Lithium-Ion Battery Separator Market Insights

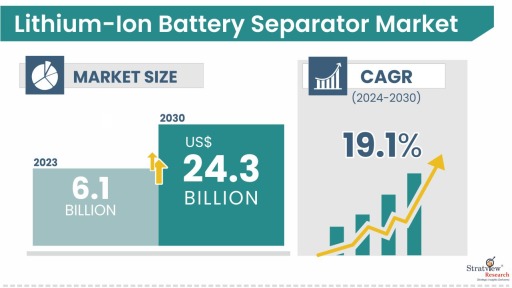

"The global lithium-ion battery separator market was estimated at USD 6.1 billion in 2023 and is likely to grow at a CAGR of 19.1% during 2024-2030 to reach USD 24.3 billion in 2030."

Want to get a free sample? Register Here

The battery separator is a vital element within a battery, maintaining the spatial separation of the positive and negative electrodes while facilitating the transport of ions between them. Typically, the separator is a porous membrane or a synthetic polymer film, carefully positioned between the anode and cathode within a battery cell. Lithium-ion batteries are the dominant rechargeable battery technology used in various applications, from portable electronics to electric vehicles. These separators are typically made from polyolefins like polyethylene (PE), polypropylene (PP), or a combination of these materials, ensuring safety and performance by acting as insulating barriers and preventing short circuits. The separator material needs to be chemically stable and compatible with the electrolyte and electrode materials used in lithium-ion batteries. This ensures long battery life and prevents degradation. Lithium-ion batteries can generate heat during operation. The separator must be thermally stable to withstand these temperatures and prevent safety hazards.

Lithium-Ion Battery Separator Market Drivers

The increasing demand for lithium-ion battery separators is driven by several key factors including the rapid expansion of the electric vehicle market, the growing deployment of renewable energy storage solutions, the widespread use of consumer electronics, continuous advancements in battery technology, strict safety regulations, and ongoing endeavors to enhance battery performance while reducing costs. These influential trends are expected to contribute to significant growth in the market for lithium-ion battery separators in the foreseeable future.

Lithium-Ion Battery Separator Market Segments' Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High Growth Opportunity

|

|

End-Use Industry-Type Analysis

|

Automotive, Industrial, and Consumer Electronics

|

Automotive is anticipated to remain the biggest demand generator for Li-ion battery separators in the years to come.

|

|

Material-Type Analysis

|

PE (UHMWPE and Others), PP, and Others

|

PE is anticipated to remain the pioneer material for Li-ion battery separators in the years to come.

|

|

Medium-Type Analysis

|

Dry and Wet

|

Wet separators are expected to remain the largest as well as the fastest-growing separator type in the market.

|

|

Separator-Type Analysis

|

Films and Nonwovens

|

Films are anticipated to remain the dominant separator type during the forecast period.

|

|

Region Analysis

|

North America, Europe, China, and the Rest of the World

|

China is expected to remain the largest market over the coming years.

|

End-Use Industry Insights

"The automotive industry segment accounted for the largest market share."

The lithium-ion battery separator market is segmented into automotive, industrial, and consumer electronics. The automotive industry is expected to remain the largest segment whereas the industrial will be the fastest-growing end-use industry of the market during the forecast period. The automotive industry, particularly the electric vehicle (EV) sector, heavily relies on lithium-ion batteries. As the automotive sector pivots towards electrification to adhere to emissions regulations and meet the growing consumer preference for sustainable transportation, there is a corresponding surge in the demand for lithium-ion battery separators. Electric vehicles (EVs) are equipped with substantial battery packs, each comprising a multitude of lithium-ion cells, with each cell relying on a separator to guarantee safe and efficient operation. The substantial requirement for separators is driven by the significant demand for batteries in EV production. Europe's "Fit for 55" program, the US Inflation Reduction Act, and the EU's plan to ban internal combustion engine (ICE) vehicles by 2035 will further fuel the demand for lithium-ion battery separators during the forecast period. The fastest growth for the industrial segment is primarily due to the demand for efficient energy storage systems, the growing implementation of automated and robotic systems in manufacturing (Industry 4.0), the integration of renewable energy sources, and a steadfast dedication to sustainability.

Material Insights

"PE segment accounted for the largest market share."

The market is segmented into PE (UHMWPE and others), PP, and others. PE is expected to remain the most preferred material of the market during the forecast period. PE offers high purity, good mechanical strength, and chemical stability. PE, especially UHMWPE, is the most preferred material type for lithium-ion battery separators due to its high porosity, excellent mechanical strength, chemical and thermal stability, and low electrical conductivity. PE is employed in the manufacturing of high-performance separators, which play a critical role in ensuring the efficiency, safety, and longevity of lithium-ion batteries. The increasing prevalence of electric and hybrid vehicles demands batteries with greater energy density, superior power output, and enhanced safety features. High-performance separators are essential in meeting these requirements.

Medium Insights

"Wet separators segment accounted for the largest market share."

The market is segmented into dry and wet separators. Wet separators are likely to remain the dominant as well as the fastest-growing medium of the market during the forecast period. Wet separators are very popular in low thickness (thickness starts from 4μm) and high-energy density cells use low-thickness separators to improve the volumetric energy density. As battery technologies advance, there is a growing need for separators that can support higher energy densities, faster charging rates, and longer cycle life. Wet separators, with their enhanced electrolyte management and thermal characteristics, are well-suited to meet these performance demands. The automotive industry, particularly the electric vehicle sector, is a major driver for wet separators. EV batteries require robust separators that can handle high-power applications and provide reliable performance over the vehicle's lifespan. Wet separators offer the necessary safety and efficiency features required for EV battery packs.

Separator Insights

"Films segment accounted for the largest market share."

The market is segmented into films and nonwovens. Films are expected to remain the dominant whereas nonwovens are estimated to register the faster growth as a separator of the market during the forecast period. Films are currently the dominant type of separator in the lithium-ion battery market. They are typically made from materials such as polyethylene (PE) or polypropylene (PP) and are characterized by their uniform structure and controlled pore size distribution. Films offer excellent mechanical strength, chemical resistance, and stability, making them suitable for high-performance applications like electric vehicles (EVs) and consumer electronics. They are also easier to handle during battery assembly and can be manufactured using well-established production techniques. Ongoing innovations for the development of nonwoven separators are likely to drive the fastest growth of nonwoven separators during the study period. Nonwovens can be engineered to have higher porosity and tortuosity, which enhances ionic conductivity and electrolyte retention within the battery cell.

Regional Insights

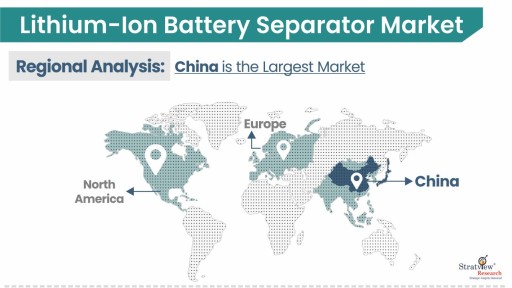

“China is expected to remain the largest market for lithium-ion battery separators whereas North America is expected to register highest growth during the forecast period.”

In terms of region, China is expected to remain the largest market for lithium-ion battery separators during the forecast period. China possesses extensive manufacturing capabilities and infrastructure for producing lithium-ion batteries and their components, including separators. The country has established numerous battery manufacturing facilities, which benefit from economies of scale and efficient production processes. China is the world's largest market for electric vehicles (EVs), consumer electronics, and energy storage systems. The rapid growth in these sectors has driven substantial demand for lithium-ion batteries, thereby increasing the need for high-quality separators. Chinese manufacturers benefit from lower production costs compared to many Western counterparts. This cost competitiveness has made Chinese lithium-ion battery separators attractive to global battery manufacturers seeking to optimize production costs without compromising quality. North America is witnessing a significant surge in EV adoption and major battery separators are opening their plants in the country.

Want to get a free sample? Register Here

Key Players

The market is highly consolidated with the presence of less than 50 players across the globe. Most of the major players compete in some of the governing factors including price, service offerings, regional presence, etc. The following are the key players in the lithium-ion battery separator market.

Here is the list of the Top Players (Based on Dominance)

- SEMCORP Group

- Shenzhen Senior Technology Material Co., Ltd.

- Asahi Kasei Corporation

- Sinoma Science & Technology Co., Ltd.

- SK Innovation Co., Ltd.

- Toray Industries

- UBE Corporation

- ENTEK International

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Write to us at sales@stratviewresearch.com

Recent Developments of Lithium-Ion Battery Separator Market

Recent Market JVs and Acquisition:

A huge number of strategic alliances including M&As, JVs, etc. have been performed over the past few years:

-

In June 2024, Toray Industries Inc., announced a joint venture with LG Chem. Ltd., to establish a lithium-ion battery separator plant in Hungary

- In January 2021, Asahi Kasie’ Polypore International, LP, and SEMRORP reached an agreement to form a joint venture with in China to produce dry-process separators for lithium-ion batteries.

Report Features

This report provides market intelligence most comprehensively. The report structure has been kept such that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market. The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, Product portfolio, New Product Launches, etc.

- COVID-19 impact and its recovery curve.

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors.

Market Segmentation

This report studies the market covering 12 years of trend and forecast. The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The lithium-ion battery separator market is segmented into the following categories

By End-Use Industry Type

- Automotive

- Industrial

- Consumer Electronics

By Material Type

- PE (UHMWPE and Others)

- PP

- Others

By Medium Type

By Separator Type

By Region

- North America (Country Analysis: The USA, Canada, and Mexico)

- Europe (Country Analysis: Germany, France, The UK, Russia, and the Rest of Europe)

- Asia-Pacific (Country Analysis: China, India, Australia, South Korea, and the Rest of Asia-Pacific)

- Rest of the World (Country Analysis: Saudi Arabia, Brazil, and Others)

Research Methodology

This strategic assessment report from Stratview Research provides a comprehensive analysis that reflects today’s lithium-ion battery separator market realities and future market possibilities for the forecast period. The report segments and analyzes the market in the most detailed manner in order to provide a panoramic view of the market. The vital data/information provided in the report can play a crucial role for market participants and investors in identifying the low-hanging fruits available in the market and formulating growth strategies to expedite their growth process.

This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools. More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data. We conducted more than 15 detailed primary interviews with market players across the value chain in all four regions and industry experts to obtain both, qualitative and quantitative insights.

Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

- Detailed profiling of additional market players (up to three players)

- SWOT analysis of key players (up to three players)

Competitive Benchmarking

- Benchmarking of key players based on the following parameters: Product portfolio, geographical reach, regional presence, and strategic alliances

Custom Research: Stratview Research offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to sales@stratviewresearch.com