Attractive Opportunities

Global Demand Analysis & Sales Opportunities in European Relay Market

-

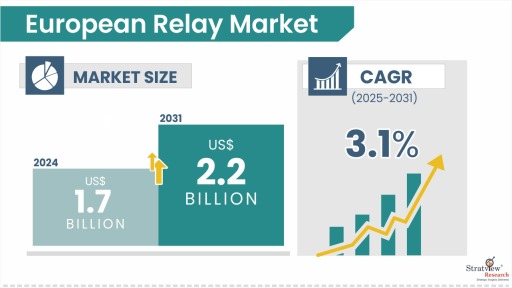

The annual demand for European relay was USD 1.72 billion in 2024 and is expected to reach USD 1.78 billion in 2025, up 3.9% than the value in 2024.

-

During the forecast period (2025-2031), the European relay market is expected to grow at a CAGR of 3.1%. The annual demand will reach USD 2.15 billion in 2031.

-

During 2025-2031, the European relay industry is expected to generate a cumulative sales opportunity of USD 13.83 billion, which is almost 1.5 times the opportunities during 2019-2024.

Want to get a free sample? Register Here

High-Growth Market Segments:

-

Germany dominates the European relay market and is expected to continue their dominance because of its technological leadership.

-

By type, Solid-state relays will experience more growth in the coming years because of the rising demand for energy efficiency.

-

By mount type, Plug-in mount relays are expected to maintain their dominance in the coming years because of their versatility across industries.

-

By application type, Industrial automation will experience higher growth in the coming years due to the rising adoption of smart factories, robotics, and Industry 4.0 initiatives.

-

By function type, Interface relays will see higher growth in the coming years as they offer enhanced compatibility.

-

By sales-channel type, Distributor sales channel will see more growth in the forecasted period because of expanding e-commerce.

-

By end-use type, OE end-use dominates the European relay market, while others (integrators, etc.) provide customized solutions.

Market Statistics

Have a look at the sales opportunities presented by the European relay market in terms of growth and market forecast.

|

European Relay Market Data & Statistics

|

|

|

Market Statistics

|

Value (in USD Billion)

|

Market Growth (%)

|

|

Annual Market Size in 2023

|

USD 1.67 billion

|

-

|

|

Annual Market Size in 2024

|

USD 1.72 billion

|

YoY Growth in 2024: 2.5%

|

|

Annual Market Size in 2025

|

USD 1.78 billion

|

YoY Growth in 2025: 3.9%

|

|

Annual Market Size in 2031

|

USD 2.15 billion

|

CAGR 2025-2031: 3.1%

|

|

Cumulative Sales Opportunity during 2025-2031

|

USD 13.83 billion

|

-

|

Market Dynamics

Introduction:

A relay is an electrically operated switch that uses an electromagnet to mechanically open or close a circuit. They open and close circuits by receiving electrical signals from outside sources. The primary purpose of a relay is to protect the electrical system from high voltage or current, allowing the safe operation of equipment. They act as intermediaries that can quickly respond to abnormal conditions, such as overcurrent or short circuits, by interrupting the flow of electricity. Relays sense abnormal voltage and current conditions and send signals to circuit breakers to isolate faulty parts of a power system.

With a single press, relays can manage a substantially larger amount of electric flow than a switch can. Relays are generally used for lower-power applications and can switch multiple contacts simultaneously. They provide isolation between different voltage levels, protecting sensitive control circuits from high voltages and surges.

Relays can be broadly classified into electromechanical relays and solid-state relays. Electromechanical relays work on electromagnetism, where an electric current energizes a coil, creating a magnetic field that pulls a switch to open or close a circuit, whereas a solid-state relay uses a semiconductor device (such as thyristors or transistors) instead of mechanical contacts.

Market Drivers:

-

Renewable energy integration demands smart relays for grid stability and efficient power management.

-

Industrial IoT adoption accelerates relay demand for remote monitoring and control applications.

-

Vehicle electrification surge creates unprecedented need for high-voltage relays in EVs and charging infrastructure.

-

Smart building automation drives the uptake of advanced relay systems for energy efficiency and occupant comfort.

-

Critical infrastructure security concerns fuel demand for relay-based protection systems in utilities and transportation.

Segments' Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High-Growth Opportunity

|

|

Type Analysis

|

Electromechanical relays and Solid-State Relays.

|

Solid-state relays will experience more growth in the coming years because of the rising demand for energy efficiency.

|

|

Mount-Type Analysis

|

PCB Mount, Panel Mount, Plug-in Mount, and Other Mounts.

|

Plug-in mount relays are expected to maintain their dominance in the coming years because of their versatility across industries.

|

|

Application-Type Analysis

|

Consumer Electronics & Appliances, Automotive, Industrial Automation, Communication, Energy/Power, Automation Testing Equipment, and Other Applications.

|

Industrial automation will experience higher growth in the coming years due to the rising adoption of smart factories, robotics, and Industry 4.0 initiatives.

|

|

Function-Type Analysis

|

Switching Power Relays, Universal Relays, and Interface Relays.

|

Interface relays will see higher growth in the coming years as they offer enhanced compatibility.

|

|

Sales-Channel-Type Analysis

|

Direct Sales and Distributor Sales.

|

The distributor sales channel will see more growth in the forecasted period because of expanding e-commerce.

|

|

End-Use-Type Analysis

|

OE, Aftermarket, and Other End-Users.

|

OE end-use dominates the European relay market, while others (integrators, etc.) provide customized solutions.

|

|

Country Analysis

|

Germany, France, Italy, the UK, and the rest of Europe

|

Germany dominates the European relay market and is expected to continue their dominance because of its technological leadership.

|

By Type

“Solid-state relays will experience more growth in the coming years because of rising demand for energy efficiency.”

-

The European relay market is segmented into electromechanical relays and solid-state relays. Solid-state relays will see more growth in the future because of advancements in industrial automation and growing adoption in EVs and smart grids.

-

As Europe pushes for electrification and smart grid expansion, solid-state relays are preferred in electric vehicles (EVs), battery management systems, and renewable energy applications because of their higher longevity and reliability.

-

Electromagnetic relays dominate the European relay market because they offer a cost-effective solution compared to solid-state relays, making them ideal for budget-sensitive industries.

Mount Insights

“Plug-in mount relays are expected to maintain their dominance in the coming years because of their versatility across industries.”

-

The European relay market is segmented into PCB mount, panel mount, plug-in mount, and other mounts. Plug-in mount relays will continue to dominate the European relay market as they offer easy installation and replacement without requiring complex wiring, making them ideal for industries that prioritize quick maintenance.

-

With the rise of EVs and smart grid infrastructure, the demand for durable, high-performance, and easily replaceable relays is expected to boost the growth of plug-in mount relays.

Application Insights

“Industrial automation will experience higher growth in the coming years due to the rising adoption of smart factories, robotics, and Industry 4.0 initiatives.”

-

The European relays market is segmented by consumer electronics & appliances, automotive, industrial automation, communication, energy/power, automation testing equipment, and other applications.

-

In the coming years, industrial automation will be the fastest-growing application as automation-driven demand for high-performance relays in manufacturing, logistics, and process industries will surpass other application segments as businesses focus on efficiency and reduced operational costs.

-

Consumer Electronics & Appliances dominate the European relay market because of the high demand for home appliances, HVAC systems, and smart devices that require reliable switching components.

Function Insights

“Interface relays will see higher growth in the coming years as they offer enhanced compatibility.”

-

The European relay market is segmented into switching power relays, universal relays, and interface relays. Interface relay will witness the fastest growth as automation continues to expand.

-

These relays play a crucial role in connecting control systems with high-power devices while ensuring electrical isolation and preventing voltage fluctuations.

-

Their compact size, fast switching speed, and ability to work with various control voltages further contribute to their increasing demand in robotics, smart factories, and industrial IoT, where reliable and efficient signal transmission is essential.

Sales Channel Insights

“Distributor sales channel will see more growth in the forecasted period because of expanding e-commerce.”

-

The European relay market is segmented into direct sales and distributor sales. Distributor sales will see more growth in the coming years because they cater to small and mid-sized businesses that require flexible purchasing options and faster deliveries.

-

Expanding regional distribution networks are making it easier for distributors to penetrate new markets, increasing their share in the relay industry.

-

Direct sales dominate the European relay market because major relay manufacturers sell directly to large industrial customers, ensuring bulk orders and strong relationships.

-

Cost efficiency in large-scale procurement makes direct sales attractive, as bulk buyers benefit from negotiated pricing and reduced intermediary costs.

End-Use Insights

“OE end-use dominates the European relay market, while other end-users (integrators, etc.), provide customized solutions.”

-

The European relay market is segmented into OE, Aftermarket, and other end-users. OE end-use dominates the European relay market because of established supply chains, brand reputation, and strong partnerships.

-

Strict standards and certifications favor OE, as large companies prefer certified, reliable suppliers for critical applications. Others will see more growth in the coming years as many end-users prefer to source relays through integrators since they offer value-added services like customization solutions, installation, system compatibility, and technical support, driving higher demand.

Country Insights

“Germany dominates the European relay market and is expected to continue their dominance because of its technological leadership.”

-

Germany being home to a well-established industrial hub, including leading manufacturers in automation, automotive, and energy, drives consistent demand for high-quality relays.

-

The country is also at the forefront of Industry 4.0 and smart manufacturing, where relays are essential components in industrial automation, robotics, and IoT-enabled systems.

-

As Germany transitions to renewable energy sources, the need for reliable relays in power grids, wind turbines, and solar energy systems continues to increase, supporting market expansion.

Want to get a free sample? Register Here

Competitive Landscape

The market is fragmented, with over 50 players. Most of the major players compete in some of the governing factors, including price, service offerings, regional presence, etc. The following are the key players in the European relay market. Some of the major players provide a complete range of services.

Here is the list of the Top Players (Based on Dominance)

-

Omron

-

TE Connectivity

-

Schneider Electric

-

Finder

-

Phoenix Contact

-

Eaton

-

ABB

-

Siemen

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Please write to us at sales@stratviewresearch.com

Recent Market JVs and Acquisitions:

A considerable number of strategic alliances, including M&As, JVs, etc., have been performed over the past few years:

-

In January 2022, TE Connectivity (TE) acquired the force-guided narrow safety relay (NSR) elementary relay technology from the Phoenix Contact Group (Phoenix Contact) as part of a long-term partnership agreement. The acquisition adds a single-pole, force-guided offering to TE’s broad relay portfolio for the factory automation, elevator, and rail markets.

Recent Product Development:

-

In February 2023, OMRON Corp. introduced the G9KA-E high-capacity power relay. G9KA-E relay is the industry's highest-performing relay for printed circuit boards, supporting 300A energization with ultra-low contact resistance (≤0.2 mΩ), minimizing heat generation, and enhancing efficiency in renewable energy applications.

Report Features

This report provides market intelligence most comprehensively. The report structure has been kept so that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market.

The following are the key features of the report:

-

Market structure: Overview, industry life cycle analysis, supply chain analysis.

-

Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

-

Market trend and forecast analysis.

-

Market segment trend and forecast.

-

Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

-

COVID-19 impact and its recovery curve.

-

Attractive market segments and associated growth opportunities.

-

Emerging trends.

-

Strategic growth opportunities for the existing and new players.

-

Key success factors.

|

Market Study Period

|

2019-2031

|

|

Base Year

|

2024

|

|

Forecast Period

|

2025-2031

|

|

Trend Period

|

2019-2023

|

|

Number of Tables & Figures

|

>100

|

|

Number of Segments Analysed

|

7 (Type, Mount Type, Application Type, Function Type, Sales-Channel Type, End-Use Type, and Country)

|

|

Free Customization Offered

|

10%

|

|

After Sales Support

|

Unlimited

|

|

Report Presentation

|

Complimentary

|

|

Market Dataset

|

Complimentary

|

|

Further Deep Dive & Consulting Services

|

10% Discount

|

Market Segmentation

This report studies the market, covering a period of 15 years of trend and forecast. The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The European relay market is segmented into the following categories:

European relay market, by Type

-

Electromechanical Relays

-

Solid State Relays

European relay market, by Mount Type

-

PCB Mount Type

-

Panel Mount Type

-

Plug-in Mount Type

-

Other Mounts

European relay market, by Application Type

European relay market, by Function Type

-

Switching Power Relays

-

Universal Relays

-

Interface

European relay market, by Sales Channel Type

-

Direct Sales

-

Distributor Sales

European relay market, by End-Use Type

-

OE

-

Aftermarket

-

Other End-Users

European relay market, by Country

-

Germany

-

France

-

Italy

-

The UK

-

Rest Of Europe

Research Methodology

-

This strategic assessment report from Stratview Research provides a comprehensive analysis that reflects today’s European relay market realities and future market possibilities for the forecast period.

-

The report segments and analyzes the market in the most detailed manner to provide a panoramic view of the market.

-

The vital data/information provided in the report can play a crucial role for market participants and investors in identifying the low-hanging fruits available in the market and formulating growth strategies to expedite their growth process.

-

This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools.

-

More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data.

-

We conducted more than 15 detailed primary interviews with market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respected clients:

Company Profiling

Competitive Benchmarking

-

Benchmarking of key players on the following parameters: Service portfolio, geographical reach, regional presence, and strategic alliances

Custom Research: Stratview Research offers custom research services across industries. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to sales@stratviewresearch.com