Market Dynamics

Military aerospace coatings are specialized protective finishes applied to military aircraft, helicopters, and aerospace equipment. They serve critical functions in enhancing performance and durability. These coatings are designed to withstand the rigors of military operations and maintain the integrity of aircraft in diverse and often harsh environments. They offer corrosion resistance, protecting against moisture, saltwater, and UV radiation. Camouflage coatings help military aircraft blend into their surroundings, reducing visual detection. Some coatings are engineered to lower radar visibility, contributing to stealth capabilities.

Thermal control coatings manage extreme temperatures experienced during flight, safeguarding sensitive electronics and structures. Resistance to chemicals, including aviation fuels and de-icing fluids, is crucial for military applications. UV resistance preserves aircraft appearance and prevents material damage from sun exposure. By extending the life of aircraft components and reducing maintenance requirements, these coatings improve fleet readiness. In summary, military aerospace coatings are essential tools in preserving and enhancing the performance and survivability of military aircraft, making them indispensable in modern military operations.

Want to have a closer look at this market report? Click Here

Segment Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High Growth Opportunity

|

|

Resin Type Analysis

|

Polyurethane, Epoxy, and Others

|

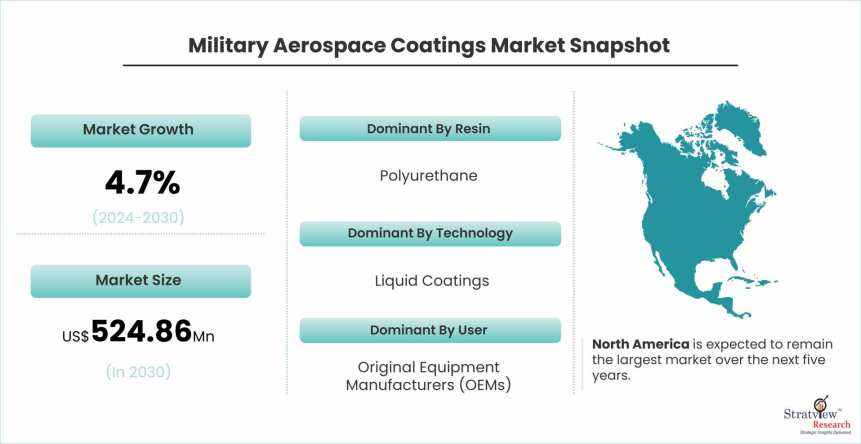

Polyurethane is anticipated to remain the biggest demand generator for profile seals in the years to come.

|

|

Technology Type Analysis

|

Liquid and Powder

|

Liquid segment dominates the military aerospace coatings in the market.

|

|

User Type Analysis

|

OEM and MRO

|

OEM considered to be the faster growing segment in the market.

|

|

Aircraft Type Analysis

|

Fixed Wing and Rotary Wing

|

Fixed Wing are the largest segment in the market.

|

|

Regional Analysis

|

North America, Europe, Asia-Pacific, and Rest of the World

|

North America is expected to remain the largest market over the next five years, whereas it is also likely to grow at the fastest rate.

