Attractive Opportunities

Global Demand Analysis & Sales Opportunities in Aerospace Wires and Cables Market

-

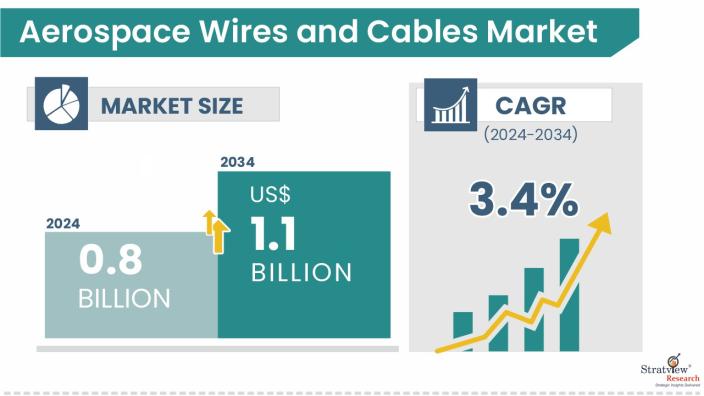

The annual demand for aerospace wires and cables was USD 771.4 million in 2024 and is expected to reach USD 818.9 million in 2025, up 6.2% than the value in 2024.

-

During the forecast period (2025-2034), the aerospace wires and cables market is expected to grow at a CAGR of 3.4%. The annual demand will reach USD 1110.3 million in 2034.

-

During 2025-2034, the aerospace wires and cables industry is expected to generate a cumulative sales opportunity of USD 9891.7 million, which is almost 3 times the opportunities during 2019-2024.

Want to get a free sample? Register Here

High-Growth Market Segments:

-

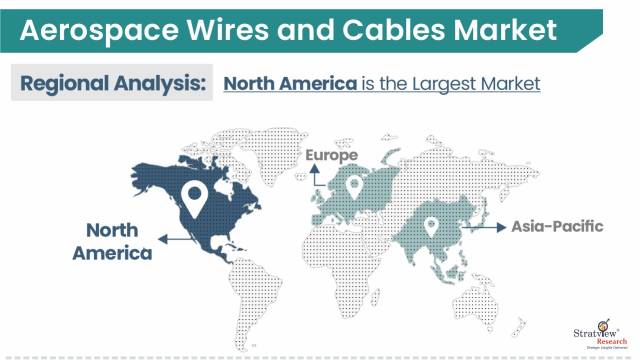

North America is expected to remain the largest market during the forecast period.

-

By platform type, Commercial aircraft is likely to remain the dominant as well as the fastest-growing platform during the forecast period.

-

By application type, Interior category is expected to be dominant as well as the fastest-growing application of the market over the forecasted period.

-

By material type, PTFE tape is expected to remain the most preferred as well as the fastest-growing material of the market in the forthcoming years.

-

By product type, Hook-up wire is expected to remain the dominant product category, and data bus cable is likely to grow at the fastest pace during the forecast period.

-

By purpose type, General-purpose wires & cables are likely to maintain their market dominance, and special-purpose wires & cables are likely to witness faster growth during the study period.

Market Statistics

Have a look at the sales opportunities presented by the aerospace wires and cables market in terms of growth and market forecast.

|

Aerospace Wires and Cables Market Data & Statistics

|

|

|

Market Statistics

|

Value (in USD Million)

|

Market Growth (%)

|

|

Annual Market Size in 2023

|

USD 649.8 million

|

-

|

|

Annual Market Size in 2024

|

USD 771.4 million

|

YoY Growth in 2024: 18.7%

|

|

Annual Market Size in 2025

|

USD 818.9 million

|

YoY Growth in 2025: 6.2%

|

|

Annual Market Size in 2034

|

USD 1110.3 million

|

CAGR 2025-2034: 3.4%

|

|

Cumulative Sales Opportunity during 2025-2034

|

USD 9891.7 million

|

-

|

|

Top 10 Countries’ Market Share in 2024

|

USD 617 million +

|

> 80%

|

|

Top 10 Company’s Market Share in 2024

|

USD 385 million to USD 540 million

|

50% - 70%

|

Market Dynamics

Introduction:

Wires & cables are often considered commodity products and form a crucial component in an aircraft. Aerospace wires & cables are required to conform to several predetermined standards, distinct to each region. They are used in various applications, such as avionics, lighting, and flight control surfaces.

Being one of the building block elements in aircraft functioning, wires & cables have ceaselessly been in demand with a gradual increase of usage in the modern aircraft. For instance, the Boeing 737 has ~40 miles of wires & cables. The company almost doubled the wires & cables consumption to 100 miles in its B767 program and further tripled it to 310 miles in its B787 program. A similar trajectory has been recorded for the Airbus programs.

Market Drivers:

-

An expected increase in the production rate of key programs (A220, A320neo family, A350XWB, B737Max, and B787).

-

The entry of new aircraft programs (B777x, C919, etc.).

-

An expected rise in the aircraft fleet size.

-

Increasing investments in electric aircraft.

