Market Insights

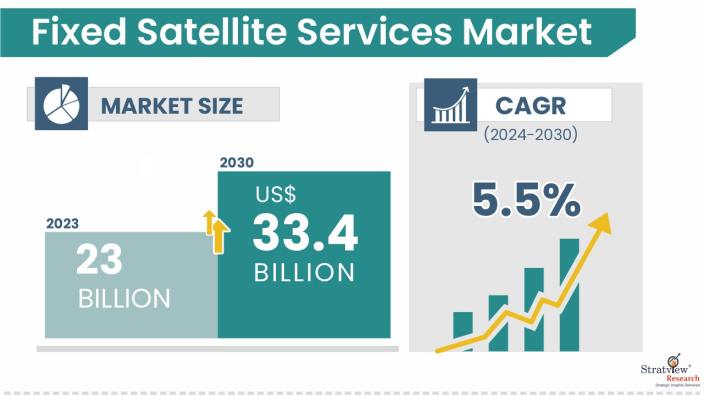

The fixed satellite services market was estimated at USD 23 billion in 2023 and is likely to grow at a CAGR of 5.5% during 2024-2030 to reach USD 33.4 billion in 2030.

Wish to get a free sample? Register Here

Market Dynamics

Introduction

The fixed satellite services (FSS) market relates to the space satellite industry segment involved in point-to-point communications employing geostationary satellites. These satellites provide DTH or fixed orbits for delivering predictable and authentic relay pathways and are utilized mainly in broadcasting, data transfer, and telecommunication. FSS helps numerous sectors with the high bandwidth requirement for transmission of television and radio, Internet, and secure long-distance data transfers. Its main strength is derived from the fact that it provides much-needed communication services where the normal fixed telecommunication structures cannot support or are absent.

Due to the increasing demand for broadband services especially in rural and unserved areas, FSS can support internet services. This trend is particularly pronounced in the rural and island countries, which the terrestrial network cannot beat. Governments and institutions are waking up to the fact that satellites can be used to minimize the digital divide.

The emergence of High Throughput Satellites has somewhat changed the face of the FSS market. Compared to conventional satellites, HTS provides operators with a much higher capability of delivering bandwidth at a cheaper price. This is especially relevant for markets such as mobile backhaul, where traffic is shortly estimated to be rising at a remarkable rate.

Recent Market Acquisition:

Companies acquire others in the market to enhance their product offerings, expand their market reach, gain access to new technologies, achieve economies of scale, and strengthen their competitive position.

The acquisition deal to MOLECUBES was declared by the Bruker Corporation in 2021, which is a dynamic innovation company of nuclear molecular imaging systems and is a benchtop Type of preclinical NMI. This strategic acquisition will also help to further bolster Bruker’s NMI portfolio in the preclinical and translational imaging research market significantly.

This move enables Bruker to incorporate MOLECUBES’ benchtop CUBES™ PET, SPECT, and CT systems into Bruker’s current in vivo imaging and molecular spectroscopy products, which forms a wider product portfolio.

Market Drivers

Key factors driving the growth of the market are:

- Growing need for continued satellite communication

- An increase in the number of broadcasting networks

- The adoption of FSS for providing broadband internet facilities in unserved areas

- The introduction of satellite services on 5G networks

Market Challenges

A major challenge that persists in sitcoms is the high cost, which drives the costs of launching as well as maintaining satellites. This is especially cumbersome, especially to small-scale enterprises or the emerging market where funds may be scarce.

An issue that satellite communication may experience some difficulties with is having to deal with restrictive regulations where necessary, hence slowing down expansion in particular areas. National policies concerning spectrum allocation and orbital slots, combined with dissimilar bureaucratic channels, might pose challenges to international service provision.

Segments Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High Growth Opportunity

|

|

Service-Type Analysis

|

Wholesale FSS, TV Channel Broadcast, Broadband and Enterprise Network, Video Contribution and Distribution, Trunking and Backhaul, Other services, and Managed FSS.

|

The broadband and enterprise network segment is projected to be the fastest-growing service type in the Fixed Satellite Services (FSS) market.

|

|

Organization Size-Type Analysis

|

Small Office Home Office, Small and Medium Businesses, and Large Enterprises

|

Among organization sizes, large enterprises are expected to dominate the FSS market throughout the study period.

|

|

Vertical-Type Analysis

|

Government, Education, Aerospace and Defence, Media & Entertainment, Oil & Gas, Retail, and Others

|

The media & entertainment sector is expected to experience significant growth in the coming six years.

|

|

Regional Analysis

|

North America, Europe, Asia-Pacific, and Rest of the World

|

The Asia-Pacific (APAC) region is forecasted to be the fastest-growing market for FSS in the coming years.

|

By Service Type

“The Broadband and Enterprise Network segment is projected to be the fastest-growing service type in the fixed satellite services market.”

- Due to the increased implementation of digital solutions, access to high-speed, reliable broadband internet in both developed and developing worlds or in the areas that are not fully covered, the demand has risen steeply. Traditional terrestrial networks can be expensive and hard to attain, which is why enterprises are now using satellite services to connect branch offices, remote workers, and business operations. This segment is expanding because the demand for always-on communications has continued to increase for corporate activities like data streams, cloud connections, and international teamwork.

