Market Insights

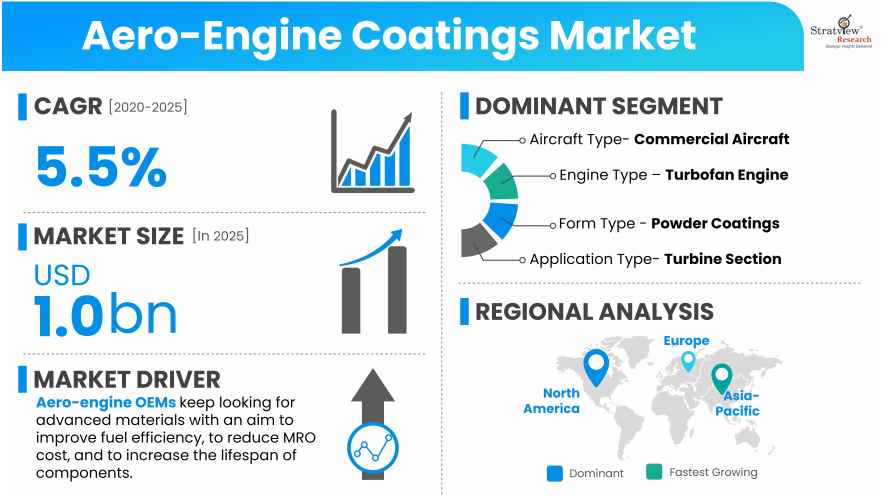

"The global aero-engine coatings market size was estimated at USD 0.82 billion in 2019 and is likely to grow at a CAGR of 5.5% during 2020-2025 to reach USD 1.0 billion by 2025."

Want to get a free sample? Register Here

Aero-engines are getting hotter day by day in order to address the airlines’ ever-lasting demand for aircraft that consumes lesser fuel and emits lower carbon oxide and nitrogen oxide. Aero-engine sections, especially, turbine and combustor, are experiencing temperatures above 3,000-degree Fahrenheit. Superalloys used in these sections generally melt at temperatures hundreds of degrees lower. Here, coatings play a pivotal role in surviving these superalloys from such extreme temperatures. The purpose of coatings is to not only to protect engine parts from such high temperatures but also protect them against oxidation, corrosion, wear, erosion, and fouling. In an aero-engine, different types of coatings are applied upon different components. For example; turbine blades are coated with thermal barrier coatings to allow components to operate at a higher temperature while limiting the thermal exposure of components and providing oxidation resistance to the parts leading to its increased lifespan.

|

Aero-Engine Coatings Market Report Overview

|

|

Market Size in 2025

|

USD 1.0 Billion

|

|

Market Size in 2019

|

USD 0.82 Billion

|

|

Market Growth (2020-2025)

|

CAGR of 5.5%

|

|

Base Year of Study

|

2019

|

|

Trend Period

|

2014-2018

|

|

Forecast Period

|

2020-2025

|

Market Dynamics

COVID-19 Impact

The aerospace industry was booming for the last 16 years with recording a gradual increase in the air passenger traffic, which impelled the major OEMs to increase the production rates of their best-selling aircraft programs. The outbreak of COVID-19 left no options to governments of many countries except the implementation of travel restrictions and the complete lockdown of several countries and cities. The Lockdown of major economies or cities has resulted in a drastic drop in the air passenger traffic and has forced airlines to reduce their capacity for international and domestic flights. Many airlines have either put their orders for new airplanes on hold or canceled orders. This pandemic disease has also affected the major aircraft OEMs and has forced them to temporarily halt their production.

Airbus has temporarily halted the production of its A220 and A320 passenger jets in the USA and has paused the assembly line of its commercial jets at their German sites. Boeing has also temporarily shut down its B787 plant in the USA due to the stay-at-home order by South Carolina’s governor. Production halt by both the major aircraft OEMs is also affecting the aircraft engine and its coatings markets. Major aircraft engine manufacturers are also taking a break from manufacturing to align themselves with aircraft production cuts of their major customers. The exact impact of COVID-19 is still unpredictable, but it is expected that the outbreak will have a short-term impact on the industry.

Aircraft OEMs have also announced revised production rates of their best-selling aircraft programs, adapting to the current market scenario. Airbus has announced the slash in production rates of their key aircraft programs by one-third, the revised rates are A320s at 40 per month, A330s at 2 per month, and A350s at 6 per month. A similar announcement of slash in their wide-body aircraft programs is expected from Boeing as well. The long-term outlook of the industry still seems promising with attractive growth opportunities across regions, especially in Asia-Pacific. Expected rise in passenger traffic and expanding LCCs may rejuvenate currently depleted aircraft deliveries. Undoubtedly, the demand for aero-engine coatings market could not escape from such market trends and may fluctuate in the near term. However, the long-term outlook of the market still healthy with good growth opportunities by 2025.

