Market Insights

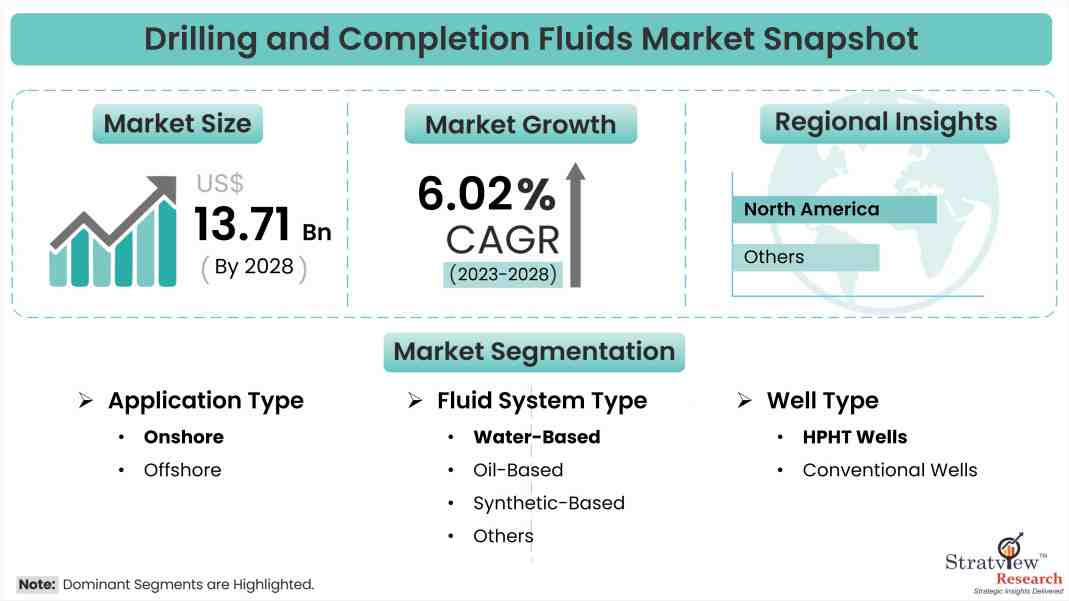

The drilling and completion fluids market was estimated at USD 9.66 billion in 2022 and is likely to grow at a CAGR of 6.02% during 2023-2028 to reach USD 13.71 billion in 2028.

_95545.jpg)

Wish to Get a Free Sample? Register Here

Market Dynamics

Introduction

The drilling and completion fluids market defines the completion fluid as a liquid used by the oil and gas industry during fulfillment of an oil or gas well. It is a low-solid mud or salt solution (brine) that is used for well testing and upon a well's completion. It is intended to reduce formation damage and control formation pressure.

Market Drivers

The growth in the drilling and completion fluids market is majorly driven by the increasing demand for oil and gas and other related reasons. Here are some more key drivers of the global drilling and completion fluids market –

- Rising demand for crude oil: The global demand for crude oil is growing rapidly and is set to grow in the coming years owing to the rising population and energy demand from developing economies. The global demand for crude oil is projected to rise by 6% between 2022 and 2028 to reach 105.7 million barrels per day (mb/d). To serve the demand, the drilling activities will grow, leading to the demand for drilling and completion fluids.

- Growing shale gas production – According to a report by PricewaterhouseCoopers (PwC) report, by 2035, shale oil production could boost the world economy by up to $2.7 trillion. Shale gas production has been increasing significantly due to the developing technologies of extracting shale gas economically. This has led to an increase in the demand for drilling fluids as these fluids are essential for the drilling and completion of shale gas wells.

- Growing offshore drilling activities – The offshore rig market and drilling activities are witnessing rapid growth, driven by advancements in regions like Guyana, Brazil, and the Middle East, states International Energy Agency (IEA). Offshore drilling also is said to yield a higher quantity of oil and natural gas. This process requires special drilling and completion fluids.

Want to have a closer look at this report. Register Here.

Key Players

The following are the key players in the drilling and completion fluids market:

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Write to us at sales@stratviewresearch.com

Segments Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High Growth Opportunity

|

|

Application Type Analysis

|

Onshore, Offshore

|

Onshore segment held the larger share of the global market in 2022 and is expected to remain dominant during the forecast period.

|

|

Fluid System Type Analysis

|

Water-Based, Oil-Based, Synthetic-Based, and Others)

|

Water-based fluid systems segment is expected to remain dominant during the forecast period.

|

|

Well Type Analysis

|

HPHT Wells, Conventional Wells

|

HPHT wells segment is estimated to register faster growth during the forecasted period.

|

|

Regional Analysis

|

North America, Europe, Asia-Pacific, and Rest of the World

|

North America is estimated to be the largest region in the drilling and completion fluids market during the forecast period.

|

By Application Type

"Onshore segment held the larger share of the global market in 2022 and is expected to remain dominant during the forecast period"

Based on the application type, the market is segmented as onshore and offshore. The onshore segment held the larger share of the global market in 2022 and is expected to remain dominant during the forecast period. The mounting use of drilling fluids in the hard rock drilling process is expected to boost the onshore applications market for drilling and completion fluids.

By Fluid System Type

"Water-based fluid systems segment is expected to remain dominant during the forecast period"

Based on the fluid system type, the market is further segmented as water-based, oil-based, synthetic-based, and others. The water-based fluid systems segment is expected to remain dominant during the forecast period. They are suitable for onshore and offshore drilling activities. Further, being economical as compared to non-aqueous-based fluids is another factor that drives the growth of this segment.

By Well Type

"HPHT wells segment is estimated to register faster growth during the forecasted period"

Based on the well type, the drilling and completion fluids market is segregated into HPHT wells and conventional wells.The HPHT wells segment is estimated to register faster growth during the forecasted period. The technological advancements have immensely supported overcoming the challenges faced in drilling HPHT wells. In addition, because most of the conventional wells are mature, there remains an increased need for the drilling of HPHT wells to find new hydrocarbon reserves.

Regional Analysis

"North America is estimated to be the largest region in the drilling and completion fluids market during the forecast period"

In terms of regions, the market in North America is estimated to be the largest region in the drilling and completion fluids market during the forecast period. Factors influencing the growth of the market are an increase in drilling activities and a surge in the exploration of shale gas reserves. Asia-Pacific and Europe are also likely to offer sizeable growth opportunities during the forecast period.

To know which region offers the best growth opportunities, Click Here

Research Methodology

- This strategic assessment report, from Stratview Research, provides a comprehensive analysis that reflects today’s Drilling and Completion Fluids market realities and future market possibilities for the forecast period of 2023 to 2028.

- The report segments and analyzes the market in the most detailed manner to provide a panoramic view of the market. The vital data/information provided in the report can play a crucial role for the market participants as well as investors in the identification of the low-hanging fruits available in the market as well as to formulate the growth strategies to expedite their growth process.

- This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools.

- More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data.

- We conducted more than 15 detailed primary interviews with the market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Report Features

This report provides market intelligence in the most comprehensive way. The report structure has been kept such that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market. The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

- COVID-19 impact and its recovery curve

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors.

Market Segmentation

This report studies the market covering 12 years of trend and forecast. The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The drilling and completion fluids market is segmented into the following categories:

By Application Type

By Fluid System Type

- Water-Based

- Oil-Based

- Synthetic-Based

- Others

By Well Type

- HPHT wells

- Conventional Wells

By Region

- North America (Country Analysis: the USA, Canada, and Mexico)

- Europe (Country Analysis: Germany, France, the UK, Russia, and Rest of Europe)

- Asia-Pacific (Country Analysis: China, Japan, India, and Rest of Asia-Pacific)

- Rest of the World (Sub-Region Analysis: Latin America, the Middle East, and Others)

Click Here, to learn the market segmentation details.

Customization Option

Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

- Detailed profiling of additional market players (up to 3 players)

- SWOT analysis of key players (up to 3 players)

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Product portfolio, geographical reach, regional presence, and strategic alliances

Custom Research:

Stratview Research offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to sales@stratviewresearch.com.