Attractive Opportunities

Global Demand Analysis & Sales Opportunities in Aircraft Elastomers Market

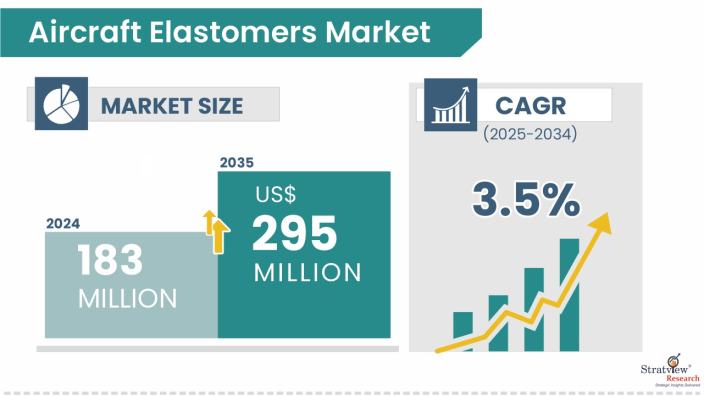

- The annual demand for aircraft elastomers was USD 183 million in 2024 and is expected to reach USD 216 million in 2025, up 18.3% than the value in 2024.

- During the forecast period, the aircraft elastomers market is expected to grow at a CAGR of 3.5%. The annual demand will reach USD 295 million in 2034.

- During 2025-2034, the aircraft elastomers industry is expected to generate a cumulative sales opportunity of USD 2653 million, which is almost 3 times the opportunities during 2019-2024.

Wish to get a free sample? Click Here

High-Growth Market Segments:

- North America is expected to remain the largest market for aircraft elastomers with more than 40% market share, attributed to its robust aviation industry and presence of major aircraft manufacturers.

- By platform type, Commercial aircraft is expected to maintain its dominance and exhibit the fastest growth, driven by increasing air travel demand and fleet expansions.

- By elastomer type, Silicone is anticipated to remain the most dominant material type, owing to its superior properties such as high-temperature resistance and durability.

- By product type, Seals are likely to remain the leading product type, essential for preventing leaks and ensuring system integrity in various aircraft components.

- By application type, Airframe and propulsion applications are likely to remain at the forefront, with more than half of the share in 2024.

Market Statistics

Have a look at the sales opportunities presented by the aircraft elastomers market in terms of growth and market forecast.

|

Aircraft Elastomers Market Data & Statistics

|

|

|

Market Statistics

|

Value (in USD Million)

|

Market Growth (%)

|

|

Annual Market Size in 2023

|

USD 171 million

|

-

|

|

Annual Market Size in 2024

|

USD 183 million

|

YoY Growth in 2024: 6.8%

|

|

Annual Market Size in 2025

|

USD 216 million

|

YoY Growth in 2025: 18.3%

|

|

Annual Market Size in 2034

|

USD 295 million

|

CAGR 2025-2034: 3.5%

|

|

Cumulative Sales Opportunity during 2025-2034

|

USD 2653 million

|

-

|

|

Top 10 Countries’ Market Share in 2024

|

USD 146 million +

|

> 80%

|

|

Top 10 Company’s Market Share in 2024

|

USD 91 million to USD 128 million

|

50% - 70%

|

Market Dynamics

Introduction:

What is the aircraft elastomer market?

Polymer, a term that covers three main groups called thermoplastics, thermosets, and elastomers. Elastomers are polymers that possess the property of elasticity. They have low Young’s modulus and high yield strain as compared to other materials. Elastomers are amorphous polymers that exist above their glass transition temperature, resulting in a possibility of considerable segmental motion. Hence, they are relatively soft and deformable at ambient temperatures. Elastomers can be thermosets (requiring a form of crosslinking called vulcanization) or thermoplastic (called TPE or thermoplastic elastomer). Elastomers are used in aircraft components for sealing, vibration damping, and insulation. Elastomeric products are being developed with better thermal stability, lightweight characteristics, and increased resistance to wear and degradation in response to the growing demand for fuel-efficient aircraft, next-generation propulsion systems, and increased durability in aerospace components. Seals and gaskets are the major elastomer products used in the aerospace industry, along with other products such as hoses & tubes and profiles. Elastomer seals can be static or dynamic. Although most seals are static, dynamic seals such as bellows are also used in the industry. Elastomers continue to play a critical role in maintaining aircraft safety, dependability, and efficiency as the aviation industry moves toward high-performance materials and sustainability.

