Market Insights

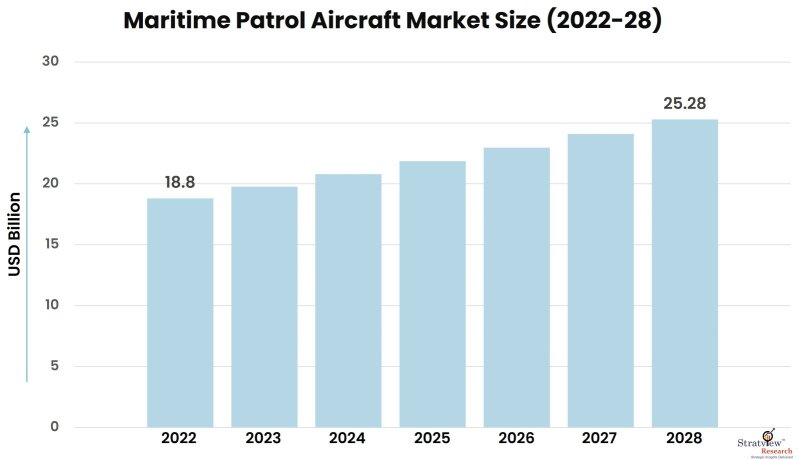

The maritime patrol aircraft market was estimated at USD 18.8 billion in 2022 and is likely to grow at a CAGR of 5.04% during 2023-2028 to reach USD 25.28 billion in 2028.

Want to know more about the market scope? Register Here

Market Dynamics

Introduction

Maritime patrol aircraft, also known as maritime reconnaissance aircraft, refers to a craft that is specifically designed to operate over water to assist smooth proceedings for anti-ship warfare, anti-submarine warfare (ASW), and search & rescue (SAR). The aircraft includes data links, sensors, infrared cameras, over-the-horizon communications systems, and several air-deployable measuring buoys. These aircraft offer security, technical support availability, reliability, flexibility, and scalability at a cost-effective price. Currently, the maritime patrol aircraft are available in armored and unarmored variations.

COVID-19 Impact

The impact of COVID-19 on the overall market revenue is deemed to be less. Manufacturing delays hit the industry for a short duration between 2020 and 2021. However, a boost in the requirements for rescue & airlifting operations and emergency medical services for COVID-19 patients in the coastal areas created a splurge in demand for maritime patrolling aircraft during this period.

Market Drivers

Rising terrorism occurrences along with growing border skirmishes between countries is one of the Key factors driving the growth of the global maritime patrol aircraft. Further, the utilization of maritime patrol aircraft in protecting the maritime trade routes and exposing illegal cross-border activities such as smuggling is positively impacting the market growth. Additionally, government initiatives and investments in strengthening the defense sector are boosting market growth.

The introduction of next-gen turbo-powered maritime patrol aircraft for surveillance is acting as another growth-inducing factor for the market. These upgraded aircraft possess characteristics such as lower fuel burn rates and higher engine efficiency. Further, strategic collaborations between regulatory bodies and the top industry players for introducing advanced product ranges with significant technological improvements and extensive R&D activities are expected to create a positive impact on the worldwide maritime patrol aircraft market. The rapid modernization of the existing maritime patrol aircraft fleet is also fuelling growth. However, currently, several manufacturers of these aircraft are finding it difficult to stay up-to-date with the technological advancements due to the high price associated with such upgrades and replacements. Such high-cost entry and expansion barriers along with the ever-changing technology requirements are expected to hamper the market growth.

Want to have a closer look at this market report? Click Here

Recent Developments

There have been several developments in the defense industry directed at maritime patrol aircraft in recent years, which would boost the overall market. Some of them are:

- Countries across the world are increasing their pace of defense acquisition to safeguard their borders. For example, in March 2020, South Korea confirmed the order of 6 Boeing P-8 maritime patrol and reconnaissance jets, which will be delivered by the end of 2022. The acquisition was in seen as a response to aggressive missile testing activities carried out in North Korea.

- In December 2019, China initiated mass production of special mission aircraft including electronic warfare aircraft, early warning aircraft, surveillance aircraft, anti-submarine aircraft, and a range of warplanes. After achieving the target manufacturing capabilities, China plans to establish a full information system to increase its self-reliance in the defense sector.

- In October 2021, the Indian Navy received the 11th anti-submarine warfare aircraft P-8I from Boeing. The Ministry of Defense had first signed a contract for eight P-8I aircraft in 2009. Later, in 2016, it signed a contract for four additional P-8I aircraft.

- In December 2021, the French Defense Procurement Agency DGA took delivery of the sixth Atlantique 2 (ATL2) maritime patrol aircraft. This aircraft is equipped with technologies like the new search master radar, which utilizes Thales’ active antenna technology developed for the Rafale.

- In June 2022, Germany announced its plans to use the Euro 100 billion special arms fund to buy additional Boeing P-8A Poseidon maritime patrol aircraft.

Segment Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High Growth Opportunity

|

|

Engine Type Analysis

|

Jet Engine and Turboprop Engine

|

The jet engine is expected to be the largest segment in the market.

|

|

Aircraft Type Analysis

|

Armored and Unarmored

|

The armored segment is expected to dominate the global maritime patrol aircraft market during the forecast period.

|

|

Platform Type Analysis

|

Fixed Wing and Rotary Wing

|

The fixed-wing segment is expected to dominate the global market.

|

|

Regional Analysis

|

North America, Europe, Asia-Pacific, and Rest of the World

|

North America was the largest maritime patrol aircraft market in 2022 and is forecast to grow at a decent pace during the forecast period.

|

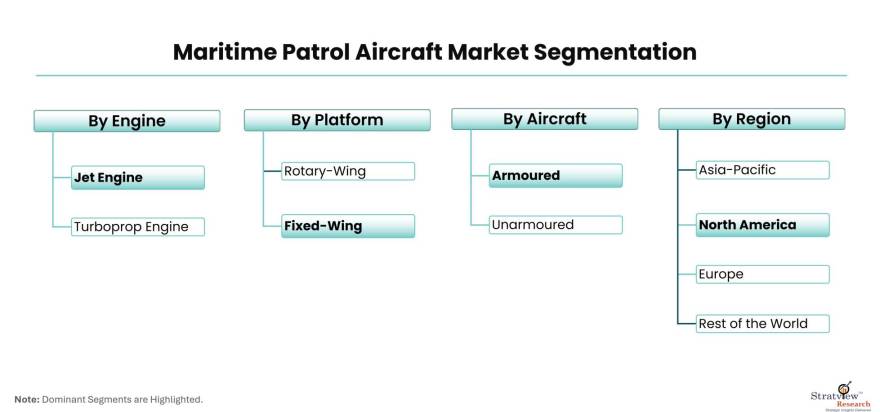

By Engine Type

Based on engine type, the maritime patrol aircraft market is divided into jet engines and turboprop engines. The jet engine is expected to be the largest segment in the market owing to the growing demand for these aircraft while the turboprop engine segment is expected to be the fastest-growing segment in the market.

By Aircraft Type

Based on aircraft type, the market is segmented into armored and unarmoured aircraft. The armored segment is expected to dominate the global maritime patrol aircraft market during the forecast period.

By Platform Type

Based on platform type, the market is segmented into fixed-wing and rotary-wing. The fixed-wing segment is expected to dominate the global market owing to the increased defense requirements for combat and surveillance.

Regional Insights

Region-wise, North America was the largest maritime patrol aircraft market in 2022 and is forecast to grow at a decent pace during the forecast period. This is due to the high defense budget, technological advancements, favorable regulations, and presence of key manufacturers in the region. However, Asia-Pacific is expected to witness the fastest demand growth by 2028 owing to the surge in investments in the defense sector, rise in terrorism activities in neighboring countries, and unstable socio-political scenarios in the region. Further, emerging economies in the region such as India and China are also investing heavily in these maritime aircraft, apart from modernizing their existing military equipment. Japan is another key market in the Asia-Pacific region.

Know the high-growth countries in this report. Click Here

Key Players

The following are the major players in the maritime patrol aircraft market:

- Airbus S.A.S

- Boeing

- Lockheed Martin Corporation

- Saab AB

- BAE Systems plc

- Leonardo S.p.A

- Thales Group

- Kawasaki Heavy Industries, Ltd

- Dassault Aviation

- Textron Inc.

- RUAG International Holding

- Israel Aerospace Industries, Inc.

- Diamond Aircraft Industries

- Embraer

- Harbin Aircraft Industry

There is stiff competition in the maritime patrol aircraft market. The growth of the companies is directly dependent on industry conditions and government support. These companies differentiate their offerings on the basis of their quality and their penetration in the target and emerging markets. Also, there have been some major developments in the industry landscape in recent years, which significantly influenced the competitive dynamics. For example:

- In June 2019, Lockheed Martin introduced a maritime patrol aircraft retrofit kit for C-130 Hercules. The kit includes a nose-mounted electro-optical/infrared camera, multi-mode radar, wing-tip-mounted electronic support measures, a magnetic anomaly detector boom on the tail, and droppable sonar buoys.

- In September 2019, India made a $ 3.1 billion deal with the US to acquire maritime aircraft for its Navy to enhance its surveillance capabilities in the Indian Ocean Region.

- In February 2022, Textron Aviation was awarded a US$ 11.4 million contract for the new Beechcraft King Air 360ER aircraft as part of a foreign military sale to Sri Lanka. The twin-turboprop aircraft – whose number was unspecified in the announcement – will be operated by the Sri Lanka Air Force (SLAF) as a maritime patrol platform.

- In February 2022, Boeing announced the delivery of the 12th P-8I maritime patrol aircraft to the Indian Navy. The MPA can be used for disaster relief and humanitarian operations and has antisubmarine warfare (ASW) capabilities. Boeing also provides the Indian Navy flight personnel with P-8I training, spare parts, and field service representative assistance, and ground support equipment.

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Write to us at sales@stratviewresearch.com

Research Methodology

- This strategic assessment report from Stratview Research provides a comprehensive analysis that reflects maritime patrol aircraft market realities and future market possibilities for the forecast period.

- The report segments and analyzes the market in the most detailed manner in order to provide a panoramic view of the market.

- The vital data/information provided in the report can play a crucial role for market participants as well as investors in the identification of the low-hanging fruits available in the market as well as to formulate growth strategies to expedite their growth process.

- This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools.

- More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data.

- We conducted more than 15 detailed primary interviews with market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Report Features

This report provides market intelligence in the most comprehensive way. The report structure has been kept such that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market. The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

- COVID-19 impact and its recovery curve

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors.

Market Segmentation

This report studies the market covering a period of 12 years of trend and forecast. The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The maritime patrol aircraft market is segmented into the following categories:

By Aircraft Type

By Engine Type

- Jet Engine

- Turboprop Engine

By Component Type

By Platform Type

By Region

- North America (Country Analysis: the USA, Canada, and Mexico)

- Europe (Country Analysis: Germany, France, the UK, Russia, Spain, and Rest of Europe)

- Asia-Pacific (Country Analysis: China, Japan, India, South Korea, and Rest of Asia-Pacific)

- Rest of the World (Sub-Region Analysis: Latin America, the Middle East, and Others)

Click Here, to learn the market segmentation details.

Report Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

- Detailed profiling of additional market players (up to 3 players)

- SWOT analysis of key players (up to 3 players)

Market Segmentation

- Current market segmentation of any one of the engine types by platform type.

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Product portfolio, geographical reach, regional presence, and strategic alliances.

Custom Research: Stratview Research offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to sales@stratviewresearch.com.