Optical Fiber Cable Market Insights

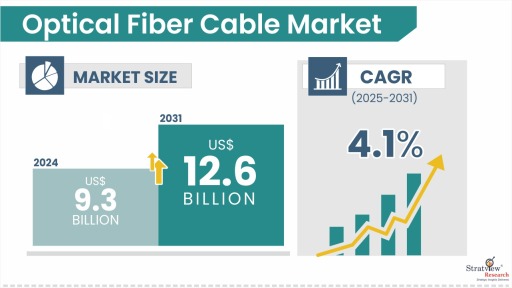

“The global optical fiber cable market size was US$ 9.3 billion in 2024 and is likely to grow at a decent CAGR of 4.1% in the long run to reach US$ 12.6 billion in 2031.”

Want to get a free sample? Register Here

Introduction

The optical fiber market is highly competitive, with leading players continuously innovating to enhance fiber performance, efficiency, and cost-effectiveness. Companies are focusing on advanced fiber technologies, high-speed networks, and fiber-optic sensing applications to gain a competitive edge in the industry.

Emerging trends include ribbon cables for higher fiber density, hollow-core fibers for lower latency, and AI-driven network management. The market is also witnessing advancements in fiber-optic sensors for industrial automation, healthcare, and security applications. Interestingly, optical fibers are playing a crucial role in quantum computing and next-generation space communication, revolutionizing connectivity beyond conventional uses.

Optical Fiber Cable Market Drivers

The optical fiber cable market is driven by the rising demand for high-speed internet, fueled by the expansion of 5G networks and increasing broadband adoption. Government initiatives like Digital India and Broadband China, along with heavy private investments, are accelerating large-scale fiber deployment. The growing need for data centers, cloud computing, and smart city infrastructure further boosts market growth. Additionally, the surge in Fiber-to-the-Home (FTTH) demand, advancements in telemedicine, and the rise of online education are increasing the reliance on fiber optic networks, making them essential for seamless and high-speed connectivity.

Additionally, the increasing adoption of the Internet of Things (IoT), Artificial Intelligence (AI), and Industrial Automation is driving the need for high-bandwidth, low-latency fiber optic networks. The rising popularity of video streaming, online gaming, and remote working has further intensified the demand for reliable and high-speed connectivity. Moreover, the expansion of submarine and terrestrial fiber optic networks is enhancing global data transmission capabilities, and supporting international trade and digital infrastructure. Growing investments in network modernization by telecom operators and the push for sustainable, energy-efficient fiber optic solutions are also key factors shaping the future of the optical fiber cable market.

Segments' Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High-Growth Opportunity

|

|

End-use Industry Analysis

|

Telecom, Aerospace, Defence & Military, Industrial, Other Communication (Premises, Utility), and Non-Communication (Sensors and Fiber Optic lighting)

|

The telecom industry leads the optical fiber demand due to 5G expansion, broadband growth, FTTH adoption, rising data traffic, smart city projects, and heavy investments by major telecom companies worldwide.

|

|

Composition-Type Analysis

|

Glass and Plastic

|

Glass dominates optical fiber cables due to its superior signal transmission capabilities, durability, and low signal loss over long distances.

|

|

Cable Mode Type Analysis

|

Single-Mode and Multi-Mode

|

Single-mode optical fiber cables are expected to be the fastest-growing due to their ability to support higher bandwidth, longer transmission distances, and lower signal loss, making them ideal for all major applications.

|

|

Strength Type Analysis

|

CSM and RSM

|

Central Strength Member (CSM) is expected to hold a larger market share in optical fiber cables due to its structural reinforcement, durability, and enhanced performance in harsh environments.

|

|

Deployment Type Analysis

|

Underground, Aerial, and Underwater

|

The underground deployment type dominates due to better protection, lower maintenance, long lifespan, and reliability in 5G, broadband, and smart city networks, ensuring secure, high-speed connectivity with minimal environmental and physical damage risks.

|

|

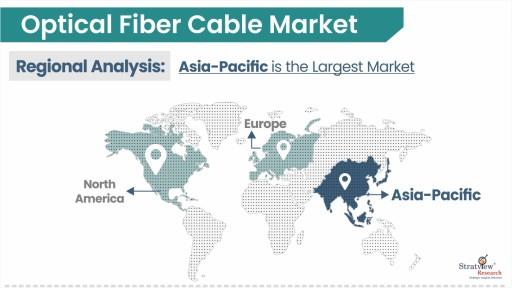

Region Analysis

|

North America, Europe, Asia-Pacific, and The Rest of the World

|

Asia-Pacific is expected to be the largest market for optical fiber cables due to rapid 5G expansion, increasing broadband adoption, large-scale smart city projects, and strong government investments in digital infrastructure.

|

Composition Insights

“The glass composition is expected to be the faster-growing for Optical Fiber Cable Market during the forecast period.”

