Market Insights

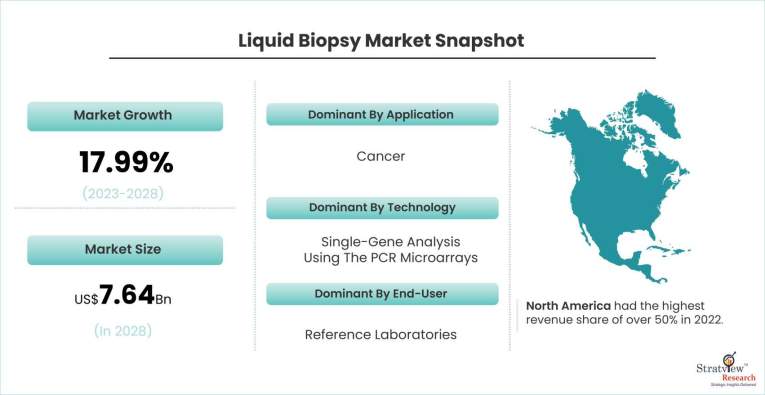

The liquid biopsy market was estimated at USD 2.83 billion in 2022 and is likely to grow at a CAGR of 17.99% during 2023-2028 to reach USD 7.64 billion in 2028.

Want to know more about the market scope? Register Here

Market Dynamics

Introduction

A liquid biopsy is a minimally invasive medical procedure that involves analyzing a blood sample or other bodily fluids to detect and monitor various diseases, including cancer. Unlike traditional biopsies, which require invasive surgical procedures, liquid biopsies offer a non-invasive alternative that can be performed more frequently and with less risk to the patient. Liquid biopsies can detect various biomarkers, such as circulating tumor cells (CTCs), cell-free DNA (cfDNA), and exosomes, providing valuable information on the existence and progression of cancer and other diseases. Liquid biopsies have the potential to revolutionize cancer diagnosis and treatment, as they enable doctors to monitor patients more closely and make more informed decisions about their care.

COVID-19 IMPACT

The impact of the global pandemic Covid-19 was felt across all industries in every field. However, the liquid biopsy market managed to escape the pandemic with minimum damage. The liquid biopsy market witnessed a slight decline in the year 2020 during the pandemic and is likely to rebound at a healthy rate in the forecast period.

|

Liquid Biopsy Market Report Highlights

|

|

Market Size in 2022

|

2.83 billion

|

|

Market Size in 2028

|

7.64 billion

|

|

Market Growth (2023-2028)

|

17.99% CAGR

|

|

Base Year of Study

|

2022

|

|

Trend Period

|

2017-2021

|

|

Forecast Period

|

2023-2028

|

Market Drivers

The liquid biopsy market is driven by several factors, including the increasing prevalence of cancer and other diseases, the need for non-invasive diagnostic methods, and the growing demand for personalized medicine. Here are some of the key drivers of the market:

- Cancer Prevalence - The rising incidence of cancer is one of the main drivers of the liquid biopsy market. As cancer rates continue to increase, there is a growing need for non-invasive and accurate methods of diagnosing and monitoring the disease.

- Non-Invasive Diagnostic Methods - Liquid biopsy provides a non-invasive alternative to traditional tissue biopsies, which can be invasive and painful for patients. This is particularly important for patients with advanced cancer or other conditions that make traditional biopsies difficult or risky.

Want to have a closer look at this market report? Click Here

- Personalized Medicine - Liquid biopsy provides doctors with a wealth of information about a patient's disease, including the specific mutations and biomarkers that may be driving the disease. This information can help doctors tailor treatment plans to the individual patient, leading to better outcomes.

- Technological Advancements - Advances in liquid biopsy technology, including improvements in sensitivity and specificity, are driving the adoption of this approach in clinical practice.

- Research Funding - Increased funding for research into liquid biopsy is fuelling innovation in this field, leading to new technologies and applications that are driving the market growth.

Segments Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High Growth Opportunity

|

|

Application Type Analysis

|

Cancer {Lung Cancer, Breast Cancer, Colorectal Cancer, Prostate Cancer, Melanoma, and Others} and Non-Cancer

|

The cancer segment is likely to grow significantly at an exponential CAGR during the forecast period.

|

|

Technology Type Analysis

|

Multi-Gene Parallel Analysis Using NGS and Single-Gene Analysis Using PCR Microarrays

|

The single-gene analysis using the PCR microarrays segment is expected to be dominant in the market over the forecast period.

|

|

End-User Type Analysis

|

Reference Laboratories, Hospitals and Physician Laboratories, Academic & Research Centers, and Others

|

The Reference laboratories are expected to be the dominant segment of the market during the forecast period.

|

|

Regional Analysis

|

North America, Europe, Asia-Pacific, and Rest of the World

|

North America had the highest revenue share of over 50%.

|

By Application Type

The liquid biopsy market is segmented into cancer and non-cancer applications. Cancer application is further sub-segmented into lung cancer, breast cancer, colorectal cancer, prostate cancer, melanoma, and others. The cancer segment is likely to grow significantly at an exponential CAGR during the forecast period, largely due to the increasing number of cancer cases and increasing demand for liquid biopsy for diagnosis. In addition, the increasing number of research studies on liquid biopsy for cancer applications is further expected to drive the growth of the market during the forecast period.

