Attractive Opportunities

Global Demand Analysis & Sales Opportunities in the Aircraft Seat Market

- The annual demand for aircraft seats was USD 4.5 billion in 2024 and is expected to reach USD 4.9 billion in 2025, up 9.7% than the value in 2024.

- During the forecast period (2025-2034), the aircraft seat market is expected to grow at a CAGR of 3.4%. The annual demand will reach USD 6.7 billion in 2034.

- During 2025-2034, the aircraft seat industry is expected to generate a cumulative sales opportunity of USD 58.8 billion, which is almost 3.5 times the opportunities during 2019-2024.

High-Growth Market Segments:

- North America is projected to retain its supremacy during the forecast period, whereas Asia-Pacific is expected to experience the fastest growth.

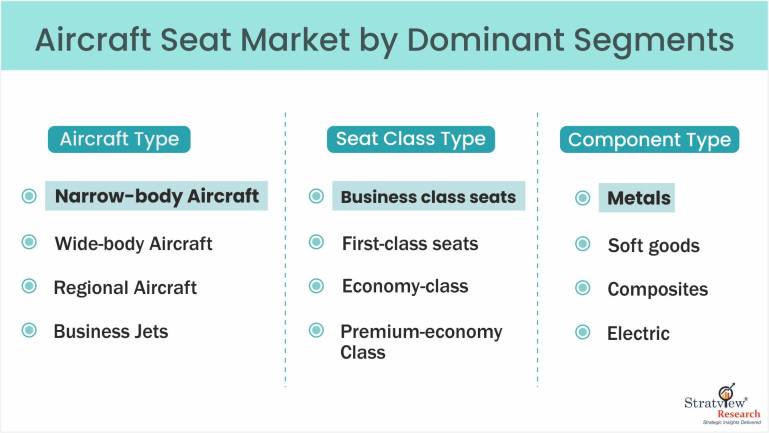

- By aircraft type, Narrow-body aircraft are anticipated to drive demand for the aircraft seat market, whereas wide-body aircraft are expected to experience the fastest growth rate in the coming years.

- By seat class type, Business class seat are anticipated to remain the dominant segment of the aircraft seat market and premium economy seat are expected to witness the fastest growth in the coming years.

- By component type, Metals are anticipated to maintain their dominance and soft goods are expected to achieve the fastest growth during the forecast period.

- By sales channel type, BFE is expected to maintain its dominance and achieve faster growth during the study period.

- By end-user type, Aftermarket is expected to maintain its dominance during the forecast period, whereas OE is likely to be the faster-growing end-user during the same period.

Market Statistics

Have a look at the sales opportunities presented by the aircraft seat market in terms of growth and market forecast.

|

Aircraft Seat Market Data & Statistics

|

|

|

Market Statistics

|

Value (in USD Billion)

|

Market Growth (%)

|

|

Annual Market Size in 2023

|

USD 4.0 billion

|

-

|

|

Annual Market Size in 2024

|

USD 4.5 billion

|

YoY Growth in 2024: 12.3%

|

|

Annual Market Size in 2025

|

USD 4.9 billion

|

YoY Growth in 2025: 9.7%

|

|

Annual Market Size in 2034

|

USD 6.7 billion

|

CAGR 2025-2034: 3.4%

|

|

Cumulative Sales Opportunity during 2025-2034

|

USD 58.8 billion

|

|

|

Top 10 Countries’ Market Share in 2024

|

USD 3.6 billion +

|

> 80%

|

|

Top 10 Company’s Market Share in 2024

|

USD 2.2 billion to USD 3.1 billion

|

50% - 70%

|

Market Dynamics

Introduction:

An aircraft seat is a type of seating specifically designed for use in aeroplanes. These seats are engineered to provide comfort, safety, and functionality for passengers during flights. Aircraft seats are constructed to be lightweight yet sturdy, as they must adhere to strict safety regulations set by aviation authorities

Market Drivers:

Rising Focus on Passenger Comfort and Experience

- Passenger comfort has become a key differentiator for airlines, driving continuous innovation in seat design.

- Manufacturers are investing heavily in R&D to develop ergonomically advanced, lightweight, and customizable seating solutions that enhance in-flight comfort and convenience.

Stringent Safety Regulations Driving Innovation

- Regulatory bodies such as the FAA and EASA are tightening safety standards related to seat strength, crashworthiness, and space optimization.

- Compliance with these evolving regulations is pushing manufacturers to adopt advanced materials and improved engineering designs that ensure passenger safety during turbulence or emergencies.

Emergence of Foldable and Modular Seat Designs

- To enhance operational flexibility, manufacturers are developing foldable and modular seating systems that allow easy reconfiguration of cabin layouts.

- These designs help airlines optimize space utilization, adjust capacity based on route demand, and improve overall efficiency.