-

Technological advancements in electrical systems and materials.

-

Growing demand for lightweight, fuel-efficient aircraft.

-

Expansion of global air travel and the need for a larger aircraft fleet.

-

Rising focus on safety and compliance with stringent regulatory standards.

Segments' Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High Growth Opportunity

|

|

Platform Type Analysis

|

Commercial Aircraft, Regional Aircraft, General Aviation, Military Aircraft, Helicopter, and Other Platforms

|

Commercial aircraft is likely to remain the dominant as well as the fastest-growing platform, during 2024-2034.

|

|

Application Type Analysis

|

Avionics, Interiors, Propulsion System, Airframe, and Other Applications

|

The interior category is expected to be dominant as well as the fastest-growing application of the market over the next nine years.

|

|

Material Type Analysis

|

PTFE Tape, Polyimide Tape/PTFE Tape, Polyimide Tape/UV Laser Markable, and Other Materials.

|

PTFE tape is expected to remain the most preferred as well as the fastest-growing material of the market in the forthcoming years.

|

|

Product Type Analysis

|

Hook-Up Wires, Coaxial Cables, Data Bus Cables, Power Cables, and Other Products.

|

Hook-up wire is expected to remain the dominant product category, and data bus cable is likely to grow at the fastest pace during the forecast period.

|

|

Purpose Type Analysis

|

General-Purpose Wires & Cables and Special-Purpose Wires & Cables

|

General-purpose wires & cables are likely to maintain their market dominance, and special-purpose wires & cables are likely to witness faster growth during the study period.

|

|

Regional Analysis

|

North America, Europe, Asia-Pacific, and Rest of the World

|

North America is expected to remain the largest market during the forecast period.

|

By Platform Type

“Commercial aircraft dominated the market in 2024 and is expected to register the highest CAGR during the forecast period."

-

Based on platform type, the aerospace wires & cables market is segmented as commercial aircraft, regional aircraft, general aviation, military aircraft, helicopters, and other platforms. The increasing production rates of various commercial aircraft are the major factor that is expected to drive the segment's growth.

-

Airbus, in its GMF 2024-43, forecasts a demand for 33,510 single-aisle and 8,920 wide-body aircraft over the next 20 years (a total of 42,430 new passenger and freighter aircraft). Similar estimation of 43,975 commercial and regional aircraft deliveries by Boeing in the next twenty years (as per Boeing’s 2024-2043 commercial market outlook).

By Application Type

“Interior category is expected to be dominant as well as the fastest-growing application of the market over the forecasted period."

-

Based on the application type, the market is segmented into avionics, interiors, propulsion systems, airframes, and other application types. The interior applications are likely to experience the fastest growth in the market owing to the rising penetration of IFECs.

-

The avionics segment is also expected to record significant growth during the forecast period, as there will be a larger usage of wires & cables with the transition to digital avionic systems in modern aircraft. High speed, lighter weight, compactness, and durability of wires & cables are the key requirements for avionics applications.

By Material Type

“The PTFE segment accounted for the largest market share in the aerospace wires & cables market."

-

Based on the material type, the market is bifurcated into PTFE tape, polyimide tape/PTFE tape, polyimide tape/UV laser markable, and other material types.

-

PTFE tape is expected to remain the dominant material type in the market during the forecast period, as these wires can withstand high power as well as protect cables from fire and heat. PTFE tape also has excellent low dielectric properties, exhibits low loss factors, and has unique resistance to high temperatures, chemical reactions, and corrosion, and FST.

By Product Type

“Hook-up wires are expected to remain the dominant segment, while data bus cable is anticipated to grow at the fastest pace during the forecast period."

-

Based on the product type, the market is bifurcated into hook-up wires, coaxial cables, data bus cables, power cables, and other product types.

-

The hook-up wires segment held the largest share of the market in 2024, owing to its widespread usage in aerospace interiors and avionics. Data bus cables aren’t far behind and have captured the second-largest share in 2024. Data bus cables are widely used in avionics, in-flight entertainment, and communication needs. The latter is also expected to record the fastest long-term growth during the forecast period.

By Purpose Type

“General-purpose wires & cables are expected to remain the dominant, while special-purpose wires & cables are anticipated to be the faster-growing purpose category of the market over the next nine years."

-

Based on the purpose type, the market is segmented into general-purpose wires & cables and special-purpose wires & cables.

-

General-purpose wires & cables dominated the market due to the wide-scale requirements for standard aerospace electrification, onboard and ATC communication, and navigation.

Regional Analysis

“North America is expected to remain the largest market over the next nine years, while Asia-Pacific is likely to grow at the fastest rate during the same period.”

-

North America is projected to continue being the largest market for aerospace wires & cables during the next nine years, driven by a robust supply chain with the presence of several stakeholders. Key wires & cables suppliers in the region are TE Connectivity, Judd Wire, Inc., Marmon Group, W.L. Gore, Allied Wire & Cable, Specialty Cable Corporation (SCC), and Harbour Industries.

-

In contrast, Asia-Pacific is expected to expand at the highest rate, boosted by rising air travel in the region, increasing defense budgets of key economies, and the opening of assembly plants of Boeing and Airbus. China and India are estimated to be the growth propellers for the region.

Want to get a free sample? Register Here

Competitive Landscape

The aerospace wires & cables market is moderately concentrated, with the presence of some regional and global players. The major players in the aerospace wires & cables market are well-established companies with high-tech capabilities, high-quality products, and high market presence. The following are the key players in the aerospace wires & cables market.

Here is the list of the Top Players (Based on Dominance)

-

Amphenol Corporation

-

TE Connectivity

-

Nexans S.A.

-

Judd Wire Inc.

-

Prysmian Group

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Please write to us at sales@stratviewresearch.com

Recent Product Developments:

-

The major players mainly focus on developing wires & cables with lighter weight, increased durability, and better resistive features. For instance, Nexans S.A.’s range of coaxial cables to replace the existing coaxial links WD and WN cables in Airbus A350 aircraft, enabling a 20%-30% weight reduction.

Recent Market JVs and Acquisitions:

A considerable number of strategic alliances, including M&As, JVs, etc., have been performed over the past few years:

-

In May 2024, Amphenol Corporation acquired Carlisle Interconnect Technologies' business from Carlisle Companies Incorporated. The acquisition enhances Amphenol Corporation’s capabilities in interconnect solutions for commercial aerospace, defense, and industrial markets.

-

In 2016, Carlisle Companies Inc. acquired Micro Coax, a leading supplier of high-frequency coaxial wires & cables and cable assemblies for mission-critical RF applications for defense, satellite, etc.

-

Prysmian Group completely acquired Draka in 2011, to form the world’s biggest cable manufacturer, supplying to all key industries.

Research Methodology

-

This strategic assessment report from Stratview Research provides a comprehensive analysis that reflects today’s aerospace wires and cables market realities and future market possibilities for the forecast period.

-

The report segments and analyzes the market in the most detailed manner to provide a panoramic view of the market.

-

The vital data/information provided in the report can play a crucial role for market participants and investors in identifying the low-hanging fruits available in the market and formulating growth strategies to expedite their growth process.

-

This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools.

-

More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data.

-

We conducted more than 15 detailed primary interviews with market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Report Features

This report provides market intelligence most comprehensively. The report structure has been kept so that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market.

The following are the key features of the report:

-

Market structure: Overview, industry life cycle analysis, supply chain analysis.

-

Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

-

Market trend and forecast analysis.

-

Market segment trend and forecast.

-

Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

-

COVID-19 impact and its recovery curve.

-

Attractive market segments and associated growth opportunities.

-

Emerging trends.

-

Strategic growth opportunities for the existing and new players.

-

Key success factors.

|

Market Study Period

|

2019-2034

|

|

Base Year

|

2024

|

|

Forecast Period

|

2025-2034

|

|

Trend Period

|

2019-2023

|

|

Number of Tables & Figures

|

>100

|

|

Number of Segments Analysed

|

6 (Material Type, Application Type, Puprose Type, Platform Type, Product Type, and Region)

|

|

Number of Regions Analysed

|

4 (North America, Europe, Asia-Pacific, Rest of the World)

|

|

Countries Analysed

|

15 (The USA, Canada, Mexico, Germany, France, Italy, The UK, China, Japan, India, Brazil, Saudi Arabia, Rest of Europe, Rest of APAC, and Rest of the World)

|

|

Free Customization Offered

|

10%

|

|

After Sales Support

|

Unlimited

|

|

Report Presentation

|

Complimentary

|

|

Market Dataset

|

Complimentary

|

|

Further Deep Dive & Consulting Services

|

10% Discount

|

Market Segmentation

The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The aerospace wires & cables market is segmented into the following categories:

Aerospace Wires & Cables Market, by Platform Type

-

Commercial Aircraft

-

Regional Aircraft

-

General Aviation

-

Military Aircraft

-

Helicopter

-

Other Platforms

Aerospace Wires & Cables Market, by Application Type

-

Avionics

-

Interiors

-

Propulsion System

-

Airframe

-

Other Applications

Aerospace Wires & Cables Market, by Material Type

Aerospace Wires & Cables Market, by Product Type

-

Hook-up Wires

-

Coaxial Cables

-

Data Bus Cables

-

Power Cables

-

Other Products

Aerospace Wires & Cables Market, by Purpose Type

Aerospace Wires & Cables Market, by Region

-

North America (Country Analysis: The USA, Canada, and Mexico)

-

Europe (Country Analysis: Germany, France, Spain, UK, Russia, and Rest of Europe)

-

Asia-Pacific (Country Analysis: Japan, China, India, and Rest of Asia-Pacific)

-

Rest of the World (Country Analysis: Brazil, Saudi Arabia, and Others)

Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respected clients:

Company Profiling

Competitive Benchmarking

-

Benchmarking of key players on the following parameters: Service portfolio, geographical reach, regional presence, and strategic alliances.

Custom Research: Stratview Research offers custom research services across industries. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to sales@stratviewresearch.com.