- In parallel, as the Internet of Things in addition to connected devices, emerges as the new standard, various industries, including logistics, oil, and gas as well as maritime, are increasingly adopting satellite-based broadband where terrestrial networks are often either unavailable or unstable. Combined with FSS and 5G networks, especially in rural areas and remote areas, it significantly increases the popularity of this service type, making it a major segment in the future years.

By Organization Size Type

“Among organization sizes, large enterprises are expected to dominate the market throughout the study period.”

- Regarding organizations, large enterprises will constitute the largest share of the market owing to their requirement for bandwidth-intensive services and global connectivity. The primary users of satellite services are the large enterprises in the oil & gas industry, aerospace & defense, and the telecom sectors, which have their facilities located in remote areas or carry out their operations in areas where access to the internet or communication is mission critical. Several enterprises can fund expensive satellite services; this will lead to the continuous growth of this segment.

By Vertical Type

“The Media & Entertainment sector is expected to experience significant growth in the coming six years.”

- Media & Entertainment segment is likely to show high growth because of requirements in high-definition (HD) and ultra-high-definition (UHD) videos, as well as live streaming. The increase in the use of streaming services, video on demand, and the requirement for real-time content in almost all platforms are the factors that are driving satellite services. Consequently, FSS occupies a dominant position in delivering content to the television broadcasting market, live sports, and significant international events, which puts this vertical under the banners of the dynamic and high-growth segment.

Regional Insights

“The Asia-Pacific (APAC) region is forecasted to be the fastest-growing market for FSS in the coming years.”

- In addition, the Asia-Pacific (APAC) market would show the highest growth rate in the coming years for FSS due to factors such as a rising economy, increasing demand for broadband, and government policy support for the improvement of digitalization. China, for instance, and most of the countries within India and Southeast Asia are investing a lot of fortunes in satellite infrastructure for telecommunication, broadcasting, and enterprise from the urban to rural areas. The effective demand to enhance communication services for developing regions and the use of satellite technology across the industries make APAC the largest growth factor for the FSS market.

Know the high-growth countries in this report. Register Here

Key Players

The fixed satellite services market is relatively cyclical, with over 100 players competing across parameters such as price, service offerings, and geographical reach. Key players in the fixed satellite services market range from specialized satellite communication providers to larger companies offering a wide array of comprehensive solutions. Many of these companies differentiate their offerings by providing end-to-end service solutions, including satellite capacity, ground equipment, network management, and technical support. Their ability to offer integrated services—satellite bandwidth and managed services to software support and maintenance—allows them to stay competitive in a dynamic market where pricing pressures and technological advancements drive competition.

Here is the list of the Top Players (Alphabetically Arranged)

- Eutelsat

- Hispasat

- Intelsat

- Russian Satellite Communications Company (RSCC)

- SES

- SKY Perfect JSAT Corporation

- Star One

- Telesat

- Thaicom

- Yahsat

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Write to us at sales@stratviewresearch.com

Research Methodology

This strategic assessment report, from Stratview Research, provides a comprehensive analysis that reflects today’s fixed satellite services market realities and future market possibilities for the forecast period of 2024 to 2030. After a continuous interest in our fixed satellite services market report from the industry stakeholders, we have tried to further accentuate our research scope to the fixed satellite services market to provide the most crystal-clear picture of the market. The report segments and analyses the market in the most detailed manner to provide a panoramic view of the market. The vital data/information provided in the report can play a crucial role for the market participants as well as investors in the identification of the low-hanging fruits available in the market as well as to formulate the growth strategies to expedite their growth process.

This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools. More than 1000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data. We conducted more than 15 detailed primary interviews with the market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Report Features

This report provides market intelligence most comprehensively. The report structure has been kept such that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market. The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

- COVID-19 impact and its recovery curve

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors.

Market Segmentation

This report studies the market, covering a period of 12 years of trend and forecast. The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The fixed satellite services market is segmented into the following categories.

By Service Type

- Wholesale FSS

- TV Channel Broadcast

- Broadband and Enterprise Network

- Video Contribution and Distribution

- Trunking and Backhaul

- Managed FSS

- Other Services

By Organization Size Type

- Small Office Home Office

- Small and Medium Business

- Large Enterprises

By Vertical Type

- Government

- Education

- Aerospace & Defence

- Media & Entertainment

- Oil & Gas

- Retail

- Other

By Region

- North America (Country Analysis: The USA, Canada, and Mexico)

- Europe (Country Analysis: Germany, France, The UK, Russia, and Rest of Europe)

- Asia-Pacific (Country Analysis: Japan, China, India, and Rest of Asia-Pacific)

- Rest of the World (Country Analysis: Brazil, Saudi Arabia, and Others)

Report Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

- Detailed profiling of additional market players (up to three players)

- SWOT analysis of key players (up to three players)

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Service portfolio, geographical reach, regional presence, and strategic alliances

Custom Research: Stratview Research offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to sales@stratviewresearch.com