Market Drivers:

The major factors driving the growth of the aircraft elastomers market are:

- Fleet Expansion: The market for commercial aircraft is expected to grow significantly over the next 20 years, according to leading aircraft manufacturers like Airbus and Boeing, which predict a demand for over 40,000 new commercial jets.

- Technological Advancements: Continuous innovations in elastomer formulations are enhancing their performance characteristics, including improved resistance to extreme temperatures and chemicals, which is vital for modern aerospace applications.

- Increasing demand for high-performance and lightweight materials: In an aircraft, weight reduction is essential for improving fuel efficiency and increasing payload capacity. The aircraft industry is seeing a continuous increase in demand for high-performance and lightweight materials. Stricter rules and testing requirements for fire-resistant materials have also been brought about by improvements in fire safety standards, guaranteeing the security of the aircraft and its occupants.

Market Challenges:

- Regulatory compliance is still a crucial component of product approval and market entry, manufacturers in the aircraft elastomers market.

- Disruptions to the global supply chain can also affect raw material availability, which can alter production costs and delivery dates. To stay competitive and maintain long-term growth, businesses must concentrate on strengthening supply chain resilience and guaranteeing adherence to increasingly stringent regulations as the industry continues to change.

Key Market Trends:

- Developments in High-Performance Elastomers for Adversarial Environments: There is an increase in need for elastomers with exceptional mechanical strength, chemical resistance, and thermal stability. Because they can tolerate high pressures, harsh aviation fluids, and extremely high temperatures, advanced fluoro-silicone and perfluoroelastomers are being used more and more in aerospace applications.

- Increasing Focus on Fuel-Efficient and Lightweight Materials: Lightweight elastomers are becoming more popular as the aviation industry transitions to aircraft that use less fuel. Fuel efficiency and operating costs are increased through the use of next-generation elastomeric materials, which are lighter but more durable.

Segment Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High-Growth Opportunity

|

|

Platform Type Analysis

|

Commercial Aircraft, Regional Aircraft, General Aviation, Military Aircraft, and Helicopter

|

Commercial aircraft is expected to maintain its dominance and exhibit the fastest growth, driven by increasing air travel demand and fleet expansions.

|

|

Elastomer Type Analysis

|

EPDM, Silicone, Fluoroelastomers, NBR, CR, and Other Elastomers

|

Silicone is anticipated to remain the most dominant material type, owing to its superior properties such as high-temperature resistance and durability.

|

|

Product Type Analysis

|

Seals, Gaskets, and Other Products

|

Seals are likely to remain the leading product type, essential for preventing leaks and ensuring system integrity in various aircraft components.

|

|

Application Type Analysis

|

Airframe; Propulsion; Interior; Landing Gear, Wheels, and Brakes; and Hydraulic & Actuation

|

Airframe and propulsion applications are likely to remain at the forefront, with more than half of the share in 2024.

|

|

Regional Analysis

|

North America, Europe, Asia-Pacific, and Rest of the World

|

North America is expected to remain the largest market for aircraft elastomers, attributed to its robust aviation industry and presence of major aircraft manufacturers.

|

Platform-Type Analysis

"The commercial aircraft platform is expected to be the largest and fastest-growing of the aircraft elastomers market during 2025–2034."

- The market is segmented into commercial aircraft, regional aircraft, general aviation, military aircraft, and helicopters. The commercial aircraft market is anticipated to continue to be the biggest and fastest-growing among aircraft types during the forecast period. The strong demand for single-aisle aircraft, which are predicted to account for 71% of the world's commercial fleet by 2043, is the main driver of this growth.