Segments' Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High Growth Opportunity

|

|

By Aircraft Type Analysis

|

Narrow-Body Aircraft, Wide-Body Aircraft, Regional Aircraft, and Business Jets

|

Narrow-body aircraft are anticipated to drive demand for the aircraft seats market, whereas wide-body aircraft are expected to experience the fastest growth rate in the coming years.

|

|

By Seat Class Type Analysis

|

First-Class, Business-Class, Premium-Economy-Class, and Economy-Class.

|

Business class seats are anticipated to remain the dominant segment of the aircraft seats market and premium economy seats are expected to witness the fastest growth in the coming years.

|

|

By Component Type Analysis

|

Soft Goods, Metals, Composites, and Electric

|

Metals are anticipated to maintain their dominance and soft goods are expected to achieve the fastest growth during the forecast period.

|

|

By Sales Channel Type Analysis

|

BFE and SFE

|

BFE is expected to maintain its dominance and achieve faster growth during the study period.

|

|

By End-User Type Analysis

|

OE and Aftermarket

|

Aftermarket is expected to maintain its dominance during the forecast period, whereas OE is likely to be the faster-growing end-user during the same period.

|

|

By Region Analysis

|

North America, Europe, Asia Pacific, and Rest of The World

|

North America is projected to retain its supremacy during the forecast period, whereas Asia-Pacific is expected to experience the fastest growth.

|

Aircraft Insights

"Narrow-body aircraft segment accounted for the largest market share."

- The market is bifurcated into narrow-body aircraft, wide-body aircraft, regional aircraft, and business jets.

- Narrow-body aircraft are expected to remain dominant and wide-body to be the fastest-growing aircraft type of the market during the forecast period. The demand for aircraft seats in narrow-body aircraft is expected to remain the largest in the foreseeable future, driven by factors such as new narrow-body aircraft programs, anticipated increases in production rates of key models, and a recovering aftermarket.

- Over the past decade, newer generation narrow-body aircraft have seen significant demand, driven by growing air passenger traffic and the increasing popularity of the low-cost carrier business model. According to the International Air Transport Association (IATA), each new generation of aircraft offers a 20% improvement in fuel efficiency.

Seat-Class Insights

"The business class seat segment accounted for the largest market share."

- The market is bifurcated into first-class, business-class, premium-economy-class, and economy-class.

- Business class seats are projected to remain dominant in the aircraft seat market, while premium economy seats are anticipated to experience the fastest growth in the years ahead. Business class seats cater to corporate travelers, affluent individuals, and passengers seeking enhanced comfort. These groups are willing to pay a premium for added amenities.

- Airlines are increasingly investing in upgrading their business class offers to differentiate themselves in a competitive market, fueling demand for these seats. Premium economy bridges the gap between economy and business class, offering more comfort at a slightly higher price. This makes it appealing to middle-income travelers seeking better experiences without the steep cost of business class.

Want to get a free sample? Register Here

Component Insights

"Metals segment accounted for the largest market share."

- The market is segmented into soft goods, metals, composites, and electric.

- Metals are expected to remain the dominant component of the aircraft seat market, and soft goods to be the fastest-growing component of the market during the forecast period. Metals are the dominant material in the aircraft seat market, particularly for various small and mid-sized parts used in seat construction.

- Aircraft seat frames are typically constructed using aluminum alloys, which ensure durability and lightweight properties. For instance, Airbus and Boeing use metal frames in their economy and business class seats to maintain balance between weight and strength. Airlines are prioritizing comfort, especially in premium segments, by using advanced materials such as memory foam and moisture-wicking fabrics.

End-User Insights

"Aftermarket segment accounted for the largest market share."

- The market is segmented as OE and aftermarket. Aftermarket is expected to remain dominant, and OE to be the faster-growing end-user type of the market during the forecast period.

- High demand for new aircraft from developing nations, upcoming aircraft programs, and the rapid rebound in air passenger traffic are factors offering faster growth in the market at the OE level.

Regional Insights

"North America accounted for the largest market share."

- The market is segmented as North America, Europe, Asia-Pacific, and Rest of the World.

- North America is expected to remain the dominant region in the market, holding a share of more than 40%. Leading aircraft seat manufacturers have a strong presence in North America, both in terms of manufacturing and sales, to capitalize on market growth.

- Asia-Pacific is expected to experience the highest growth in the aircraft seat market during the forecast period. Growth in the region is driven by indigenous commercial and regional aircraft programs, such as the COMAC C919. China, Japan, and India are the major markets in Asia-Pacific and will continue to drive growth in the region in the coming years.

