According to the insights from Stratview Research, the global graphite electrode market is set to reach US $15.3 billion by 2024 with the steel segment being the dominant application. The global EAF penetration is set increase to 33% by 2024 supporting the growth in the graphite electrode market

In the current scenario of rising CO2 emissions, environmentally friendly methods for steel production are gaining popularity world over. The emerging economies are imposing new green regulations on its steel sector for reducing the carbon footprint. This has been instrumental in the sudden jump in demand for Graphite Electrodes (GE), mainly for steel production through the eco-friendly EAF method. EAF method of steel production is one of the major applications of Graphite Electrodes. EAF method mainly uses steel scrap for production of crude steel.

What are Graphite Electrodes?

Graphite electrodes are used in electric arc furnace (EAF) and ladle furnace (LF) for steel production. They are used to melt steel scrap. They transfer the electrical energy from the power supply to the steel melt in the EAF bath. It also has its application in aluminium, silicon metal production and other smelting processes.

The tip of these electrodes can reach up to 3000-degree Celsius, which is approximately half the temperature of the sun. In addition to excellent mechanical strength, thermal expansion, thermal shock resistance and machinability, the high temperature helps in reducing the entire mass of steel.

Depending on the grade of the electrode, up to 6kgs of electrode is used to produce one tonne of steel. It is the mainstay of Steel production through EAF method as there are no substitutes available as opposed to silicon and aluminium.

There are different grades of Graphite Electrodes that are used. The Ultra High Power (UHP), High Power (HP) and Regular Power (RP). UHP captures major share of the total graphite electrode market as it is chiefly used in large EAF furnaces, which are becoming the norm in steel production.

Increasing EAF Share in Crude Steel Production

Steel Production is a key driver for graphite electrodes. There are two ways to produce steel. The Blast Furnace (BOF) method and the Electric Arc Furnace (EAF) method. The EAF method is an eco-friendly one compared to the blast furnace method as it uses scrap steel and electricity as opposed to Iron ore & coal. World over, this method has been gaining prominence due to availability of steel scrap in developed nations.

The global graphite electrode market is set to reach US $15.3 billion by 2024 with the steel segment being the dominant application. The global EAF penetration is set increase to 33% by 2024 supporting the growth in the graphite electrode market. (View Source: Graphpite Electrode Market Report by Stratview Research)

Figure 1 : Steel Production and EAF Penetration

The graphite electrode industry experienced a demand slack from 2011-2016 due to declining steel production after a decade of stable growth, leading to closure of 236 thousand tonnes of graphic electrodes capacity across the globe (other than China) along with significant fall in its price.

China, which accounts for 50% of global steel production (as per WSA), used the BOF method for 93% of its production in 2016. However, after the crackdown on polluting units by the Chinese Government, the EAF penetration increased to 9.3% in 2017, igniting a V shaped recovery for the graphite electrode market. This also led to a 5-fold increase in the Graphite Electrodes price in 2017-18 to an all-time high of approximately US $ 13,500 per tonne in 2018.

China’s steel production through EAF is expected to further increase to 17% by 2024 and 30% by 2030 which will further drive the demand for graphite electrodes.

The global growth for graphite electrode is set to improve. The Asia-Pacific region, mainly China, will be driving the growth during 2019-2024. The European market, mainly Turkey will also generate significant demand.

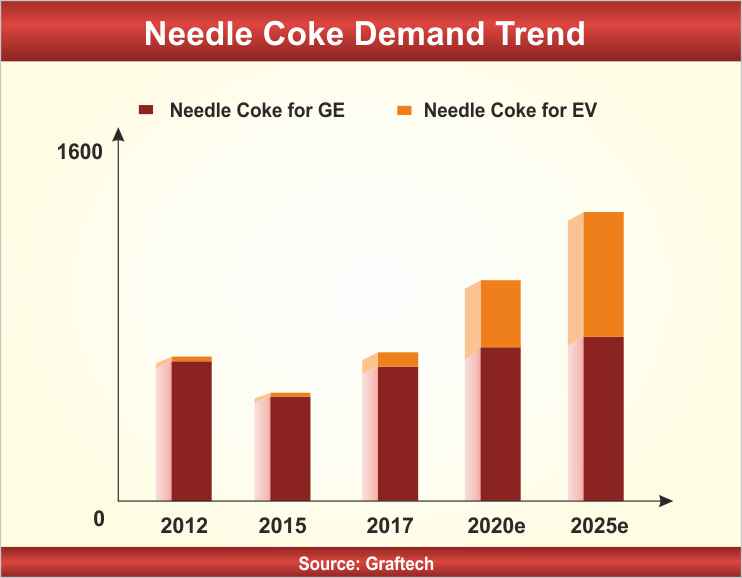

Raw Material Supply – A Major Constraint

The main raw material needed for production of graphite electrodes, is needle coke. Petroleum needle coke is used to manufacture UHP graphite electrode whereas Pitch needle coke is used for producing HP and RP graphite electrode.

Figure 2 : Needle Coke Demand Trend

Changing Industry Dynamics

The graphite electrode industry has seen its share of ups and downs, registering stable growth from 1990 to 2010. The subsequent decline in the next 5 years can be attributed to muted growth in steel production and mainly due to low share of EAF steel production in China. This severely impacted the demand-supply position, forcing many units to shut down leading to loss of global.

Excluding China, there are a handful of market players and we can say that the market is oligopolistic in nature. The top five players (Showa Denko, GRAFTech International Ltd., Fangda Carbon New Material Co. Ltd., Graphite India Limited, and Tokai Carbon Co., Ltd) captured more than half the market.

The sudden increase in demand in 2017 and subsequent price increase has led to market consolidation, with Showa Denko K.K. acquiring SGL GE which was the second largest supplier of Graphite Electrode and Tokai Carbon, acquiring 100% in the US subsidiary of SGL GE.

Graftech International is a major player, having the benefit of backward integration of manufacturing Petroleum Needle coke, which addresses the raw material constraint.

Chinese Demand - Key to Growth

The prospects for any intermediate good is dependent on the demand from the end-industry. Until the quarter ended September 30, the realised price for graphite electrode (high grade) was $14,000 -15000 per tonne. This has since corrected to $12,000, as per Graftech, largely because of the weakness in the steel market. Global steel production was down 1.3 percent quarter-on-quarter in the three months ended December 2018. Further, the steel supply chain distortions caused by trade war between the US and China have added to the oversupply situation.

China, the largest graphite electrode maker, is resuming production after a seven-year break, with annual production of nearly 30,000 tonnes. With new needle coke and electrode capacities having been installed and commissioned in China, it is likely that electrode supply will be more balanced or to certain extent exceed as compared to demand. Hence, the market dynamics may reverse if enough Arc Furnace Steel capacity is not installed in China quickly (Source: 2018-19 Annual Report: Graphite India Ltd).

With Stricter environmental regulation and abundant availability of electricity, and enough availability of domestic steel scrap, EAF Steel Production is set to increase in China. However, the financial burden, may influence the decision to shift to EAF steel making from the already efficiently running BOF steel making units in China. This may impact the market dynamics.