Stratview Research, after examining a wide range of relevant factors and constraints, anticipates modest growth in the market over the next five years, with the market size projected to reach approximately US$ 200 million by 2023.

Batteries, Powering and Empowering Our Future

Batteries are our mobile powerhouse, powering everything from a small wrist-watch to giant electric buses. There is no gainsaying that the journey from the first battery i.e. “Voltaic Pile” to the high energy density rechargeable Li-ion battery of today is no less than astonishing.

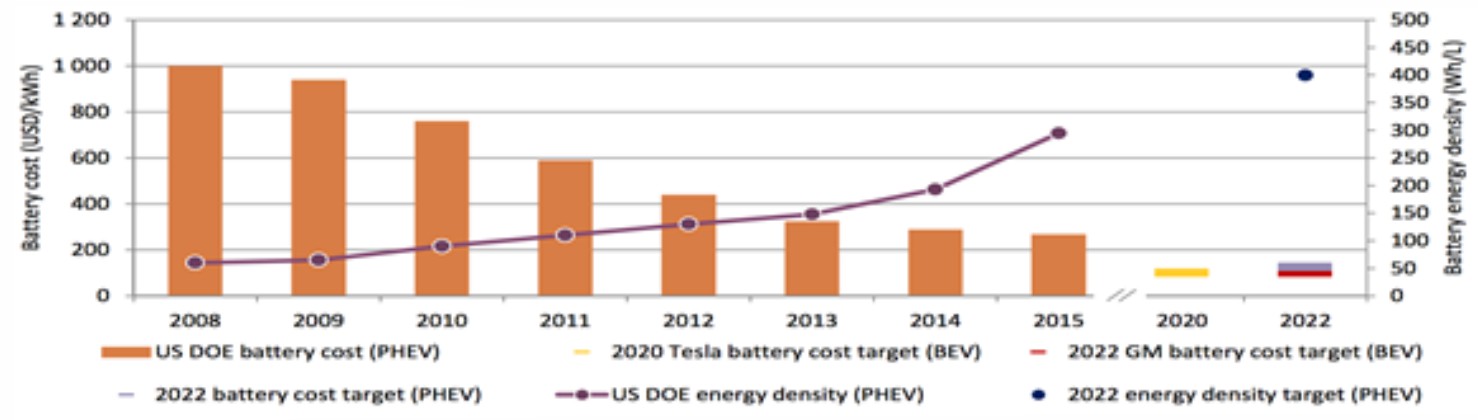

In this evolutionary voyage, the development of batteries can be attributed to the rise of mobile electronics which shrank significantly in size, forcing the batteries to lose weight, size and gain power. The graph below encapsulates the developments in the past decade; the costs have gone down with impressive rises in energy density.

Figure : Batteries, Powering and Empowering Our Future

A battery is also monumentally significant for an aircraft as it performs many functions like power backup, powering emergency systems, starting the engine and turbine. The battery is a critical component for an aircraft as a power failure or interruptions have severe underpinnings, necessitating the infallibility of the batteries under normal as well as extreme conditions.

Aircraft Batteries: A Comparative Analysis

An aircraft battery must meet FAA requirements and must be free of potential hazards and only after meeting the rigorous standards a battery becomes eligible to be used in the aircraft.

The batteries used in the A&D industry are mainly of three types; Nickel-Cadmium, Lead-acid and Lithium-ion batteries. Contrary to consumer electronics, Nickel-Cadmium battery rules over a major share of the aircraft battery market, followed by Lead-acid battery and then lithium-ion battery.