Want to get a free sample? Register Here

Competitive Landscape

Among the aircraft industry value chain, interiors are believed to be the segment that recorded the highest numbers of M&As over the past decade, especially keeping the number of players in mind. Other aerospace industry stakeholders, especially the tier players, seemed interested in acquiring the key interior suppliers. As a result, both aerospace giants (Zodiac Aerospace and B/E Aerospace) were acquired by Safran and Collins Aerospace, respectively. The following are some of the key players in the aircraft seats market.

-

Collins Aerospace

-

Safran S.A.

-

Recaro Aircraft Seating GmbH & Co. KG

-

Airbus Atlantic (STELIA Aerospace)

-

AVIC Cabin Systems Limited

-

Haeco Cabin Solutions

-

Adient Aerospace LLC

-

Geven S.p.A.

-

Acro Aircraft Seating Ltd.

-

Aviointeriors S.p.A.

-

Expliseat SAS

-

Jamco Corporation

-

Mirus Aircraft Seating Ltd

-

Zim Flugsitz GmbH

Note: The above list does not necessarily include all the top players in the market.

Recent Developments

Recent Market JVs and Acquisitions:

-

In Feb. 2024, Air India chose RECARO Aircraft Seating to install over 22,000 seats in their wide-body aircraft, including the CL3710 and CL3810 for economy and PL3530 for premium economy, over the next five to six years.

-

In Nov 2023, Emirates signed a $1.2 billion contract with Safran, which includes next-generation business, premium economy, and economy class seats for their A350 and 777X-9 fleet, as well as advanced galley shipsets, to elevate cabin comfort and design across its fleet.

-

AVIC Cabin Systems partnered with Singapore Airlines in 2021 to deliver a custom-designed business-class cabin on their Boeing 737-8 program, offering luxurious and efficient “Vantage” seating that enhances comfort, space, and style.

Recent Product Development:

Collins Aerospace has invested £16 million in R&D at its Kilkeel site, Northern Ireland, to develop advanced seating for wide-body aircraft, supporting economic growth and engineering innovation.

Report Features

This report provides market intelligence most comprehensively. The report structure has been kept so that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market.

The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

- COVID-19 impact and its recovery curve.

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors.

|

Market Study Period

|

2019-2034

|

|

Base Year

|

2024

|

|

Forecast Period

|

2025-2034

|

|

Trend Period

|

2019-2023

|

|

Number of Tables & Figures

|

>100

|

|

Number of Segments Analysed

|

6 (Aircraft Type, Seat Class Type, Component Type, Sales Channel Type, End-User Type, and Region)

|

|

Number of Regions Analysed

|

4 (North America, Europe, Asia-Pacific, Rest of the World)

|

|

Countries Analysed

|

15 (The USA, Canada, Mexico, Germany, France, Italy, The UK, China, Japan, India, Brazil, Saudi Arabia, Rest of Europe, Rest of APAC, and Rest of the World)

|

|

Free Customization Offered

|

10%

|

|

After Sales Support

|

Unlimited

|

|

Report Presentation

|

Complimentary

|

|

Market Dataset

|

Complimentary

|

|

Further Deep Dive & Consulting Services

|

10% Discount

|

Market Segmentation

This report studies the market, covering a period of 15 years of trend and forecast. The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The aircraft seat market is segmented into the following categories:

Aircraft Seat Market, by Aircraft Type

- Narrow-body aircraft

- Wide-body aircraft

- Regional Aircraft

- Business Jet

Aircraft Seat Market, by Seat Class Type

- First-Class Seat

- Business-Class Seat

- Premium-Economy-Class Seat

- Economy-Class Seat

Aircraft Seat Market, by Component Type

- Soft Goods

- Metals

- Composites

- Electric

Aircraft Seat Market, by Sales Channel Type

Aircraft Seat Market, by End-User Type

Aircraft Seat Market, by Region

- North America (Country Analysis: The USA, Canada, and Mexico)

- Europe (Country Analysis: Germany, France, The UK, Russia, and Rest of Europe)

- Asia-Pacific (Country Analysis: China, Japan, India, and the Rest of Asia-Pacific

- Rest of the World (Country Analysis: Brazil, Saudi Arabia, and Others)

Research Methodology

- This strategic assessment report from Stratview Research provides a comprehensive analysis that reflects today’s aircraft seat market realities and future market possibilities for the forecast period

- The report segments and analyzes the market in the most detailed manner to provide a panoramic view of the market.

- The vital data/information provided in the report can play a crucial role for market participants and investors in identifying the low-hanging fruits available in the market and formulating growth strategies to expedite their growth process.

- This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools.

- More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data.

- We conducted more than 15 detailed primary interviews with market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

Competitive Benchmarking

-

Benchmarking of key players on the following parameters: Product portfolio, geographical reach, regional presence, and strategic alliances

Custom Research: Stratview Research offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to sales@Stratviewresearch.com