According to insights from Stratview Research, the market is expected to surpass US$ 430 million by 2025, driven by recovering aircraft production and growing demand for high-performance sealing solutions, and is projected to record a strong CAGR of over 6% during 2020–2025.

The 16-year long growth streak of the Aviation industry has been brought to the screeching halt by the Covid-19 pandemic. The crisis aggravates the problems faced by the aviation industry like the grounding of B737 max and delays in entries of most awaited programs (B777x, C919, MC-21, etc.) in 2019. The lockdown severely reduces the aircraft production rates and hampers the overall growth of the industry.

Our research estimates that the growth would bounce back by 2021. The growth is expected to spike when the crisis begins to fade away; this is because the fundamentals remain strong and the growth drivers like lightweighting, higher performance, etc. are still bullish.

Safety, performance, and innovation are the 3 pillars of Aerospace research. Seals have a critical role to play in each of the three areas and in promoting the aircraft of the future. Not only do they have direct bearing to aircraft performance by promoting improved reliability and service life, optimized pressure retention and extreme temperature-withstanding capabilities; they also play a vital role in ensuring greater fuel efficiency through lightweighting and aerodynamics.

The Bird’s-Eye-View of the Aircraft Aerodynamic Seal Market

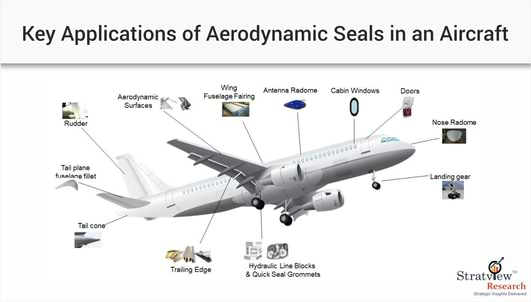

Of the various seals used in aircraft, aerodynamic seals cover almost half of the market. From tail-cone to the nose-radome, aerodynamic seals have a critical role to play in aircraft’s safe and efficient functioning.

Fig. 1 : Key Applicants of Aerodynamic Seals in Aircraft

|

Airframe |

Flight Control |

Landing Gears, Wheels& Brakes |

Other |

|

Static seals are used in doors, windows, fuselages and fairings. |

High-Strength wear and pressure-resistant seals are used in ailerons. elevators, rudders, flaps, slats etc. |

Inflatable seals in landing gear strut wheels, and braking system control. |

Others include hydrulic line blocks, quick seals grommates, inflatable seals for cockpit canopy, tailcone, and nacelle seals. |

Table : Application Breakdown of Seals in Modern Aircraft Systems

Airframe makes up for about half of the market whereas light control surfaces the fastest-growing ones.

To perform under such varied conditions, different materials are used to optimize performance.

There are three types of materials out of which seals are made:

- Polymers: Include elastomers, such as silicone, fluoro silicone, thermoplastics and PTFE, rubber, and plastics, etc.

Rubber is the major elastomer type used to manufacture seals for the aircraft industry.

- Metal: Aluminum, Titanium, Nickel, and alloys

Aluminum is the most popular.

- Composites: Reinforcement materials can be Dacron, Nomex, fiberglass, Nextel, Kevlar, Inconel knit wire and other proprietary materials.

Polymer seals are the most widely used seals commanding over three-fourths of the market in 2019. Exceptional mechanical properties such as their ability to contract 10 times more than steel along with higher flexibility at lower temperatures are the reason behind their wider use.

Fastest Growing: Composite seals, owing to superior mechanical properties, demand for higher fuel efficiency and emissions reduction, and growth of next-generation aircraft, are the fastest growing aerodynamic seals.

The Growth Dynamics

The pandemic at best brings a short-term growth hiatus as the fundamentals remain strong, and the long-term market outlook is still roseate.

The aircraft aerodynamic seals market is expected to shrink by over 15% in 2020 because of Y-o-Y fall in the total global passenger airline revenue by 55%, as per the recent impact assessment of IATA.

But over the long run, Stratview Research estimates that the market will cross US$ 430.0 million by 2025 with a sound growth rate of >6.0% (2020-2025).

Factors propelling the growth of aircraft aerodynamic seals

The factors propelling the market would remain bullish. Here is a snapshot of the main factors:

- Expected Recovery in Commercial and Regional Aircraft Deliveries

Deliveries of B737Max and other aircraft are now long due and would fuel growth.

- Increasing Commercial Aircraft Fleet Size

Both Boeing and Airbus are more than doubling the fleet in 2038 from the 2018 level.

- Increasing Demand for Fuel-Efficient Aircraft

The dire need for higher fuel-efficiency and reduction in carbon emissions would push the demand for better, and lighter seals, thus increasing the market in value.

- Advancements in Aerodynamic Designs of Aircraft

An improvement in aerodynamic designs is increasing the penetration of seals as wingspans and other applications increase.

The Competitive & Regional Landscape

The market is highly concentrated with the top five players, Meggitt PLC, Hutchinson SA, Trelleborg AB, TransDigm Group (TA Aerospace and Kirkhill), and Freudenberg Group, capturing over two-thirds of the market in 2019.

These players are expected to hold their hegemony in the coming years too. Globally there are less than 50 global and regional players in this market. North America leads the market, followed by Europe, and Asia-Pacific (APAC).

It is Time for Cautious Optimism

The 16-year long streak of growth has been fortified by strong fundamentals and economists over the world foresee a v-shaped recovery which is only subject to the opening of markets as the pandemic recedes.

Since aircraft aerodynamic seals are an integral part of aircraft of all types, the growth spike would be in tandem with the recovery in the aviation industry. The market would not only grow in volume, but the requirements of next-gen aircraft would push the growth in terms of value too.