Market Insights

Global Demand Analysis & Sales Opportunities in Aircraft Nacelle Components Market

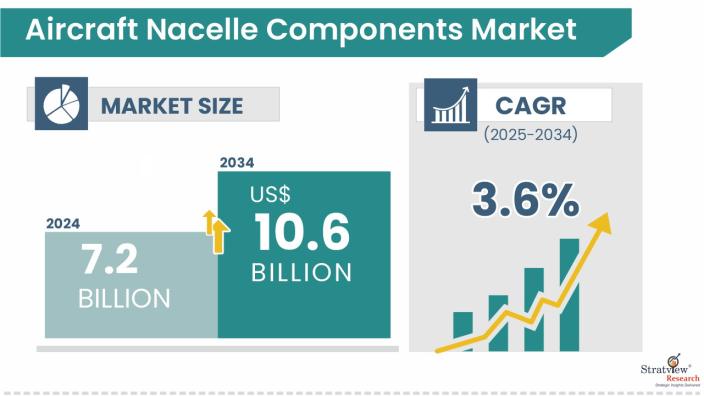

- The annual demand for aircraft nacelle components was USD 7.2 billion in 2024 and is expected to reach USD 7.7 billion in 2025, up 6.7% than the value in 2024.

- During the forecast period (2025-2034), the aircraft nacelle components market is expected to grow at a CAGR of 3.6%. The annual demand will reach USD 10.6 billion in 2034, which is almost 1.5 times the demand in 2025.

- During 2025-2034, the aircraft nacelle components industry is expected to generate a cumulative sales opportunity of USD 93.3 billion, which is more than 2.5 times the opportunities during 2019-2024.

Wish to get a free sample? Click Here

High-Growth Market Segments:

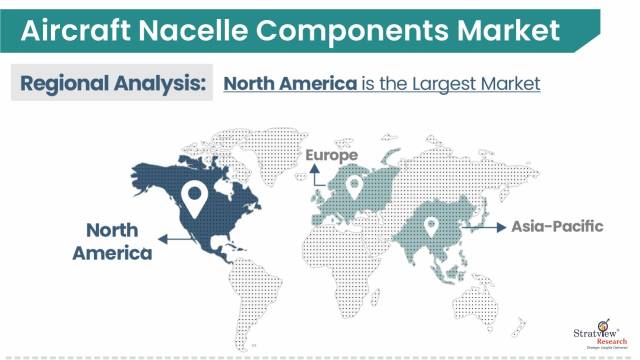

- Asia-Pacific is anticipated to be the fastest-growing market for aircraft nacelle components over the forecast period.

- By aircraft type, Wide-body aircraft are projected to record the highest growth among aircraft types during the forecast period.

- By component type, Thrust reversers are anticipated to continue as the most widely used nacelle component throughout the forecast period.

- By process type, AFP/ATL processes are forecasted to grow at the fastest rate among all the manufacturing methods.

- By material type, Composites are projected to remain the preferred material for manufacturing nacelle components throughout the forecast period.

Market Statistics

Have a look at the sales opportunities presented by the aircraft nacelle components market in terms of growth and market forecast.

|

Aircraft Nacelle Components Market Data & Statistics

|

|

|

Market Statistics

|

Value (in USD Billion)

|

Market Growth (%)

|

|

Annual Market Size in 2023

|

USD 6.0 billion

|

-

|

|

Annual Market Size in 2024

|

USD 7.2 billion

|

YoY Growth in 2024: 19.9%

|

|

Annual Market Size in 2025

|

USD 7.7 billion

|

YoY Growth in 2025: 6.7%

|

|

Annual Market Size in 2034

|

USD 10.6 billion

|

CAGR 2025-2034: 3.6%

|

|

Cumulative Sales Opportunity during 2025-2034

|

USD 93.3 billion

|

|

|

Top 10 Countries’ Market Share in 2024

|

USD 5.8 billion +

|

> 80%

|

|

Top 10 Company’s Market Share in 2024

|

USD 3.6 billion to USD 5.0 billion

|

50% - 70%

|

Market Dynamics

Introduction:

Aircraft nacelle components serve as the protective shell around an aircraft’s engine, playing a vital role in both performance and safety. Aircraft nacelle components include fan cowls, inlet cowls, thrust reversers, and exhaust systems. These components not only guard the engine against outside elements but also help to manage airflow, minimize noise, and incorporate essential functions such as fire protection, de-icing, and thermal management. Aircraft nacelle components are crucial for enhancing aerodynamics, fuel efficiency, and the overall reliability of modern aircraft.

As global air travel evolves, focusing more on regional connections and sustainable practices, the aircraft nacelle components market is experiencing a major shift. It's no longer just about growing air traffic and expanding fleets, as the market is also being influenced by the rise of advanced propulsion systems, like hybrid-electric and ultra-high-bypass engines. These technologies require next-gen nacelle designs that can manage new thermal and acoustic challenges.

At the same time, the aerospace supply chain is evolving, embracing digital manufacturing and stricter sustainability standards. Nacelle manufacturers are rethinking their approach to design and build these components, taking into account everything from carbon emissions over the product’s life to the use of recyclable or circular materials. The combination of environmental concerns, new engine technologies, and growing demands for efficiency are reshaping the role of nacelle components in the aircraft of the future.

Segments Analysis

|

Segmentations

|

List of Sub-Segments

|

Dominant and Fastest-Growing Segments

|

|

Aircraft-Type Analysis

|

Narrow-Body Aircraft, Wide-Body Aircraft, Regional Aircraft, Military Aircraft, and General Aviation

|

Wide-body aircraft is projected to record the highest growth among aircraft types during the forecast period.

|

|

Component-Type Analysis

|

Inlet Cowl, Fan Cowl, Thrust Reverser, and Other Components

|

Thrust reversers are anticipated to continue as the most widely used nacelle component throughout the forecast period.

|

|

Process-Type Analysis

|

Hand Layup, Resin Infusion, AFP/ATL, Machining/Forming, and Other Processes

|

AFP/ATL processes are forecasted to grow at the fastest rate among all the manufacturing methods.

|

|

Material-Type Analysis

|

Composites, Nickel & Alloys, Titanium & Alloys, and Other Materials

|

Composites are projected to remain the preferred material for manufacturing nacelle components throughout the forecast period.

|

|

Regional Analysis

|

North America, Europe, Asia-Pacific, and The Rest of the World

|

Asia-Pacific is anticipated to be the fastest-growing market for aircraft nacelle components over the forecast period.

|

By Aircraft Type

“Narrow-body aircraft are likely to retain their leading position, whereas wide-body aircraft are expected to register the fastest growth.”

- The aircraft nacelle components market is segmented by aircraft type into narrow-body aircraft, wide-body aircraft, regional aircraft, military aircraft, and general aviation.

- Narrow-body aircraft, commonly used for short- to medium-haul flights, dominate the market due to their extensive use by airlines around the world. These aircraft usually feature smaller aircraft nacelle components that are built to be efficient and reliable. The demand for aircraft nacelle components in narrow-body aircraft is growing because airlines want fuel-efficient solutions and reduced costs and still want to meet the operational requirements of airlines while ensuring passenger comfort and safety.

- The wide-body aircraft, mainly utilized for long-haul and international flights, are projected to be the fastest-growing aircraft type. These aircraft require more extensive and advanced aircraft nacelle components that can support multiple engines while ensuring top-notch performance in various flight conditions. The fleet expansions, modernization initiatives, and the introduction of next-generation aircraft that boast cutting-edge nacelle technologies drive the demand for advanced aircraft nacelle components in wide-body aircraft.

By Component Type

“Thrust reversers are projected to continue as the most widely used component, while inlet cowls are expected to witness the highest growth rate during the forecast period.”

- Based on Component type, the aircraft nacelle components market is segmented into inlet cowl, fan cowl, thrust reverser, and other component types.

- The thrust reverser is expected to remain dominant throughout the forecast period. They play a key role in helping aircraft decelerate upon landing, which improves safety and reduces wear on the brakes, making them a critical component across both commercial and military aviation. Their widespread use, along with the fact that they need to be replaced relatively often, further reinforces their dominant position in the market.

