Market Insights

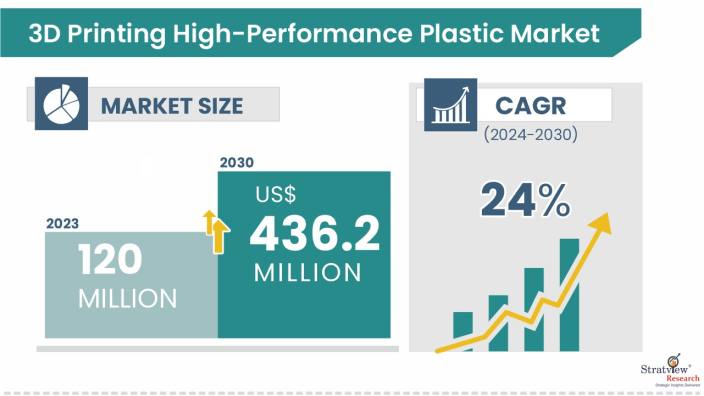

The 3D printing high-performance plastic market was estimated at USD 120 million in 2023 and is likely to grow at a decent CAGR of 24% during 2024-2030 to reach USD 436.2 million in 2030.

Wish to get a free sample? Register Here

Market Dynamics

Introduction

Government policies and support for integrating advanced 3D printing technology in different industries has resulted in growing demand for 3D printing high-performance plastics. Strategic support provided by these policies has accelerated the acceptance of such advanced materials in medical & healthcare, aerospace & defense, transportation, and oil & gas industries. 3D high-performance plastics are deeply involved in allowing performance-gain applications in these industries to build and increase their functionalities and efficiency to further push innovation and technological development.

The high-end 3D printing plastics are characterized by higher strength, lighter weight, and longer lifespan, which are increasing their demand in industries such as medical, transportation, oil & gas, electronics, and aerospace. The high-end variants of these plastics are mostly strengthened with glass and carbon fibers among other additives that find intensive uses in critical fields such as in surgical implants within the health industry.

Recent Market JVs and Acquisitions:

The 3D printing high-performance plastic market has undergone a few mergers and acquisitions in recent years as enterprises strive to augment their market presence and leverage synergies to refine their product offerings and optimize their fiscal outcomes. Some M&A and JVs are:

- Italian 3D printing service, CRP Technology of Modena, Italy has been officially welcomed as a partner to UAE private aerospace company Orbital Space of Dubai, UAE for its Lunaris moon mission.

- Arkema extended its high-performance polymers portfolio in 2023 by acquiring a majority interest in PI Advanced Materials. PIAM's portfolio fits perfectly in the advanced materials segment, reinforcing the high-performance polymer range.

Recent Product Development:

- In 2021, Markforged launched Onyx FR. This filament is a flame-retardant version of Onyx, with high-performance polymer and more safety for aerospace and automotive applications.

- In 2021, SABIC launched Ultem™ AMX-10F. This new grade brings improved performance for aerospace and industrial applications, featuring greater toughness and increased heat resistance compared to previous versions.

Market Drivers

Corresponding to the diversification of applications that is in growth, different classes of 3D printing plastics are available in the market, with price from low to high. Original equipment manufacturer certifications by organizations like the European Commission and the US FDA guarantee the safety of these plastics for healthcare applications, according to standards like USP Class VI. Oxford Performance Materials, for example, manufactures more than 500 different 3D-printed PEKK parts for Boeing's Starliner passenger capsules. This will lead to an increased demand for application-specific grades that is likely to drive the market towards high-performance 3D printing plastics.

Several other factors, such as advancements in 3D printing technology, increased demand from aerospace and defense, growing use of such plastics in healthcare applications, etc., are the key drivers of the 3D printing high-performance plastics market. Innovations in the automotive industry encourage the production of lightweight and high-strength parts. All these areas of application help in growing the 3D printing high-performance plastics market.

Challenges

While 3D printing has seen a good growth rate, its adoption rate has varied across regions owing to different macroeconomic factors, such as GDP and industrial growth. Developed regions, like North America and Europe, tend to be more open to new technologies compared to emerging regions like the Asia-Pacific. This might be related to lower opportunity costs and more active government support for R&D in developed countries. In turn, barriers to the adoption of advanced technologies stand higher for emerging regions, which directly impacts their speed of adoption for the same.

Segments Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High Growth Opportunity

|

|

By Type

|

PA, PEI, PEEK & PEKK, Reinforced HPP, and Others

|

The PEEK & PEKK segment is anticipated to register the highest market share.

|

|

By Form Type

|

Filament & Pellet, and Powder

|

Filament & Pellet is the largest segment and constitutes the biggest portion as per form type.

|

|

By Technology

|

FDM/FFF and SLS

|

FDM/FFF emerged as the largest segment for the forecast period

|

|

By Application Type

|

Prototyping, Tooling, & Functional Part Manufacturing

|

The prototyping segment accounted for the largest market share and is likely to retain its market position.

|

|

By End-use Industry Type

|

Healthcare, Transportation, Aerospace & Defence, Automotive & Transportation, Others

|

The healthcare segment had the lion’s share in the end-use industry type analysis.

|

|

By Region

|

North America, Europe, Asia-Pacific, and The Rest of the World

|

North America region is showing robust growth in this market for the forecasted period.

|

By Type

“PEEK & PEKK are forecasted to emerge as the foremost and most rapidly expanding category in the market during the forecast period.”

