Market Insights

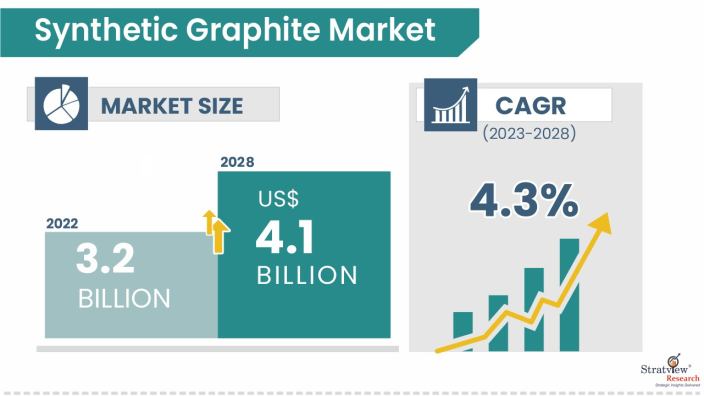

The synthetic graphite market was estimated at USD 3.2 billion in 2022 and is likely to grow at a healthy CAGR of 4.3% during 2023-2028 to reach USD 4.1 billion in 2028.

Want to know more about the market scope? Register Here

Market Dynamics

Introduction

Synthetic graphite, also called artificial graphite, is a man-made substance manufactured by the high-temperature treatment (2,500 to 3,000 degrees Celsius) of amorphous carbon materials. It is manufactured by the calcination and subsequent graphitization of petroleum coke and can achieve a purity of 99.9% carbon.

The types of amorphous carbon used as precursors to graphite are many and can be derived from petroleum, coal, or natural and synthetic organic materials. Synthetic graphite holds the major share of the global graphite market.

Carbon fiber and synthetic blocks are expected to experience the fastest growth in the next five years, driven by increasing penetration of carbon composites in aerospace and automotive industries and double-digit growth of lithium-ion batteries in electric vehicles.

Segment Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High Growth Opportunity

|

|

Form Type Analysis

|

Electrode, Block, Powder, and Fiber

|

The graphite electrode segment accounted for the largest market share during the forecast period.

|

|

Application Type Analysis

|

Electrode, Cathode and furnaceh Temperature Applications, EDM, Polysilicon Production, Lubricants, Foundry, Frictional Products, Parts & Components, and Others

|

Graphite electrodes are the largest application of synthetic graphite and is expected to remain the largest application in the next five years.

|

|

Regional Analysis

|

North America, Europe, Asia-Pacific, and Rest of the World

|

Asia Pacific accounted for the largest market share during the forecast period.

|

By Form Type

"The graphite electrode segment accounted for the largest market share."

Synthetic graphite has four principal types; electrode, block, powder, and fiber. The largest type of the synthetic graphite is graphite electrode which is predominately used in electric arc furnaces for melting steel & iron and producing alloys.

Synthetic graphite blocks are also man-made products and are made using petroleum coke. Blocks are produced from isostatic, extruded, die molded, and vibration molded processes. All these processes offer distinctive benefits and are used for producing graphite for different applications. Synthetic blocks are used in the large variety of applications ranging from polysilicon production for photovoltaic industry to high temperature reactors in nuclear industry.

Synthetic graphite powder is a low-cost material because it’s a by-product. It is used in applications, such as brake linings, lubricants and carbon brush. Synthetic graphite powder is generally a result of the granular graphite or graphite dust gathered during machining electrodes and blocks.

Carbon fiber is considered an advanced fiber type and is used in many industries including aerospace and defense and the automotive industry. High specific strength, lightweight, good fatigue strength, and excellent corrosion resistance make it a preferred material in high performance applications. High focus on fuel efficiency, low carbon emission, weight reduction, comfort and passenger safety, and government regulations, such as CAFÉ standards are driving the increasing penetration of carbon composite structures in aerospace & defense, automotive, and wind energy segments. Carbon fiber is likely to experience double digit growth in the next five years. Carbon fiber market players are continuously working on the development of alternative precursors and efficient manufacturing processes with the aim to reduce the carbon fiber price. The target price of carbon fiber is about $5 per pound for usage in mass-production applications.

By Application Type

"Graphite electrodes segment accounted for the largest market share."

Graphite electrodes are the largest application of synthetic graphite and is expected to remain the largest application in the next five years. The Asia-Pacific region is the major consumer of graphite electrodes driven by rising demand for steel and other metals, mainly in China and India.

Battery is currently a hot topic in the graphite market. Battery is an application where both natural and synthetic graphite are used and truly compete with each other. There will be a continuous shift in the graphite market away from amorphous natural graphite towards flake and synthetic graphite as emerging applications like batteries typically require large flake and high-purity grades.

Graphite electrode is expected to remain the largest application of synthetic graphite in the next five years. Increasing use of electric arc furnaces for producing steel across the world is expected to drive sales of graphite electrodes.

Regional Insights

"Asia Pacific accounted for the largest market share."

North America and Europe are major consumers as well as producers due to their robust industries like automotive, aerospace, and energy storage industries. The Asia Pacific, specifically China, is the largest and is expected to grow the fastest due to the use of steel and the increased deployment of electric cars. Latin America and the Middle East & Africa are nascent markets with signs of growing industrialization and infrastructural advancement, which will drive demand.

Know the high-growth countries in this report. Register Here

Key Players

The key synthetic graphite manufacturers globally are:

- SGL Carbon SE

- GrafTech International Holdings Inc

- Mersen Group

- Nippon Graphite Industries

- Tokai Carbon Co.

- Toray Industries

- Toho Tenax

- Toyo Tanso

- Mitsubishi Rayon Co.

- Baofeng Five-star Graphite

- IBIDEN CO

- Showa Denko K.K.

- Graphite India.

New product development, collaboration with customers, and long term contacts are the key strategies adopted by the key players to gain competitive edge in the market.

Note: The above list does not necessarily include all the top players of the market.

Are you the leading player in this market? We would love to include your name. Write to us at [email protected]

Report Features

This report provides market intelligence in the most comprehensive way. The report structure has been kept such that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market. The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

- COVID-19 impact and its recovery curve

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors

Market Segmentation

This report studies the market, covering a period of 12 years of trends and forecasts. The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The synthetic graphite market is segmented in the following ways:

By Form Type

- Synthetic Electrode

- Synthetic Block

- Synthetic Carbon Fiber

- Synthetic Powder

By Product Type

- Primary Product

- Secondary Products

By Application Type

- Electrode

- Cathode & Furnace

- High Temperature Applications

- Electrical Discharge Machining

- Polysilicon Production

- Lubricants

- Foundry

- Frictional Products

- Parts & Components

- Others

By End-Use Industry Type

- Metal Industry

- Aerospace & Defense

- Automotive

- Photovoltaic Industry

- Electrical & Electronic

- Industrial

- Others

By Manufacturing Process Type

- Isostatic

- Molded

- Expanded

- Extruded

By Sales Channel Type

- Direct Sales

- Distributors

By Region

- North America (Country Analysis: the USA, Canada, and Mexico)

- Europe (Country Analysis: Germany, France, the UK, Russia, Spain, and Rest of Europe)

- Asia-Pacific (Country Analysis: China, Japan, India, South Korea, and Rest of Asia-Pacific)

- Rest of the World (Sub-Region Analysis: Latin America, the Middle East, and Others)

Research Methodology

This strategic assessment report, from Stratview Research, provides a comprehensive analysis that reflects today’s synthetic graphite market realities and future market possibilities for the forecast period of 2023 to 2028. The report segments and analyzes the market in the most detailed manner in order to provide a panoramic view of the market. The vital data/information provided in the report can play a crucial role for the market participants as well as investors in the identification of the low-hanging fruits available in the market as well as to formulate the growth strategies to expedite their growth process.

This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools. More than 1000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data. We conducted more than 15 detailed primary interviews with the market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

- Detailed profiling of additional market players (up to three players)

- SWOT analysis of key players (up to three players)

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Product portfolio, geographical reach, regional presence, and strategic alliances.

Custom Research: Stratview Research offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected].