners will have to train quite a large number of pilots for their fleets.

2.Community Acceptance: This is the main parameter that will determine the success of eVTOLs, as privacy could surface as a concern here. Unlike other aircraft, eVTOLs will fly at a lower altitude and therefore potentially invade the privacy of many. Therefore, acceptance has to come from those who will fly in it and from those who will not. Not to mention that, at first, everyone will be a little hesitant to fly in one.

Although eVTOLs are undoubtedly one of the most exciting innovations in the mobility industry, the current scenario indicates that the schedule will move further north, and the pace of growth will also be a bit slower than most project. original equipment manufacturers. There's also the "uncertain recession," the anticipation of which has led tech giants to lay off thousands of employees. Even if there are no major layoffs in the eVTOL industry due to small team sizes, funding and pre-orders could see a significant reduction.

However, the opportunities in the sector are so lucrative that not only the aerospace industry, but also major automakers such as Honda are enlisting as OEMs, and others such as Toyota and Stellantis have already formed manufacturing partnerships with other leading OEMs. .

As for the magnitude of the fruits that these opportunities can bear, it will depend on the effectiveness with which the sector is able to overcome obstacles such as community acceptance and certification. Undoubtedly, eVTOLs are capable of ushering in a new era in the mobility sector and it won't be long before we witness their true potential.

Authored by Stratview Research. Also published on – Hispavacion