Market Dynamics

Introduction

Vision guided robotics is a type of robotics system that uses cameras and computer vision algorithms to enable robots to perform tasks that require visual perception and interpretation. The main idea behind vision guided robotics is to equip robots with the ability to see and understand their environment, so that they can navigate, interact with objects, and perform tasks with greater accuracy and efficiency.

Vision guided robots typically use high-resolution cameras, combined with advanced image processing and machine learning algorithms, to analyze visual information and make decisions based on that information. Some common applications of vision guided robotics include pick-and-place operations, assembly and inspection, quality control, and packaging.

Market Drivers

The benefits of vision guided robotics include increased speed, accuracy, and flexibility, as well as the ability to perform tasks that would be difficult or impossible for humans to do manually. Vision guided robotics can also improve safety by enabling robots to work in hazardous environments or perform tasks that involve heavy lifting or repetitive motions.

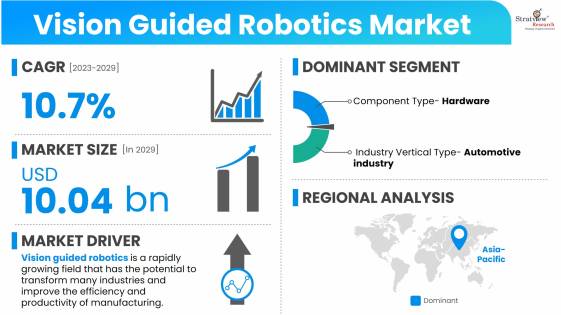

Overall, vision guided robotics is a rapidly growing field that has the potential to transform many industries and improve the efficiency and productivity of manufacturing and other types of operations.

Several factors affect the global market for vision-guided robotics, including the demand for automation and increased labor costs. The extent of growth in the market is also determined by awareness among SMEs and technological advancements. Together, these factors create opportunities for growth in the vision-guided robotics market, although some of them also pose limitations. Each factor has its own impact on the market, which can vary depending on its specific characteristics.

Need for Automation

The demand for automation in all industry sectors is rising, leading to a significant increase in the use of robots. Organizations are increasingly turning to robotics to automate their processes, which helps them to produce high-quality products, expand their manufacturing capabilities, improve customer service, and efficiently manage their operations. This factor is driving organizations to adopt robotics, which is further strengthening the vision guided robotics market.

Labor Safety Concerns

As international labor safety standards become increasingly strict, organizations are turning to robots to replace human workers in hazardous environments. Robots are capable of handling tasks that are dangerous and unsafe for human beings, such as working in rough terrains and managing hazardous substances. By utilizing robots in these situations, organizations can reduce the risks and minimize the number of work accidents. This factor is driving greater adoption of robotics solutions in the global vision guided robotics industry.

Growing Adoption Among SMEs

There has been a noticeable increase in the acceptance of robotics by small and medium-sized enterprises (SMEs) in recent years. SMEs are turning to robots to improve the efficiency and functionality of their processes. The ability to customize products for specific applications increases flexibility of usage, which is particularly important for smaller companies. New technological advancements are being developed to meet this demand. Vendors in the market are creating specialized, low-cost, and energy-efficient robotics solutions for SMEs, which is expected to further enhance the adoption of robotics.

Technological Advancements

The emergence of new technologies has led to the development of better and more efficient robotics solutions in the market. These robots are capable of performing tasks with greater accuracy and precision, leading to reduced costs. Advancements in technology have made robotics solutions more compact and modular, resulting in enhanced quality and more flexible robots. The increasing use of augmented and modular robots is expected to further strengthen the market in the future.

Greater use in Diverse Industries such as Food & Beverages, Electronics, and Healthcare

The use of robotics has become more prevalent in various industries, including food & beverage, electronics, healthcare, and defense, among others. These industries are relying on robots to meet their specific needs and improve their efficiency. Customized robots are developed and deployed for these industries to meet their particular specifications. The increasing deployment of robotics in diverse applications has resulted in significant growth in the vision guided robotics market, and its impact is expected to continue increasing in the years ahead.

High Initial Investment

The high initial costs of setup and integration limit the use of robots primarily to heavy manufacturing organizations. Industries with high labor costs are more likely to adopt robotics to reduce labor costs and produce high-quality products. Industries where precision and accuracy are critical, such as automotive and electronics, use robots to meet international quality standards. However, with the emergence of new robotic technologies and growing competition in the market, the costs of vision guided robotic systems are expected to decrease in the future.

Rising Labor and Energy Costs

The cost of labor has increased globally, particularly in developed countries. To reduce labor and energy costs, organizations are adopting robotics solutions. While the initial cost of implementing these solutions may be high, they enable organizations to efficiently manage their processes and reduce overall operational expenditure. As robotics technology continues to advance, rising costs are expected to have a lower impact on the market in the future.

Want to have a closer look at this market report? Click Here

Segment Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High Growth Opportunity

|

|

Component Type Analysis

|

Hardware, Software, Services

|

Hardware segment dominated the market during the forecast period.

|

|

Industry Vertical Type Analysis

|

Automobile, Electrical and Electronics, Aerospace and Defense, Food and Beverage, Healthcare and Pharmaceutical, Metal Processing

|

Automobile industry had the largest market share during the forecast period.

|

|

Regional Analysis

|

North America, Europe, Asia-Pacific, and Rest of the World

|

Asia Pacific market is the leading market during the forecast period.

|

By Component Type

"Hardware segment dominated the market during the forecast period"

The market is segmented into three component types: Hardware, Software, and Services. In previous years, the hardware segment dominated the market, with the software segment coming in second. This trend is expected to continue over the forecast period.

By Industry Vertical Type

"Automobile industry had the largest market share during the forecast period"

In terms of Industry Vertical, the market is segmented into Automobile, Electrical and Electronics, Aerospace and Defense, Food and Beverage, Healthcare and Pharmaceutical, and Metal Processing. In previous years, the Automobile industry had the largest market share during the forecast period, it is expected to maintain its dominance in the vision-guided market. The Electrical and Electronics industry had the second-largest market share, and it is predicted to grow significantly throughout the forecast period.

Regional Analysis

"Asia Pacific market is the leading market during the forecast period"

The vision guided robotics market is categorized into North America, Europe, Asia Pacific, Middle East and Africa, and South America based on regional analysis. Currently, the Asia Pacific market is the leading market due to significant demand from the fast-developing industrial sector and the presence of some of the world's leading businesses conducting robotics research. The markets in North America and Europe follow due to the high rate of automation adoption in the industrial sectors, with each accounting for a significant share of the global market.

Know the high-growth countries in this report. Register Here