|

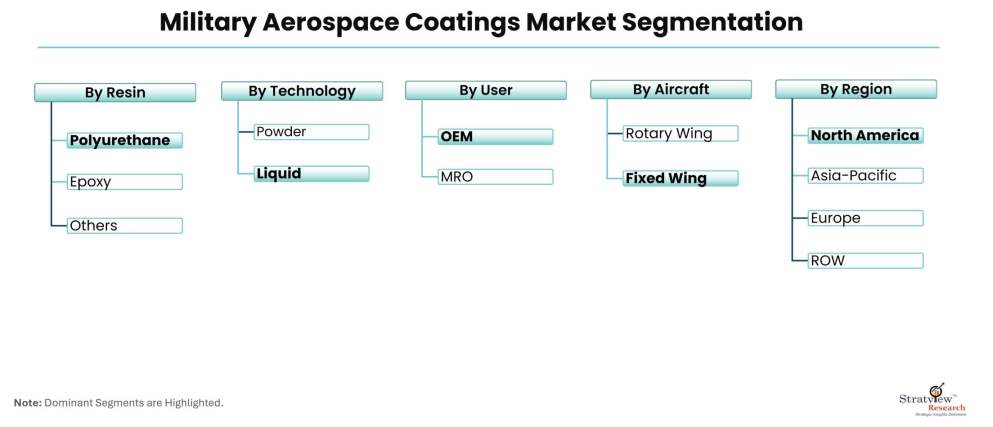

By Resin Type

Based on the resin type, the military aerospace coatings market is segmented into polyurethane, epoxy, and others. Polyurethane is gaining prominence in the military aerospace coatings market as the resin segment due to its exceptional durability, high-performance properties, and resistance to harsh conditions. These coatings offer superior protection against corrosion, abrasion, chemicals, and UV radiation, crucial for military aircraft exposed to varied environments. Polyurethane formulations can also meet camouflage requirements and contribute to reduced radar visibility, enhancing aircraft stealth capabilities. Additionally, their longevity reduces maintenance needs, ensuring aircraft readiness. As technology advances, polyurethane coatings continue to evolve, aligning with stringent military requirements while adhering to environmental standards, making them a preferred choice for aerospace coatings.

By Technology Type

Based on the technology type, the market is segmented into liquid and powder. Liquid coatings dominate the military aerospace coatings market as a technology segment due to their flexibility, durability, and ease of application. Liquid coatings offer superior corrosion resistance, weatherability, and the ability to conform to complex aircraft surfaces. They can be customized to meet specific military requirements, including stealth technology and radar-absorbing materials. Additionally, liquid coatings are cost-effective and can be efficiently repaired or reapplied, making them a practical choice for maintaining and protecting military aircraft, ensuring their long-term performance and mission success.

By User Type

Based on the user type, the market is segmented into OEM and MRO. Original Equipment Manufacturers (OEMs) are considered the dominant segment in the military aerospace coatings market due to their pivotal role in the aircraft manufacturing process. OEMs integrate coatings during aircraft production, ensuring precise application and adherence to stringent specifications for performance, durability, and safety. They have the capability to incorporate advanced coatings technologies, like radar-absorbing materials and stealth coatings, directly into the aircraft's design. This early-stage application provides long-term protection, reduces maintenance costs, and enhances operational capabilities. Moreover, OEMs often collaborate with coating manufacturers to develop specialized solutions, maintaining their position as key influencers in the military aerospace coatings sector.

Regional Insights

In terms of regions, the North American region's dominance in the military aerospace coatings market can be attributed to a combination of historical, economic, and technological factors, notably the United States, serves as a global hub for the aerospace and defense industry. It hosts major aerospace corporations such as Boeing, Lockheed Martin, Northrop Grumman, Raytheon, and many others, which are deeply involved in military aircraft production. These companies demand high-performance coatings to protect their products. North American institutions and corporations have been at the forefront of aerospace coatings research and development. They have made substantial progress in developing coatings tailored to military aircraft requirements, including radar-absorbing materials and stealth coatings.

The cumulative effect of these factors places North America at the forefront of the military aerospace coatings market, making it the dominant region in this sector.

Know the high-growth countries in this report. Register Here

Report Features

This report provides market intelligence in the most comprehensive way. The report structure has been kept such that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market. The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis

- Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis

- Market trend and forecast analysis

- Market segment trend and forecast

- Competitive landscape and dynamics: Market share, Product portfolio, New Product Launches, etc.

- COVID-19 impact and its recovery curve

- Attractive market segments and associated growth opportunities

- Emerging trends

- Strategic growth opportunities for existing and new players

- Key success factors

Market Segmentation

This report studies the market covering a period of 12 years of trend and forecast. The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The military aerospace coatings Market is segmented into the following categories.

By Resin Type

- Polyurethane

- Epoxy

- Others

By Technology Type

By User Type

By Aircraft Type

By Region

- North America (Country Analysis: The USA, Canada, and Mexico)

- Europe (Country Analysis: Germany, France, The UK, Russia, and The Rest of Europe)

- Asia-Pacific (Country Analysis: Japan, China, India, and The Rest of Asia-Pacific)

- Rest of the World (Country Analysis: Brazil, Saudi Arabia, and Others)

Click Here, to learn the market segmentation details.

Report Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

- Detailed profiling of additional market players (up to three players)

- SWOT analysis of key players (up to three players)

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Product portfolio, geographical reach, regional presence, and strategic alliances

Custom Research: Stratview Research offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to sales@stratviewresearch.com.