According to Stratview Research, after delving into the minutest of details relevant to the floor adhesive market, expects it to grow at a modest CAGR over the next five years to reach a market size of around US$ 7 billion by 2023.

The history of adhesive is as old as 2,00,000 years when Neanderthals produced tar and used it in bonding stone tools to wooden handles. Our world is functional because of adhesives, from beautiful crafts children make, to cosmic exploration by spacecraft, nothing escapes the application of adhesives.

Floor adhesive is an important adhesive application. It is the floor of one's house that takes the brunt of everyday activities and is subject to significant wear and tear. The type of flooring one opts for, is an important decision thus. There are different types of floorings primarily available such as tiles and stones, wooden flooring (softwood and hardwood), carpet flooring and laminated flooring. The choice of flooring is very critical but equally important is the type of adhesive one is using to fix the flooring.

There are various methods used for fixing the flooring, such as mechanical fastening systems, cementitious products and adhesives.

Among them, adhesives are gaining currency on account of their useful properties such as strong adhesion, an ability to bond dissimilar materials, moisture resistance, longer life and ease of installation.

Each adhesive has a set of properties which can be encapsulated as its response to chemical, water and heat resistance, UV resistance, along with adhesion strength, mechanical and electrical (insulating) properties. These properties decide adhesive’s suitability for use in places such as hospitals, corporate buildings, shopping malls and complexes as there is high traffic along with industrial places such as factories and manufacturing units.

A Granular Look into the Floor Adhesives Industry

Stratview Research, after delving into the minutest of details relevant to the floor adhesive market, expects it to grow at a modest CAGR over the next five years to reach a market size of around US$ 7 billion by 2023.

In this moderately consolidated market, the incumbents are showing eagerness for inorganic growth and the industry can be expected to move towards higher consolidation.

The top five players Henkel AG & Co. KGaA, Arkema Inc., Sika AG, Mapei Corporation and H. B. Fuller (in decreasing order of their respective market share) together accounted for a little less than half of the market share.

Asia-Pacific is the capital of the construction industry. The impressive economic growth of the Asia-Pacific has resulted in its dominant share of around 40% in the global floor adhesive market. The region is also expected to retain its leadership; under the dominance of China, followed by Japan and India.

China, the USA, Japan, Germany and India, the top five countries together occupy around half of the global market.

The major floor adhesives used are Acrylic, Polyurethane, Epoxy, Vinyl adhesives.

|

Adhesive type |

Major Application |

Properties |

|

Acrylic adhesives (the largest market share) |

Are being increasingly used in Luxury Vinyl Tiles (LVT) flooring, carpets and carpet tiles. |

It is fireproof, bonds dissimilar materials, has hidden bond lines, also the galvanic corrosion is improbable. It has faster curing and allows unique designs of the floor. |

|

Polyurethane adhesives (2nd Largest, fastest growing) |

Wooden flooring

|

Long-lasting surface finish with superior chemical, solvent and scratch resistance, fast drying, resistance to UV light damage. |

|

Epoxy adhesives |

High-end flooring application areas, such as commercial kitchens, lobbies, swimming pools, bathrooms and shopping malls |

High strength, resistance to physical abuse and shock, which makes it suitable for high-traffic flooring. |

|

Vinyl adhesives |

PVC floor coverings for sheets and tiles, cushioned vinyl floor coverings and carpets |

Pressure sensitive characteristics to the flooring surfaces |

Table : Comparison of Adhesive Types and Their Applications in Flooring

Fig. 1 : Floor Adhesives Market by Major Applications

The environmental and work safety regulations on VOC emissions have become increasingly stringent, mandating the suppliers to qualify various standards like LEED (Leadership in Energy and Environmental Design). This has given a push to the use of Water-based adhesives which are very safe while discouraging the use of Solvent-based adhesives.

Propellants of Growth

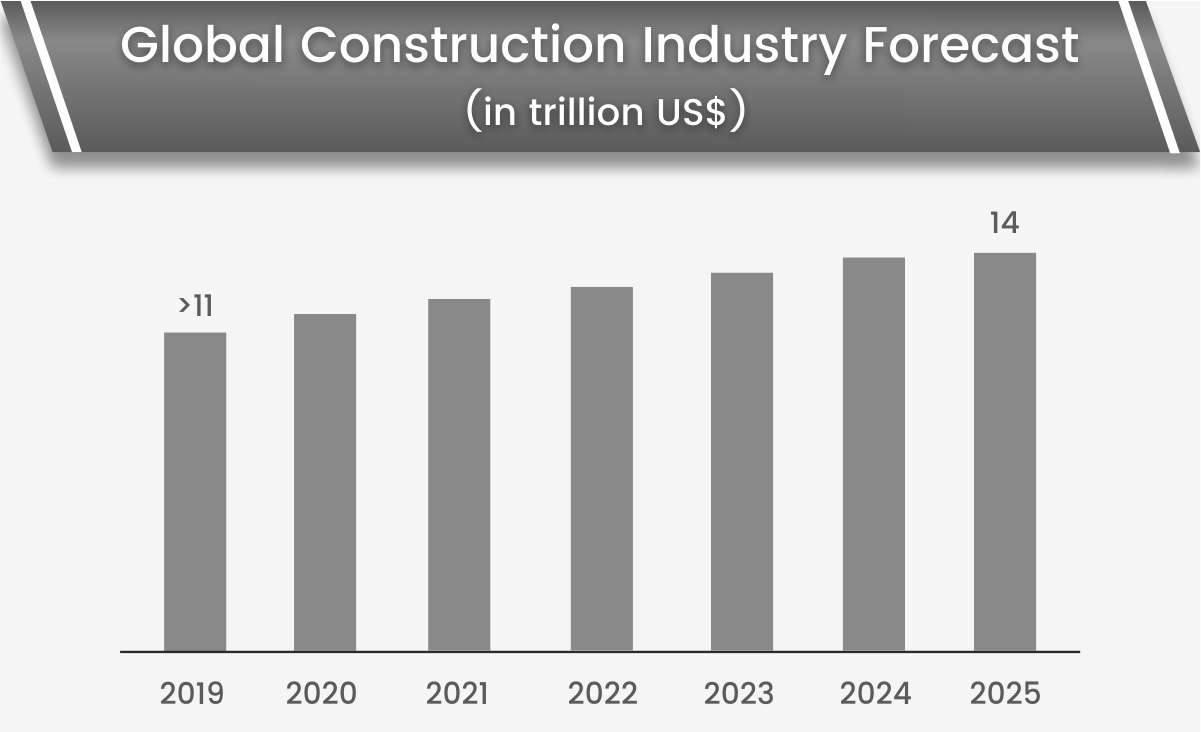

The Global Construction Industry was valued at a gargantuan size of around UD$ 11 trillion in 2019 and is expected to grow at a CAGR of >3%, which will give sustainable growth to floor adhesive industry.

