Market Insights

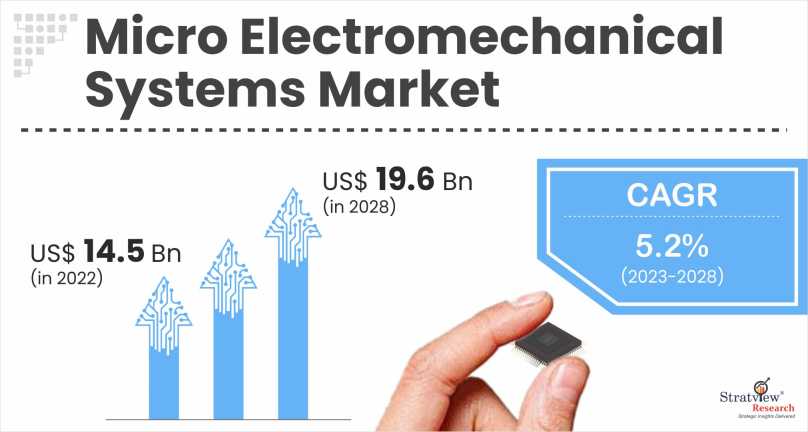

The micro electromechanical systems market was estimated at USD 14.5 billion in 2022 and is likely to grow at an impressive CAGR of 5.2% during 2023-2028 to reach USD 19.6 billion in 2028.

Want to know more about the market scope? Register Here

Market Dynamics

Introduction

MEMS stands for Micro-Electro-Mechanical Systems. It is a process technology that combines mechanical and electrical components to create tiny integrated devices or systems. MEMS are usually fabricated using integrated circuit (IC) batch processing techniques and can range in size from a few micrometers to millimeters. These devices/ systems can sense, control, and actuate on the micro level and can generate effects on the macro scale. In the most general form, MEMS consist of mechanical microstructures, microsensors, microactuators, and microelectronics, all integrated into the same silicon chip. Examples of MEMS devices include accelerometers, pressure sensors, microphones, and inkjet printer heads. MEMS technology enables the creation of tiny devices that can perform complex functions, making them ideal for use in compact consumer electronics, medical devices, and other applications where size is critical.

Market Drivers

One of the key drivers of the micro electromechanical systems market's expansion is the growing demand for smart gadgets, such as smartphones & wearables and Internet of Things (IoT) devices. Micro electromechanical systems sensors and actuators enable accurate sensing and control in a wide range of applications, such as automotive safety systems, industrial automation, and medical devices. Automotive airbag sensors, medical pressure sensors (used to monitor blood pressure), and inkjet printer heads were among the first commercial applications of micro electromechanical systems. Continued innovation and research and development efforts are driving the growth of the micro electromechanical systems industry, as companies seek to develop new and improved micro electromechanical systems devices for a wide range of applications.

Recent Developments

Recent Market JVs and Acquisitions:

- In 2023, Dover Corporation acquired Knowles Electronics for US$ 750 million. Knowles is the world's largest producer of high-performance transducers for hearing aids. Knowles is also the leading manufacturer of MEMS microphones, which provide significant advantages over existing technology, with current applications in the high-end cell phone market.

- In 2022, Bosch Sensortec announced its acquisition of Arioso Systems, a spin-off from the Fraunhofer Institute for Photonic Microsystems (IPMS), developing and commercializing MEMS micro speakers for wireless in-ear devices. The acquisition will help Bosch to expand from MEMS microphones to attractive market segments of silicon microspeakers.

- In 2021, Qorvo a leading provider of innovative radio frequency (RF) solutions announced the acquisition of California-based NextInput, a pioneer in the emerging field of force-sensing solutions for human-machine interface (HMI). NextInput has shipped tens of millions of MEMS-based sensors to leading manufacturers of smartphones, wearables, automobiles, and other applications. The acquisition will expand Qorvo's technology portfolio and enable Qorvo to accelerate the deployment of force-sensing solutions utilizing MEMS-based sensors.

- In 2021, STMicroelectronics, a global semiconductor leader acquired Cartesiam, a software company founded in 2016, which specializes in artificial intelligence (AI) development tools enabling machine-learning and inferencing on Arm®-based microcontrollers, which today power billions of devices. The acquisition will reinforce STMicroelectronic's AI strategy and strengthen its technology portfolio to address the full spectrum of embedded machine-learning needs.

- In 2021, Canon Inc. acquired Redlen Technologies Inc. a leading supplier of advanced radiation detection and imaging technology used in CZT semiconductor detector modules, which play an important role in the development of Photon Counting CT (PCCT).

