Attractive Opportunities

Global Demand Analysis & Sales Opportunities in the Aircraft Seat Market

-

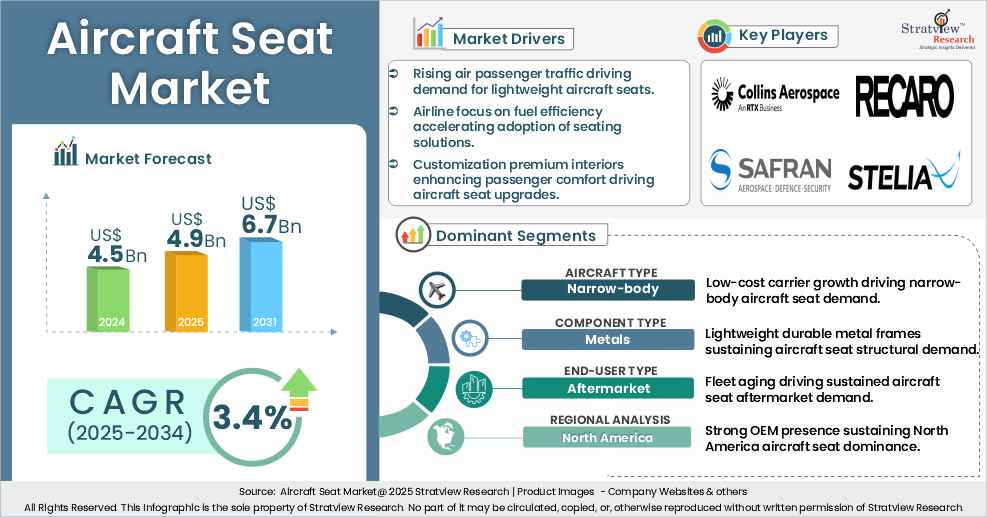

The annual demand for aircraft seats was USD 4.5 billion in 2024 and is expected to reach USD 4.9 billion in 2025, up 9.7% than the value in 2024.

-

During the forecast period (2025-2034), the aircraft seat market is expected to grow at a CAGR of 3.4%. The annual demand will reach USD 6.7 billion in 2034.

-

During 2025-2034, the aircraft seat industry is expected to generate a cumulative sales opportunity of USD 58.8 billion, which is almost 3.5 times the opportunities during 2019-2024.

Want to get a free sample? Register Here

High-Growth Market Segments:

-

North America is projected to retain its supremacy during the forecast period, whereas Asia-Pacific is expected to experience the fastest growth.

-

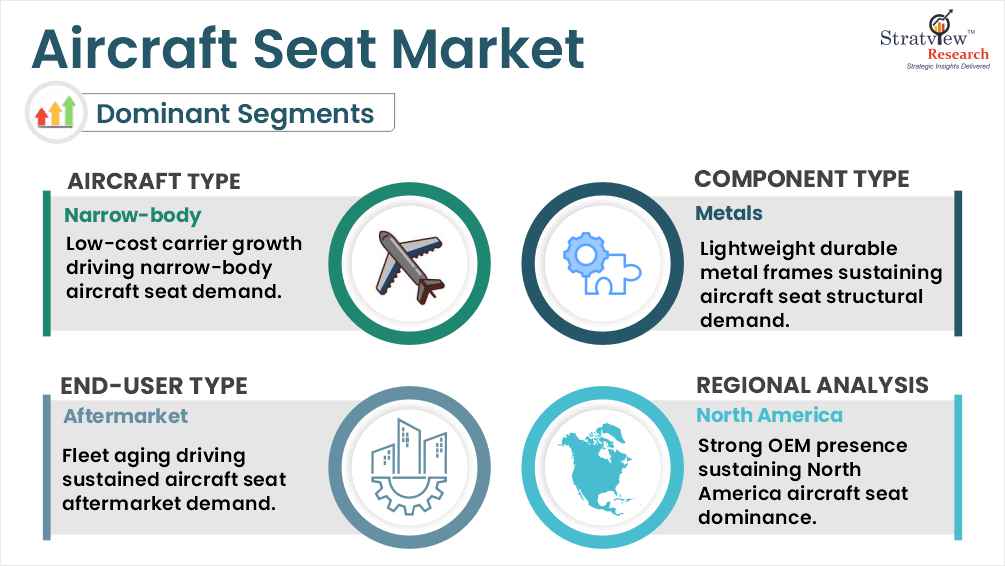

By aircraft type, Narrow-body aircraft are anticipated to drive demand for the aircraft seat market, whereas wide-body aircraft are expected to experience the fastest growth rate in the coming years.