Fig. 2 : Global Construction Industry Forecast

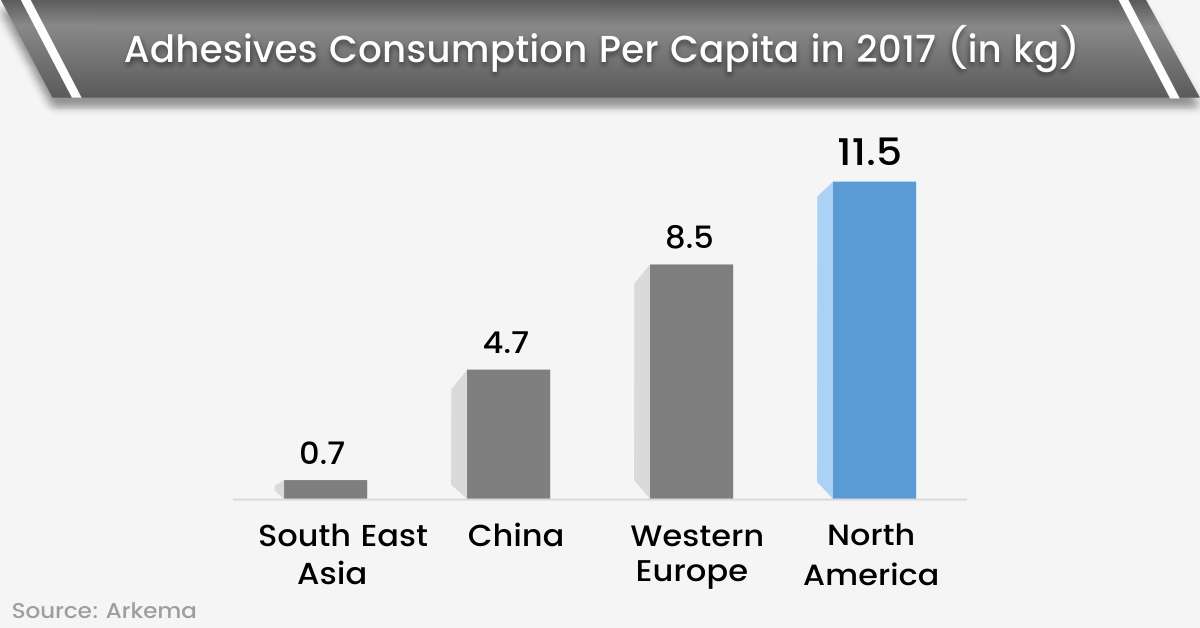

There has been a growth in per capita consumption of adhesives in general. North America tops per capita consumption, while Asia-Pacific leads in overall consumption.

Fig. 3 : Adhesives Consumption Per Capita in 2017 (in kg)

Adhesives are rapidly replacing the traditional mechanical fasteners, such as screws, nuts, bolts, rivets and welds in flooring applications, especially in the case of wooden flooring. Adhesives have long replaced glue and are outpacing conventional cement with their better results.

Their ability to bond dissimilar substrates is also a meritorious quality which is increasing its popularity and boosting the growth of floor adhesives.

The Inorganic Growth & Innovations

The industry seems to move towards consolidation phase, as portended by frequent acquisitions. The acquisitions were either with an intention to increase the stronghold on adhesive market or to diversify.

Bostik completed the acquisition of XL Brands, in 2018, with an intention to gain share in the growing high-value-added adhesives market. Interestingly Bostik was acquired by Arkema in 2015. The acquisition was done to further Arkema’s goal of becoming a world leader in specialty chemicals and advanced materials.

H.B. Fuller acquired Royal Adhesives in 2017. The acquisition was in synchronicity with the firm's vision of expansion in engineering adhesives business.

Numerous product launches have happened in the industry of late. These innovations seem to be directed towards increasing versatility of adhesives, enhancement in their properties and addressing specific application related issues.

Bona R851 made by Bona, is a wood-based adhesive with elastomeric characteristics which allow the adhesive to move with the wood as it expands and contracts over the life of the floor.

RollSmart, SpraySmart 901, Tarkett 959 were the products launched by Tarkett in 2016. RollSmart uses fast dry technology to shorten the curing time, while SpraySmart 901 is resilient floor spraying adhesive. Tarkett 959 is a luxury and solid vinyl tile adhesive that can be used with all type of concrete.

Greenforce is a high-performance hardwood flooring adhesive launched by Bostik, 2017. Greenforce has extremely low moisture vapour permeability, obviating the time-consuming concrete moisture testing.

It is abundantly clear that significant technological advances are being made and is a good sign for the industry.

The Road Ahead

In line with the trends in other industries, conventional materials are giving way to the new age materials; floor adhesive market is no exception. There have been rapid innovations which are empowering the adhesives to transcend their limitations. Constraints such as limited life, inflexibility, long curing time, limited moisture tolerance etc., are fast disappearing.

With these innovations, adhesives are fast replacing old or conventional materials; this broadening of the horizons of application, coupled with the healthy growth in the construction industry (led by Asia-Pacific) is set to give prodigious impetus to the growth of the global floor adhesives market.