Stratview Research projects a favorable long-term outlook, with the market anticipated to grow at a CAGR of over 6.5% and reach a record value of approximately USD 347.7 million by 2025.

Only on a strong foundation can a one-and-a-half-decade long growth phase survive, and it cannot be truer for the aviation industry. Unfortunately, the world saw itself reach a standstill for the first and second quarter of 2020, severely impacting the aircraft production rates and hampering the overall growth of the industry.

Fortunately, our research outcomes are encouraging. We expect the growth to bounce back in 2021; the deliveries of long due aircraft such as B373 max, and expected deliveries of B777x, C919, MC-21, etc. would induce the growth.

Seals play a critical role in the functioning of modern aircraft. They help aircraft retain pressure, be fire-resistant, fluid retaining, conductive, insulating, and more. Modern aircraft function under varied and extreme conditions. Cold temperatures at higher altitudes, larger engines, leaner bodies, and other such tough operating conditions motivate research into the development of innovative materials such as seals which can enhance aircraft performance.

Seals are used in almost every system of an aircraft, among them, the engine seals have been the fastest-growing ones and are anticipated to maintain their growth momentum in years to come.

A Deeper Look into the Aircraft Engine Seal Market

Engine seals can augment aircraft performance, increase service life, and bring down costs. There are four types of seals used in aircraft engine:

|

Fire seals |

They can withstand high temperatures and hence find major application in aircraft engines. |

|

Conductive & Insulative Seals |

These seals offer excellent shielding of electromagnetic and thermal interference and elastomers are the most suited to make conductive seals. |

|

Air & Fluid Handling Seals |

Aircraft are highly complex machines with a labyrinth of air and fluid channels and zones. These seals ensure that various components of the aircraft function properly and there is no leakage or spillage. |

|

Others |

Other functions of seals include prevention of deformation against load, noise insulation from the air drag and engine, etc. |

Table : The Four Types of Seals

- Polymers Seals: Includes elastomers, such as silicone, fluoro silicone, thermoplastics and PTFE, rubber, plastics, etc. Rubber is the major elastomer type used to manufacture seals for the aircraft industry.

- Metal Seals: Aluminum, Titanium, Nickel, and alloys; Aluminum is the most popular.

- Composites Seals: Reinforcement materials can be Dacron, Nomex, fiberglass, Nextel, Kevlar, Inconel knit wire and other proprietary materials.

Polymer seals are the most widely used seals; commanding over two-thirds of the market in 2019. Exceptional mechanical properties such as their ability to contract 10 times more than steel along with higher flexibility at lower temperatures are few of the reasons behind their wider use.

Composite seals are the fastest growing ones with an impressive CAGR of over 8% till 2025, owing to their superior mechanical properties, demand for lightweighting, and growth of next-generation aircraft.

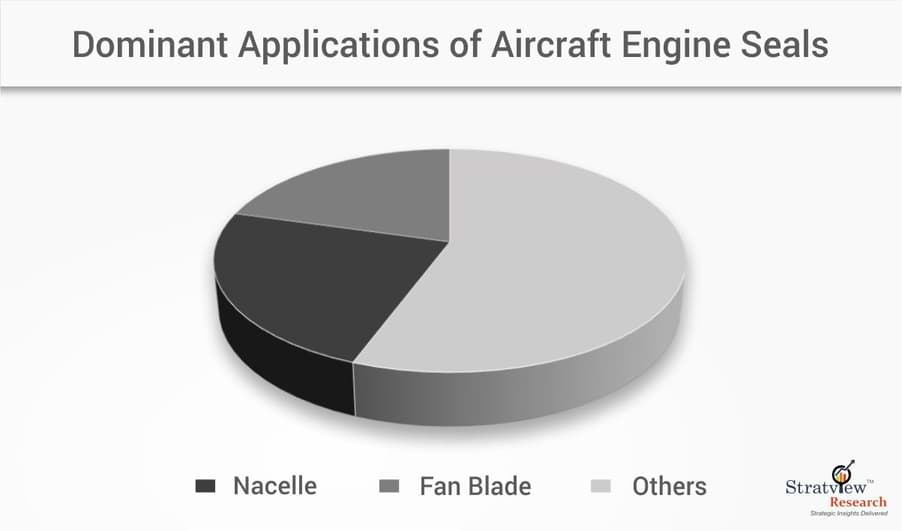

Speaking of the application areas, engine seals are used in Nacelle, Oil & Fuel Systems, Fan Blade, Combustion & Exhaust Section, and Others. The nacelle is not only the largest application; it is also the fastest-growing one too.