Below is a comparative table of properties:

|

Attributes |

NiCd |

Lead Acid |

Li-ion |

|

Volumetric Energy Density(Wh/l) |

70-90 |

54-95 |

250-620 |

|

Specific Power(W/Kg) |

250 |

125 |

300-1500 |

|

Recycle times (to 80% of initial capacity) |

500-1200 |

800 |

2000 |

|

Environmental Impact |

High |

High |

Very low |

|

Operating Temperature (discharge only) |

-40 to 80°C |

-10 to 50°C |

-20 to 70°C |

|

Self-discharge / day (% @ room temperature) |

0.5% |

1% |

Very Low (10% per month) |

|

Working voltage (V) |

1.2 |

2 |

3.6 |

|

Usable SOC (%) |

30 |

28 |

18-20 |

Table : Comparison of Battery Chemistries: NiCd vs Lead Acid vs Li-ion

Nickel-Cadmium’s dominance is due to excellent track record, long service and shelf -life, easy maintenance and higher safety. They have been fast replacing Lead-acid batteries in many segments because of relatively better properties.

Lead-acid batteries are used in few lighter segments like helicopters, as they are inexpensive, simple to manufacture, they are mature, reliable and well-understood technology. Their self-discharge is among the lowest and are capable of high discharge rates.

Li-ion batteries have the highest energy density, supplying the highest comparative voltage, while they occupy the least amount of space. Vis-a-vis the Nickel-Cadmium battery, Li-ion batteries are 40% lighter and have high service maintenance period (2 years as compared to 4-5 months for nickel-cadmium).

These factors help the OEMs to achieve lightweighting. For instance, four Li-ion batteries in A350 reduced the aircraft weight by more than 80 kg as compared to Ni-Cd battery, are testimonies of the immense potential of Li-ion batteries. It also has the capacity to deliver a large amount of power in a short period of time, enabling high-energy tasks such as starting a jet engine.

Li-ion batteries have low overcharge tolerance (as Li-ion cannot absorb extra charge), as well as overheating issues on account of thermal runaway (overheating in one cell causes other to heat-up) are a cause of concern, but the use of more sophisticated protection circuits and more stringent regulatory framework has addressed these concerns to a great extent.

The lithium-ion battery is the fastest-growing type and has seen a spike in growth on account of preference by next-gen aircraft, B787, A350XWB, and F-35; many other aircraft are expected to follow the suit.

Magnified View of the Industry & Factors Influencing the Growth Dynamics

Stratview Research after espying a whole host of germane factors and constraints expects modest growth in the market during the next five years; market size can grow to around US$ 200 million by 2023.

The USA, world largest A&D battery market, is expected to maintain its leadership over the next five years too. The USA, Germany, France, China and the UK are the top markets with a cumulative share of two-thirds of the market and likely to remain so.

Manufacturing battery for aircraft is a highly technical task requiring technological and procedural exactitude, excellent track-record and many certifications. Unsurprisingly the global aerospace and defense battery market is highly consolidated with the hegemony of a handful of firms.

Saft Groupe S.A., Securaplane Technologies Inc., Concorde Battery Corporation, and GS Yuasa Corporation are the top players in order of market share and together they have around nine-tenths of the market.

Lightweighting and emission pressures have indirectly pushed OEMs to go for lightweight alternatives like Lithium-ion batteries. Its ten-folds power as well as battery life while occupying half the space and a quarter of weight over lead-acid battery along with simplified maintenance procedures are catapulting Lithium-ion battery to a higher growth trajectory.

The Rise of Li-ion Battery and The Road Ahead

The most conspicuous change the industry seems to be witnessing is the gradual shift to Li-ion batteries. But for an industry-wide acceptance and application, they have to address their major lacuna i.e. overheating. The fire in two B787 aircraft (2013) caused by lithium-ion batteries is the biggest reason for the industry’s reluctance and gradual acceptance. Since then the regulators have overhauled the testing, manufacturing and other safety-related guidelines which have addressed security concerns. The B787 is flying again with Li-ion batteries with no further incidents.

Notwithstanding its limitations, the Li-ion battery is the fastest-growing battery segment. The aircraft engineers have even pondered on further electrifying the aircraft and use electric power for taxiing on the ground to save fuel cost. There are ideas like the possible uses of regenerative braking to charge batteries too. This portends a greater use of electric power in future. Thus the cautious shift towards Li-ion batteries is due to the want of options currently unavailable and also due to improvements expected by industry experts both in terms of power as well as safety. At present, the shift to Li-ion seems to be irrevocable.