Market Insights

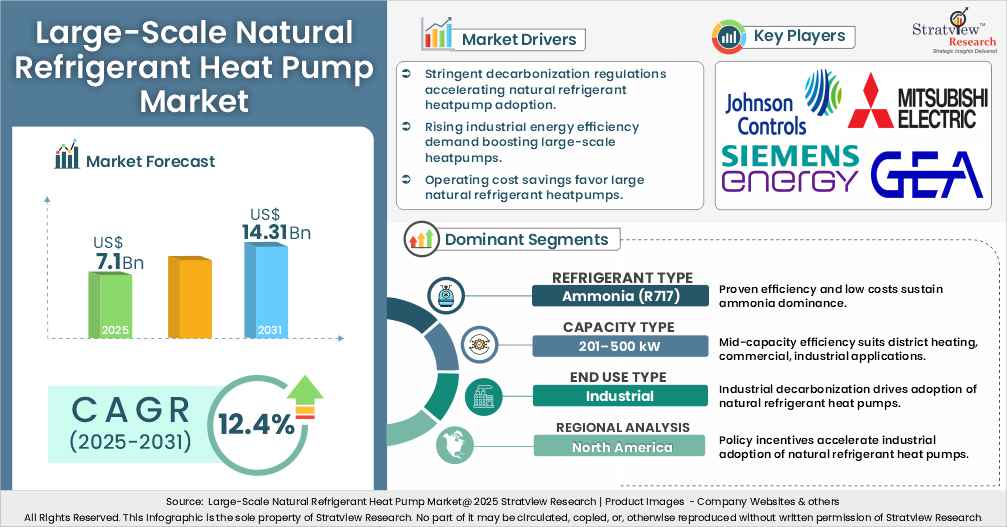

The large-scale natural refrigerant heat pump market size value was US$7.1 billion in 2025 and is likely to grow at a robust CAGR of 12.4% in the long run to reach US$14.31 billion in 2031.”

Want to get a free sample? Register Here

Market Dynamics

Introduction

Large-scale natural refrigerant heat pumps use eco-friendly working fluids like ammonia (NH₃), carbon dioxide (CO₂), and hydrocarbons to provide heating and cooling across industries and commercial sectors and in district energy applications. These natural refrigerant based heat pumps systems are a sustainable alternative to conventional systems which rely on synthetic refrigerants with high global warming potential (GWP) and Due to superior thermodynamic efficiency, long term safety and compliance with regulatory frameworks, these pumps are increasingly deployed in district heating networks and in food and beverage processing, manufacturing and large commercial buildings which offer reliable, high capacity and energy thermal solutions.

Large-scale natural refrigerant heat pumps are being adopted more rapidly energy price inflation and stricter refrigerant regulation. These clean heating and cooling technologies are being adopted by governments and industry stakeholders in climate-neutral strategies, which is creating a surge in market investment. This, along with improvement in natural refrigerant heat pumps in component design, system integrations, and digital controls, is improving reliability and importance in a changing economy, supporting the energy transition around the world.

Recent Market Developments:

A considerable number of strategic alliances, market development, etc., have been performed over the past few years:

- In 2024, Siemens Energy revealed the installation of a massive-scale natural refrigerant heat pump system in Hamburg, Germany, that can supply district heating to more than 20,000 homes. The project employs CO₂ as the refrigerant and aids the city in its decarbonization plan by replacing coal-fired heating, one of Europe's biggest renewable heat pump installations.

- Johnson Controls released its YORK® next-generation natural refrigerant heat pump in 2024, which is available for commercial and industrial applications with the refrigerant being ammonia (R717). The system provides high-efficiency heating with no direct greenhouse gas emissions and complies with the EU's F-gas phase-down regulations, further solidifying Johnson Controls' leadership in sustainable HVAC solutions.

Recent JVs, acquisitions, mergers:

- In early 2023, Johnson Controls purchased Hybrid Energy AS, a Norwegian technology firm that focuses on high-temperature natural-refrigerant heat pumps that can achieve temperatures over 100 °C with ultra-low GWP refrigerants. This buy strengthens Johnson Controls' industrial heat pump offering, facilitating more efficient district heating and process heating solutions, particularly for European markets targeting decarbonization objectives.

- Carrier Global Corporation completed its acquisition of Viessmann Climate Solutions in January 2024. At a value of about €12 billion (~USD 13 billion), the strategic acquisition enhances Carrier's heating portfolio by combining Viessmann's innovative heat pump and renewable energy solutions, especially in Europe. Carrier hopes to become a dedicated, high-growth leader in sustainable climate solutions.

Segments Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High-Growth Opportunity

|

|

Refrigerant Analysis

|

Ammonia (R717), Carbon Dioxide (R744), Hydrocarbons

|

CO₂ (R744) heat pumps are the fastest-growing segment because they are non-toxic, non-flammable, highly efficient, and supported by global low-GWP regulations, making them safer and more scalable than ammonia or hydrocarbons for large-scale applications.

|

|

Capacity Analysis

|

20–200 kW, 201–500 kW, 501–1,000 kW, above 1,000 kW

|

The 200–500 kW capacity segment is the fastest-growing, driven by increasing demand from medium-scale commercial and industrial applications.

|

|

End Use Analysis

|

Commercial and Industrial

|

Industrial is the faster-growing end-use category because rising sustainability mandates and the need for cost-efficient thermal energy solutions are accelerating adoption in large-scale operations.

|

|

Region Analysis

|

North America, Europe, Asia-Pacific, and The Rest of the World

|

Asia-Pacific is the dominant region for large-scale natural refrigerant heat pumps because booming infrastructure development, aggressive government investments in green technologies, and rapid industrialization are supercharging adoption.

|

By Refrigerant

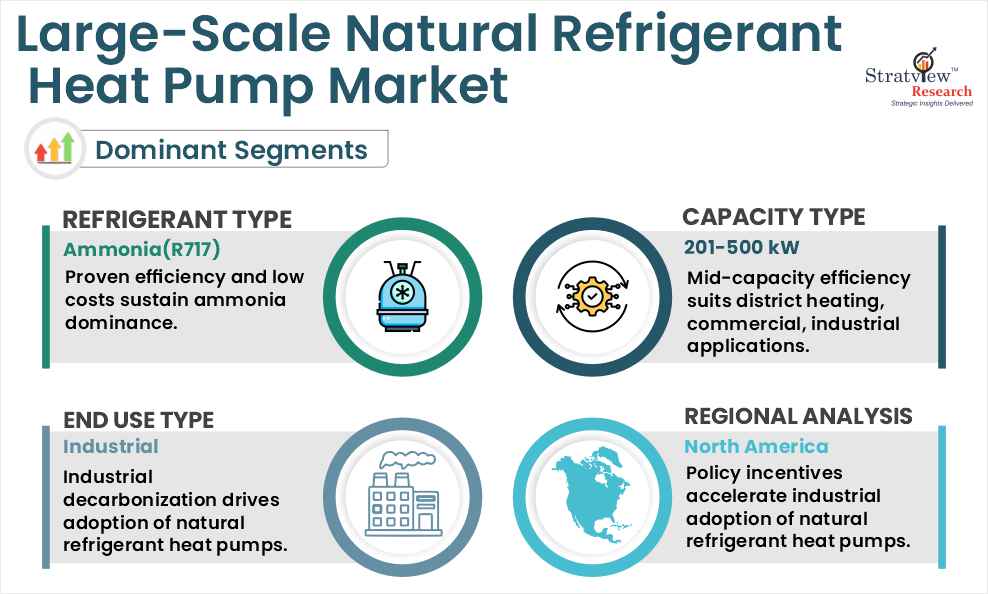

“Ammonia (R717) is the largest refrigerant segment because of its proven efficiency, cost-effectiveness, and long-standing dominance in large-scale industrial applications such as food processing and cold storage.”

Ammonia (R717) heat pumps currently predominate the market because of their long-established use in large industrial applications. They offer excellent thermodynamic efficiency, low operating costs, and a proven safety profile in controlled industrial environments. Due to their high coefficient of performance (COP), they remain the refrigerant of choice for food processing, cold storage, and large-scale manufacturing, where performance and cost-effectiveness are critical.

Carbon Dioxide (R744) heat pumps, however, are expected to be the fastest-growing segment, driven by their low global warming potential (GWP = 1), non-flammability, and increasing regulatory pressures to phase out high-GWP synthetic refrigerants. With expanding adoption in district heating, commercial buildings, and supermarkets, R744 is gaining traction as governments push for natural refrigerants in both industrial and urban heating systems. Its ability to perform efficiently in colder climates makes it particularly attractive in Europe and Asia, where decarbonized heating is a priority

By Capacity Analysis

“201–500 kW capacity heat pumps are the dominant and fastest-growing segment because they strike the right balance between efficiency, scalability, and suitability for both commercial and industrial applications.”

The 201–500 kW segment is dominating the market because it addresses varied end-applications like district heating, large commercial facilities, food processing, and factories. These are strong enough to manage high-heating and high-cooling loads while not being too rigid or expensive compared to extremely large capacity equipment. They are gaining traction in Europe and Asia as countries adopt policies around decarbonization and district heating initiatives, which are propelling mid-capacity, natural refrigerant heat pumps demand

By End Use Analysis

“Industrial is the dominant and fastest growing end-use industry for large-scale natural refrigerant heat pumps driven by the sustainable and energy efficient thermal systems in manufacturing, food processing, chemicals, and district heating.”

Industries are progressively adopting natural refrigerants like ammonia and CO₂ in a bid to meet aggressive decarbonization targets, lower operational expenses, and improve energy efficiency in large-scale operations. This has made the industrial sector the clear frontrunner in adoption

Want to get more details about the segmentations? Register Here

Regional Analysis

“North America is the most rapidly growing market for large-scale natural refrigerant heat pumps, fuelled by robust policy support, growing industrial uptake, and the imperative for decarbonization.”

North America is the fastest-growing market for large-scale natural refrigerant heat pumps, led by robust government policies, decarbonization objectives, and swift uptake in commercial and industrial segments. The United States and Canada are using incentives, laws, and corporate sustainability initiatives to replace fossil fuel-powered heating with sustainable ones.

Key Players

The market is moderately fragmented, with over 80 players. Most of the major players compete in some of the governing factors, including price, service offerings, and regional presence, etc. The following are the key players in the large-scale natural refrigerant heat pump market.

Here is the list of the Top Players (Based on Dominance)

- Johnson Controls

- Siemens Energy

- Mitsubishi Electric Corporation

- GEA Group Aktiengesellschaft

- Emerson Electric Co.

- MAN Energy Solutions SE

- Panasonic Corporation

- Guangdong PHNIX Eco-Energy Solution Ltd.

- Star Refrigeration

- Emicon AC S.p.a.

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Please write to us at [email protected]

Report Features

This report provides market intelligence most comprehensively. The report structure has been kept so that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market. The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

- COVID-19 impact and its recovery curve.

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors.

The global large-scale natural refrigerant heat pump market is segmented into the following categories.

Large-Scale Natural Refrigerant Heat Pump Market, by Refrigerant

- Ammonia (R717) (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Carbon Dioxide (R744) (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Hydrocarbons (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

Large-Scale Natural Refrigerant Heat Pump Market, by Capacity

- 20–200 kW (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- 201–500 kW Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- 501–1,000 kW (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Above 1,000 kW (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

Large-Scale Natural Refrigerant Heat Pump Market, by End Use

- Industrial (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Commercial (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

Large-Scale Natural Refrigerant Heat Pump Market by Region

- North America (Country Analysis: The USA, Canada, and Mexico)

- Europe (Country Analysis: Germany, France, The UK, Russia, and the Rest of Europe)

- Asia-Pacific (Country Analysis: China, India, Japan, and Rest of Asia-Pacific)

- Rest of the World (Country Analysis: Brazil, Saudi Arabia, and Others)

Research Methodology

- This strategic assessment report from Stratview Research provides a comprehensive analysis that reflects today’s large-scale natural refrigerant heat pumps market realities and future market possibilities for the forecast period.

- The report segments and analyzes the market in the most detailed manner in order to provide a panoramic view of the market.

- The vital data/information provided in the report can play a crucial role for market participants and investors in identifying the low-hanging fruit available in the market and formulating growth strategies to expedite their growth process.

- This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools.

- More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data.

- We conducted more than 15 detailed primary interviews with market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respected clients:

Company Profiling

- Detailed profiling of additional market players (up to three players)

- SWOT analysis of key players (up to three players)

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Service portfolio, geographical reach, regional presence, and strategic alliances

Custom Research: Stratview Research offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected]