According to Stratview Research, after scrupulously analyzing all facets of the industry expects the global space electronics market to grow at a healthy CAGR, reaching a market size of over USD 1.6 billion by 2024.

Space Exploration

Space represents the final frontier for human exploration, albeit a limitless one. Since the launch of first human satellite i.e. Sputnik 1, 1957, over six decades we have ceaselessly strived to explore the cosmic hinterlands. In 2017, Casini-Huygens mission sent its last pictures of Saturn (2017) from the farthest point in space (around 1.2 billion km) we had yet systematically explored. Such a great feat would not have been possible without advancements in space-grade electronics.

The journey into space has also been very rewarding with the development of GPS, accurate weather forecasts, expanding telecommunication capabilities, earth observatories and many more. Today many nations are continuously launching satellites into space for the betterment of their economy and national security.

The Spacecraft, Vehicle of Space Exploration

Any foray into space cannot happen without a spacecraft. There are two parts of a spacecraft; the Launch vehicle (rockets) & the Payloads (satellite, landers, rovers and space shuttle etc.). To successfully execute the complex task of launching, positioning and proper functioning of a satellite or a probe, there are various subsystems functioning in synchronicity with each other.

The basic subsystems of a spacecraft are:

|

Subsystems* |

Functions |

|

Communication Subsystems (Largest and Fastest Growing) |

Transmits signals between spacecraft/satellite & ground equipment. |

|

Telemetry, Tracking and Command |

To control and measure the function of the payload; it includes receivers, transmitters, antennas, sensors for temperature, current, voltage, and tank pressure. |

|

Attitude and Orbital Control |

To monitor and control speed, position and movements of the satellite. |

|

Electrical Subsystems |

Convert solar energy into electric power and store it etc. |

|

Structural Subsystems |

Convert solar energy into electric power and store it etc. |

*(arranged in decreasing order of market share) Table : Key Satellite Subsystems and Their Functions

The dominance of communication subsystems can be attributed to the rise in demand for high definition satellite television services, radio services, broadband services and mobile services, the rise in data usage, satellite TV subscriptions have led to the dominance of communication subsystems.

It is abundantly clear that to execute such a complex task, advanced space-grade electronics are indispensable. But the electronics used in space systems are not the usual electronics we use at home. They are Radiation Hardened/Tolerant and qualify the highest quality standards such as Qualified Manufacturer List (QML) class V, in order to be used in space.

The Lay of the Land

Stratview Research, after scrupulously analyzing all facets of the industry expects the global space electronics market to grow at a healthy CAGR, reaching a market size of over USD 1.6 billion by 2024.

Also, increasing investments in commercial space programs and in small satellites by private players will lead to a doubling of the current market in the next ten years.

The USA, Russia, China, Japan, and India together accounted for about three-fourths of the global space electronics market in 2018. Asia-Pacific is expected to grow the fastest, on account of the dominance in smaller satellites and enhanced launch capabilities.

At present, space electronic industry is very cost competitive and highly regulated with rigorous quality checks before they allow parts to be used in a spacecraft. The regulatory guidelines have been forcing the incumbents to develop high radiation tolerant parts with a simultaneous reduction in size, weight and power consumption. Entry of promising companies (Space X, One Web satellites LLC etc.), which have offered significant weight reductions and savings are making the market highly competitive.

Microsemi Corporation, Cobham Plc., Texas Instruments, Honeywell International Inc., and BAE Systems Plc. are the top five players of a fairly consolidated market and they account for around two-thirds of the total market in 2018.

Satellite, Landers, Rovers, Space Shuttle etc. & spacecraft, are the main products manufactured to facilitate space exploration. Satellites accounted for a high share of the global space electronic market.

Space electronics must be made capable of withstanding an extremely harsh environment in space. The space-grade electronics are either Radiation-Hardened (can tolerate a very harsh environment and have a longer life) and Radiation-Tolerant (are less resilient). The dominance of Radiation-Hardened satellite can be assigned to a higher percentage of bigger satellites out of 1957 ones currently operational. As bigger satellites need more radiation-hardened components for longer life and durability.

Radiation-hardened components find application in military communications and reconnaissance satellites such as MILSTAR and the KH-11 “Keyhole” satellites and their increased usage gives the growth impetus.

Radiation-tolerant electronics are used in smaller satellites and are growing at a faster rate due to rise in small satellites used in earth observation, lunar probes, communication and networking applications. The low-cost feature of radiation-tolerant electronics compared to radiation-hardened electronics is likely to create high growth opportunities in space application.

