Attractive Opportunities

Global Demand Analysis & Sales Opportunities in Green Hydrogen Market

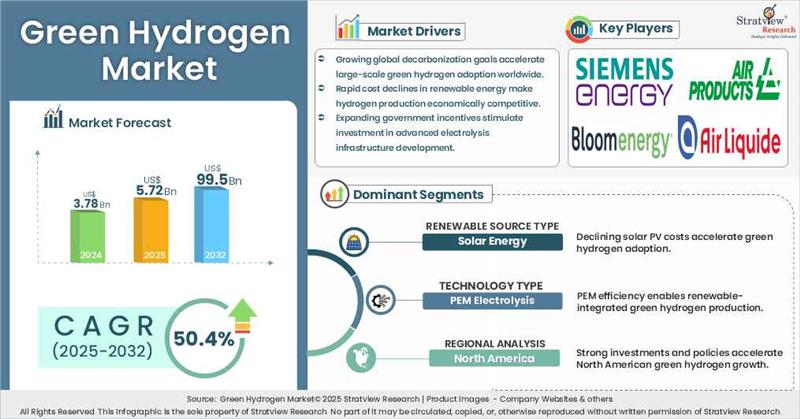

- The annual demand for green hydrogen was USD 3.78 billion in 2024 and is expected to reach USD 5.72 billion in 2025, up 51.2% than the value in 2024.

- During the next 8 years (forecast period of 2025-2032), the green hydrogen market is expected to grow at a CAGR of 50.4%. The annual demand will reach USD 99.5 billion in 2032, which is almost 20 times the demand in 2025.

Want to get a free sample? Register Here

During 2025-2032, the green hydrogen industry is expected to generate a cumulative sales opportunity of USD 286.6 billion.?

High-Growth Market Segments:

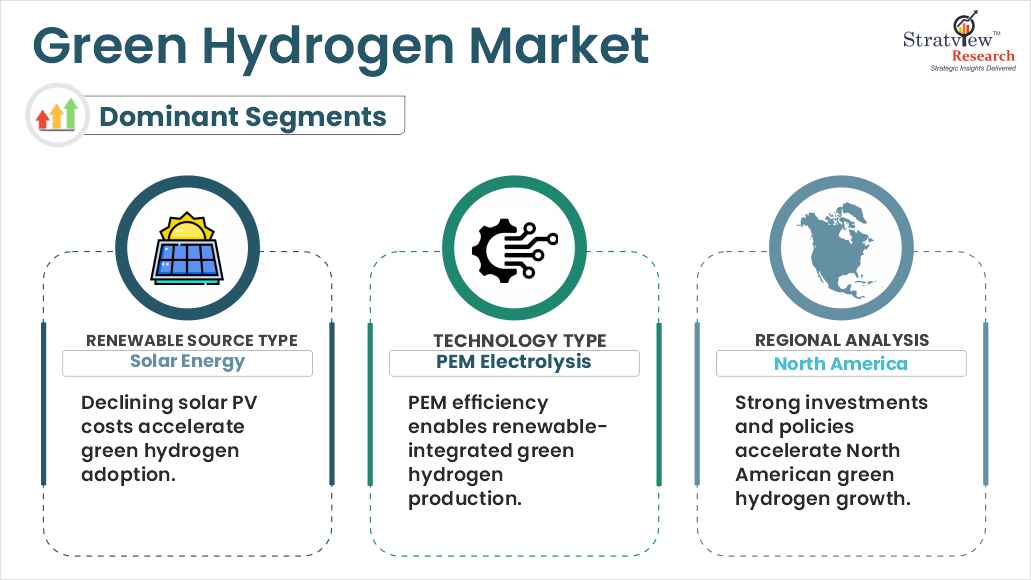

- North America is expected to be the dominant and fastest-growing region over the forecasted period.

- By renewable source type, the Solar Energy segment is projected to be the fastest-growing segment of this market during the forecast period.

- By technology type, the PEM Electrolysis segment is projected to be the fastest-growing segment of this market during the forecast period.

- By end-use type, the Mobility segment accounted for the largest share of the green hydrogen market.