- Commercial aircraft leads the market, propelled by the constant flow of passengers, larger fleets in operation, more frequent flights, and the ongoing need for regular maintenance. Stratview estimates suggest that in 2025, Airbus aims to deliver 816 aircraft, and Boeing, 549 aircraft. Expected increase in deliveries of B737max, A320neo family, B777/777x, A350, A220, and B787 is likely to act as another solid long-term driver.

Elastomer-Type Analysis

"Silicone elastomers are anticipated to capture a major share of the pie, owing to their superior properties.”.

- The market is segmented into EPDM, silicone, fluoroelastomers, NBR, neoprene, and other elastomers. Silicone or VMQ offers remarkable qualities, which include superior low-temperature flexibility, high heat tolerance, and resistance to aging, ozone, weathering, and ultraviolet (UV) radiation. Because of these qualities, silicone elastomers are essential for aerospace applications where materials need to be able to endure harsh environmental conditions. The growing need for high-performance materials in the aerospace industry is likely to nudge the demand further. Key applications include door & window seals and gaskets, profiles, hoses, overhead bin rod ends, mounts, etc. Silicone’s versatility and capacity for optimization also drive its usage in emerging applications.

- Key fluoro-elastomers used for aircraft applications are FKM, FFKM, and FVMQ. FKM has greater tensile strength, tear strength, and abrasion resistance as compared to fluoro-silicones. FFKM can withstand aggressive chemicals at temperatures up to 325°C. FVMQ is preferred for static sealing systems for a wide temperature range. EPDM offers the advantage of the lowest price among all elastomers and presents a strong combination of thermal and mechanical properties.

Product Type Analysis

"Seals are expected to remain the dominant product of the aircraft elastomers market, while gaskets are projected to emerge as the fastest-growing category due to advancements in lightweight, high-performance materials."

- The aircraft elastomers market is segmented into seals, gaskets, and other products. Seals are likely to remain the dominant product type due to their extensive use across various aircraft applications, including airframes, propulsion units, interiors, and landing gear.

- Molding is a key production process for seals, wherein a block of rubber is pressed into a rubber molding metal cavity, and it is then exposed to heat to activate a chemical reaction. Key molded products include O-rings, rubber & metal bonded seals, bulb seals, spring seals, piston rings, enclosures, bellows, connectors, isolators, and dampers.

- Gaskets are likely to be the fastest-growing product type, fueled by advancements in material technologies and the aerospace industry's emphasis on lightweight, high-performance components to enhance fuel efficiency and reduce emissions. Key applications are doors, windows, side wall panels, ceiling panels, lavatories, and galleys.

Application Type Analysis

“Airframe and propulsion are the two key areas of applications where there is high usage of elastomers. These two applications are likely to present healthy long-term opportunities in the market.”

- The market is segmented into airframe, propulsion, interiors, landing gear, wheels, and brakes, and hydraulic & actuation. Airframe was the largest application in 2024. There is a high usage of seals in the airframe due to a large number of parts in the body and wings. Key areas of elastomer usage are wing, belly fairing, cockpit, tail, APU, stabilizer, elevator, and rudder.

- Some common elastomeric products used in the airframe are aerodynamic seals, control surface seals, diaphragms, ducting and shrouds, gaskets, electrical connector seals, EMI seals, firewall seals, fuel line shrouds, fuel seals, inlet, plenum, and exhaust seals, loading hatch seals, plate seals, tapes, transfer tubes, and ventilation ducting.

- The growing need for high-performance elastomeric components in next-generation aircraft engines is driving demand for propulsion applications. There is a increasing need for high-performance, fuel-efficient, and durable engine components in modern aircraft. Key areas of elastomer usage in the engine are the cowling and thrust reverser, pylon, nacelle, engine, and turbine.

Regional Analysis

"North America is expected to remain the dominant market for aircraft elastomers, while Asia-Pacific is anticipated to continue as the fastest-growing region."

- The market for aircraft elastomers is highly dominated by North America, with the USA acting as the main thrust-bearer of the region’s dominance, with one of the largest fleets of commercial aircraft in the world and the presence of major companies across the supply chain, being the hub of the aerospace industry as well as aircraft elastomers. The region is an early adopter concerning technology and material adoption. The opening of assembly plants for the A320 and A220 aircraft programs by Airbus in the USA further assures a healthy growth of the market in the region.