By Technology Type

The market is segmented as multi-gene parallel analysis using NGS and single-gene analysis using PCR microarrays. Between these two technology types, the single-gene analysis using the PCR microarrays segment is expected to be dominant in the market over the forecast period. The segment's growth can be attributed to the use of PCR, which is increasing due to its increasing use for various purposes, including detecting fungal infections, bacterial infections, gene mapping, and other genomic applications. PCR tests' quick and real-time diagnostic results are accurate, and they can guide targeted therapies for cancer treatment. PCR is rapidly gaining popularity and is expected to grow at a rapid pace in the coming years.

Want to get more details about the segmentations? Register Here

By End-User Type

The market is segmented as reference laboratories, hospitals and physician laboratories, academic & research centers, and others. Reference laboratories are expected to be the dominant segment of the market during the forecast period. The outsourcing of liquid biopsy tests to reference laboratories is expected to drive market growth over the forecast period.

Regional Analysis

The liquid biopsy market is segmented into North America, Europe, Asia-Pacific, and the Rest of the world. Among these regions, Asia-Pacific is expected to be the fastest-growing region in the market during the forecast period.

In 2022, North America had the highest revenue share of over 50%. Due to higher investments and the existence of numerous biotechnology businesses developing tests in the U.S., this region dominates the most. The region is distinguished by rising disposable income, increasing healthcare expenditure, growing awareness of liquid biopsy techniques, and rising adoption of advanced diagnostic techniques in hospitals, clinics, and diagnostic laboratories. The growing penetration of hospitals and diagnostic centers in the region is likely to bolster the growth of the market over the forecast period.

Know the high-growth countries in this report. Register Here

Key Players

Some of the key players in the market are-

- Biocept Inc.

- Bio-Rad Laboratories

- F. Hoffmann-La Roche Ltd.

- Guardant Health Inc.

- Illumina, Inc.

- Johnson & Johnson

- Laboratory Corporation of America Holdings

- MDxHealth SA

- QIAGEN N.V.

- Thermo Fisher Scientific Inc.

Research Methodology

- This strategic assessment report from Stratview Research provides a comprehensive analysis that reflects today’s liquid biopsy market realities and future market possibilities for the forecast period.

- The report segments and analyzes the market in the most detailed manner in order to provide a panoramic view of the market.

- The vital data/information provided in the report can play a crucial role for market participants as well as investors in the identification of the low-hanging fruits available in the market as well as to formulate growth strategies to expedite their growth process.

- This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools.

- More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data.

- We conducted more than 15 detailed primary interviews with market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Report Features

Liquid Biopsy Market Report Highlights

|

|

Base

Year of Study Base

Year of Study |

2022 |

Forecast

Period Forecast

Period |

2023 - 2028 |

Trend

Period Trend

Period |

2017 - 2021 |

No. of Segment Analyzed No. of Segment Analyzed |

6 |

No. of Region No. of Region |

4 |

No. of Countries Studies No. of Countries Studies |

17 |

No. of Figures No. of Figures |

4 |

No. of Tables No. of Tables |

2 |

Target Audience Target Audience |

4 |

Free Customization Free Customization |

10 |

Report Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

- Detailed profiling of additional market players (up to 3 players)

- SWOT analysis of key players (up to 3 players)

Market Segmentation

- Current market segmentation by any one of the technology types by application type.

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Product portfolio, geographical reach, regional presence, and strategic alliances.

Custom Research: Stratview Research offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected].

Recent News & Developments

MAY 2023: Singlera Genomics Receives FDA Breakthrough Device Designation for PDACatch, a Liquid Biopsy Assay for Pancreatic Cancer Detection in High-Risk Individuals- Singlera Genomics, a company specializing in innovative DNA methylation technologies for genetic diagnosis, has just revealed its receipt of the FDA's Breakthrough Device Designation for its PDACatch assay. This groundbreaking liquid biopsy test, based on DNA methylation, is designed to detect pancreatic adenocarcinoma in individuals at a heightened risk for the disease.

APRIL 2023: Quest Diagnostics to Acquire Haystack Oncology, Adding Sensitive Liquid Biopsy Technology for Improving Personalized Cancer Care to Oncology Portfolio- Quest Diagnostics (NYSE: DGX), the foremost provider of diagnostic information services in the nation, and Haystack Oncology, an emerging player in the field of oncology with a primary focus on minimal residual disease (MRD) testing to enhance early, precise identification of lingering or recurrent cancer and to enhance therapeutic decision-making, have jointly announced a definitive agreement. According to this agreement, Quest will acquire Haystack in an all-cash equity transaction.

JULY 2022: Novel urine-based liquid biopsy launched in US prostate cancer market- The miR Sentinel, a urine-based liquid biopsy designed to assess the risk of aggressive prostate cancer, is now accessible for commercial use in the United States, as announced by its developer, miR Scientific.

More precisely, the miR Sentinel molecular test employs a biostatistical algorithm to analyze small noncoding RNAs extracted from urinary exosomes, providing an assessment of an individual's risk of developing aggressive prostate cancer. The company states that this test is intended to support clinicians in the care of men aged 45 and older who are at risk of prostate cancer.

JULY 2022: Delfi Diagnostics Announces $225 Million Series B Financing to Develop Globally Accessible Portfolio of Liquid Biopsy Tests.

Delfi Diagnostics, Inc., a pioneering developer of a new class of high-performance, accessible liquid biopsy tests for early cancer detection and monitoring, today announced a Series B funding of $225 million.