- On the other hand, inlet cowls are expected to be the fastest-growing component, mainly driven by advancements in aerodynamics and engine integration, as well as the need for lighter and more efficient nacelle structures. Inlet cowls help guide airflow into the engine and are increasingly being reengineered using advanced materials to improve fuel efficiency and reduce noise. This aligns perfectly with the industry’s broader goals of improving performance while also becoming more sustainable.

- Several leading manufacturers offer advanced thrust reverser and inlet cowl systems, such as the O-Duct thrust reverser offered by Safran Nacelles for the COMAC C919; Spirit AeroSystems provides composite nacelle systems for the Boeing 737 MAX, which include thrust reversers designed for enhanced fuel efficiency; Nexcelle, a joint venture of Safran & ST Engineering, provides inlet cowls for the LEAP-1C engine; and Collins Aerospace supports the A320neo with advanced nacelle components, including inlet cowls.

By Process Type

“Hand layup is expected to remain the primary process type and dominate the market, whereas AFP/ATL is forecasted to witness the fastest growth.”

- The market is segmented into the hand layup, resin infusion, AFP/ATL, machining/forming, and other processes.

- Hand Layup is expected to remain the leading process type as it is the simplest method of composite processing. It involves manually layering reinforcement materials and resin onto an open mold, followed by rolling and curing to create the desired composite part. This method is often used for medium-volume production and allows for tailored properties and complex shapes. Many manufacturers continue to rely on hand layups because they offer flexibility in fabrication and require lower upfront investment.

- The AFP/ATL processes are expected to witness the fastest growth during the forecast period. As demand for higher production rates, greater precision, and weight reduction increases, especially in newer aircraft programs, automation is becoming more attractive. Modern aerospace manufacturing is adopting the AFP/ATL processes due to the benefits they offer, such as better manufacturing speed, lower material waste, and improved consistency.

By Material Type

“Composites are projected to remain the most commonly used material, whereas titanium & alloys are projected to experience the highest growth rate.”

- The market is segmented into composites, nickel & alloys, titanium & alloys, and other materials.

- Composites are expected to continue being the most preferred material in the aircraft nacelle components market as they allow for more complex designs, reduced part count, and better aerodynamic performance compared to traditional metals. Composites are extensively used to produce aircraft nacelle components like fan cowls, inlet cowls, and thrust reversers due to their strength-to-weight ratio, corrosion resistance and ability to withstand extreme temperatures, making them ideal for improving fuel efficiency and reducing overall aircraft weight.

- On the other hand, titanium & alloys are projected to experience the fastest growth, mainly due to their exceptional heat resistance and durability, making it well-suited for high-stress areas near the engine. With advancements in manufacturing techniques and increased focus on high-performance materials for modern aircraft, titanium is becoming a more viable and attractive option for nacelle component manufacturers.

Regional Analysis

“North America is likely to retain its dominant share of the market, whereas Asia-Pacific is projected to see the most significant growth during the forecast period.”

- North America is expected to remain the largest market for aircraft nacelle components during the forecast period. This is mainly because North America is home to some of the major aircraft manufacturers, suppliers, and research institutions in the world, making it a well-established aerospace industry in the region. A strong emphasis on innovation, along with high defense spending and advanced manufacturing capabilities, leads to the development of high-quality, high-performance nacelle components.

- Meanwhile, the Asia-Pacific region is expected to grow at the fastest rate during the same period. Countries like China, India, and Japan are making big investments to build up their aerospace industries, both for commercial airlines and military needs. This growth is driven by increasing air traffic, a growing middle class, and a rising number of aircraft being purchased. All these factors generate a strong demand and future growth opportunity for nacelle components.

Know the high-growth countries in this report. Register Here

Competitive Landscape

The market is highly concentrated, with the top 3 players grabbing healthy market share. Most of the major players compete on some of the governing factors, including technological innovation, price, Component offerings, regional presence, etc. The following are the key players in the aircraft nacelle components market.

- Collins Aerospace

- Safran S.A.

- Spirit Aerosystems Holding, Inc.

- Melrose Industries (GKN Aerospace)

- Leonardo S.p.A

- The Nordam Group, Inc.

- GE Aviation

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Please write to us at sales@stratviewresearch.com

Recent Developments/Mergers & Acquisitions:

A moderate number of strategic alliances, including M&As, JVs, etc., have been performed over the past few years:

- In April 2019, ST Engineering North America acquired Middle River Aerostructure Systems (MRAS), a key player in nacelle systems, thrust reversers, and other aerospace components.

- In April 2019, The Carlyle Group acquired StandardAero, one of the world's largest independent providers of services, including engine and airframe maintenance, repair, and overhaul, engine component repair, engineering services, interior completions, and paint applications.

- In October 2020, Spirit AeroSystems acquired the select assets of Bombardier aerostructures and aftermarket services businesses in Belfast, Northern Ireland (known as Short Brothers); Casablanca, Morocco; and Dallas, United States.

Report Features

This report provides market intelligence most comprehensively. The report structure has been kept so that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market.

The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

- COVID-19 impact and its recovery curve.

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors.

|

Market Study Period

|

2019-2034

|

|

Base Year

|

2024

|

|

Forecast Period

|

2025-2034

|

|

Trend Period

|

2019-2023

|

|

Number of Tables & Figures

|

>100

|

|

Number of Segments Analysed

|

5 (Component Type, Aircraft Type, Process Type, Material Type, and Region)

|

|

Number of Regions Analysed

|

4 (North America, Europe, Asia-Pacific, Rest of the World)

|

|

Countries Analysed

|

15 (The USA, Canada, Mexico, Germany, France, Italy, The UK, China, Japan, India, Brazil, Saudi Arabia, Rest of Europe, Rest of APAC, and Rest of the World)

|

|

Free Customization Offered

|

10%

|

|

After Sales Support

|

Unlimited

|

|

Report Presentation

|

Complimentary

|

|

Market Dataset

|

Complimentary

|

|

Further Deep Dive & Consulting Services

|

10% Discount

|

Market Segmentation

This report studies the market, covering a period of 15 years of trend and forecast. The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The aircraft nacelle components market is segmented into the following categories.

Aircraft Nacelle Components Market, by Aircraft Type

- Narrow-Body Aircraft (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Wide-Body Aircraft (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Regional Aircraft (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Military Aircraft (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- General Aviation (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

Aircraft Nacelle Components Market by Component Type

- Inlet Cowl (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Fan Cowls (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Thrust Reverser (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Exhaust Systems (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Other Component Types (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

Aircraft Nacelle Components Market, by Process Type

- Hand Layup (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Resin Infusion (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- AFP/ATL (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Machining/Forming (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Other Processes (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

Aircraft Nacelle Components Market, by Material Type

- Composites (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Nickel & Alloys (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Titanium & Alloys (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Other Materials (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

Aircraft Nacelle Components Market, by Region

- North America (Country Analysis: The USA, Canada, and Mexico)

- Europe (Country Analysis: Germany, France, The UK, Russia, and The Rest of Europe)

- Asia-Pacific (Country Analysis: Japan, China, India, and The Rest of the Asia-Pacific)

- Rest of the World (Country Analysis: Saudi Arabia, Brazil, and Others)

Research Methodology

- This strategic assessment report from Stratview Research provides a comprehensive analysis that reflects today’s aircraft nacelle components market realities and future market possibilities for the forecast period.

- The report segments and analyzes the market in the most detailed manner in order to provide a panoramic view of the market.

- The vital data/information provided in the report can play a crucial role for market participants and investors in identifying the low-hanging fruit available in the market and formulating growth strategies to expedite their growth process.

- This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools.

- More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data.

- We conducted more than 15 detailed primary interviews with market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respected clients:

Company Profiling

- Detailed profiling of additional market players (up to three players)

- SWOT analysis of key players (up to three players)

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Service portfolio, geographical reach, regional presence, and strategic alliances

Custom Research: Stratview Research offers custom research services across industries. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to sales@stratviewresearch.com