- The market for aircraft elastomers is expanding quickly in the Asia-Pacific area due to the growth of the commercial aviation industry and rising defense expenditures. With the help of large investments, China and India are spearheading the growth momentum for the region’s market.

Know the high-growth countries in this report. Register Here

Competitive Landscape

Top Players

Most of the major players compete in some of the factors, including price, service offerings, regional presence, etc. The following are the key players in the aircraft elastomers market -

- TransDigm Group

- Trelleborg AB

- Hutchinson SA

- Parker Meggitt

- The Chemours Company

- The Freudenberg Group

- The Dow Chemical Company

- Wacker Chemie AG

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Please write to us at [email protected]

Recent Mergers & Acquisitions:

- Parker-Hannifin Corporation acquired Meggitt PLC (2022): This strategic move significantly enhances Parker's aerospace capabilities by integrating Meggitt's complementary technologies and expanding its product portfolio

- Trelleborg AB's acquired Minnesota Rubber & Plastics (2022): This acquisition helped Trelleborg enhance its expertise in engineered elastomeric components and expand its customer base across multiple industries.

Research Methodology

- This strategic assessment report from Stratview Research provides a comprehensive analysis that reflects today’s aircraft elastomers market realities and future market possibilities for the forecast period.

- The report segments and analyzes the market in the most detailed manner to provide a panoramic view of the market.

- The vital data/information provided in the report can play a crucial role for market participants and investors in identifying the low-hanging fruits available in the market and formulating growth strategies to expedite their growth process.

- This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools.

- More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data.

- We conducted more than 15 detailed primary interviews with market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Report Features

This report provides market intelligence most comprehensively. The report structure has been kept so that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market.

The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

- COVID-19 impact and its recovery curve.

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors.

|

Market Study Period

|

2019-2034

|

|

Base Year

|

2024

|

|

Forecast Period

|

2025-2034

|

|

Trend Period

|

2019-2023

|

|

Number of Tables & Figures

|

>100

|

|

Number of Segments Analysed

|

5 (Platform Type, Elastomer Type, Application Type, Product Type, and Region)

|

|

Number of Regions Analysed

|

4 (North America, Europe, Asia-Pacific, Rest of the World)

|

|

Countries Analysed

|

15 (The USA, Canada, Mexico, Germany, France, Italy, The UK, China, Japan, India, Brazil, Saudi Arabia, Rest of Europe, Rest of APAC, and Rest of the World)

|

|

Free Customization Offered

|

10%

|

|

After Sales Support

|

Unlimited

|

|

Report Presentation

|

Complimentary

|

|

Market Dataset

|

Complimentary

|

|

Further Deep Dive & Consulting Services

|

10% Discount

|

Market Segmentation

The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The aircraft elastomers market is segmented into the following categories:

Aircraft Elastomers Market, by Platform Type

- Commercial Aircraft (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Regional Aircraft (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- General Aviation (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Military Aircraft (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Helicopter (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

Aircraft Elastomers Market, by Elastomer Type

- EPDM (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the world)

- Silicone (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Fluoro elastomers (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- NBR (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- CR (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Other Elastomers (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

Aircraft Elastomers Market, by Product Type

- Seals (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Gaskets (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Other Products (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

Aircraft Elastomers Market, by Application Type

- Airframe (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Propulsion (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Interior (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Landing Gear, Wheels, and Brakes (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Hydraulic & Actuation (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

Aircraft Elastomers Market, by Region

- North America (Country Analysis: The USA, Canada, and Mexico)

- Europe (Country Analysis: Germany, France, The UK, Russia, and the Rest of Europe)

- Asia-Pacific (Country Analysis: Japan, China, India, and Rest of Asia-Pacific)

- Rest of the World (Country Analysis: Brazil, The UAE, Saudi Arabia, and Others

Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respected clients:

Company Profiling

- Detailed profiling of additional market players (up to three players)

- SWOT analysis of key players (up to three players)

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Service portfolio, geographical reach, regional presence, and strategic alliances.

Custom Research: Stratview Research offers custom research services across industries. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected].