Aircraft Tire Market Insights

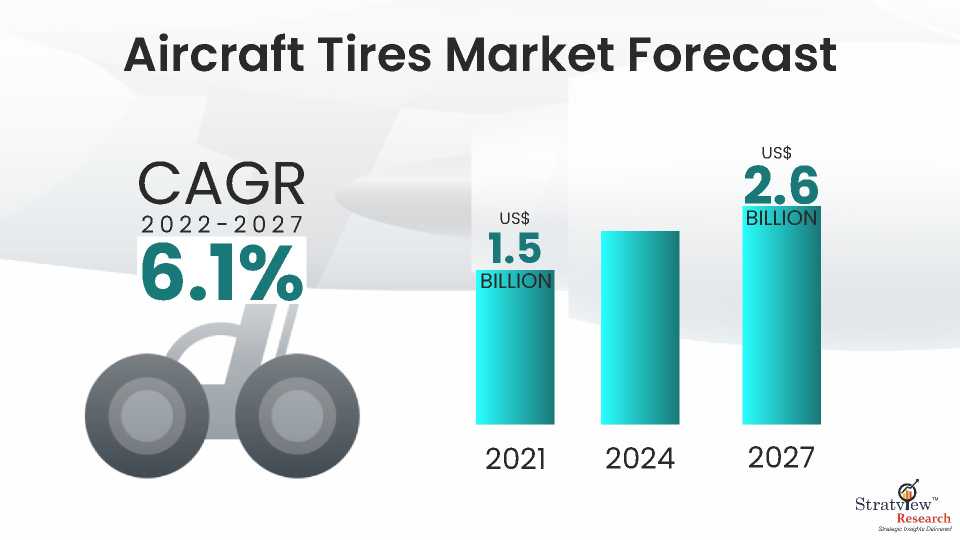

"The global aircraft tires market was estimated at USD 1.5 billion in 2021 and is likely to grow at a CAGR of 6.1% during 2022-2027 to reach USD 2.6 billion in 2027."

Want to get a free sample? Register Here

Introduction

An aircraft tire is a specialized rubber tire designed to support the weight of an aircraft during landing, takeoff, and taxiing. These tires are engineered to withstand high loads, speeds, and pressures encountered during flight operations. Their key role is to ensure the safety and stability of flights, absorb the impact of landings, and provide sufficient grip for ground maneuverability.

Aircraft tires are difficult to design since they must avoid bursting to prevent damage to the aircraft. Maintaining stability, carrying huge weight at fast speeds, and giving effective braking capabilities are significant expectations from aircraft tires. As an aircraft's weight increases, the number of tires required grows as the weight must be spread more evenly.

Aircraft tires are designed to carry heavy weights for short periods. Increasing air passenger traffic over the past two eons paired with frequent take-offs & landings make the tire a more important and indispensable focus area of the entire aerospace community.

Aircraft Tire Market Drivers

The major factors driving the growth of the aircraft tires market are-

- Increasing aircraft production.

- Growing aircraft fleet size.

- Continuous Rise in Military Aircraft Production.

- Faster Replacement Rate of Aircraft Tires.

COVID IMPACT

The COVID-19 outbreak has brought forth several unprecedented challenges before aircraft and airline companies with thousands of planes grounded around the world, devastating their profits and balance sheets, and sending them at least a decade back. Tires, one of the most pivotal parts of an aircraft, endured a heavy decline of over 40% in demand in the year 2020.

The aerospace industry had already started marching toward the path of recovery. However, the emergence of new COVID-19 variants affected its growth trajectories and delayed the overall recovery period.

It is still uncertain when the commercial aerospace industry will hit its peak level in 2018. However, the entire industry stakeholders are highly resilient and have been accustomed to such fatal market environments. It is anticipated that the commercial aerospace industry stakeholders will emerge again and create gargantuan opportunities before market stakeholders.

Segments Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High Growth Opportunity

|

|

Tire Type Analysis

|

Radial Tire and Bias Tire

|

A radial tire is expected to remain the dominant as well as the fastest-growing tire type in the market during the forecast period.

|

|

Aircraft Type Analysis

|

Commercial Aircraft, Regional Aircraft, Military Aircraft, Helicopter, and General Aviation

|

Commercial aircraft will continue to lead the market.

|

|

End-User Type Analysis

|

OE and Aftermarket

|

Aftermarket is expected to remain the dominant segment of the market during the forecast period.

|

|

Regional Analysis

|

North America, Europe, Asia-Pacific, and Rest of the World

|

Asia-Pacific is expected to remain the largest market for aircraft tires during the forecast period

|

Tire Insights

"Radial Tire segment accounted for the largest market share."

Based on the tire type, the market is segmented into radial tire and bias tire. A radial tire is expected to remain the dominant as well as the fastest-growing tire type in the market during the forecast period. The demand for radial tires is driven by continuous innovations targeting a reduction in weight, increased durability, and mobility. These aspects enable companies to improve fuel efficiency, tire life, and passenger comfort, resulting in higher usage of radial tires in the industry.

