The global heat exchanger market was valued at around USD 15.3 billion in 2023 and is projected to reach USD 16 billion in 2024. According to Stratview Research, this article explores key trends, market dynamics, and growth opportunities in the sector.

A heat exchanger is a device used to transfer heat from one medium to another. However, beyond the technical definition, heat exchangers are indispensable not just for your small appliances like refrigerators and air conditioners making your life comfortable, but also for big engineering applications like the power plants lighting up the world around you.

The total heat exchanger market size was approx. USD 15.3 billion in 2023 and is expected to hit USD 16 billion in 2024 (source: Stratview Research). This article scouts various aspects of the heat exchanger market.

Types of Heat Exchangers:

Heat exchangers come in various configurations, each carrying their own merits and demerits. Broadly, heat exchangers can be classified into shell and tube heat exchangers, plate heat exchangers, and air-cooled heat exchangers based on their working.

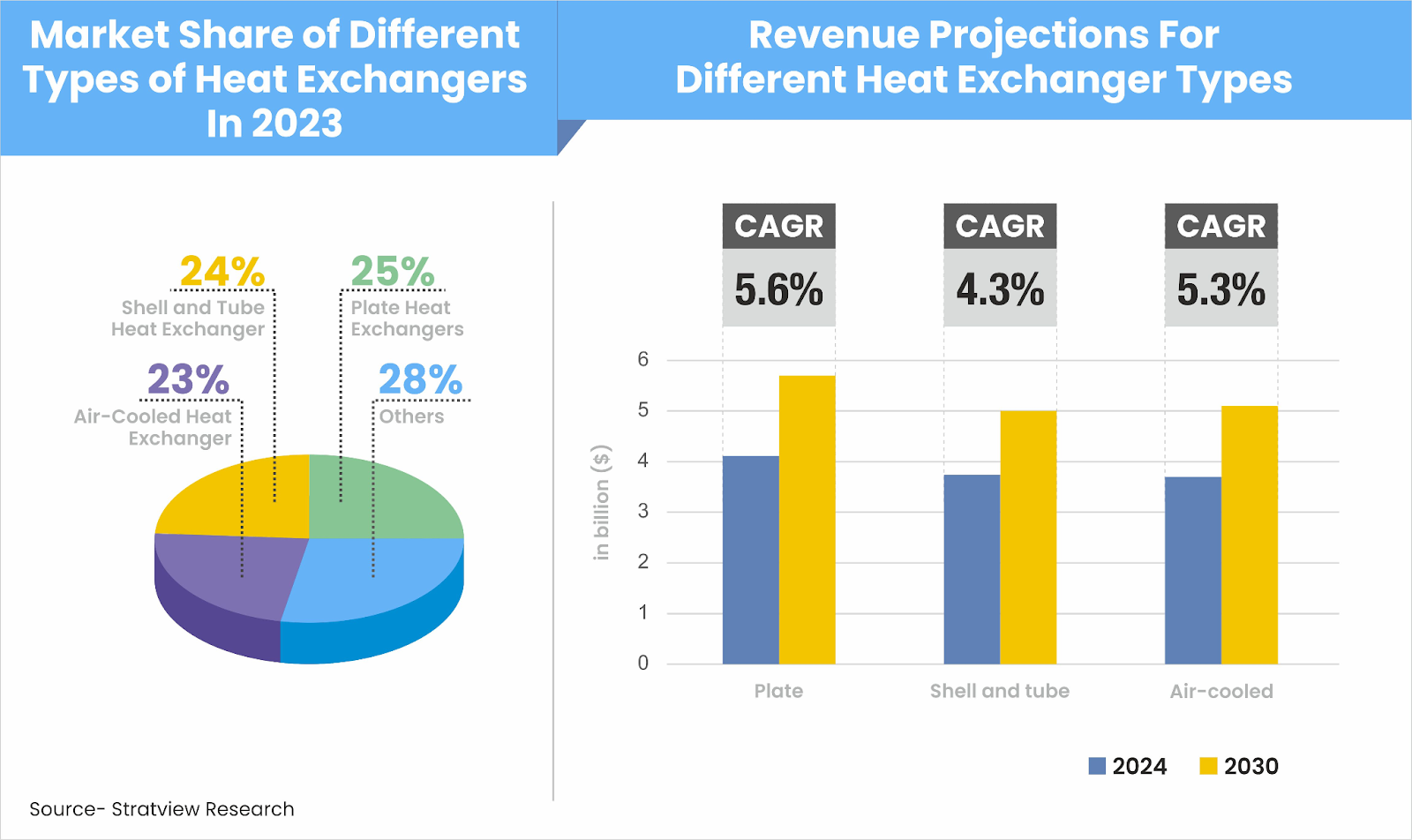

A plate heat exchanger (PHE) uses thin, corrugated metal plates to transfer heat between two fluids. PHEs are simple and hence easy to repair, maintain, and service. Furthermore, benefits such as their high heat transfer coefficient, the ability to enhance the capacity of the exchanger by introducing new plates and excellent heat transfer efficiency due to the turbulent flow on both sides make them the most popular type of heat exchangers in the market. With more than 25% of revenue share, plate heat exchangers are the dominant and fastest-growing type in the market. The plate heat exchangers alone are expected to generate a revenue of approximately USD 4.11 billion in 2024 and hit USD 5.7 billion in 2030 growing at a CAGR of 5.6% (source: Stratview Research).

