Market Insights

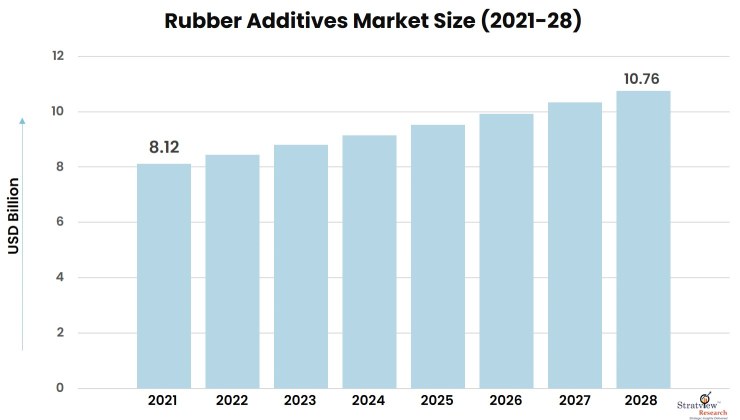

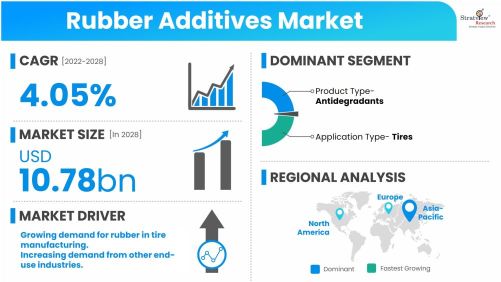

The rubber additives market was estimated at USD 8.12 billion in 2021 and is likely to grow at a CAGR of 4.05% during 2022-2028 to reach USD 10.76 billion in 2028.

Want to know more about the market scope? Register Here

Market Dynamics

Introduction

Rubber additives are ingredients added to synthetic or natural rubber to produce desired properties. Rubber additives help to improve the durability of rubber and its resistance to heat, sunlight, mechanical stress, and other environmental factors. Sulfur, sulfonamide, carbon black, silica, amines, aliphatic esters, silanes, and other chemical compounds are among the rubber additives.

Covid-19 Impact

The pandemic outbreak shook the automotive industry to the core, affecting the growth of the rubber additives market. Due to supply chain disruption, production halts, and lockdowns across regions, the automotive industry recorded a massive decline in vehicle production in 2020. The impact of this has been documented throughout its supply chain, including the demand for rubber additives in 2020.

Market Drivers

Key factors driving the growth of the rubber additives market are:

- The recovery of the automotive industry

- Growing demand for rubber in tire manufacturing.

- Increasing demand from other end-use industries.

Furthermore, rapid industrialization and urbanization, rising standards of living, and a surge in electric vehicle production will likely bolster the demand for rubber additives in the coming years.

Want to have a closer look at this market report? Register Here

Segments Analysis

By Product Type

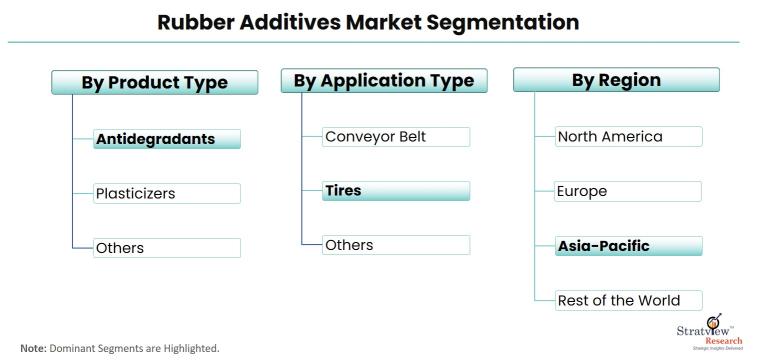

The market is bifurcated into antidegradants, accelerators, activators, vulcanization inhibitors, plasticizers, and others. Antidegradants are estimated to remain the biggest demand generator for rubber additives in the foreseen future, due to the growing automotive industry. In addition, the increasing demand for antidegradants is fuelled by the expansion in their applications such as tire and industrial rubber products. Antidegradants are also used to improve the durability and resistance of rubber against the effects of sunlight, oxidation, heat, and mechanical stress. This is expected to further boost the demand for antidegradants over the assessment period.

By Application Type

The market is segmented into tires, conveyor belts, electric cables, and others. Tires are expected to be the largest application of rubber additives during 2022-2028, as rubber is the primary raw material used in the production of tires. The increasing use of rubber additives to improve tire performance and wear resistance has escalated the demand for rubber additives. As tires are one of the major applications in the rubber industry, rising initiatives in the tire industry by several countries are likely to drive market growth. One such example is the China Rubber Industry Association (CRIA), which has issued new industry development guidelines for the years 2021 to 2025.

Regional Analysis

Asia-Pacific is expected to remain the largest market for rubber additives over the forecast period. Furthermore, the region is expected to experience healthy market growth in the coming years. China, Japan, India, South Korea, and Thailand are Asia's preferred automobile manufacturing destinations. Increasing disposable income in the region, combined with an increasing motorization rate, ensures high automobile production in Asia-Pacific, which is likely to generate significant demand for rubber additives in the region.

Know the high-growth countries in this report. Register Here

Key Players

Automotive remains one of the key industries that all the key rubber additive suppliers are targeting today. The following are some of the key players in the market:

- Akzonobel N.V.

- Arkema SA

- BASF SE

- Behn Meyer Group

- China Petroleum and Chemical Corporation

- Eastman Chemical Company

- Emery Oleochemicals LLC

- Lanxess AG

- R.T. Vanderbilt Company, Inc

- Solvay SA

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Write to us at sales@stratviewresearch.com

Research Methodology

This strategic assessment report, from Stratview Research, provides a comprehensive analysis that reflects today’s rubber additives market realities and future market possibilities for the forecast period of 2022 to 2028. After a continuous interest in our rubber additives market report from the industry stakeholders, we have tried to further accentuate our research scope to the rubber additives market to provide the most crystal-clear picture of the market. The report segments and analyses the market in the most detailed manner to provide a panoramic view of the market. The vital data/information provided in the report can play a crucial role for the market participants as well as investors in the identification of the low-hanging fruits available in the market as well as to formulate the growth strategies to expedite their growth process.

This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools. More than 1000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data. We conducted more than 15 detailed primary interviews with the market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Report Features

This report provides market intelligence in the most comprehensive way. The report structure has been kept such that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market. The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

- COVID-19 impact and its recovery curve

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors.

Market Segmentation

This report studies the market, covering a period of 12 years of trend and forecast. The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The rubber additives market is segmented into the following categories:

By Product Type

- Antidegradants

- Accelerators

- Activators

- Vulcanization Inhibitors

- Plasticizers

- Others

By Application Type

- Tires

- Conveyor Belts

- Electric Cables

- Others

By End-Use Industry Type

- Automotive

- Consumer Goods

- Building & Construction

- Electrical Insulation

- Others

By Region

- North America (Country Analysis: the USA, Canada, and Mexico)

- Europe (Country Analysis: Germany, France, the UK, Russia, Spain, and Rest of Europe)

- Asia-Pacific (Country Analysis: China, Japan, India, South Korea, and Rest of Asia-Pacific)

- Rest of the World (Sub-Region Analysis: Latin America, the Middle East, and Others)

Click here to learn the market segmentation details.

Customization Options

Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

- Detailed profiling of additional market players (up to three players)

- SWOT analysis of key players (up to three players)

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Product portfolio, geographical reach, regional presence, and strategic alliances

Custom Research: Stratview Research offers custom research services across the sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to sales@stratviewresearch.com