- This growth is attributed to their biocompatibility, chemical resistance, and adaptability in advanced medical, automotive, aerospace, and industrial applications, hence both PEEK and PEKK are expected to represent an accelerated growth rate.

- These engineered plastics, with glass or carbon reinforcement, present better mechanical properties and therefore can meet the demands of very aggressive environments typical of medical implants, aircraft engines, and oil & gas systems.

By Form Type

“Filament & Pellet segment is anticipated to demonstrate the most rapid growth during the forecast period driven by low cost and ease of handling.”

- Filaments & pellets have less waste and are economically produced and processed; on the other hand, powder forms require more material and sometimes additional post-processing.

- Many 3D printing systems are optimized for filament & pellet forms. This way, they can enable a greater number of compatible materials and pave the way for their easier integration into already existing processes.

By Technology Type

“The fastest growth rates are expected in the FDM/FFF technology, supported by wide adoption across industries due to its cost-effective production and excellent versatility.”

- High-performance plastics are combined with FDM/FFF because it is flexible for a variety of industries and provide cost-effective production.

- It allows the work in rapid prototyping with high-performance plastics; hence, FDM/FFF is quite suitable for several manufacturing applications where the issues of speed and versatility are so significant.

By Applications Type

“The prototyping segment held a major chunk of the pie, and it is likely to grow fast as well.”

- 3D printing of prototypes with high-performance plastics is considerably more cost-effective to test designs, refine concepts, and then go to full-scale production. It speeds up the product development cycle and reduces costs during development.

- 3D printing in the automotive sector also has wide applications in making prototypes of vehicle parts and their accessories. This aids in the development and testing of the designs for better efficiency, hence reducing time-to-market.

By End-Use Industry Type

“Healthcare segment had a significant market share in revenue, which is driven by the use of 3D-printed plastics in dentistry, surgical guides and instruments, and prosthetics.”

- 3D printing with high-performance plastics revolutionizes patient care by enabling personalized, cost-effective implants and prosthetics tailored to individual anatomies.

- Surgeons leverage 3D-printed guides and instruments for enhanced precision in complex procedures, utilizing durable, sterilizable, high-performance plastics in surgeries.

Regional Insights

“The North America region is forecasted to hold the largest share in the market for 3D printing high-performance plastic in the mentioned period.”

- North America, led by the US, dominates the 3D printing high-performance plastics market due to major industry players like Stratasys.

- Growing demand from the aerospace, healthcare, electronics, and automotive sectors is driving 3D printing plastics adoption across the region.

Know the high-growth countries in this report. Register Here

Key Players

It would be fair to say that the market is fairly consolidated, with few players contributing significantly to the market. The leading players in the industry contend with several critical factors, including pricing strategies, service portfolios, regional presence, and other governing parameters. The following are the key players in the 3D Printing High-Performance Plastic market. These big players often engage in mergers and acquisition activities as a key strategy to enhance their portfolios and regional presence.

Here is the list of the Top Players (Based on Dominance)

- Arkema France

- 3D Systems, Inc. US

- Markforged US

- Stratasys US

- Evonik Industries AG Germany

- Oxford Performance Materials, Inc. US

- EOS GmbH Germany

- Solvay Belgium

- SABIC Saudi Arabia

- BASF SE Germany

- Impossible Objects US

- Apium Additive Technologies GmbH Germany

- Ensinger Germany

- Victrex plc (UK)

- CRP Technology S.r.l. (Italy)

Note: The above list does not necessarily include all the top players of the market.

Are you the leading player in this market? We would love to include your name. Write to us at sales@stratviewresearch.com

Research Methodology

This strategic assessment report, from Stratview Research, provides a comprehensive analysis that reflects today’s 3D printing high-performance plastic market realities and future market possibilities for the forecast period of 2024 to 2030. After a continuous interest in our 3D printing high-performance plastic market report from the industry stakeholders, we have tried to further accentuate our research scope to the 3D printing high-performance plastic market to provide the most crystal-clear picture of the market. The report segments and analyses the market in the most detailed manner to provide a panoramic view of the market. The vital data/information provided in the report can play a crucial role for the market participants as well as investors in the identification of the low-hanging fruits available in the market as well as to formulate the growth strategies to expedite their growth process.

This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools. More than 1000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data. We conducted more than 15 detailed primary interviews with the market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Report Features

This report provides market intelligence most comprehensively. The report structure has been kept such that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market. The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

- COVID-19 impact and its recovery curve

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors.

Market Segmentation

This report studies the market, covering a period of 12 years of trend and forecast. The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The 3D printing high-performance plastic market is segmented into the following categories.

By Type

- PA

- PEI

- PEEK & PEKK

- Reinforced HPP

- Others

By Form Type

By Technology Type

By Application Type

- Prototyping

- Tooling

- Functional Part Manufacturing

By End-Use Industry Type

- Medical & Healthcare

- Aerospace & Defense

- Transportation

- Oil & Gas

- Others

By Region

- North America (Country Analysis: The USA, Canada, and Mexico)

- Europe (Country Analysis: Germany, France, The UK, Russia, and Rest of Europe)

- Asia-Pacific (Country Analysis: Japan, China, India, and Rest of Asia-Pacific)

- Rest of the World (Country Analysis: Brazil, Middle East & Africa, and Others)

Report Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

- Detailed profiling of additional market players (up to three players)

- SWOT analysis of key players (up to three players)

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Service portfolio, geographical reach, regional presence, and strategic alliances

Custom Research: Stratview Research offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to sales@stratviewresearch.com