Market Statistics

Have a look at the sales opportunities presented by the green hydrogen market in terms of growth and market forecast.

|

Green Hydrogen Market Data & Statistics

|

|

|

Market Statistics

|

Value (in USD Billion)

|

Market Growth (%)

|

|

Annual Market Size in 2023

|

USD 2.53 billion

|

-

|

|

Annual Market Size in 2024

|

USD 3.78 billion

|

YoY Growth in 2024: 49.5%

|

|

Annual Market Size in 2025

|

USD 5.72 billion

|

YoY Growth in 2025: 51.2%

|

|

Annual Market Size in 2032

|

USD 99.50 billion

|

CAGR 2025-2032: 50.4%

|

|

Cumulative Sales Opportunity during 2025-2032

|

USD 286.60 billion

|

|

|

Top 10 Countries’ Market Share in 2024

|

USD 3.02 billion +

|

> 80%

|

|

Top 10 Company’s Market Share in 2024

|

USD 1.89 billion to USD 2.64 billion

|

50% - 70%

|

Market Dynamics

Introduction:

What is green hydrogen?

Green hydrogen is a clean energy source generated by the electrolysis of water with renewable electricity, like solar or wind energy. Unlike conventional hydrogen, it emits no greenhouse gases during production. Green hydrogen plays a crucial role in decarbonizing sectors like industry and transportation, offering a sustainable alternative to fossil fuels in the global transition to clean energy.

Market Drivers:

High Demand from FCEVs and Power Industry

- High demand from Fuel Cell Electric Vehicles (FCEVs) and the power industry significantly drives the growth of the green hydrogen market. FCEVs need hydrogen as a clean fuel source, with quick refueling and longer range, making them ideal for commercial transport.

- At the same time, the power sector employs green hydrogen as an energy storage agent and for grid balancing, particularly with variable renewable sources. As these sectors expand to meet decarbonization goals, green hydrogen becomes vital for achieving sustainable, low-emission energy solutions.

Market Challenges:

High Cost of Green Hydrogen

- High associated with the production of green hydrogen is one of the major challenges faced by this market. Electrolysis, a primary production process, is still more costly than traditional fossil fuel-based processes owing to high capital expenses for electrolyzers, high-cost renewable energy inputs, and reduced efficiency. Furthermore, the lack of established infrastructure for production, storage, and distribution adds to overall costs.

- Although advancements in technology and increased deployment of renewables are helping reduce expenses, persistent barriers such as initial capital investment and higher fuel cell costs continue to hinder large-scale adoption.

Segments' Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High-Growth Opportunity

|

|

Renewable Source Analysis

|

Wind Energy, Solar Energy, and Other Renewable Sources

|

Solar Energy segment is projected to be the fastest-growing segment of this market during the forecast period.

|

|

Technology Analysis

|

Alkaline Electrolysis and PEM Electrolysis

|

PEM Electrolysis segment is projected to be the fastest-growing segment of this market during the forecast period.

|

|

End-Use Analysis

|

Mobility, Chemical, Power, Grid Junction, and Industrial

|

Mobility segment accounted for the largest share of green hydrogen market.

|

|

Regional Analysis

|

North America, Europe, Asia-Pacific, and The Rest of the World

|

North America is expected to be the dominant and fastest-growing region over the forecasted period.

|

By Renewable Source Type

“Solar Energy segment is projected to be the fastest-growing segment of this market during the forecast period.”

- The green hydrogen market is segmented into wind energy, solar energy, and other renewable sources.

- Solar Energy segment is projected to be the fastest-growing segment of this market during the forecast period. The rapid decline in solar photovoltaic (PV) costs has made solar-powered electrolysis increasingly cost-effective for hydrogen production.

- Moreover, governments and private players are increasingly investing in solar-hydrogen initiatives, supported by favorable policies, tax incentives, and infrastructure development plans aimed at achieving net-zero emissions.

By Technology Type

“PEM Electrolysis segment is projected to be the fastest-growing segment of this market during the forecast period.”

- The green hydrogen market is segmented into alkaline electrolysis and PEM electrolysis.

- PEM Electrolysis segment is projected to be the fastest-growing segment of this market during the forecast period, due to its high efficiency, rapid response times, and compatibility with renewable energy sources. PEM electrolyzers can function optimally under varying loads and are thus well-suited for integration with intermittent renewables such as solar and wind power.

- Additionally, advancements in PEM technology have led to cost reductions and improved durability, further driving their adoption across various industries seeking sustainable hydrogen solutions.

Want to get more details about the segmentations? Register Here

Regional Analysis

“North America is expected to be the dominant and fastest-growing region over the forecasted period.”

- In terms of region, the green hydrogen market is segmented into the North American region, the European region, the Asia-Pacific region, and the rest of the world.

- North America is expected to be the dominant and fastest-growing region over the forecasted period, driven by substantial public and private investments, supportive policies, and a strong focus on decarbonization.

- Moreover, the growing green hydrogen manufacturing facilities in North America, coupled with major green hydrogen key players provides a high potential for market growth in the coming years.

Competitive Landscape

Most of the major players compete in some of the factors, including price, service offerings, regional presence, etc. The following are the key players in the green hydrogen market -

- Air Liquide

- Air Products Inc.

- Bloom Energy

- Cummins Inc.

- Engie

- Linde plc.

- Nel ASA

- Siemens Energy

- Toshiba Energy Systems & Solutions Corporation

- Uniper SE

Note: The above list does not necessarily include all the top players in the market.

Are you a leading player in this market? We would love to include your name. Please write to us at sales@stratviewresearch.com

Recent Developments/Mergers & Acquisitions:

- In September 2024, Thermax has collaborated with Ceres Power to produce large-scale Solid Oxide Electrolysis Cells (SOEC) for producing green hydrogen on an industrial scale by making use of industrial waste heat. This partnership is intended to develop efficient systems that will be optimized for industries like steel and refineries.

- In April 2024, Oman's Hydrom entered into an agreement worth USD 11 billion with Electricité de France (EDF Group) to develop two green hydrogen projects. This project aims to produce approximately 178,000 tonnes per year (tpa) of green hydrogen by 2030, using approximately 4.5 gigawatts (GW) of wind and solar energy coupled with battery storage and an estimated 2.5 GW electrolyzer.

Report Features

This report provides market intelligence most comprehensively. The report structure has been kept so that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market.

The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

- COVID-19 impact and its recovery curve.

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors.

|

Market Study Period

|

2019-2032

|

|

Base Year

|

2024

|

|

Forecast Period

|

2025-2032

|

|

Trend Period

|

2019-2023

|

|

Number of Tables & Figures

|

>100

|

|

Number of Segments Analysed

|

4 (Renewable Source Type, Technology Type, End-Use Type, and Region)

|

|

Number of Regions Analysed

|

4 (North America, Europe, Asia-Pacific, Rest of the World)

|

|

Countries Analysed

|

15 (The USA, Canada, Mexico, Germany, France, Italy, The UK, China, Japan, India, Brazil, Saudi Arabia, Rest of Europe, Rest of APAC, and Rest of the World)

|

|

Free Customization Offered

|

10%

|

|

After Sales Support

|

Unlimited

|

|

Report Presentation

|

Complimentary

|

|

Market Dataset

|

Complimentary

|

|

Further Deep Dive & Consulting Services

|

10% Discount

|

Market Segmentation

This report studies the market, covering a period of 15 years of trend and forecast. The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The green hydrogen market is segmented into the following categories.

Green Hydrogen Market, by Renewable Source Type

- Wind Energy

- Solar Energy

- Other Renewable Sources

Green Hydrogen Market, by Technology Type

- Alkaline Electrolysis

- PEM Electrolysis

Green Hydrogen Market, by End-Use Type

- Mobility

- Chemical

- Power

- Grid Junction

- Industrial

Green Hydrogen Market, by Region

- North America (Country Analysis: The USA, Canada, and Mexico)

- Europe (Country Analysis: Germany, France, Italy, The UK, and Rest of Europe)

- Asia-Pacific (Country Analysis: Japan, China, India, and Rest of Asia-Pacific)

- Rest of the World (Country Analysis: Brazil, Saudi Arabia, and Others)

Research Methodology

- This strategic assessment report from Stratview Research provides a comprehensive analysis that reflects today’s Green Hydrogen market realities and future market possibilities for the forecast period.

- The report segments and analyzes the market in the most detailed manner to provide a panoramic view of the market.

- The vital data/information provided in the report can play a crucial role for market participants and investors in identifying the low-hanging fruits available in the market and formulating growth strategies to expedite their growth process.

- This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools.

- More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data.

- We conducted more than 15 detailed primary interviews with market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respected clients:

Company Profiling

- Detailed profiling of additional market players (up to three players)

- SWOT analysis of key players (up to three players)

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Service portfolio, geographical reach, regional presence, and strategic alliances

Custom Research: Stratview Research offers custom research services across industries. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to sales@stratviewresearch.com