Growth Boosters

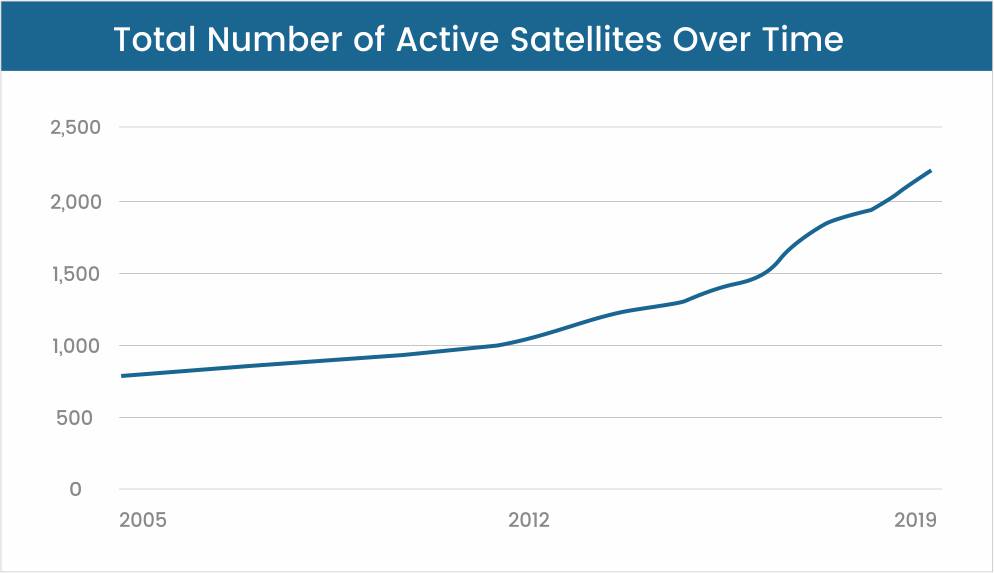

The rapid increase in the number of satellites in the past few years, with an even higher growth expected in future, shall drive the growth of space electronics.

Figure 1 : Total Number of Active Satellites Over Time

Towards the end of 2019, there were around 2218 active satellites. The graph (UCS Satellite Database) shows a sharp rise in the number of satellites in the past few years. It is also expected that around an astounding number of 4,000 satellites are to be delivered in the next five years, one can easily fathom the colossal growth potential.

Also, a drastic increase in the number of small satellites is expected, owing to the rising demand for low cost & high-speed internet facilities. Such a spurt is expected to drive the growth of the global space electronics market.

The governmental spending in space exploration programs is expected to increase at a nominal CAGR of 2%, to reach an enormous level of USD 80 billion by 2023. USA’s budget for space exploration exceeds all others, followed by Europe. Increased spending along with the renewed interest in manned missions across countries is also set to expedite growth in the space electronics market.

A sharp rise in the investments has been witnessed with the coming of around 150 new firms in space-based activities. Space X, One Web satellites LLC, Planet Labs Inc., Kymeta corporation and Spire are some major private companies. Space X and One Web have planned to develop 1000s of small satellites in the coming five years which will present a great opportunity for the global space electronics market.

Investments are also increasing to enable cost reduction and technological advancements by bringing in miniaturization and lightweighting, development of high-resolution optical imaging, increasing bandwidth of communication etc.

A Glimpse of the Future

The expected expansion of global economy coupled with copious advantages of satellites and rekindled global interest in manned missions are resulting in unabated growth of space electronics. But the growth is not without encumbrances.

It is estimated that there are around 5,00,000 space debris orbiting the earth and are a potential danger to new satellites.

Since launching satellites is an expensive affair, their long life is exceedingly desirable. But apparently, the radiation hardened space electronics which increase the longevity of satellites parts are very expensive. Though the industry is working on it, it still poses a formidable challenge.

The stringent quality check which requires 100% testing and inspection, increases the cost substantially and poses a hindrance for new less opulent players. This impedes rapid innovation brought in by new players.

Notwithstanding the challenges, the demand for space electronics will continue unhindered, as governmental spending, as well as private investments, have grown consistently. A prodigious number of satellites are to be launched, along with major manned and unmanned mission and space probes, which will propel the growth in the next five years.

As the costs go down in future, many more countries and private firms shall be able to leverage the advantageousness of modern satellites and other missions, catapulting the space electronic market into a higher growth trajectory.