Market Insights

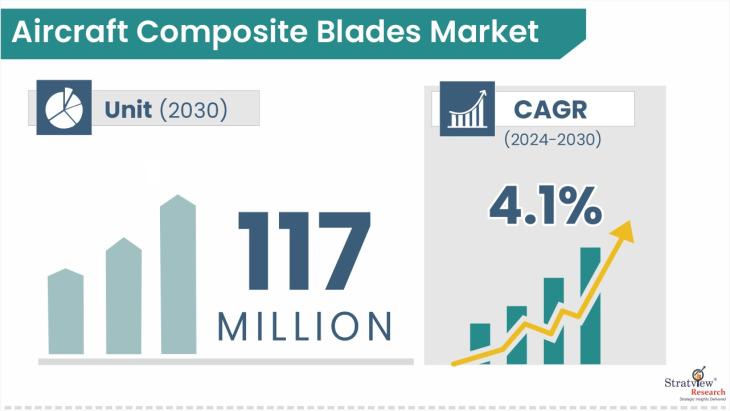

“The aircraft composite blades market is estimated to grow at a CAGR of 4.1% over the coming years to reach more than 117 million units in 2030.”

Want to get a free sample? Register Here

Market Dynamics

Introduction

Aircraft composite blades are manufactured using carbon, glass, and hybrid composites. It offers a superior strength-to-weight ratio and a longer lifespan and is more cost-efficient than conventional metal blades. These blades are manufactured using a variety of processes, including injection molding, overmolding paired with RTM (Resin Transfer Molding), and prepreg. Blade manufacturers are increasingly adopting composite materials as modern aircraft designs (in military transport aircraft, regional turboprops, and general aviation) employ more blades, which is challenging to achieve with traditional metallic blades. The market growth is driven by advancements in urban air mobility, rising civil drone demand, increasing global turboprop fleet, and expansion in military airpower.

Recent Market M&As and Strategic Collaborations:

The aircraft composite blades market has undergone a few mergers & acquisitions in past years and several strategic collaborations as enterprises strive to augment their market presence and leverage synergies to refine their product offerings and optimize their fiscal outcomes. Some M&A and partnerships are:

- In March 2024, Hartzell Propeller completed the acquisition of Whirlwind Propellers, expanding its portfolio in light sport aircraft. Hartzell plans to expand Whirlwind’s capabilities further by designing and manufacturing advanced carbon composite propellers. In addition, Hartzell partnered with Beta Technologies to explore opportunities in the UAM market.

- During 2022-2023, DUC Helices Propellers was announced as the propeller suppliers for Eve Air Mobility's and Plana Aero's eVTOL programs. DUC will supply propeller blades for the EVE and Plana CP-01 programs.

- In 2024, Mejzlik Propellers s.r.o was announced as the propeller supplier for Dufour Aerospace’s Aero 2 program. The company is a trusted player in the UAV and UAM propeller market. Collaboration with Dufour allows them to harness their experience in blade design.

Market Drivers:

Growth in the composite blades market is mainly driven by the growing turboprop fleet in general aviation and regional airliners. In 2023, more than 1000 aircraft equipped with composite blades were delivered to the general aviation category alone. The outlook for general aviation and regional turboprops also promises an optimistic scenario regarding the adoption of composite blades. The rising defense budget and focus on expanding the aircraft fleet are also important driving factors. Increasing population and traffic congestion indicate the need for eVTOL programs, consequently driving the demand for composite blades. Civil drones, which rely on lightweight, high-performance composite blades to achieve longer flight endurance and higher payload capacity, are the biggest drivers for the composite blade market.

Challenges:

The aircraft composite blades market faces several challenges despite its high growth potential. High production costs associated with composite blade production, stringent certification, and regulatory challenges, and suspended production of some popular aircraft programs are the growth limiters for the market. Delays in eVTOL production and deliveries are resulting in declined investor confidence and a decline in funding. Supply chain disruptions and US sanctions on major drone manufacturers are also significant obstacles to composite blade market growth.

Market Segments' Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High Growth Opportunity

|

|

By Platform Type

|

Military Transport Aircraft, Regional Turboprops, General Aviation, eVTOL, Civil Drones, and Military Cargo Drones.

|

Military cargo drones and eVTOLs are the segments estimated to have the highest expansion in the coming years.

|

|

By Material Type Analysis

|

Carbon Composites, Glass Composites, and Hybrid Composite.

|

Carbon composites dominate all other platforms, i.e., military transport, regional, general aviation, eVTOL, and military cargo drones.

|

|

By Process Type Analysis

|

Injection Molding, Overmolding+RTM, Overmolding, and Prepreg.

|

Injection Molding is the most widely adopted process for manufacturing composite blades; Prepreg is likely to register a high growth rate during the forecast period.

|

|

By Region Analysis

|

North America, Europe, Asia-Pacific, and The Rest of the World

|

Asia-Pacific is the most dominant region due to the region's concentration of civil drone production.

|

By Platform Type

“Civil drones will remain the biggest, whereas military cargo drones and eVTOLs are the most rapidly expanding category in the market during the forecast period.”

Civil drones heavily dominate the market, owing to the millions of units sold yearly. The widespread adoption of civil drones in agriculture, videography, and surveillance has resulted in increased demand for civil drones. Growing regional connectivity is boosting demand for 6-bladed twin-engine turboprops like ATR 72. UAM and military cargo drones are in their early stages of adoption and represent new opportunities for composite blades. Military transport aircraft like the C-130J Super Hercules, Airbus A400M, and Airbus C295 are in high demand. Airbus has expanded its production facility in the Asia-Pacific region.

By Material Type

“Glass composites dominate in the aircraft composite blades market owing to their wide adoption in the civil drone propellers. In the future, carbon composites are expected to increase as manufacturers focus on increasing strength-to-weight ratio.”

Glass composites are dominantly used by civil drone propeller manufacturers due to their cost-efficiency and feasibility, as well as their easier and faster manufacturing process, injection molding. The industry is slowly shifting towards carbon composites due to their strength and higher payload lifting capacity. Apart from civil drones, military transport aircraft, region turboprops, and eVTOL blades are mainly manufactured using carbon composites. Several eVTOL programs employ fully carbon composite structures that employ 30-40 composite blades per aircraft.

By Process Type

“Injection molding to be the dominant process, prepreg to record significant growth during the study period.”

Injection molding dominates civil blade production because it creates highly uniform products. It also significantly reduces vibration, which is important for videography and surveillance. Small blades typically produced by drone manufacturers lack strength and often get damaged, creating a significant aftermarket and replacement demand. Injection molding machines can accommodate more cavities, resulting in additional units per production cycle. Prepreg is forecasted to be the fastest-growing process, as the major eVTOL and military cargo drone manufacturers prefer to manufacture their propeller blades using this process.

Regional Analysis

“Asia-Pacific region is forecasted to be both biggest and the fastest growing region driven by China’s dominant presence.”

Asia-Pacific is likely to generate the highest demand for composite blades owing to the presence of major drone and eVTOL manufacturers in the region. China is the leading country with two eVTOL programs, EHang and Autoflight, which have received type certifications. In addition to civil drones, many composite propeller aircraft are also being manufactured in the region; AVIC’s MA700 turboprop and TATA-Airbus C-295 are the ones worth mentioning. The region will also generate heavy aftermarket demand for replacement as it hosts a massive fleet of turboprops for general aviation and military transport aircraft.

Want to get a free sample? Register Here

Key Players

It would be fair to say that the market is fairly consolidated, with a few players contributing significantly to it. The leading players in the industry contend with several critical factors, including pricing strategies, service portfolios, regional presence, and other governing parameters. The following are the key players in the aircraft composite blades market. These big players often engage in mergers and acquisition activities as a key strategy to enhance their portfolios and regional presence.

Here is the list of the Top Players (Based on Dominance)

- DJI Technology Co., Ltd.

- Hartzell Propeller

- MT-Propeller

- Dowty Propellers

- Collins Aerospace

- EHang Holdings

- DUC Helices Propellers

- Mejzlik Propellers s.r.o

- Joby Aviation Inc.

- Archer Aviation Inc.

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Please write to us at [email protected]

Report Features

This report provides market intelligence most comprehensively. The report structure has been kept so that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market. The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints and Porter’s five forces analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, Service portfolio, New product launches, etc.

- COVID-19 impact and its recovery curve.

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors.

The aircraft composite blades market is segmented into the following categories:

Aircraft Composite Blades Market, by Platform Type

- Military Transport Aircraft (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Regional Turboprops (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- General Aviation (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- eVTOL (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Civil Drones (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Military Cargo Drones (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

Aircraft Composite Blades Market, by Material Type

- Carbon Composites (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Glass Composites (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Hybrid Composites (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

Aircraft Composite Blades Market, by Process Type

- Injection Molding (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Overmolding+RTM (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Overmolding (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Prepreg (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

Aircraft Composite Blades Market by Region

- North America

- Europe

- Asia-Pacific

- Rest of the World

Research Methodology

This strategic assessment report from Stratview Research provides a comprehensive analysis that reflects today’s aircraft composite blades market realities and future market possibilities for the forecast period. The report segments and studies the market in the most detailed manner to provide a panoramic view of the market. The vital data/information provided in the report can play a crucial role in helping market participants and investors identify the low-hanging fruits available in the market and formulate strategies to expedite their growth process. This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools.

Over 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data. We conducted more than 15 detailed primary interviews with market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

- Detailed profiling of additional market players (up to three players)

- SWOT analysis of key players (up to three players)

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Service portfolio, geographical reach, regional presence, and strategic alliances

Custom Research: Stratview Research offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected]