Attractive Opportunities

Global Demand Analysis & Sales Opportunities in Automotive Telematics Market

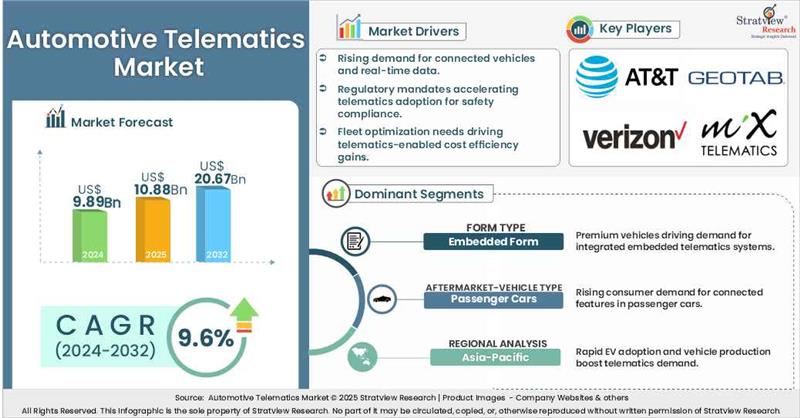

- The annual demand for automotive telematics was USD 9.89 billion in 2024 and is expected to reach USD 10.88 billion in 2025, up 10.0% than the value in 2024.

- During the next 8 years (forecast period of 2025-2032), the automotive telematics market is expected to grow at a CAGR of 9.6%. The annual demand will reach USD 20.67 billion in 2032, which is almost 2 times the demand in 2025.

- During 2025-2032, the automotive telematics industry is expected to generate a cumulative sales opportunity of USD 123 billion, which is almost 3 times the opportunities during 2019-2024.

Want to get a free sample? Register Here

High-Growth Market Segments:

- Asia Pacific region holds the largest share of the automotive telematics market because of the significant growth in electric vehicle adoption and telematics services.

- By service type, Remote Diagnostics segment is anticipated to drive the market during the forecast period due to increasing demand for predictive maintenance and vehicle health monitoring.

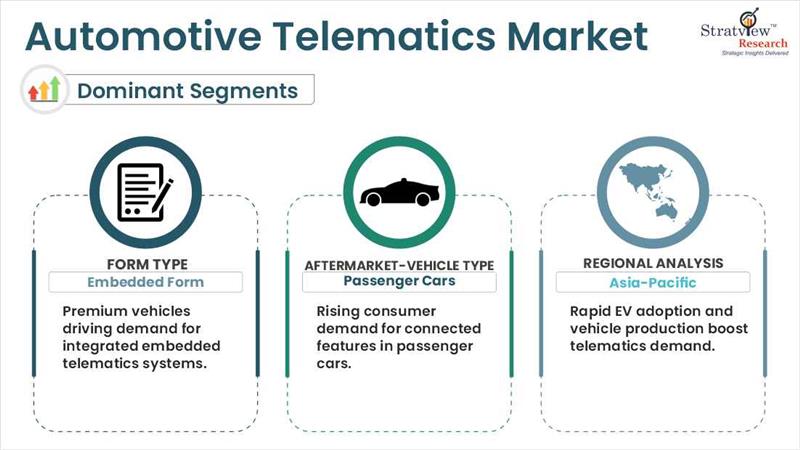

- By form type, Embedded Form is expected to hold the largest market share during the forecast period due to the growing preference for in-vehicle systems in premium vehicles.

- By offering type, Software is leading the market with the highest CAGR because of increased demand for cloud-based solutions and software updates.

- By vehicle type, Passenger Cars are anticipated to hold the largest share of the market due to increased adoption of connected and smart vehicles.

- By connectivity type, 5G is expected to grow with the highest CAGR during the forecast period because of 5G’s low latency and high bandwidth support for autonomous and connected features.

- By aftermarket-vehicle type, Passenger Cars are expected to drive the market because of the growing consumer demand for telematics features in everyday vehicles.

- By fleet management type, Vehicle Maintenance and Diagnostics segment is anticipated to be the leading one due to the increased fleet efficiency and maintenance management.

- By EV & hybrid vehicle service type, Remote Diagnostics is the emerging segment during the forecast period, as it is essential for maintaining EV and Hybrid vehicle health.

- By EV & hybrid vehicle - vehicle type, Battery Electric Vehicles (BEVs) hold the largest share of the market due to growing adoption of BEVs, due to environmental regulations and consumer demand.

Market Statistics

Have a look at the sales opportunities presented by the automotive telematics market in terms of growth and market forecast.

|

Automotive Telematics Market Data & Statistics

|

|

|

Market Statistics

|

Value (in USD Billion)

|

Market Growth (%)

|

|

Annual Market Size in 2023

|

USD 8.97 billion

|

-

|

|

Annual Market Size in 2024

|

USD 9.89 billion

|

YoY Growth in 2024: 10.3%

|

|

Annual Market Size in 2025

|

USD 10.88 billion

|

YoY Growth in 2025: 10.0%

|

|

Annual Market Size in 2032

|

USD 20.67 billion

|

CAGR 2025-2032: 9.6%

|

|

Cumulative Sales Opportunity during 2025-2032

|

USD 123 billion

|

|

|

Top 10 Countries’ Market Share in 2024

|

USD 8 billion +

|

> 80%

|

|

Top 10 Company’s Market Share in 2024

|

USD 5 billion to USD 7 billion

|

50% - 70%

|

Market Dynamics

Introduction:

Automotive telematics is the combination of telecommunications and informatics within automobiles, allowing real-time data exchange between cars and external systems. It encompasses services such as GPS navigation, vehicle tracking, remote diagnostics, and driver behaviour monitoring. The automotive telematics market includes the technologies, software, and services that enable these features. Automotive telematics is led by innovation with a focus on providing increased comfort for passengers as well as higher levels of interaction in the car. The technology integrates telecommunications and information technology to offer cars features ranging from navigation to safety and security. Popular applications of telematics are car navigation systems, safety and security features, car sharing, vehicle analytics, tracking of containers, emergency warning systems, tracking of trailers, etc.

Market Drivers:

Rising Consumer Demand for Advanced In-Vehicle Technologies and Functional Enhancements

- The increasing demand from consumers for sophisticated vehicle functions and features is driving the global automotive telematics market.

- Today's drivers require built-in infotainment systems, real-time navigation, remote diagnostics, and in-car connectivity, all of which are based on telematics platforms. This move toward user-oriented, digital driving experiences has forced automakers to include telematics solutions as standard.

- In addition, capabilities such as predictive maintenance, over-the-air (OTA) updates, and emergency response systems improve safety and convenience, meeting changing consumer expectations and driving market growth of automotive telematics.

Growing Integration and Utilization of Connected Vehicle Services

- The growing demand for advanced in-vehicle technologies, combined with rapid advancements in telecom infrastructure, is a major driver of the global automotive telematics market.

- Consumers increasingly expect features like seamless connectivity, intelligent navigation, and remote diagnostics, prompting automakers to integrate telematics systems powered by IoT, AI, and cloud computing.

- The deployment of 5G networks has further enabled real-time data exchange, supporting functions such as autonomous driving and predictive maintenance, thereby accelerating telematics adoption across both passenger and commercial vehicle segments worldwide.

Market Challenges:

Absence of Uniform Industry Standards

- One of the biggest challenges in the automotive telematics industry is the absence of standardized procedures and regulatory conformity across regions, resulting in systems that are fragmented in nature.

- OEMs tend to create proprietary telematics platforms that are not compatible with third-party software, thus restricting cross-platform functionality and end-user experience. Fragmentation impedes real-time data exchange, diagnostics, and traffic updates.

- For instance, Europe's DSRC technology is not readily compatible with GPS-based systems in North America, inhibiting the creation of a global telematics ecosystem and retarding innovation and adoption.

Market Opportunities:

Deployment of 5G/6G Connectivity along with Artificial Intelligence

- The growth in sales of luxury and premium cars has given birth to new possibilities for the development of telematics devices, which raise vehicle maintenance detection, user experience, remote diagnostics, and in-vehicle infotainment systems.

- The rollout of 5G/6G connectivity, coupled with artificial intelligence (AI), is propelling further growth in the automotive telematics market. With higher speed, lower latency, and greater bandwidth, 5G/6G allows telematics units to handle huge volumes of data, maximizing operating efficiency and decision-making.

- AI-powered features, such as Tesla's Autopilot, enhance safety and autonomous driving, and predictive maintenance enables fleet managers to sidestep expensive repairs. The combination of 5G/6G and AI places automotive telematics on a trajectory for major future market growth.

Segments Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High-Growth Opportunity

|

|

Service Type

|

Emergency Calling, On-Road Assistance, Remote Diagnostics, Insurance Risk Assessment, Stolen Vehicle Assistance

|

Remote Diagnostics segment is anticipated to drive the market during the forecast period due to increasing demand for predictive maintenance and vehicle health monitoring.

|

|

Form Type

|

Embedded, Integrated

|

Embedded Form is expected to hold the largest market share during the forecast period due to the growing preference for in-vehicle systems in premium vehicles.

|

|

Offering Type

|

Hardware, Software

|

Software is leading the market with the highest CAGR because of increased demand for cloud-based solutions and software updates.

|

|

Vehicle Type

|

Passenger Cars, Light Commercial Vehicles (LCVs), Buses, Trucks

|

Passenger Cars are anticipated to hold the largest share of the market due to increased adoption of connected and smart vehicles.

|

|

Connectivity Type

|

Satellite, Cellular, 4G/3G, 5G

|

5G is expected to grow with the highest CAGR during the forecast period because of 5G’s low latency and high bandwidth support for autonomous and connected features.

|

|

Aftermarket-Vehicle Type

|

Passenger Cars, Light Commercial Vehicles (LCVs), Heavy Commercial Vehicles (HCVs)

|

Passenger Cars are expected to drive the market because of the growing consumer demand for telematics features in everyday vehicles.

|

|

Fleet Management Services

|

Operation Management, Vehicle Maintenance and Diagnostics, Fleet Analytics and Reporting

|

Vehicle Maintenance and Diagnostics segment is anticipated to be the leading one due to the increased fleet efficiency and maintenance management.

|

|

EV & Hybrid Vehicle Service Type

|

Emergency Calling, On-Road Assistance, Remote Diagnostics, Insurance Risk Assessment, Stolen Vehicle Assistance

|

Remote Diagnostics is the emerging segment during the forecast period, as it is essential for maintaining EV and Hybrid vehicle health.

|

|

EV & Hybrid Vehicle - Vehicle Type

|

Battery Electric Vehicles (BEVs), Plug-In Hybrid Electric Vehicles (PHEVs), Fuel-Cell Electric Vehicles (FCEVs)

|

|

Battery Electric Vehicles (BEVs) hold the largest share of the market due to growing adoption of BEVs, due to environmental regulations and consumer demand.

|

|

|

Region

|

North America, Europe, Asia-Pacific, and Rest of the World.

|

Asia Pacific region holds the largest share of the automotive telematics market because of the significant growth in electric vehicle adoption and telematics services.

|

By Form Analysis

“Embedded Form will hold the largest market share during the forecast period due to the growing preference for in-vehicle systems in premium vehicles.”

- Embedded form will hold the largest market share of the automotive telematics market during the forecast period due to the growing preference for in-vehicle systems in premium vehicles.

- Offering seamless integration, real-time data access, and enhanced safety features, embedded telematics is increasingly adopted by both luxury and mainstream automakers to meet rising consumer demand for connected and intelligent vehicle solutions.

By Aftermarket-Vehicle Type Analysis

“Passenger Cars are expected to drive the market because of the growing consumer demand for telematics features in everyday vehicles.”

- Passenger vehicles have the largest market for aftermarket telematics units, which is motivated by increasing demand for real-time navigation, vehicle diagnostics, driver behavior monitoring, and roadside emergency assistance.

- These solutions provide an affordable way to bring modern connectivity capabilities to older vehicles without buying new cars. Growing acceptance of ride-sharing and small fleet operations based on passenger cars continues to drive demand, as fleet managers gain more efficient route optimization and driver monitoring.

- Automakers and technology firms such as Delphi, Ford, and Verizon are increasingly providing portable aftermarket telematics solutions. This increasing trend makes passenger cars the most rapidly expanding segment in the aftermarket telematics market.

Want to get more details about the segmentations? Register Here

Regional Analysis

“The Asia-Pacific region holds the largest share of the automotive telematics market because of the significant growth in electric vehicle adoption and telematics services.”

- Asia Pacific is likely to be the most profitable market for automotive telematics. In the Asia Pacific market, China has the largest share, >45% of the market share, in vehicle production.

- In line with a report, Asia Pacific passenger car manufacturing is predicted to increase from ~57 million units in 2024 to ~62 million units by the year 2030, and the fastest rate of growth would be experienced in India, owing to alterations in customer consumption patterns towards premium and luxury offerings. India's major key players are MG Motor, Maruti Suzuki, Hyundai, and Tata Motors, which are constantly incorporating telematics solutions in their cars to meet the rising demand.

- Moreover, telecommunication industry key players, including Vodafone Idea, Airtel, and Jio, are providing their strong connectivity solutions and services to the enhanced features provided in luxury and high-end cars.

Competitive Landscape

Most of the major players compete in some of the factors, including price, service offerings, regional presence, etc. The following are the key players in the global automotive telematics market:

- AT&T Inc (US)

- Verizon (US)

- Geo Tab Inc. (Canada)

- Mix Telematics (South Africa)

- Microlise Limited (UK)

- Robert Bosch GmbH (Germany)

- Continental AG (Germany)

- LG Electronics (South Korea)

- Harman International (US)

- Aptiv Plc (Ireland)

Note: The above list does not necessarily include all the top players in the market.

Are you a leading player in this market? We would love to include your name. Please write to us at sales@stratviewresearch.com

Recent Developments/Mergers & Acquisitions:

- In January 2024, at CES 2024, the future of individualized travel was unveiled at IAA Mobility by Continental AG and Google Cloud coming together. The Google Cloud's generative AI voice assistant is embedded in Continental's Smart Cockpit High-performance Computer (HPC), hence a natural and intuitive user-to-assistant interaction is formed. Its capabilities include conversational navigation, driver personalization, and in-car control, where users can ask specific car-related questions, discover the sites of interest, and engage in back-and-forth conversations for an enhanced traveling experience.

- In January 2024, Continental AG, the company of Aurora Innovation, created hardware architectures and designs. Continental will showcase its latest technologies at CES 2024 in Las Vegas. The hardware of the Aurora Driver employs Continental products, such as sensors, automated driving Control Units (ADCL 151's high-performance computers), and telematics units.

Report Features

This report provides market intelligence most comprehensively. The report structure has been kept so that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market.

The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

- COVID-19 impact and its recovery curve.

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors.

|

Market Study Period

|

2019-2032

|

|

Base Year

|

2024

|

|

Forecast Period

|

2025-2032

|

|

Trend Period

|

2019-2023

|

|

Number of Tables & Figures

|

>100

|

|

Number of Segments Analysed

|

10 (Service Type, Form Type, Offering Type, Vehicle Type, Connectivity Type, Aftermarket Vehicle Type, Fleet Management Type, EV & Hybrid Vehicle Service Type, EV & Hybrid Vehicle – Vehicle Type, and Region)

|

|

Number of Regions Analysed

|

4 (North America, Europe, Asia-Pacific, Rest of the World)

|

|

Countries Analysed

|

15 (The USA, Canada, Mexico, Germany, France, Italy, The UK, China, Japan, India, Brazil, Saudi Arabia, Rest of Europe, Rest of APAC, and Rest of the World)

|

|

Free Customization Offered

|

10%

|

|

After Sales Support

|

Unlimited

|

|

Report Presentation

|

Complimentary

|

|

Market Dataset

|

Complimentary

|

|

Further Deep Dive & Consulting Services

|

10% Discount

|

Market Segmentation

This report studies the market, covering a period of 15 years of trend and forecast. The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

By Service Type

- Emergency Calling

- On-Road Assistance

- Remote Diagnostics

- Insurance Risk Assessment

- Stolen Vehicle Assistance

- Others

By Service Type

By Offering Type

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Buses

- Trucks

By Connectivity Type

- Satellite

- Cellular

- 4G/3G

- 5G

By Aftermarket-Vehicle Type

By Fleet Management Services Type

- Operation Management

- Fleet Analytics and Reporting

- Vehicle Maintenance and Diagnostics

By EV & Hybrid Vehicle-Service Type

- Emergency Calling

- On-Road Assistance

- Remote Diagnostics

- Insurance Risk Assessment

- Stolen Vehicle Assistance

By EV & Hybrid Vehicle-Vehicle Type

- Battery Electric Vehicles

- Plug-In Hybrid Electric Vehicles

- Fuel-Cell Electric Vehicles

By Region

- North America (Country Analysis: The USA, Canada, and Mexico)

- Europe (Country Analysis: Germany, France, Italy, The UK, and the Rest of Europe)

- Asia-Pacific (Country Analysis: Japan, China, India, and Rest of Asia-Pacific)

- Rest of the World (Country Analysis: Brazil, Saudi Arabia, and Others)

Research Methodology

- This strategic assessment report from Stratview Research provides a comprehensive analysis that reflects today’s global automotive telematics market realities and future market possibilities for the forecast period.

- The report segments and analyzes the market in the most detailed manner in order to provide a panoramic view of the market.

- The vital data/information provided in the report can play a crucial role for market participants and investors in identifying the low-hanging fruits available in the market and formulating growth strategies to expedite their growth process.

- This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools.

- More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data.

- We conducted more than 15 detailed primary interviews with market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

- Detailed profiling of additional market players (up to three players)

- SWOT analysis of key players (up to three players)

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Service portfolio, geographical reach, regional presence, and strategic alliances.

Custom Research: Stratview Research offers custom research services across industries. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to sales@stratviewresearch.com.