Attractive Opportunities

Global Demand Analysis & Sales Opportunities in Gas Chromatography Market

-

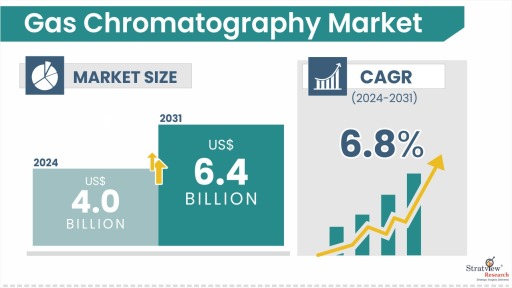

The annual demand for gas chromatography was USD 4.0 billion in 2024 and is expected to reach USD 4.3 billion in 2025, up 7.6% than the value in 2024.

-

During the forecast period (2025-2031), the gas chromatography market is expected to grow at a CAGR of 6.8%. The annual demand will reach USD 6.4 billion in 2031, which is almost 1.5 times the demand in 2025.

-

During 2025-2031, the gas chromatography industry is expected to generate a cumulative sales opportunity of USD 37.3 billion, which is almost 6 times the opportunities during 2019-2024.

Want to get a free sample? Register Here

High-Growth Market Segments:

-

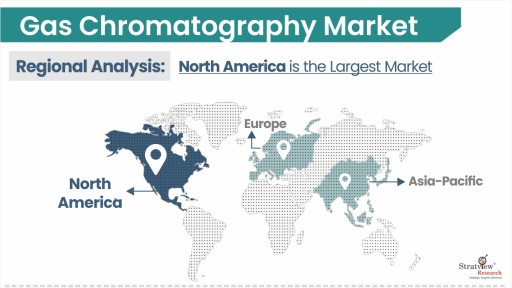

North America is expected to maintain its reign over the forecast period, whereas Asia-Pacific is likely to grow at the fastest rate.

-

By product type, Instrument/skid is expected to hold the largest share of the market throughout the study period.

-

By end-use industry type, Pharmaceuticals held the largest share, whereas environmental testing is likely to grow the fastest during the study period.

Market Statistics

Have a look at the sales opportunities presented by the gas chromatography market in terms of growth and market forecast.

|

Gas Chromatography Market Data & Statistics

|

|

|

Market Statistics

|

Value (in USD Billion)

|

Market Growth (%)

|

|

Annual Market Size in 2023

|

USD 3.7 billion

|

-

|

|

Annual Market Size in 2024

|

USD 4.0 billion

|

YoY Growth in 2024: 7.8%

|

|

Annual Market Size in 2025

|

USD 4.3 billion

|

YoY Growth in 2025: 7.6%

|

|

Annual Market Size in 2031

|

USD 6.4 billion

|

CAGR 2025-2031: 6.8%

|

|

Cumulative Sales Opportunity during 2025-2031

|

USD 37.3 billion

|

-

|

|

Top 10 Countries’ Market Share in 2024

|

USD 3.2 billion +

|

> 80%

|

|

Top 10 Company’s Market Share in 2024

|

USD 2.0 billion to USD 2.8 billion

|

50% - 70%

|

Market Dynamics

Introduction:

Gas chromatography (GC) is an advanced analytical technique used to separate, identify, and quantify volatile and semi-volatile compounds in complex mixtures. It works by passing a vaporized sample through a stationary phase inside a column, carried by an inert gas such as helium or nitrogen. Due to its high sensitivity and accuracy, GC is widely used across various industries, including pharmaceuticals, environmental testing, food and beverage, oil and gas, chemicals, and forensic research.

Market Drivers:

The market for gas chromatography is expected to grow steadily, driven by several key factors.

-

The pharmaceutical and biotechnology sectors use GC for drug analysis and quality control, especially with stringent regulations from agencies like the FDA and EMA. Similarly, increasing environmental concerns and regulations from organizations like the EPA are boosting demand for GC in pollution monitoring.

-

In the oil and gas sector, GC plays a critical role in hydrocarbon analysis and refining processes, with growing investments in energy exploration further expanding its application.

-

Technological advancements, such as hyphenated techniques (GC-MS, GC-FTIR), automation, and portable GC systems, are also propelling market growth by improving efficiency and accuracy.

-

Stringent food safety regulations worldwide are increasing the use of GC for detecting contaminants and ensuring compliance with safety standards. With the rising need for precise and reliable analytical solutions across industries, the gas chromatography market is set to witness continuous expansion in the coming years.