After PHE, a shell and tube heat exchanger is the popular choice, with around 24% market share. It is made up of multiple tubes housed inside a pressurized vessel called a shell. One fluid flows through the tubes and the other over them in the vessel, facilitating the heat transfer. It is cheaper compared to plate heat exchangers and suitable for high temperatures and pressure. However, it is less efficient compared to plate heat exchangers, requires more space, and the cooling capacity cannot be increased at a later stage. Shell and tube heat exchangers are expected to generate a revenue of approximately USD 3.74 billion in 2024 and hit USD 5 billion in 2030, growing at a CAGR of 4.3% (source: Stratview Research).

Air-cooled heat exchangers occupy the third largest place in the market, with around 23% of the market share. They eject heat from the desired system to the outer atmosphere using the principles of convection and conduction. They offer lower operating costs, a high heat transfer coefficient, and simple controls. However, they are usually expensive and larger in size compared to liquid-cooled exchangers. Air-cooled heat exchangers are expected to generate revenue of approximately USD 3.7 billion in 2024 and hit USD 5.1 billion in 2030, growing at a CAGR of 5.3% (source: Stratview Research).

Fig. 1 : Market Share & Revenue Forecasts for Heat Exchanger Types

The Dominant Duo: Chemical & Power Generation

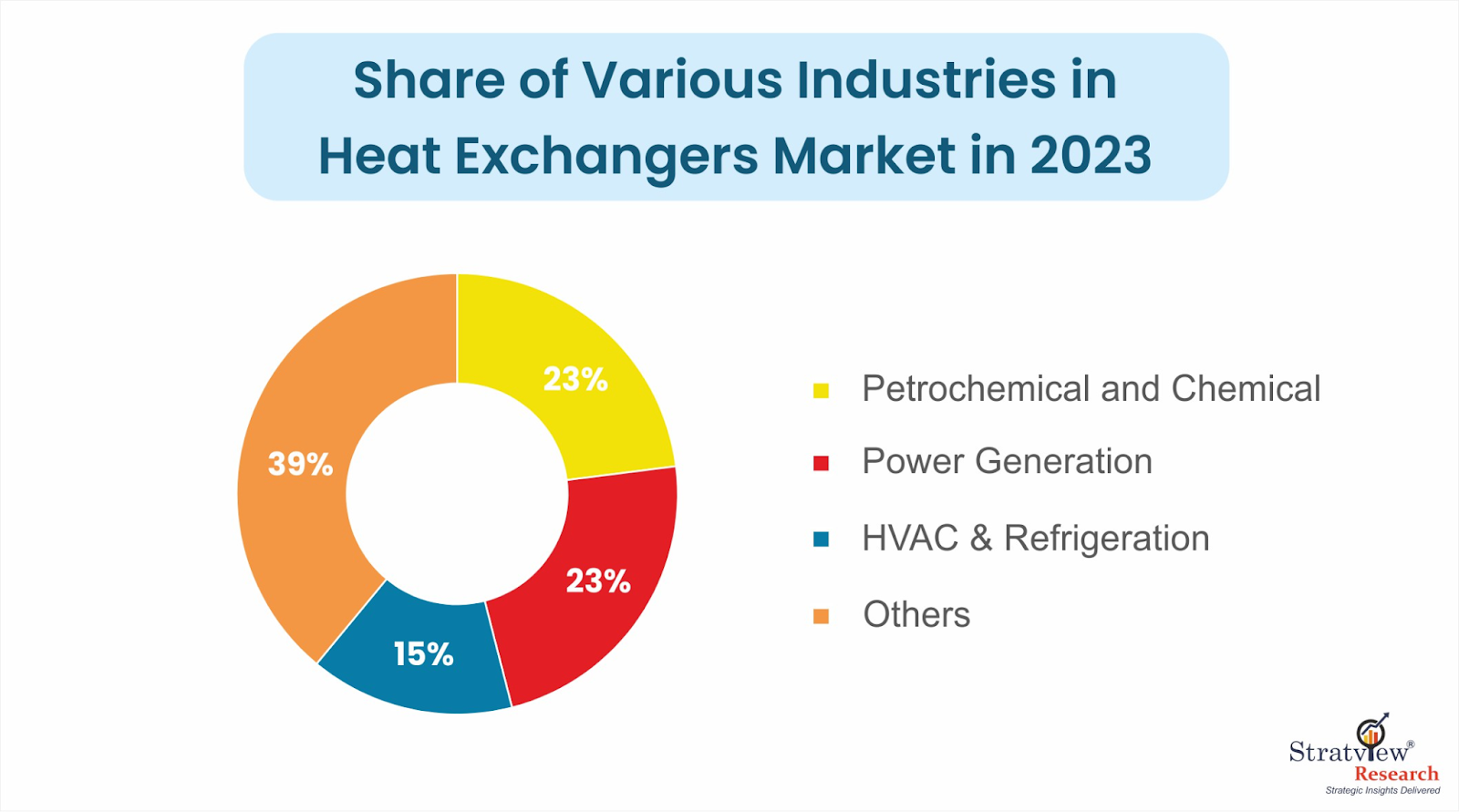

Power generation and petrochemical and chemical industries are the dominant drivers, each bringing 23.3% and 23% revenue, respectively, to the heat exchanger market. The petrochemical industry deals with processes with high pressure and temperature and hence needs efficient heat optimization.

Condensation of solvents and chemicals, cooling or heating reactors, production units, base, intermediate, or final products, and reducing CO2 emissions by capturing CO2 from gas streams are some of the widespread applications of heat exchangers in this industry. For example, crude oil is preheated using a shell-and-tube heat exchanger before it enters the distillation column during the refinery process. In power generation, applications of heat exchangers include cooling down reactor coolants and wet storages (in nuclear power plants), condensation, condensate sub-cooling, feed water pre-heating, and heat extraction (in fossil fuel-based power plants). Furthermore, plate heat exchangers are also used as gas and electrolyte coolers in electrolysis plants.

Next to power generation and petrochemicals, the HVAC and refrigeration industry is the most dominant industry, driving more than 15% of revenue. Heat exchangers are the primary components of air conditioning and refrigeration systems as they transfer heat between the source and the fluid (refrigerant, air, or water). Examples include finned-tube heat exchangers in air conditioners to transfer heat from indoor air to the refrigerant, plate heat exchangers used as evaporators in commercial refrigerator systems, baseboard radiators used to heat rooms in residential buildings, etc.

