Market Dynamics

Introduction

Ethylene Vinyl Acetate (EVA) films consist of a specialized polymeric material with toughness, flexibility, and superior optical clarity. They are a copolymer of ethylene and vinyl acetate and are used in various industries due to their superior adhesive properties, thermal stability, and resistance to UV. EVA films also appear in the solar industry in the form of encapsulants for photovoltaic (PV) modules, protecting solar cells from moisture, dirt, and mechanical stress. EVA films are also employed in packaging, laminated glass, agriculture, and electronics, where clarity and strength with elasticity are most critical.

Increased emphasis on sustainable energy, high-performance construction materials, and creative packaging has transformed the demand for films across the world. EVA films are extensively utilized because of their resistance to extreme temperatures, in both industrial and consumer uses. The development of new technologies and changes in legislation that seek to preserve the environment have led to increased dependence on EVA films, and this is expected to persist in the future.

Recent Market Developments:

A considerable number of strategic alliances, market development, etc., have been performed over the past few years:

- In 2024, Mitsui Chemicals, Inc. released a high-transparency EVA film specifically for bifacial solar modules, which can gather sunlight from both sides to increase energy yield. The new grade possesses improved optical clarity, thermal stability, and low moisture permeability, contributing to the longevity and efficiency of future solar technologies.

- Shanghai HIUV New Materials Co., Ltd. has heavily invested in new R&D facilities to improve the lifetime and performance of EVA films with greater resistance to potential-induced degradation (PID) and ultraviolet (UV) exposure. This is aimed at prolonging solar module lives and sustaining efficiency under extreme conditions to meet the requirements of utility-scale projects. It also solidifies HIUV's reputation as a top innovator in the encapsulant industry, in line with the changing needs of world solar manufacturers.

Recent JVs, acquisitions, mergers:

- In 2021, Sekisui Chemical Co., Ltd., a major Japanese chemical and materials producer, expanded its capabilities by acquiring STR Holdings, Inc., a United States-based company that engages in the production of EVA encapsulants: the product used in the photovoltaic modules (PV). The foundation of this acquisition was to enhance the position of Sekisui in the global solar supply chain, particularly the encapsulant market, which is rapidly growing. STR Holdings had been known to possess state-of-the-art EVA film technologies, specifically for high-performance solar modules. By acquiring STR, Sekisui was able to gain access to its boosted R&D, its installed base in North America and Europe, and its manufacturing infrastructure.

Segments Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High-Growth Opportunity

|

|

Type Analysis

|

Standard EVA Films and Anti-PID EVA Films

|

Anti-PID EVA films are the faster growing type because they prevent power loss in solar panels due to anti-PID property, making them more reliable for long-term and high-performance solar applications.

|

|

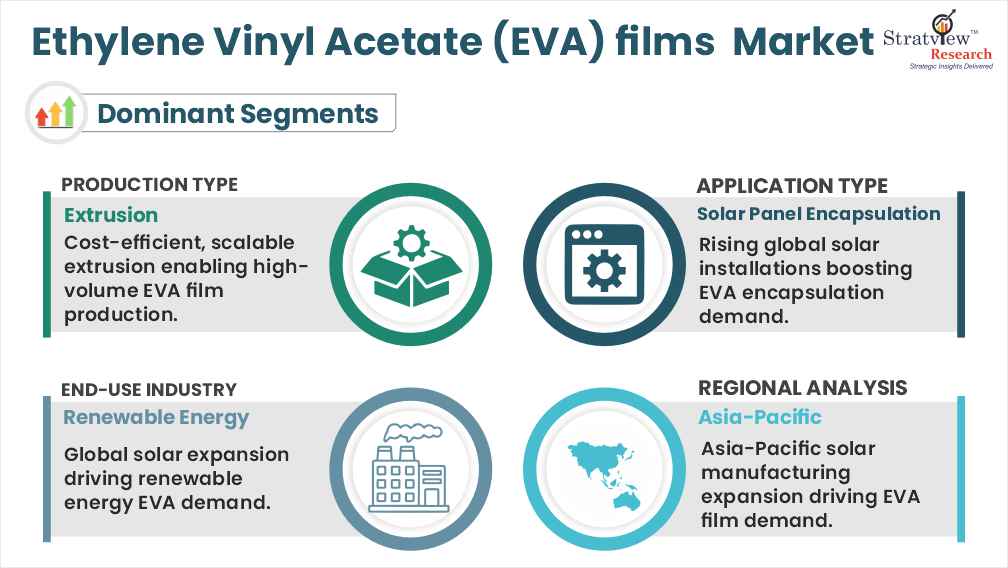

Production Method Analysis

|

Extrusion and Casting

|

Extrusion is the dominant and faster-growing EVA film production method for EVA film production due to its cost efficiency, speed, and suitability for applications like solar encapsulation and packaging.

|

|

Application Analysis

|

Solar Panel Encapsulation, Lamination, and Heat Seal

|

Solar panel encapsulation is expected to experience the fastest growth in the forecasted period due to the rising global adoption of solar energy systems.

|

|

End Use Industry

|

Renewable Energy, Packaging, and Automotive

|

Due to the global surge in sustainable energy, especially solar energy deployment, renewable energy is the leading and fastest-growing end-use industry for EVA films.

|

|

Region Analysis

|

North America, Europe, Asia-Pacific, and The Rest of the World

|

Asia-Pacific is both the largest and fastest-growing region for the EVA films market, driven by its dominance in solar module manufacturing and strong industrial growth.

|

By Type

“Anti-PID EVA films are witnessing the fastest growth, fueled by the rising demand for improved protection and durability in solar modules.”

Standard EVA films dominate the market because of their cost-effectiveness, good performance, and extensive application, particularly in the encapsulation of solar panels, packaging, and industry. They possess good transparency, adhesion, and flexibility, making them a good choice for bulk-conscious manufacturers. Their extensive application in established solar module production lines has ensured they maintain a considerable market share around the world.

Whereas, Anti-PID EVA films are expected to be the fastest-growing category, triggered by the growing awareness of Potential Induced Degradation (PID) and the demand for higher efficiency solar modules. As solar farms move into high-humidity and high-voltage conditions, demand for long durability and low power loss is spurring growth for Anti-PID solutions. These films are emerging as popular choices among high-end solar module manufacturers seeking to provide longer warranties and superior long-term performance

By Production Method Analysis

“Extrusion is the dominant and fastest-growing production method for EVA films, because of its cost-efficiency, scalability, and high-quality output.”

Extrusion leads the EVA films market because it can easily produce large quantities and high-performance films at low cost. It is common in most of the high-demand applications, such as solar panel encapsulation, flexible, and construction materials. The method provides greater control of film thickness, uniformity, and mechanical strength, favouring large-scale industrial applications. Due to an increase in demand for efficient and scalable production, extrusion continues to be the dominant and preferred manufacturing method in the EVA films market.

Want to get more details about the segmentations? Register Here

Application Analysis

“Solar panel encapsulation is the dominant and fastest-growing application of EVA films, driven by the global acceleration in solar energy installations and the need for long-lasting, high-performance encapsulants.”

The solar panel encapsulation is the dominant and fastest growing application of EVA films, because EVA films are used in the solar panel encapsulation, which is important in protecting the photovoltaic (PV) modules. EVA has high durability, UV stability, and good adhesion to glass and cells-excellent performance during extended use under changing environmental conditions. As the world has witnessed the explosive growth in solar capacity, the need to use high-quality encapsulation materials has multiplied.

By End-Use Industry

“Renewable energy is the dominant and fastest-growing end-use industry for EVA films, driven by the global surge in solar installations and the need for reliable encapsulation materials.”

EVA films find extensive applications in photovoltaic (PV) modules due to their longevity, resistance to UV, and protective characteristics, thus being critical to ensure long-term solar panel efficiency. China, India, and the U.S. are aggressively increasing solar capacity, driving demand for EVA encapsulants.

While consumer and packaging products also account for a considerable portion of EVA film usage, their expansion is relatively sluggish. Automotive uses are slowly on the rise, particularly in electric vehicles and lightweight parts, but are still a limited portion of the market. With aggressive policy encouragement and ongoing solar growth, renewable energy will likely propel the market growth of EVA film in the coming years

Regional Analysis

“The Asia-Pacific region is the dominant as well as the fastest-growing market in the EVA film, driven by the rapid expansion of solar energy, strong industrial growth, and rising demand for advanced packaging solutions.”

Key countries such as China, India, Japan, and South Korea are driving EVA film adoption, particularly for solar panel encapsulation. China's huge solar manufacturing facilities and India's ambitious renewable energy targets are major growth drivers. Government policies favouring domestic manufacturing growth and improvement in anti-PID EVA technology are further enhancing the market share of the region. With increasing supply chain localization, the Asia-Pacific region is poised to retain its leadership in production as well as consumption of EVA films.

Key Players

The market is moderately fragmented, with over 80 players. Most of the major players compete in some of the governing factors, including price, service offerings, and regional presence, etc. The following are the key players in the EVA films market.

Here is the list of the Top Players (Based on Dominance)

- Hangzhou First Applied Material Co., Ltd.

- Shanghai HIUV New Materials Co., Ltd.

- STR Holdings, Inc.

- Mitsui Chemicals, Inc.

- Bridgestone Corporation

- 3M Company

- Hanwha Solutions Corporation

- H.B. Fuller

- Astenik Solar

- Guangzhou Lushan New Materials Co., Ltd.

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Please write to us at [email protected]

Report Features

This report provides market intelligence most comprehensively. The report structure has been kept so that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market. The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

- COVID-19 impact and its recovery curve.

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors.

The EVA films market is segmented into the following categories.

EVA films Market, by Type

- Standard EVA Films (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Anti-PID EVA Films (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

EVA films Market, by Production method

- Extrusion (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Casting (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

EVA films Market, by Application

- Solar Panel Encapsulation (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Lamination (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Heat Seal (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

EVA films Market, by End Use Industry

- Renewable Energy (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Packaging (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Automotive (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

EVA films Market by Region

- North America (Country Analysis: The USA, Canada, and Mexico)

- Europe (Country Analysis: Germany, France, The UK, Russia, and the Rest of Europe)

- Asia-Pacific (Country Analysis: China, India, Japan, and Rest of Asia-Pacific)

- Rest of the World (Country Analysis: Brazil, Saudi Arabia, and Others)