Recent Products Developments

- In 2022, Infineon Technologies AG launched its next-generation XENSIV™ MEMS microphones that define a new industry standard. IM69D127, IM73A135, and IM72D128 are the latest additions to Infineon’s growing microphone portfolio targeting consumer electronics such as headphones with active noise cancellation (ANC), TWS earbuds, conference devices with beamforming capability, laptops, tablets, or smart speakers with voice-user-interfaces.

- In 2022, TDK introduced the T5828 SoundWire™ MEMS microphone as part of the SmartSound™ family of performance products for mobile, TWS, IoT, and other consumer devices.

- In 2022, STMicroelectronics introduced its third generation of MEMS sensors. The product range includes LPS22DF and waterproof LPS28DFW barometric pressure sensors, which operate from 1.7µA and have an absolute pressure accuracy of 0.5hPa. Further, the company also designed the LIS2DU12 3-axis accelerometer to build an outstanding ultralow-power architecture with active antialiasing.

- In 2021, TDK InvenSense introduced new solutions for applications in the mobile, smart home, wearable, and automotive segments. New products introduced by the company include IIM-42652 - the company's smallest, lowest power and cost 6-axis Industrial IMU solution; the IIM-42352 - a very low noise and low power 3-axis accelerometer solution; and the IIM-42351 - for a wide range of industrial IoT applications. Further, in the SmartAutomotive sensor family, the company introduced the InvenSense IMU IAM-20685 high-performance automotive 6-Axis MotionTracking sensors platform for ADAS and autonomous systems along with two high-performance SmartMotion motion-tracking sensor solutions i.e. The ICM-40627 and the ICM-42688-V.

Segment Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High Growth Opportunity

|

|

Component-Type Analysis

|

Microsensors and Microactuators

|

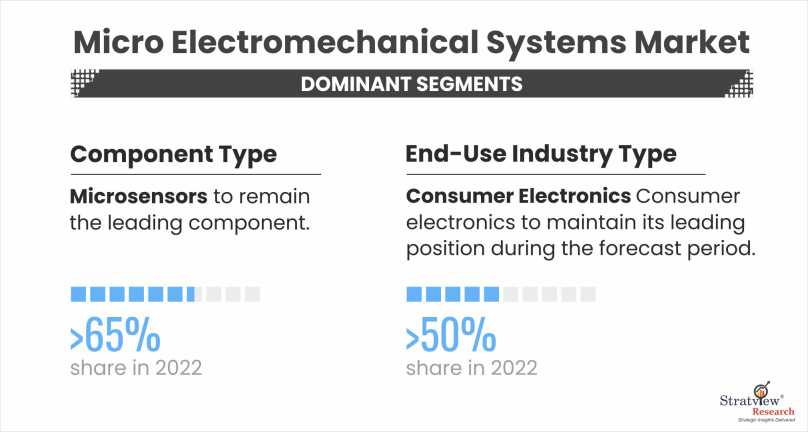

Microsensors to remain the leading component whereas microactuators to expand at a higher rate during the forecast period.

|

|

End-Use Industry-Type Analysis

|

Consumer Electronics, Industrial, Automotive, Healthcare, and Others

|

Consumer electronics to maintain its leading position during the forecast period whereas the automotive end-use industry to record the highest growth during 2023-2028.

|

|

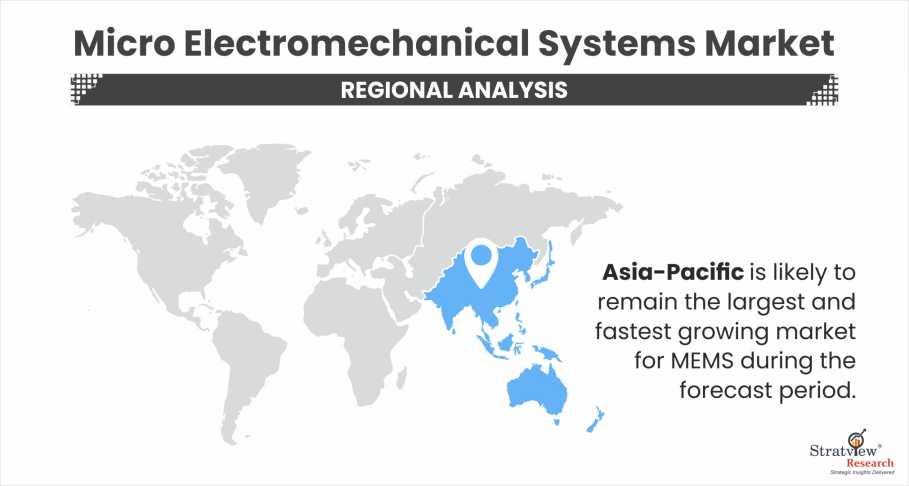

Regional Analysis

|

North America, Europe, Asia-Pacific, and Rest of the World.

|

Asia-Pacific is projected to remain the largest and fastest-growing market for MEMS during the forecast period.

|

By Component Type

“Microsensors are likely to remain the higher demand generator of the market during the forecast period.”