Glass is the dominant material in optical fiber cables due to its superior signal transmission, durability, and minimal signal loss over long distances. It experiences low signal attenuation, allowing data to travel vast distances without degradation. It enables high-speed data transmission, making it ideal for 5G networks, cloud computing, and broadband expansion. Unlike copper cables, glass fiber is immune to electromagnetic interference (EMI), ensuring stable and uninterrupted communication in critical applications.

Additionally, glass fiber offers higher bandwidth capacity, supporting the increasing demand for data-intensive applications. Its durability and resistance to extreme temperatures and moisture make it suitable for varied environmental conditions. Despite its higher initial costs, glass fiber is cost-effective for long-distance networks due to its low maintenance and long lifespan. These factors make it the preferred choice for telecom, data centers, and high-speed communication networks worldwide.

End-use Industry Insights

“Telecom segment is expected to hold the largest share in optical fiber cable market during the forecast period.”

The telecom industry is set to be the largest demand generator for optical fiber cables during the forecast period, driven by several key factors. The rapid deployment of 5G networks requires high-speed, low-latency fiber optic infrastructure for seamless data transmission and network backhaul. Additionally, increasing broadband penetration, fueled by rising internet users and government-backed initiatives, is significantly boosting demand for fiber optic cables. Another major driver is the expansion of Fiber-to-the-Home (FTTH) networks, as telecom companies invest in ultra-fast home internet solutions to cater to growing consumer needs for streaming, gaming, and remote work.

Furthermore, the surge in data traffic—driven by video streaming, IoT, cloud computing, and AI applications—necessitates high-capacity optical fiber networks. The development of smart cities and IoT ecosystems is also accelerating fiber optic adoption, as telecom operators deploy robust networks to support connected devices and industrial automation. Additionally, leading telecom giants like AT&T, Verizon, Reliance Jio, and China Mobile are making substantial investments in fiber optic expansion to enhance network coverage and capacity. These factors collectively establish the telecom industry as the largest and fastest-growing consumer of optical fiber cables globally.

Strength Insights

“CSM (Central Strength Member) is expected to hold the larger share of the optical fiber cable market during the forecast period.”

Central Strength Member (CSM) dominates the optical fiber cable market due to its structural reinforcement, durability, and resilience in harsh environments. It provides mechanical strength, preventing fiber breakage and ensuring long-term reliability in telecom, data centers, and industrial applications.

CSM-based cables are ideal for underground, aerial, and submarine networks, resisting tension, pressure, and environmental stress. With the rise of 5G and broadband expansion, CSM ensures stable, high-speed data transmission. Its compatibility with both single-mode and multi-mode fibers makes it versatile for telecom, military, and smart city networks.

Deployment Insights

“The underground deployment is anticipated to dominate the optical fiber cable market.”

The underground is expected to lead the optical fiber cable market due to its protection from environmental damage, durability, and reliability. Unlike aerial cables, it resists harsh weather, physical damage, and electromagnetic interference, ensuring stable and long-lasting network performance.

With lower maintenance needs and a longer lifespan, underground fiber is cost-effective for large-scale 5G and broadband expansion. It supports smart city infrastructure, reduces urban clutter, and offers enhanced security with minimal downtime, making it the preferred choice for telecom, data centers, and high-speed internet networks.

Regional Insights

“Asia-Pacific is expected to be the largest market for optical fiber cable market during the forecast period.”

Asia-Pacific dominates the optical fiber cable market due to rapid 5G expansion, broadband growth, and smart city projects. Countries like China, India, Japan, and South Korea are aggressively deploying 5G networks, significantly increasing fiber optic demand for high-speed connectivity.

Rising internet penetration and Fiber-to-the-Home (FTTH) adoption are fueling market expansion. Government initiatives like Digital India, China’s Broadband Strategy, and Japan’s Smart City plans are heavily investing in digital infrastructure, boosting large-scale fiber optic installations across the region.

Additionally, booming data centers, IoT, and AI-driven automation require high-speed, low-latency fiber networks. The demand for secure, high-capacity connectivity in industrial and urban areas further strengthens Asia-Pacific’s position as the largest and fastest-growing market for optical fiber cables.

Want to get a free sample? Register Here