Segments' Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High-Growth Opportunity

|

|

Product-Type Analysis

|

Instrument/Skid, Consumables, Software, and Other Products

|

Instrument/skid is expected to hold the largest share of the market throughout the study period.

|

|

End-Use Industry-Type Analysis

|

Pharmaceutical, Biotechnology, Academic, Chemicals, Environmental Testing, CROs (Contract Research Organizations), Government Research, Hospitals & Clinical Trials, Agriculture, Food & Beverages, and Other End-Use Industries

|

Pharmaceuticals held the largest share whereas environmental testing is likely to grow the fastest during the study period.

|

|

Region Analysis

|

North America, Europe, Asia-Pacific, and The Rest of the World

|

North America is expected to maintain its reign over the forecast period, whereas Asia-Pacific is likely to grow at the fastest rate.

|

Product Insights

“Instruments/skids are expected to maintain their market dominance, while consumables will experience the fastest growth during the forecast period.”

-

The gas chromatography market is segmented into instrument/skid, consumables, software, and other products.

-

The instruments/skid segment is expected to maintain its dominance in the gas chromatography (GC) market due to the essential nature and high cost of GC systems. An average GC instrument/skid costs range between US$ 10,000 to US$ 30,000 which is way higher than the cost of consumables and software combined. Gas chromatographs, auto-samplers, and detectors are fundamental components in analytical laboratories across industries such as pharmaceuticals, chemicals, and environmental testing. A new skid contains all the necessary consumables and software making them costlier than what is available in the market individually. These skids are designed based on the nature of the analyte and particle size that will be analyzed in them. Additionally, the growing adoption of hyphenated technologies like GC-MS (Gas Chromatography-Mass Spectrometry) and GC-FTIR (Fourier Transform Infrared Spectroscopy), along with advancements in portable and micro-GC systems, is further driving demand.

-

Consumables are set to witness the fastest growth in the gas chromatography market, driven by the rising demand for refurbished systems and aftermarket replacements. These include columns, detectors, autosamplers, and other essential attachments that keep GC systems running efficiently. Unlike instruments, consumables have a limited lifespan and require frequent replacement, especially in high-throughput industries like pharmaceuticals and environmental testing. Another key factor accelerating the growth of the consumables segment is the outsourcing of analytical testing to third-party laboratories, particularly in the pharmaceutical and food sectors. Contract research organizations (CROs) and contract manufacturing organizations (CMOs) conduct large volumes of sample testing, leading to increased usage of GC consumables.

End-Use Industry Insights

“Pharmaceutical industry is expected to lead the market, whereas environmental testing is expected to be the fastest-growing industry during the forecast period.”

-

The market is segmented into pharmaceutical, biotechnology, academic, chemicals, environmental testing, CROs (contract research organizations), government research, hospitals & clinical trials, agriculture, food & beverages, and other end-use industries.

-

The pharmaceutical industry is expected to lead the Gas Chromatography (GC) market due to its critical role in drug development, quality control, and regulatory compliance. Gas chromatography is widely used in pharmaceutical applications for analyzing complex mixtures, ensuring the purity of active pharmaceutical ingredients (APIs), and detecting impurities at trace levels. Stringent regulations imposed by agencies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) require precise and reliable analytical techniques, further driving the demand for GC systems in this industry.

-

Environmental testing is projected to be the fastest-growing end-use industry for GC during the forecast period. Rising concerns over environmental pollution, stricter government regulations, and the need for monitoring air, water, and soil quality are key drivers fueling the adoption of gas chromatography in this sector. Regulatory bodies such as the U.S. Environmental Protection Agency (EPA) and the European Environment Agency (EEA) mandate rigorous testing of environmental samples to detect pollutants, volatile organic compounds (VOCs), and hazardous substances.

Regional Insights

“North America is expected to remain the largest market for gas chromatography during the forecast period.”

-

North America dominates the gas chromatography (GC) market due to its strong regulatory framework, advanced pharmaceutical and environmental testing industries, and the presence of leading market players. Strict regulations from agencies like the FDA and EPA drive demand for GC in drug development, quality control, and environmental monitoring. Additionally, significant investments in research and technological advancements further strengthen the region’s leadership.

-

Asia-Pacific is the fastest-growing region, driven by rapid industrialization, expanding pharmaceutical and biotechnology sectors, and stricter environmental regulations. Countries like China and India are witnessing increasing demand for GC in healthcare, food safety, and petrochemicals. Government support for research, rising foreign investments, and the shift of manufacturing to the region further fuel market growth.

Want to get a free sample? Register Here

Competitive Landscape

The market is highly consolidated, with less than 50 players across the globe. The following are the key players in the gas chromatography market. Some of the major players provide a complete range of products, including instrument/skids, consumables, and software.

Here are the Top Players (Based on Dominance)

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Please write to us at [email protected]

Recent Developments

New Product Launches:

A considerable number of gas chromatography products were launched over the past few years:

-

During 2022-2023, four new gas chromatography instruments were commercialized in the market which include:

-

7000E and 7010C GC/TQ by Agilent Technologies Inc.

-

5977C GC/MSD by Agilent Technologies Inc.

-

VOCAM by Defiant Technologies Private Limited

-

GC 2400 Platform by PerkinElmer Inc.

-

During 2022-2023, two new sampling and detecting devices entered the market:

-

During 2022-2023, three new software and online resources were launched in the market:

-

GC/ID Version 4.0 by Cerno Bioscience

-

ChromaTOF Sync by LECO Corporation

-

ProEZGC by Restek Corporation

Recent Advancements:

There were two major advancements happened in the gas chromatography industry that includes:

-

Advanced Hydrogen Safety Sensors: Advanced sensors detect hydrogen in the oven atmosphere in real-time, triggering automatic shutdown, cooling adjustments, and operator alerts. This safety feature ensures smooth operation and risk mitigation.

-

Helium Conversion: A new device was introduced to tackle the global helium shortage by allowing GC and GC-MS systems to switch between carrier gases. It conserves helium by switching to nitrogen when idle or using hydrogen, ensuring efficiency while minimizing helium use.

Report Features

This report provides market intelligence most comprehensively. The report structure has been kept so that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market.

The following are the key features of the report:

-

Market structure: Overview, industry life cycle analysis, supply chain analysis.

-

Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

-

Market trend and forecast analysis.

-

Market segment trend and forecast.

-

Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

-

COVID-19 impact and its recovery curve.

-

Attractive market segments and associated growth opportunities.

-

Emerging trends.

-

Strategic growth opportunities for the existing and new players.

-

Key success factors.

|

Market Study Period

|

2019-2031

|

|

Base Year

|

2024

|

|

Forecast Period

|

2025-2031

|

|

Trend Period

|

2019-2023

|

|

Number of Tables & Figures

|

>100

|

|

Number of Segments Analysed

|

3 (Product Type, End-Use Industry Type, and Region)

|

|

Number of Regions Analysed

|

4 (North America, Europe, Asia-Pacific, Rest of the World)

|

|

Countries Analysed

|

15 (The USA, Canada, Mexico, Germany, France, Italy, The UK, China, Japan, India, Brazil, Saudi Arabia, Rest of Europe, Rest of APAC, and Rest of the World)

|

|

Free Customization Offered

|

10%

|

|

After Sales Support

|

Unlimited

|

|

Report Presentation

|

Complimentary

|

|

Market Dataset

|

Complimentary

|

|

Further Deep Dive & Consulting Services

|

10% Discount

|

Market Segmentation

The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The gas chromatography market is segmented into the following categories:

Gas Chromatography Market, by Product Type

-

Instrument/Skid

-

Consumables

-

Software

-

Other Products

Gas Chromatography Market, by End-Use Industry Type

Gas Chromatography Market, by Region

-

North America (Country Analysis: The USA, Canada, and Mexico)

-

Europe (Country Analysis: Germany, France, The UK, and the Rest of Europe)

-

Asia-Pacific (Country Analysis: Japan, China, India, and Rest of Asia-Pacific)

-

Rest of the World (Country Analysis: Latin America, Middle East, and Others)

Research Methodology

-

This strategic assessment report from Stratview Research provides a comprehensive analysis that reflects today’s gas chromatography market realities and future market possibilities for the forecast period.

-

The report segments and analyzes the market in the most detailed manner to provide a panoramic view of the market.

-

The vital data/information provided in the report can play a crucial role for market participants and investors in identifying the low-hanging fruits available in the market and formulating growth strategies to expedite their growth process.

-

This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools.

-

More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data.

-

We conducted more than 15 detailed primary interviews with market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

Competitive Benchmarking

-

Benchmarking of key players on the following parameters: Service portfolio, geographical reach, regional presence, and strategic alliances

Custom Research: Stratview Research offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected]