Market Insights

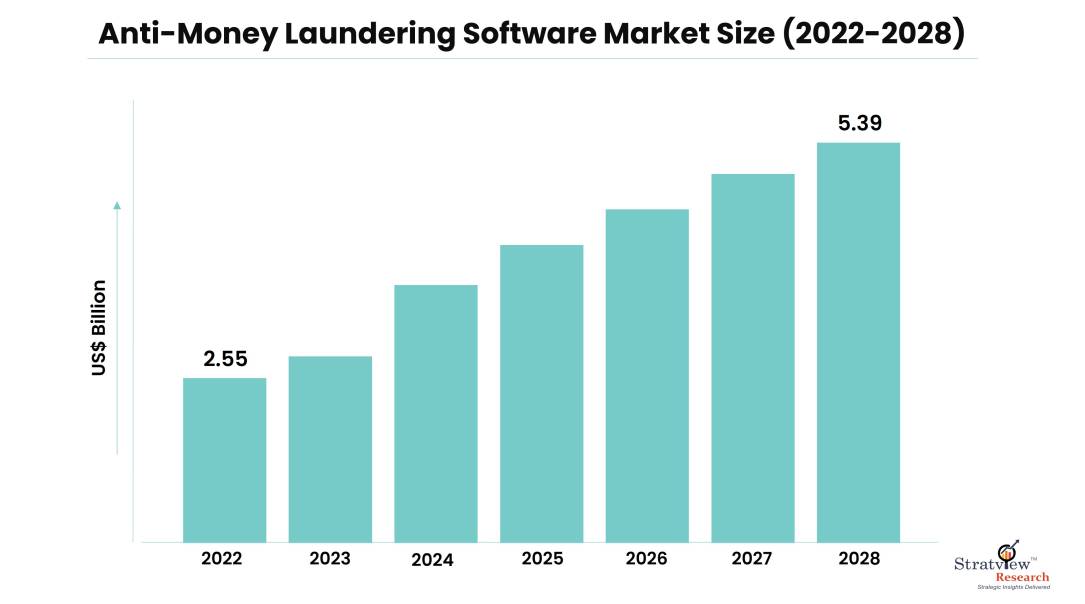

The anti-money laundering software market is estimated to grow from USD 2.55 billion in 2022 to USD 5.39 billion by 2028 at a CAGR of 13.20% during the forecast period.

Wish to get a Free Sample? Register Here.

What is Anti-Money Laundering Software?

Anti-money laundering software can be defined as software that is used across industries to meet legal requirements and other regulated entities to prevent money laundering activities. Based on product, anti-money laundering software can be categorized as transaction monitoring, currency transaction reporting, customer identity management, and compliance management.

|

Anti-Money Laundering Software Market Reports Overview

|

|

Market Size in 2028

|

USD 5.39 Billion

|

|

Market Size in 2022

|

USD 2.55 Billion

|

|

Market Growth (2023-2028)

|

CAGR of 13.20%

|

|

Base Year of Study

|

2022

|

|

Trend Period

|

2017-2021

|

|

Forecast Period

|

2023-2028

|

Key Players

The following are some of the key players operating in the anti-money laundering software market are-

- Accenture plc (Ireland)

- SAS Institute (US)

- Fiserv, Inc. (US)

- OpenText Corporation (Canada)

- Experian Information Solutions, Inc. (US)

- Oracle Corporation (US)

- FICO TONBELLER (Germany)

- Ascent Business (India)

- EastNets (UAE)

- Trulioo (US)

- BAE Systems plc (UK)

- ACI Worldwide, Inc. (US)

- NICE Actimize (US)

- Verafin Inc. (Canada)

- LexisNexis (US)

Market Dynamics

The growth of the anti-money laundering software market is primarily driven by:

- Increasing unstructured data: Financial institutions must comply with strict anti-money laundering regulations, which require monitoring and analyzing large amounts of unstructured data, which can be automated using anti-money laundering software.

- Increasing money laundering across verticals: Money laundering is a global issue affecting various sectors, including banking, real estate, gaming, trade, and charities, with an increasing incidence in recent years.

- Increasing product adoption in the end-use industries: The increasing adoption of AML software in end-use industries is expected to create lucrative opportunities for market players in the coming years.

- Complexity of AML regulations: AML regulations are constantly evolving due to changing criminal methods, making compliance challenging for financial institutions and businesses.

_96930.jpg)

To Get the full scope of the report, Register Here.

Opportunities:

- Surge in sophistication of money launderers. Criminals continuously develop new money laundering methods, using complex transactions and shell companies to conceal fund origins, making it challenging for financial institutions and businesses to detect and prevent such activities.

- Increasing technology to facilitate money laundering: Technology, including cryptocurrencies, mobile banking, and darknet markets, is being used by criminals for money laundering, making it challenging for financial institutions and businesses to keep up.

- Increasing demand for AML compliance: Businesses face increased accountability for AML compliance due to increased awareness of money laundering risks, with non-compliance resulting in fines and penalties.

RESTRAINING FACTORS:

High Cost and Operational Process to Hinder the Market Growth

- High software deployment costs and complications hinder early fraud detection while adjusting practices to new, untested systems or technology solutions creates operational challenges.

- Small & medium-sized fintech companies often struggle to estimate the effectiveness of advanced solutions among competing vendors, posing significant operational challenges.

The growth of the anti-money laundering software market may be hindered by the aforementioned factors.

Segment Analysis

Component Trends

The market has been segmented into software & service, Under these, The software segment occupied a significant share of the market in 2022 & is expected to grow at a robust CAGR during the forecast period.

AML software can assist financial institutions in detecting, investigating, and reporting suspicious transactions by analyzing vast amounts of data using complex algorithms and machine-learning techniques. The integration of anti-money laundering software with financial systems and tools such as payment systems and risk management solutions increased demand for the software market even further. These technologies can also assist institutions in meeting regulatory requirements, lowering the risk of financial penalties and reputational harm. Furthermore, the increasing usage of artificial intelligence and big data analytics in AML software is predicted to drive segment growth in the coming years.

Product Trends

The market has been bifurcated into transaction monitoring, currency transaction reporting, customer identity management, and compliance management. The transaction monitoring segment dominated the market with the highest share in 2022 & is expected to remain dominant during the forecast period. Transaction monitoring is an important component of AML compliance programs since it enables financial institutions to monitor and analyze all transactions in real-time. Suspicious transactions can be flagged by transaction monitoring software based on predefined risk indicators such as odd transaction quantities or patterns. This product category is critical for identifying and stopping money laundering, terrorist financing, and other financial crimes that might jeopardize the financial system, which drives their acceptance in the anti-money laundering market.

Deployment Trends

The market has been bifurcated into Cloud and on-premise. Under these, the cloud segment held the largest share in 2022 and is anticipated to grow with the highest CAGR during the projection period. Because of the enhanced efficiency and low cost of developing an IT infrastructure, the cloud-based approach is likely to grow. Furthermore, cloud-native software gives firms additional options for combating financial crime. Furthermore, the software-as-a-service model allows for greater scalability, efficiency, and price flexibility.

End User Trends

The market has been segmented into BFSI, defense and government, healthcare, IT and telecom, retail, transportation and logistics, and others. The BFSI segment held the largest share of the market in 2022 & is projected to register a significant CAGR during the review period. The healthcare segment is expected to register significant growth during the review period.

Regional Insight

North American anti-money laundering software market accounted for the largest market share in 2022 and is expected to register a significant CAGR during the review period. The market growth can be attributed to widespread product use in the end-use industries coupled with the presence of key market players such as SAS Institute (US) and Fiserv, Inc. (US). The market in Asia-Pacific is expected to be driven by increasing product adoption across industries in developing countries, particularly China and India.

Want to know which region offers the best growth opportunities? Register Here.

Segmentation

This report studies the market covering a period of 12 years of trend and forecast. The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The anti-money laundering software market is segmented into the following categories.

By Component type

By Product type

- Transaction Monitoring

- Currency Transaction Reporting

- Customer Identity Management

- Compliance Management

By Deployment type

By End User type

- BFSI

- Defense and Government

- Healthcare

- IT and Telecom

- Retail

- Transportation and Logistics

- Others

By Region

- North America (Country Analysis: The USA, Canada, and Mexico)

- Europe (Country Analysis: Germany, France, The UK, Russia and Rest of Europe)

- Asia-Pacific (Country Analysis: China, India, Australia, South Korea, and Rest of Asia-Pacific

- Rest of the World (Country Analysis: Saudi Arabia, Brazil, and Others)

Report Features

This report provides market intelligence in the most comprehensive way. The report structure has been kept such that it offers maximum business value. It provides critical insights into the market dynamics and will enable strategic decision-making for the existing market players as well as those willing to enter the anti-money laundering software market.

What Deliverables Will You Get in this Report?

|

Key questions this report answers

|

Relevant contents in the report

|

|

How big is the sales opportunity?

|

In-depth Analysis of the anti-money laundering software market

|

|

How lucrative is the future?

|

The market forecast and trend data and emerging trends

|

|

Which regions offer the best sales opportunities?

|

Global, regional, and country-level historical data and forecasts

|

|

Which are the most attractive market segments?

|

Market segment analysis and Forecast

|

|

Which are the top players and their market positioning?

|

Competitive landscape analysis, Market share analysis

|

|

How complex is the business environment?

|

Porter’s five forces analysis, PEST analysis, Life cycle analysis

|

|

What are the factors affecting the market?

|

Drivers & challenges

|

|

Will I get the information on my specific requirement?

|

10% free customization

|

Research Methodology

This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools. More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles have been leveraged to gather the data. We conducted more than 10 detailed primary interviews with companies across the value chain in all four regions and with industry experts to obtain both qualitative and quantitative insights.

Target Audience

The target audience of the market includes-

- Manufacturers

- Suppliers

- Distributors

- Organizations

- Government bodies

COVID-19 Impact

The COVID-19 outbreak posed significant challenges to industries across geographies. It impacted the growth of the market positively as product adoption increased across enterprises.

Customization Options

Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

- Detailed profiling of additional market players (up to three players)

- SWOT analysis of key players (up to three players)

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Product portfolio, geographical reach, regional presence, and strategic alliances

Custom Research: Stratview Research offers custom research services across the sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected].