Attractive Opportunities

Global Demand Analysis & Sales Opportunities in Aerospace & Defense Thermoplastic Composites Market

-

The annual demand for aerospace & defense thermoplastic composites was USD 553.7 million in 2025 and is expected to reach USD 731.0 million in 2026, up 32.0% than the value in 2025.

-

During the forecast period (2026-2032), the aerospace & defense thermoplastic composites market is expected to grow at a CAGR of 8.1%. The annual demand will reach USD 930.8 million in 2032.

-

During 2026-2032, the aerospace & defense thermoplastic composites industry is expected to generate a cumulative sales opportunity of USD 5860.7 million, which is almost 3 times the opportunities during 2019-2024.

Want to know more about the market scope? Register Here

High-Growth Market Segments:

-

Europe is expected to remain the largest market over the next six years, whereas North America is likely to grow at the fastest rate.

-

By aircraft type, commercial aircraft segment is anticipated to remain the largest demand generator in the years to come.

-

By resin type, PEEK-based composites were the most dominantly used thermoplastic composites for aerospace applications and are also likely to mark the highest growth during the forecast period.

-

By application type, airframe took the lead and is also expected to grow at the highest rate during the forecast period.

-

By fiber type, carbon fiber composites are expected to maintain their dominance throughout the forecast period.

-

By consolidation type, compression molding grabbed the major share of the market and is anticipated to be the fastest-growing segment over the forecasted period.

Market Statistics

Have a look at the sales opportunities presented by the aerospace & defense thermoplastic composites market in terms of growth and market forecast.

|

Aerospace & Defense Thermoplastic Composites Market Data & Statistics

|

|

|

Market Statistics

|

Value (in USD Million)

|

Market Growth (%)

|

|

Annual Market Size in 2024

|

USD 380.4 million

|

-

|

|

Annual Market Size in 2025

|

USD 553.7 million

|

YoY Growth in 2025: 45.7%

|

|

Annual Market Size in 2026

|

USD 731.0 million

|

YoY Growth in 2026: 32.0%

|

|

Annual Market Size in 2032

|

USD 930.8 million

|

CAGR (2026-2032): 8.1%

|

|

Cumulative Sales Opportunity during 2026-2032

|

USD 5860.7 million

|

-

|

|

Top 10 Countries’ Market Share in 2025

|

USD 440+ million

|

> 80%

|

|

Top 10 Company’s Market Share in 2025

|

USD 275 million to USD 390 million

|

50% - 70%

|

Market Dynamics

Introduction:

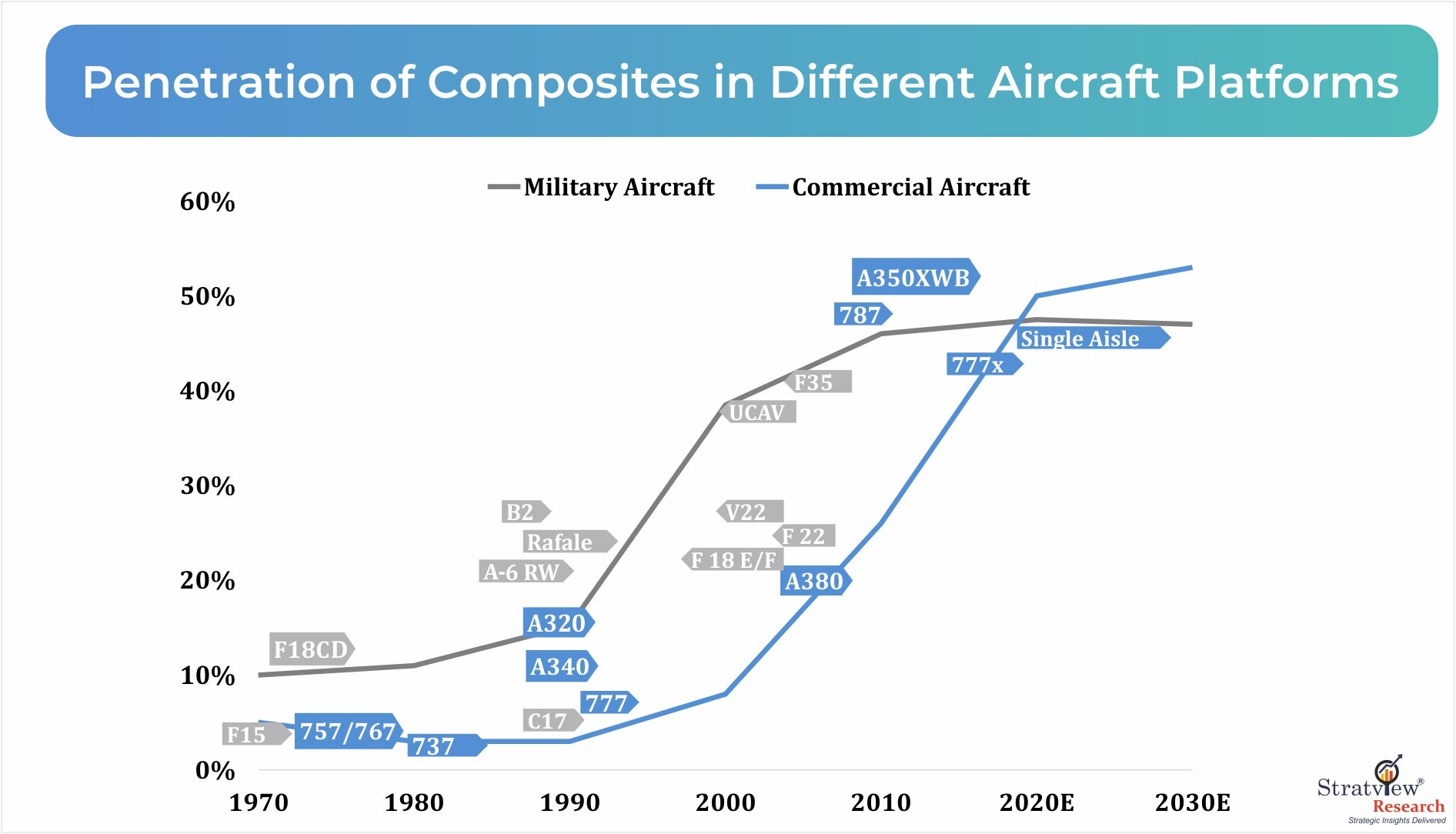

Composites have transformed aerospace, growing from roughly 4?% of structural weight in 1970s aircraft to over 50?% in modern airframes, enabling lighter, stronger, and more fuel-efficient designs. Building on this success, thermoplastic composites have emerged as a preferred choice for current and future aircraft components, offering not only excellent mechanical performance and design flexibility but also recyclability, faster processing, and the ability to replace both metallic and thermoset parts in high-performance structures.

Market Drivers:

Fuel Efficiency and Cost Pressures Accelerating Lightweight Material Adoption

-

Rising fuel costs and tightening emissions regulations are pushing aircraft OEMs and airlines to prioritize aggressive weight reduction. Thermoplastic composites address this need through an exceptional strength- and stiffness-to-weight balance, enabling up to 30–50% weight savings versus conventional materials.

- Lighter structures directly improve fuel efficiency, extend range, increase payload capacity, and lower lifecycle operating costs, making thermoplastic composites a strategic enabler for both commercial and defense aviation programs.

Growing Penetration in Modern Aircraft Programs

-

The adoption of thermoplastic composites is accelerating across modern commercial and defense aircraft as OEMs increasingly specify these materials for both primary and secondary structures.

-

For instance, on the Boeing 787, approximately 150 thermoplastic shear webs are used to reinforce fuselage frames, while the Airbus A350 XWB incorporates around 8,000 thermoplastic composite clips and cleats. The Boeing 787 goes even further, using an estimated 10,000–15,000 thermoplastic clips and cleats per aircraft. As thermoplastics are designed into aircraft at the part level, material consumption per platform continues to rise.

