Stratview Research, after a comprehensive evaluation of the market, projects the global aircraft AFP/ATL composites market to expand at an impressive CAGR exceeding 8% between 2019 and 2024, reaching nearly US$4 billion by 2024. This growth is particularly notable, representing a 73% jump compared to the cumulative sales recorded over the previous six years (2013–2018).

The Aircraft industry seems particularly fixated with composites for several reasons ranging from emissions pressures, higher strength-to-weight ratio, higher temperature resistance, lower part count, and higher fuel efficiency. The industry has also been the frontrunner in adopting composites and has worked with the composite manufacturers to develop better and faster manufacturing processes.

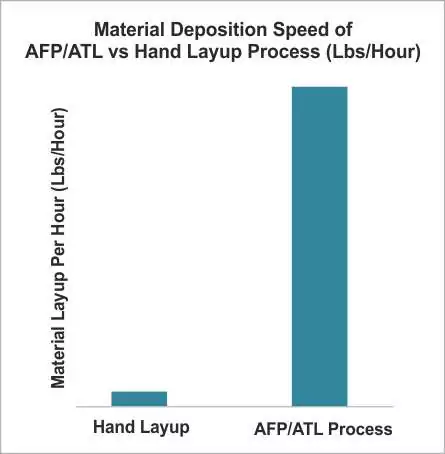

The processing of composites is far from being perfected and is only semi-automated at best. The rate of production is abysmally low, with a layup rate of 2.5 lbs/hour (manual). The resins and solvents used in the manufacturing of composites are hazardous to human health. The finishing operations require grinding, routing and sanding, which generates dust that forces workers to wear extensive personal protective equipment (PPE), adding to the woes of the workers as well as the cost.

The industry is thus on the look-out for new techniques to produce composite parts rapidly and with greater precision. Two significant advancements come in the form of Automated Fibre Placement (AFP) and Automated Tape Layup (ATL) manufacturing processes. AFP & ATL use numerically controlled machines to lay single or multiple layers of composites in the form of fabrics or tows onto a mold to give desired contour and shape. These processes are generally used to manufacture significant components in the aircraft industry, such as fuselage sections, wings, and nose cone. Some of the key advantages offered by the AFP/ATL process are as follows:

- Fast speed of material deposition & Enhanced part quality

- Less labor intensive process & Less waste of materials (lower buy/fly ratio)

- Repeatability of results & seamless transition between manufacturing and design.

- Low cost of production when used for mass production

Automated Fibre Placement uses multiple pre-impregnated tows which are placed with high precision on a rotating mandrel. It provides higher flexibility in creating complex shapes or high curvature parts such as aircraft fuselage sections and wing spars.

Automated Tape Layup involves pre-impregnated unidirectional tape or strips of fabric which is laid with precision. ATL is suitable for both, thermoset as well as thermoplastic prepregs and is more likely to be used in monolithic structures. Companies are leveraging ATL systems to develop parts, for instance, skins, stiffeners, and spars of the main wing and wing boxes of the B787 program are manufactured by Mitsubishi Heavy Industries (MHI), whereas Fuji Heavy Industries (FHI) is engaged in the manufacturing of center wing box. Also, ATL systems are better suited for composite vertical and horizontal stabilizers manufacturing.

In 2018, AFP accounted for a dominant share of the market and was the fastest growing one too. Its growth and dominance can be attributed to its greater precision over ATL and it also meets flexible part design requirements; AFP is also a useful technique for shorter course placements. Such merits have led to the dominance of the AFP process.

Aircraft requires its parts to be made out of advanced materials which have qualities such as high strength-to-weight ratio, high tensile and compressive strength, low coefficient of thermal expansion and high fatigue resistance at an extremely low weight. As carbon fiber fulfills all the requirements, the aircraft industry has widely adopted carbon-fiber in various applications, resulting in the dominance of carbon fiber composites in the global aircraft AFP/ATL composites market, followed by glass fiber composites and aramid fiber composites.

Automated tape layup machines are highly compatible with glass fiber composites, which give an excellent structural strength to the components. Ribs, spars, aileron, and ice protection plates are some of the applications manufactured using glass fiber composites, and they are also widely used in making aircraft interiors.

A Closer Look Into the Market & Its Growth Prospects

Stratview Research, after studying the market in its entirety, envisions the global aircraft AFP/ATL composites market to grow at an impressive CAGR of over 8% during the next five years (2019-24) to reach a market size of US $ 4 bn by 2024. The growth seems more impressive as the cumulative sales are up by 73% of the aggregate sales of the last six years (2013-2018).

A regional dissection reveals that North America is the largest market for aircraft AFP/ATL composites with near half of the share in 2018 in terms of value, followed by Europe and Asia-Pacific. The USA, France, China, Germany, and the UK together account for three-fourths of the total market in 2018 and are expected to remain the growth engines.

AFP/ATL systems are exorbitantly expensive and need high capital investment, along with exceptional product development capabilities to develop precise composite parts for different aircraft programs. This has resulted in a consolidated market in the hands of Spirit AeroSystems, Premier Aerotech, Leonardo S.p.A, Boeing, and Kawasaki Heavy Industries which together command two-thirds of the market share (2018).

Of the various application, Airframe application dominates the aircraft AFP/ATL composites market with over half of the share in 2018 in terms of value, followed by flight control surfaces (Horizontal & Vertical tail cone, Rudder, Elevator, Horizontal stabilizer, Ailerons, and Flaps), engine application and other applications.

Out of the overall aerospace aerostructures market, wings and fuselage together account for more than two-third share of the market. Replacing Aluminium, which has been the preferred material so far, the wings and fuselage of next-generation aircraft, B787 and A350XWB, are being made of advanced composites which are fabricated through the AFP/ATL process. This has led to the dominance of the airframe segment in the total AFP/ATL composites market.

Factors Propelling Growth

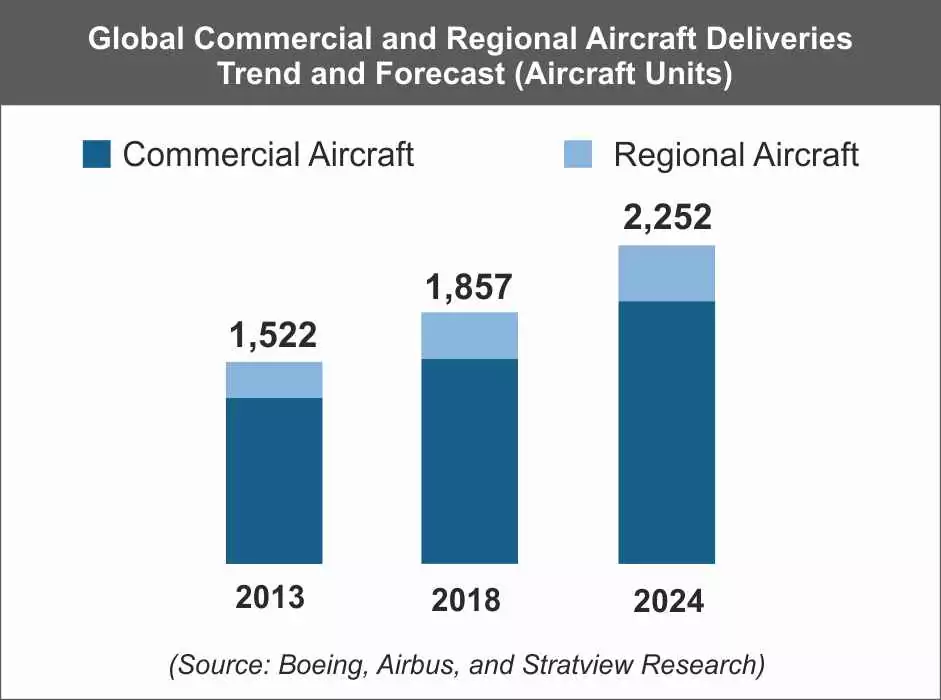

The production rate of aircraft is also increasing along with the global commercial aircraft deliveries which are expected to reach approximately 1,936 units by 2024, mainly driven by the demand from the Asia-Pacific region.

Figure 1 : Aircraft Deliveries Outlook: Commercial and Regional Segments Through 2024

Figure 1 : Aircraft Deliveries Outlook: Commercial and Regional Segments Through 2024

The global annual F-35 aircraft deliveries are expected to reach approximately 160 units by 2023, from 66 units in 2017 and shall create a strong demand for AFP/ATL composites.

Penetration: Composite materials have experienced a drastic increase in their penetration over the last five decades.

|

1970s |

1990s |

2010 |

|

4% |

21% |

50+% |

Table: Growth of EAF Steel Production Share Over the Decades

Composite materials in the next-generation aircraft, such as B787 and A350XWB, constituted around 50% of the total structural weight and the trend is expected to continue in all aircraft.

Significant Reduction in Layup Time With AFP/ATL Process

Hand layup is a quite labor intensive as well as time-consuming process. Layup rate of the AFP/ATL process at 50 lbs./hr is 20 times more as compared to meager 2.5 lbs./hr of the hand layup process. AFP/ATL pitch in to provide the much-needed speed in the production of composites.

Figure 2: Material Deposition Speed: AFP/ATL vs. Hand Layup

Cost Bottleneck & The Way Forward

There are plenty of advantages of AFP/ATL process, but the sky-high cost of AFP/ATL machines along with the need for highly skilled technicians are key factors that limit its usage in the highly cost-sensitive composite markets.

Also, the very design of AFP/ATL machines makes it suitable for manufacturing large-sized components, such as fuselage and wings. This withholds its application in making small and precision composite components.

These limitations also create scope for further growth, as advancements could be expected to do away with the bottlenecks of cost and size. Notwithstanding the limitations, the market of AFP/ATL process in aircraft industry seems to be healthy. With the rise in aircraft production and deliveries along with the dire need for emission cut and fuel efficiency improvements, the future of technologies like AFP & ATL which bring in the much-needed automation and expedite production, seems to be a gilded one.