Market Drivers

An expected recovery in the commercial aircraft deliveries post 2020, the FAA and other regulatory authorities’ approvals to Boeing for the B737Max, incorporation of advanced materials in the crucial sections of engines, and advancements in the coating systems and techniques are foremost ones, are likely to bring back the market to the growth track. Also, the development of high-thrust engines coupled with the requirement of high-performance coatings and coatings on complex-shaped engine parts are driving the coating suppliers to develop new coating systems as well as sophisticated deposition techniques.

Aero-engine OEMs keep looking for advanced materials with an aim to improve fuel efficiency, to reduce MRO cost, and to increase the lifespan of components. Several advanced materials including titanium and ceramic matrix composites are strategically incorporated by engine OEMs in their latest engine series to maximize the benefits. Such adoption of advanced materials is shuffling the dynamics of the aero-engine coatings market. Major coating suppliers are working for the development of advanced coating systems addressing the industry requirements. For instance; the development of oxidation-resistant coatings for titanium aluminide, latter is approved for high-pressure compressor sections of the next-generation engines.

Segments' Analysis

|

Segmentations

|

List of Sub-Segments

|

Dominant and Fastest-Growing Segments

|

|

Aircraft-Type Analysis

|

Commercial Aircraft, Military Aircraft, Regional Aircraft, General Aviation, and Helicopter

|

Commercial aircraft are likely to remain the growth engine of the market during the forecast period.

|

|

Engine-Type Analysis

|

Turbofan Engine, Turbojet Engine, Turboprop Engine, and Turboshaft Engine

|

Turbofan engine is expected to remain the dominant and the fastest-growing segment of the market during the forecast period.

|

|

Form-Type Analysis

|

Powder Coatings, Liquid Coatings, and Wired Coatings

|

Powder coatings are expected to remain dominant as well as the fastest-growing segment of the market during the forecast period.

|

|

Application-Type Analysis

|

Turbine Section, Combustion Section, Compressor Section, Afterburner Section, and Bearings & Accessories

|

Turbine section is expected to remain the dominant as well as the fastest-growing application type in the market during the forecast period.

|

|

Regional Analysis

|

North America, Europe, Asia-Pacific, and Rest of the World

|

North America is projected to maintain its dominance in the global aero-engine coatings market during the forecast period.

|

By Aircraft Type

"The commercial aircraft segment accounted for the largest market share."

The market is segmented into commercial aircraft, military aircraft, regional aircraft, general aviation, and helicopter. Commercial aircraft are likely to remain the growth engine of the market during the forecast period. Market entry of new players such as COMAC’s C919 and Irkut’s MC-21 and an expected increase in commercial aircraft deliveries are primary growth drivers of the aero-engine coatings in the commercial aircraft segment.

By Engine Type

"The turbofan engine segment accounted for the largest market share."

The market is segmented into turbofan engine, turbojet engine, turboprop engine, and turboshaft engine. Turbofan engine is expected to remain the dominant and the fastest-growing segment of the market during the forecast period. Turbofan engine preferably used in commercial aircraft, regional aircraft, and business jets. B777X, B737, B787, A320, A330neo, and A350XWB are the key platforms for the turbofan engines. GE’s LEAP, GEnx, and GE9x; Pratt & Whitney’s PW1000G; and Rolls-Royce’s Trent XWB, 1000, and 7000 are estimated to remain the biggest demand generators for coatings in the turbofan engine segment. Key aero-engine manufacturers are collaborating with aero-engine coating manufacturers to develop innovative solutions for their jet engines, this ongoing trend is expected to drive the aero-engine coating market for turbofan engines.

By Form Type

"The powder coating segment accounted for the largest market share."

The market is segmented into powder coating, liquid coating, and wired coating. Powder coatings are expected to remain dominant as well as the fastest-growing segment of the market during the forecast period. Powder coatings deliver cost-effective solutions with improved performance. Further, these coating materials are free from volatile organic compounds unlike solvent-based coatings, which results in its significant demand in the aircraft industry.

By Application Type

"The turbine section segment accounted for the largest market share."

The market is segmented into turbine section, combustion section, compressor section, afterburner section, and bearings & accessories. Turbine section is expected to remain the dominant as well as the fastest-growing application type in the market during the forecast period. High-pressure turbines of an aero-engine undergo the most severe conditions as they rotate at more than 10,000 rpm. In these extreme conditions, turbine blades may suffer from oxidation and corrosion. In order to avoid degradation of blades, oxidation resistance coatings and thermal barrier coatings are applied upon them as well as in other components of the turbine section.

Regional Insights

"North America accounted for the largest market share."

North America is projected to maintain its dominance in the global aero-engine coatings market during the forecast period. The number of cases of COVID-19 has been increasing in the USA, forcing governments to announce lockdown and shut down manufacturing facilities. This, in turn, is negatively impacting the growth of the region’s aviation industry including aero-engine coatings. However, the engine assembly plants of all the major aero-engine suppliers, such as GE Aviation, CFM International, and Pratt & Whitney, assure the region’s unassailable lead in the global market.

The USA is the growth engine of the region’s market and has one of the largest fleets of commercial aircraft across the world. The country also owns the largest fleet of military, regional, and general aviation aircraft. Presence of all major aircraft OEMs, aero-engine OEMs, tier players, aero-engine coating suppliers, and raw material suppliers are primarily driving the aero-engine coatings market in the region.

Despite the outbreak of COVID-19 in China, the biggest aviation market in Asia-Pacific, the region is likely to witness the highest growth in the next five years, driven by a host of factors including increasing demand for commercial aircraft to support rising passenger traffic, the opening of assembly plants of Boeing and Airbus for B737, A320, and A330 in China, upcoming indigenous commercial and regional aircraft (COMAC C919 and Mitsubishi SpaceJet), and increasing aircraft fleet size. The opening of new facilities in the region by key aero-engine manufacturers to produce aero-engine parts is expected to further fuel the demand for aero-engine coatings in the region.

Want to get a free sample? Register Here

Key Players

The supply chain of this market comprises raw material suppliers, aero-engine coating manufacturers, coating service providers, tier players, aero-engine OEMs, aircraft OEMs, airlines, aircraft leasing companies, and MRO companies.

The key players in the aero-engine coatings market are-

- Praxair Inc.

- OC Oerlikon Corporation AG

- Chromalloy Gas Turbine LLC

- PPG Industries Inc.

- Akzo Nobel N.V.

- Dupont de Nemours, Inc.

- Indestructible Paint Ltd.

- A&A Company Inc.

- APS Materials, Inc.

- Lincotek Group S.p.A.

The development of high-performance coatings, expansion in untapped and growing markets, and execution of mergers & acquisitions are the key strategies adopted by the major players to gain a competitive edge in the market.

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Write to us at [email protected]

Research Methodology

For calculating the market size, our analysts follow either Top-Bottom or Bottom-Top approach or both, depending upon the complexity or availability of the data points. Our reports offer high-quality insights and are the outcome of detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders and validation and triangulation with Stratview Research’s internal database and statistical tools. We leverage multitude of authenticated secondary sources, such as company annual reports, government sources, trade associations, journals, investor presentation, white papers, and articles to gather the data. More than 10 detailed primary interviews with the market players across the value chain in all four regions and industry experts are usually executed to obtain both qualitative and quantitative insights.

Report Features

This strategic assessment report, from Stratview Research, provides a comprehensive analysis that reflects today’s aero-engine coatings market realities and future growth possibilities for the forecast period of 2020 to 2025. The report segments and analyzes the market in the most detailed manner in order to provide a panoramic view of the market. The report also provides compelling evidence to support the market participants as well as investors in the identification of the low-hanging fruits available in the market as well as formulate their growth strategies.

What Deliverables Will You Get in this Report?

|

Key questions this report answers

|

Relevant contents in the report

|

|

How big is the sales opportunity?

|

In-depth Analysis of the Aero-Engine Coatings Market

|

|

How lucrative is the future?

|

Market forecast and trend data and emerging trends

|

|

Which regions offer the best sales opportunities?

|

Global, regional, and country-level historical data and forecasts

|

|

Which are the most attractive market segments?

|

Market Segment Analysis and Forecast

|

|

Which are the top players and their market positioning?

|

Competitive landscape analysis, Market share analysis

|

|

How complex is the business environment?

|

Porter’s five forces analysis, PEST analysis, Life cycle analysis

|

|

What are the factors affecting the market?

|

Drivers & challenges

|

|

Will I get the information on my specific requirement?

|

10% free customization

|

The aero-engine coatings market is segmented in the following ways:

By Aircraft Type:

- Commercial Aircraft

- Regional Aircraft

- General Aviation

- Helicopter

- Military Aircraft

By Engine Type:

- Turbofan Engine

- Turbojet Engine

- Turboprop Engine

- Turboshaft Engine

By Process Type:

- Spray Process

- EBPVD Process

- Others

By Form Type:

- Powder Coating

- Liquid Coating

- Wired Coating

By Application Type:

- Turbine Section

- Combustion Section

- Compressor Section

- Afterburner Section

- Bearings & Accessories

By Region:

- North America (Country Analysis: The USA, Canada, and Mexico)

- Europe (Country Analysis: Germany, France, The UK, Poland, and Rest of Europe)

- Asia-Pacific (Country Analysis: China, Japan, Singapore, and Rest of Asia-Pacific)

- Rest of the World (Sub-Region Analysis: Latin America, Middle East, and Others)

Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respectable clients:

Competitive Assessment

- Competitive Benchmarking of key players (up to three players)

- SWOT analysis of key players (up to three players)

Regional Segmentation

- Current market size (2019) of aero-engine coatings in any of the engine types by form type

Custom Research: Stratview Research offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry at [email protected].