The rest 39% of the market is driven by industries such as Food and Beverages (pasteurization, sterilization, heating & cooling, evaporation, removing deposits, etc.), Oil & Gas (separating oil and water, temperature control during various processes, heat transfer in fuel gas conditioning systems, application in selective catalytic reduction (SCR) units, etc.), Water and Wastewater (cooling wastewater, recovering heat from raw and treated sewage, removing water from wastes by evaporation, cooling water before discharging, etc.), Marine and Shipbuilding (cooling ship engines and hydraulic oils, cooling fresh water after distillation, etc.), Pharmaceuticals (crystallization, evaporation and distillation to change the state of products, solvent recovery, and drying, maintaining sterility, etc.), and others.

Fig. 2: Share of Various Industries in Heat Exchangers Market in 2023

Key Regions and Players:

Asia-Pacific is the largest and fastest-growing market capturing around 34% of the total heat exchanger market. This could be attributed to the consistent industrial growth across sectors such as chemicals, manufacturing, pharmaceuticals, and HVAC systems. Furthermore, Asia-Pacific accounts for approximately 50% of the global petrochemical market, 45% of the global HVAC market, and 35% of the global power generation market. As discussed, petrochemical, HVAC, and power generation are the largest end-use industries in the heat exchanger market, which explains this region’s dominance.

The global heat exchangers market has low market concentration with the top 5 companies, namely, Alfa Laval AB, Johnson Controls, Kelvion Holding GmbH, Linde PLC, and SWEP International AB, together holding 28% share in 2023. Almost all the leading players have a presence in all three major types of heat exchangers and have a global presence offering their solutions in multiple locations.

Alfa Laval AB, for instance, offers plate heat exchangers, air-cooled heat exchangers, scraped surface heat exchangers, and tubular heat exchangers, delivers services in 160+ countries, and has a network of 100+ service centers. The company also claims to have the market’s widest plate heat exchanger portfolio. SWEP International has also developed a unique calculation software, the SWEP Software Package, for advanced heat exchange calculations. All the other top players have an almost similar range of product offerings and have a wide geographical reach.

Looking Ahead:

Heat exchangers have proven to be an indispensable part of a wide range of industries. From appliances providing comfort and convenience in households to complex industrial processes, these devices make temperature management possible. As the industries continue to evolve and become more sophisticated, the role of heat exchangers will become more critical. Hence, the heat exchangers market is expected to demonstrate consistent growth with a CAGR of 5.1% and hit USD 21.8 billion in 2030.

Authored by Stratview Research. Also published on – Heat Exchangers World