Aircraft Insights

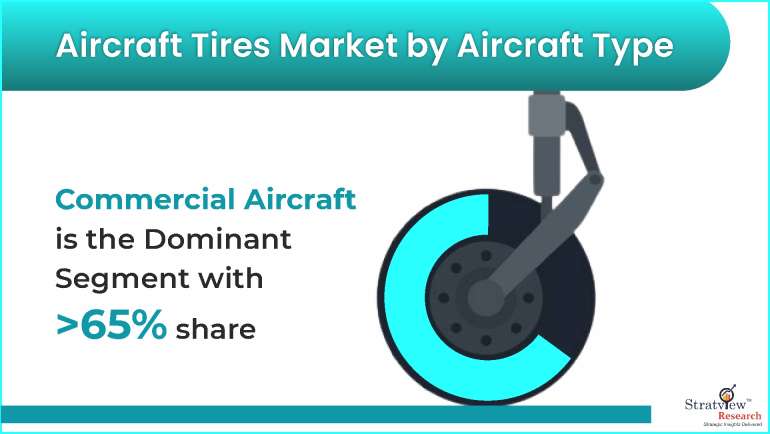

"Commercial Aircraft segment accounted for the largest market share."

Based on the aircraft type, the market is segmented as commercial aircraft, regional aircraft, military aircraft, helicopters, and general aviation. The commercial aircraft segment is expected to dominate the market, holding a revenue share of more than 65%. An expected recovery in air passenger traffic is likely to imprint a positive impact across the supply chain including the demand for tires. An expected rise in flying activity paired with higher wear and tear of tires is likely to drive the demand for tires at the aftermarket level. Continuous rise in military aircraft production is further estimated to drive the demand for tires in the years to come.

Want to get a free sample? Register Here

End-User Insights

"Aftermarket segment accounted for the largest market share."

Based on the end-user type, the market is segmented as OE and aftermarket. Aftermarket is expected to remain the dominant segment of the market during the forecast period. The long service life of an aircraft requires a large number of tires throughout its lifetime. Aircraft tires are subjected to operation in extreme temperatures and pressure. Tires continuously degrade during take-off and landings. Take-off is the most common cause of wear & tear of tires as the aircraft is fully loaded with fuel, passengers, and luggage. Tires are already pre-heated by taxiing on the runway, making take-off more crucial leading to the wearing of tires, creating a greater demand for tires.

Regional Insights

"Asia-Pacific accounted for the largest market share."

In terms of regions, Asia-Pacific is expected to remain the largest market for aircraft tires, holding a revenue share of more than 30%. Major countries in the region (China, India, Japan, Singapore, and South Korea) have a large fleet of aircraft in order to meet the large passenger traffic. Furthermore, these countries also generate a sustained demand for new aircraft to address the incessant rise in passenger traffic. North America and Europe are other markets and are likely to generate a sizeable demand for tires in the years to come.

Want to get a free sample? Register Here

Key Players

The market for tires for the aerospace industry is different from those tire markets used in other industries. One of the major reasons for the difference is its competitive landscape. The market is highly consolidated with a bunch of players securing the huge pie of the market. The following are the key players in the market.

- Compagnie Generale Des Etablissements Michelin S.C.A.

- Bridgestone Corporation

- The Goodyear Tire & Rubber Company

- Dunlop Aircraft Tyres Ltd.

- Mitas a.s. (a Trelleborg A.B. company)

- Kumho Tire Co. Inc.

- Petlas Tire Corporation

- Qingdao Sentury Tire Co., Ltd.

- Specialty Tires of America

- Wilkerson Company, Inc.

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Write to us at sales@stratviewresearch.com

Report Features

This report provides market intelligence in the most comprehensive way. The report structure has been kept so that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market. The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

- COVID-19 impact and its recovery curve

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors.

Market Segmentation

This report studies the market covering a period of 12 years of trend and forecast. The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The aircraft tires market is segmented into the following categories:

By Aircraft Type

- Commercial Aircraft

- Regional Aircraft

- Military Aircraft

- Helicopter

- General Aviation

By Tire Type

By End-User Type

By Region

- North America (Country Analysis: the USA, Canada, and Mexico)

- Europe (Country Analysis: Germany, France, the UK, Russia, Spain, and Rest of Europe)

- Asia-Pacific (Country Analysis: China, Japan, India, South Korea, and Rest of Asia-Pacific)

- Rest of the World (Sub-Region Analysis: Latin America, the Middle East, and Others)

Research Methodology

This strategic assessment report, from Stratview Research, provides a comprehensive analysis that reflects today’s aircraft tires market realities and future market possibilities for the forecast period of 2022 to 2027. The report segments and analyzes the market in the most detailed manner to provide a panoramic view of the market. The vital data/information provided in the report can play a crucial role for the market participants as well as investors in the identification of the low-hanging fruits available in the market as well as to formulate the growth strategies to expedite their growth process.

This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools. More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data. We conducted more than 15 detailed primary interviews with the market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

- Detailed profiling of additional market players (up to three players)

- SWOT analysis of key players (up to three players)

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Product portfolio, geographical reach, regional presence, and strategic alliances.

Custom Research: Stratview Research offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to sales@stratviewresearch.com.