-

This trend is further amplified by long-term fleet expansion, with Airbus forecasting over 42,000 new aircraft deliveries between 2024 and 2043, underpinning sustained demand for thermoplastic composites across future production cycles.

Market Challenges:

High Raw Material Costs

Market Opportunities:

Technological Advancements in Manufacturing Processes

-

Technological advances such as Automated Fiber Placement (AFP), Automated Tape Laying (ATL), compression molding, and in-situ consolidation are reshaping how thermoplastic composite parts are made.

- These processes improve dimensional accuracy and reduce material waste. They also enable much faster production rates, with cycle times up to 80% shorter than conventional methods. As a result, thermoplastic composites are becoming increasingly suitable for large-scale aerospace and defense programs.

Sustainability Mandates Accelerating Material Transition

-

Thermoplastic composites can be reheated and recycled, unlike thermosets, making them easier to reuse and helping reduce material waste at the end of their service life.

-

This advantage aligns with aerospace OEM sustainability goals, supporting lower environmental impact and compliance with tightening emissions and regulatory requirements.

Key Trends:

Scaling Up Thermoplastic Composites for Large Aircraft Structures

-

The aerospace industry is increasingly transitioning from small components to large-scale thermoplastic composite structures, enabled by advancements in automated manufacturing and joining processes.

-

One of the key highlights in 2024 was the successful manufacture of the world’s largest thermoplastic composite fuselage segment. Fraunhofer Gesellschaft and international partners achieved this milestone under the EU-funded Clean Sky 2 / Clean Aviation Large Passenger Aircraft (LPA) project, where two 8-meter CFRP half-shells were successfully welded to form a true-to-scale upper and lower fuselage shell of the Multi-Functional Fuselage Demonstrator (MFFD). An almost rivet-less architecture and automated pre-integration enabled approximately 10% savings in both weight and cost. This milestone demonstrates structural feasibility, automation readiness, and the growing maturity of large-scale thermoplastic composite manufacturing, signalling a shift toward fully integrated, lightweight, and recyclable aircraft structures.

Segments' Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High-Growth Opportunity

|

|

Aircraft-Type Analysis

|

Commercial Aircraft, General Aviation, Military Aircraft, and Others

|

Commercial aircraft segment is anticipated to remain the largest demand generator in the years to come.

|

|

Resin-Type Analysis

|

PPS-based Composites, PEEK-based Composites, PEI-based Composites, and Other Composites

|

PEEK-based composites were the most dominantly used thermoplastic composites for aerospace applications and are also likely to mark the highest growth during the forecast period.

|

|

Application-Type Analysis

|

Airframe, Interiors, and Others

|

Airframe took the lead in terms of applications and is also expected to grow at the highest rate during the forecast period.

|

|

Fiber-Type Analysis

|

Carbon Fiber Composites and Glass Fiber Composites

|

Carbon fiber composites are expected to maintain their dominance throughout the forecast period.

|

|

Consolidation-Type Analysis

|

Press or Compression Molding, Bagging, and Injection Molding

|

Compression molding grabbed the major share of the market and is anticipated to be the fastest-growing segment over the forecasted period.

|

|

Regional Analysis

|

North America, Europe, Asia-Pacific, and The Rest of the World

|

Europe is expected to remain the largest market over the next six years, whereas North America is likely to grow at the fastest rate.

|

Aircraft Insights

“Commercial aircraft are expected to remain dominant as well as the fastest-growing aircraft type in the market during the forecast period."

-

The aerospace & defense thermoplastic composites market is segmented by aircraft type into commercial aircraft, general aviation, military aircraft, and others. Commercial aircraft are expected to remain dominant as well as the fastest-growing aircraft type in the market during the forecast period.

-

Commercial aircraft increasingly rely on composites across primary structures, with modern platforms such as the Airbus A350 XWB and Boeing 787 featuring more than 50% composite content. This material shift, driven by decades of redesign at both Airbus and Boeing, has created sustained, large-scale demand for thermoplastic composite materials. With Boeing projecting nearly 50,000 active commercial airplanes by 2044, demand is set to expand further.

-

Weight reduction is critical in commercial aviation, as lighter structures improve fuel efficiency, extend range, cut emissions, and lower lifecycle costs, making thermoplastic composites a strategic priority for OEMs.

Wish to get a free sample report? Click Here

Resin Insights

“PEEK-based composites segment accounted for the largest and fastest-growing market share."

-

The aerospace & defense thermoplastic composites market is segmented by resin type into PPS-based composites, PEEK-based composites, PEI-based composites, and other composites. PEEK-based composites are expected to remain the dominant and fastest-growing resin of the market during the forecast period.

-

PEEK composites offer an exceptional combination of benefits, aiding aerospace OEMs, designers, and processors to attain cost savings, quality, and performance. They help lower weight, improve buy-to-fly ratios, and provide design freedom to optimize the design.

-

PEEK is often used with carbon fiber to fabricate clips, cleats, brackets, clamps, and connectors. Clean Sky 2’s OUTCOME project demonstrated the suitability of PEEK thermoplastic in a safety-critical wing box structure in Airbus C-295 aircraft, enabling simplified processing, weight reduction, and improved fuel efficiency, while delivering environmental benefits and advancing energy-efficient aerospace manufacturing.

Application Insights

“Airframe took the lead in terms of applications and is also expected to grow at the highest rate during the forecast period.”

-

The aerospace & defense thermoplastic composites market is segmented by application type into airframe, interiors, and others. Airframe is expected to remain the most attractive application of the market throughout the forecast period.

-

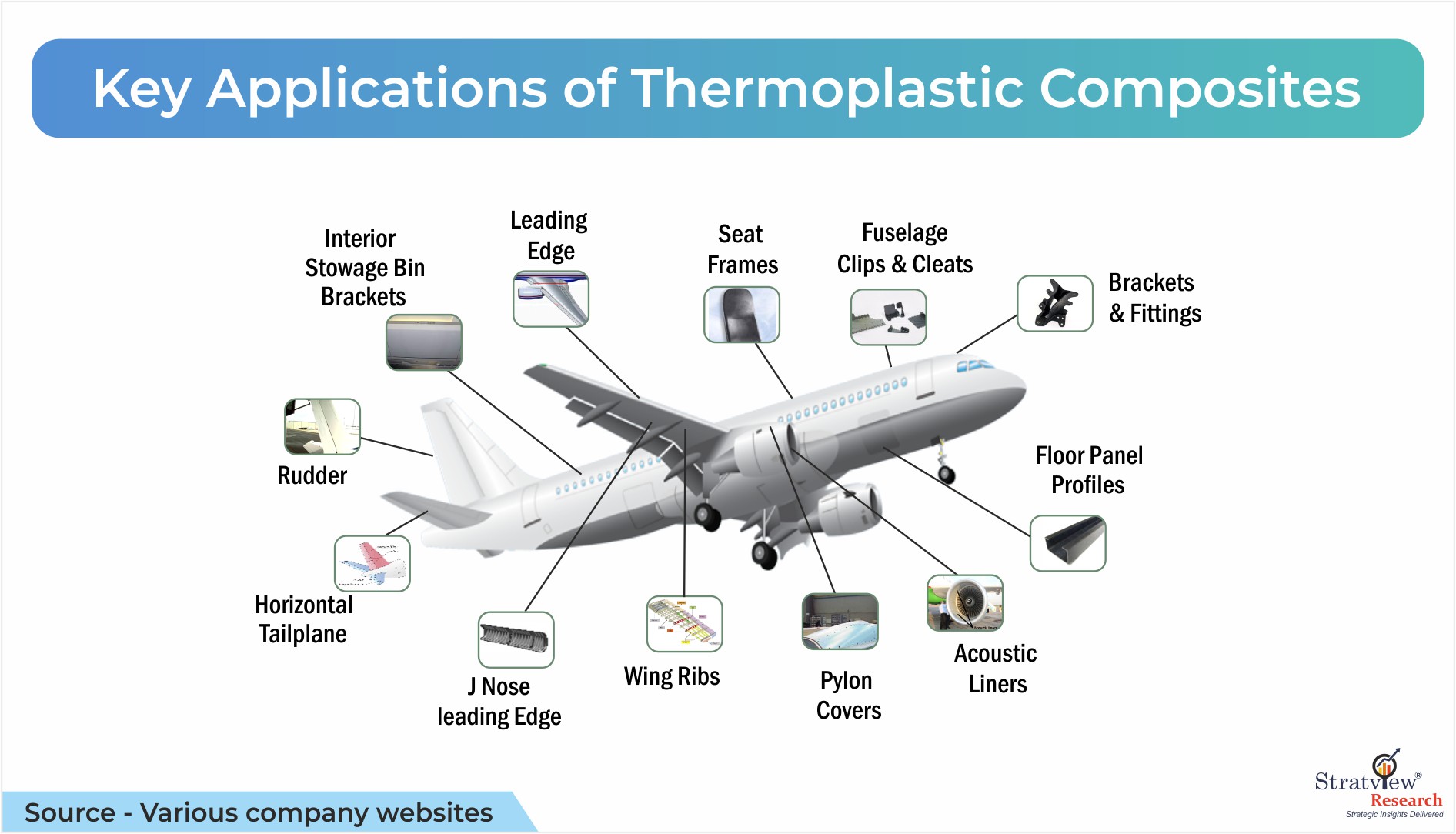

Key application areas in the airframe segment are clips, cleats, leading edges, panels for the fuselage, shear webs, stringers, ribs, rudders, and elevators. There is also growing interest in thermoplastic composites in interiors with floor panels, brackets, profiles, and seat backs being key applications.

-

Additionally, advanced projects like the EU-funded DOMMINIO project showcase thermoplastic composites for multifunctional, intelligent airframe parts. Using Toray TC 1225 UD tape with LM PAEK polymer, the project demonstrates benefits in repair, recycling, and next-generation aircraft design.

Wish to get a free sample report? Click Here

Regional Insights

"Europe is projected to retain its position as the leading market over the next six years.”

-

Europe is anticipated to remain at the forefront throughout the forecast period. It contributes over 50% of the global aerospace & defense thermoplastic composites market by value and volume, reflecting a strong regional aerospace manufacturing ecosystem and established supply chains.

-

Leading European companies, Daher, Dutch Thermoplastic Composites (Collins Aerospace), and Premium AEROTEC, supply thermoplastic composite components for aircraft programs including Airbus A350XWB, A320, and A330 families.

-

Airbus consistently outpaced Boeing in aircraft deliveries, supporting Europe’s strong position in aerospace thermoplastic composites sector, driving demand for advanced composite materials across multiple platforms.

Competitive Landscape

In 2025, the competitive landscape was dominated by the top 10 players, collectively accounting for 50%–70% of the market. Most major players compete across key parameters such as pricing, service offerings, and regional presence, particularly within the aerospace & defense thermoplastic composites market -

-

GKN Aerospace

-

Premium AEROTEC GmbH

-

Daher

-

Collins Aerospace

-

Avanco Group

-

SEKISUI Aerospace

-

ATC Manufacturing

-

Cutting Dynamics, Inc.

Note: The above list does not necessarily include all the top players in the market.

Are you a leading player in this market? We would love to include your name. Please write to us at sales@stratviewresearch.com

Recent Developments:

-

In December 2025, Toray secured NCAMP qualification for its Cetex TC1225 thermoplastic composite, providing aerospace OEMs with an FAA-accepted, certification-ready material that accelerates adoption of high-performance thermoplastics in next-generation aircraft structures, including integrated lightning and corrosion protection.

-

In June 2025, Daher, Tarmac Aerosave, and Toray Advanced Composites launched a joint program to recycle and repurpose thermoplastic composite aircraft parts, advancing circularity by recovering carbon fibers for second-life aeronautical structural applications.

-

In 2025, as part of the HELUES project, Hexcel and Arkema unveiled a PEKK/carbon overwing emergency exit door at the Paris Air Show, demonstrating autoclave-free, one-step manufacturing that reduces assembly steps, accelerates production, and enables scalable, recyclable aerospace components.

Report Features

This report provides market intelligence most comprehensively. The report structure has been kept so that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market.

The following are the key features of the report:

-

Market structure: Overview, industry life cycle analysis, supply chain analysis.

-

Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

-

Market trend and forecast analysis.

-

Market segment trend and forecast.

-

Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

-

COVID-19 impact and its recovery curve.

-

Attractive market segments and associated growth opportunities.

-

Emerging trends.

-

Strategic growth opportunities for the existing and new players.

-

Key success factors.

|

Market Study Period

|

2019-2032

|

|

Base Year

|

2025

|

|

Forecast Period

|

2026-2032

|

|

Trend Period

|

2019-2024

|

|

Number of Tables & Figures

|

>100

|

|

Number of Segments Analysed

|

6 (Aircraft Type, Resin Type, Application Type, Fiber Type, Consolidation Type, and Region)

|

|

Number of Regions Analysed

|

4 (North America, Europe, Asia-Pacific, Rest of the World)

|

|

Countries Analysed

|

15 (The USA, Canada, Mexico, Germany, France, Italy, The UK, China, Japan, India, Brazil, Saudi Arabia, Rest of Europe, Rest of APAC, and Rest of the World)

|

|

Free Customization Offered

|

10%

|

|

After Sales Support

|

Unlimited

|

|

Report Presentation

|

Complimentary

|

|

Market Dataset

|

Complimentary

|

|

Further Deep Dive & Consulting Services

|

10% Discount

|

Market Segmentation

The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The global aerospace & defense thermoplastic composites market is segmented into the following categories:

Aerospace & Defense Thermoplastic Composites Market, By Aircraft Type

-

Commercial Aircraft

-

General Aviation

-

Military Aircraft

-

Others

Aerospace & Defense Thermoplastic Composites Market, By Resin Type

-

PPS-based Composites

-

PEEK-based Composites

-

PEI-based Composites

-

Others

Aerospace & Defense Thermoplastic Composites Market, By Application Type

-

Airframe

-

Interiors

-

Others

Aerospace & Defense Thermoplastic Composites Market, By Fiber Type

Aerospace & Defense Thermoplastic Composites Market, By Consolidation Type

-

Press Molding

-

Bagging

-

Injection Molding

Aerospace & Defense Thermoplastic Composites Market, By Region

-

North America (Country Analysis: The USA, Canada, and Mexico)

-

Europe (Country Analysis: Germany, France, The UK, and Rest of Europe)

-

Asia-Pacific (Country Analysis: China, Japan, India, and Rest of Asia-Pacific)

-

Rest of the World (Country Analysis: Latin America, The Middle East, and Others)

Research Methodology

-

This strategic assessment report from Stratview Research provides a comprehensive analysis that reflects today’s aerospace & defense thermoplastic composites market realities and future market possibilities for the forecast period.

-

The report segments and analyzes the market in the most detailed manner to provide a panoramic view of the market.

-

The vital data/information provided in the report can play a crucial role for market participants and investors in identifying the low-hanging fruits available in the market and formulating growth strategies to expedite their growth process.

-

This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools.

-

More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data.

-

We conducted more than 15 detailed primary interviews with market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

Competitive Benchmarking

-

Benchmarking of key players on the following parameters: Product portfolio, geographical reach, regional presence, and strategic alliances

Custom Research: Stratview Research offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to sales@stratviewresearch.com