- We have segmented the MEMS market based on component type as microsensors and microactuators.

- The growing range of applications of microsensors in key industries such as healthcare, automotive, consumer electronics, and aerospace are major factors leading to its dominance in the MEMS market.

- Compact size and high sensitivity are the key features that have led to its increased adoption.

- In this study, Microsensors are further classified based on type as pressure sensors, inertial combos, accelerometers, gyroscopes, microphones, and others.

- Similarly, microactuators are further classified based on type as RF actuators, Inkjet heads, and others.

By End-Use Industry Type

“Consumer electronics is expected to remain the dominant end-use industry type, whereas the automotive industry is expected to be the fastest-growing in the foreseen future.”

- Based on end-use industry type, the market is classified as consumer electronics, industrial, automotive, healthcare, and others.

- Consumer electronics held the leading position in the market in 2022 and is expected to maintain its dominance during the forecast period driven by its wide penetration in applications such as smartphones, tablets, wearables, hearables, laptops, drones, robots, smart homes as well as in gaming and AR/VR applications.

- The automotive industry is expected to witness the highest growth driven by penetration in both ICEs and EVs. MEMS are used in a variety of ways in the automotive industry to improve safety and reliability. For instance, pressure sensors are used in engine control to detect gases and liquids, similarly, inertial MEMS sensors are used in safety features such as airbag control, antitheft, electronic parking brake, and navigation system.

Want to have a closer look at this market report? Click Here

Regional Analysis

“Asia-Pacific is likely to remain the largest and fastest growing market for MEMS during the forecast period.”

- China is the largest market for MEMS in Asia-Pacific as well as in the world. China has a huge industrial base and dominates the global automotive and consumer electronics industry.

- Similarly, the USA is the largest market in North America and the second largest in the world. The country marks the presence of some of the key players in the global MEMS market including Broadcom Inc., Qorvo, Inc., Texas Instruments, Hewlett Packard, Analog Devices, Inc., and Honeywell International, Inc.

Know the high-growth countries in this report. Register Here

Key Players

The market is highly fragmented with the presence of over 100 players across the globe. Most of the major players compete in some of the governing factors including price, service offerings, regional presence, product innovation, etc. Developing advanced products, executing mergers & acquisitions, and forming contracts with OEMs are the key strategies adopted by the market players to gain a competitive edge in the market. Also, there have been some major mergers and acquisitions in the industry in recent years, which have had a substantial impact on the entire competitive landscape. The following are the key players in the micro electromechanical systems market:

Here is the list of the Top Players (Based on Dominance)

- Robert Bosch GmbH

- Broadcom Inc.

- Qorvo Inc.

- STMicroelectronics NV

- Texas Instruments Incorporated

- Goermicro

- HP Development Company, L.P.

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Write to us at sales@stratviewresearch.com

Research Methodology

- This strategic assessment report from Stratview Research provides a comprehensive analysis that reflects today’s Micro Electromechanical System Market realities and future market possibilities for the forecast period.

- The report segments and analyzes the market in the most detailed manner in order to provide a panoramic view of the market.

- The vital data/information provided in the report can play a crucial role for market participants as well as investors in the identification of the low-hanging fruits available in the market as well as to formulate growth strategies to expedite their growth process.

- This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools.

- More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data.

- We conducted more than 15 detailed primary interviews with market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Report Features

This report provides market intelligence most comprehensively. The report structure has been kept such that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market. The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis

- Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis

- Market trend and forecast analysis

- Market segment trend and forecast

- Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc

- COVID-19 impact and its recovery curve

- Attractive market segments and associated growth opportunities

- Emerging trends

- Strategic growth opportunities for the existing and new players

- Key success factors

Market Segmentation

This report studies the market covering 12 years of trend and forecast. The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The micro electromechanical systems market is segmented into the following categories.

By Component Type

- Microsensors (Type Analysis: Pressure Sensor, Inertial Combos, Accelerometer, Gyroscope, Microphone, and Others)

- Microactuators (Type Analysis: RF Actuators, Inkjet Heads, and Others)

By End-Use Industry Type

- Consumer Electronics

- Industrial

- Automotive

- Healthcare

- Others

By Region

- North America (Country Analysis: The USA and Rest of North America)

- Europe (Country Analysis: Germany, France, The UK, and Rest of Europe)

- Asia-Pacific (Country Analysis: Japan, China, and Rest of Asia-Pacific)

- Rest of the World

Report Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

- Detailed profiling of additional market players (up to three players)

- SWOT analysis of key players (up to three players)

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Service portfolio, geographical reach, regional presence, and strategic alliances

Custom Research: Stratview Research offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to sales@stratviewresearch.com