Figure 1 : The Dominant Applications of Aircraft Engine Seals : Nacelle, Fan Blade & Others

The Growth Projections

With strong fundamentals, both Boeing and Airbus, are positive about their business outlook and are projecting that the commercial aircraft fleet would more than double in the next 20 years. The huge pile of backlogs and a surge in demand is expected as the lockdowns end, opening the domestic and international borders for travel.

Notwithstanding the bleak outlook projected by many, Stratview Research anticipates that the long-term outlook still feels conducive to growth. Galloping at a CAGR of over 6.5%, the market is expected to reach an all-time-high level of around USD 347.7 million by 2025.

Factors Fortifying the Growth

Our growth projections have been fortified with various strong fundamental factors.

- The expected increase in Commercial and Regional Aircraft Deliveries

The global annual commercial aircraft deliveries are expected to reach approximately 1,944 units by 2025, an impressive number by any measure.

- Increasing Commercial Aircraft Fleet Size

The commercial aircraft fleet size in 2038 is expected to be more than double than that in 2018.

- Expected Increase in Production of LEAP Engines

By the end of 2019, there were total of 1,736 LEAP engines delivered and 391 CFM56 engines delivered by the CFM International. Safran/CFM significantly increased its LEAP engine deliveries from merely 1,118 in 2018 and 459 in 2017.

- Increasing Demand for Fuel-Efficient Aircraft

The dire need for higher fuel-efficiency and reduction in carbon emissions would push the demand for better, and lighter seals, thus increasing the market in value.

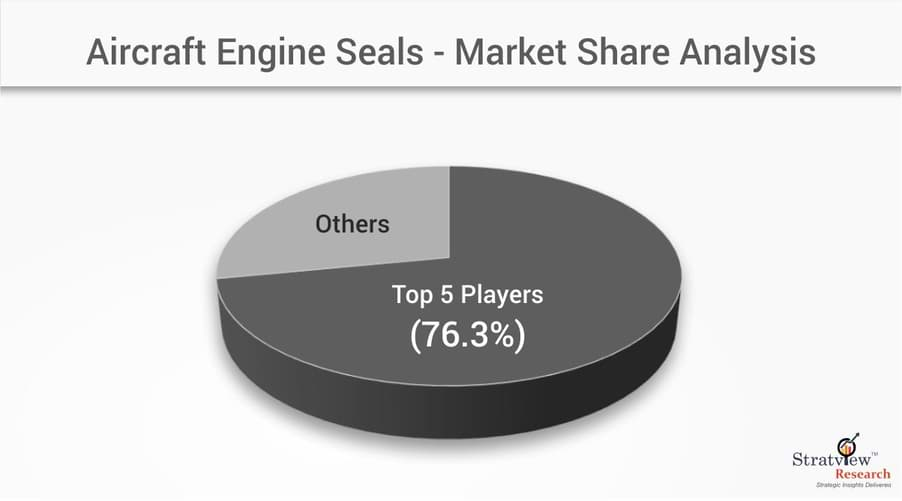

The Competition & Market Consolidation Analysis

The market for aircraft engine seals is highly consolidated. The top five players, Hutchinson SA, Trelleborg AB, Meggitt PLC, TransDigm Group Inc., and Freudenberg Group accounted for over three-fourths of the market in 2019. These companies have a presence in both aircraft engine and aerodynamic seals markets and are among the leading players in both the markets as well.

Figure 2 : Market Share Analysis of Aircraft Engine Seals

TransDigm’s acquisition of Esterline for USD 4 billion in 2019, is an indication that the competition is still high and consolidation is still going on as smaller firms are bringing in innovation.

The Road Beyond COVID-19

The macroeconomic changes caused by COVID-19 will improve with time, but the behavioral changes would take longer to normalize. The growth would pick up again, maybe not exactly as a perfect V-shaped recovery, but we expect things to get much better in 2021 and beyond.

Engine seals play a critical role in an aircraft’s performance, and the developments and growth in engine seals would be more or less in tandem with the overall growth of the industry. There are many reasons for hope, and quick economic recovery as the fundamentals remain strong.