-

By seat class type, Business class seat are anticipated to remain the dominant segment of the aircraft seat market and premium economy seat are expected to witness the fastest growth in the coming years.

-

By component type, Metals are anticipated to maintain their dominance and soft goods are expected to achieve the fastest growth during the forecast period.

-

By sales channel type, BFE is expected to maintain its dominance and achieve faster growth during the study period.

-

By end-user type, Aftermarket is expected to maintain its dominance during the forecast period, whereas OE is likely to be the faster-growing end-user during the same period.

Market Statistics

Have a look at the sales opportunities presented by the aircraft seat market in terms of growth and market forecast.

|

Aircraft Seat Market Data & Statistics

|

|

|

Market Statistics

|

Value (in USD Billion)

|

Market Growth (%)

|

|

Annual Market Size in 2023

|

USD 4.0 billion

|

-

|

|

Annual Market Size in 2024

|

USD 4.5 billion

|

YoY Growth in 2024: 12.3%

|

|

Annual Market Size in 2025

|

USD 4.9 billion

|

YoY Growth in 2025: 9.7%

|

|

Annual Market Size in 2034

|

USD 6.7 billion

|

CAGR 2025-2034: 3.4%

|

|

Cumulative Sales Opportunity during 2025-2034

|

USD 58.8 billion

|

-

|

|

Top 10 Countries’ Market Share in 2024

|

USD 3.6 billion +

|

> 80%

|

|

Top 10 Company’s Market Share in 2024

|

USD 2.2 billion to USD 3.1 billion

|

50% - 70%

|

Aircraft Seat Market Dynamics

What is an aircraft seat?

An aircraft seat is a purpose-built seating system installed in commercial and private aircraft to ensure passenger safety, comfort, and regulatory compliance during flight. Designed to meet strict aviation safety and weight standards, aircraft seats use lightweight, fire-resistant materials, ergonomic cushioning, and integrated restraints such as seat belts. These seats are attached securely to the aircraft structure and play a key role in passenger safety and cabin efficiency.

Market Drivers:

Rising Air Passenger Traffic & Fleet Expansion

-

The growth of global air travel is fueling strong demand for aircraft seats, as airlines expand and modernize fleets to meet rising passenger volumes.

-

According to ACI World, global passenger traffic is projected to exceed 12 billion passengers annually by 2030, prompting fleet expansions. Airbus forecasts over 42,000 new aircraft deliveries between 2024 and 2043, directly increasing requirements for commercial and premium aircraft seating solutions, making this a key driver of the aircraft seat market.

Fleet Modernization & Premium Travel Demand

-

Airlines are increasingly investing in modern aircraft such as the A320neo and Boeing 737 MAX, along with premium seating options like lie-flat business class seats, to enhance passenger comfort and differentiate services.

-

For instance, Qantas has ordered A321XLR aircraft featuring lie-flat seats starting in 2028, reflecting growing market opportunities for aircraft seat manufacturers as airlines prioritize premium cabin upgrades, retrofits, and modernization programs to attract high-value travellers.

Demand for Lightweight Materials & Fuel Efficiency

-

Sustainability goals and rising fuel costs are driving airlines to adopt lightweight materials in aircraft seating. Seats incorporating advanced composites, magnesium frames, and lightweight alloys reduce aircraft weight, improve fuel efficiency, and lower carbon emissions.

-

This trend is particularly relevant for commercial and narrow-body aircraft, positioning lightweight seat innovations as a critical growth driver in the aircraft seat market and encouraging OEMs to develop high-performance, durable, and eco-friendly seating solutions.

Market Challenges:

Stringent Certification and Regulatory Frameworks

-

Stringent certification and regulatory frameworks imposed by authorities such as the FAA and EASA significantly restrain the aircraft seat market by increasing development timelines and compliance costs.

-

Manufacturers must undergo extensive safety testing, documentation, and multi-stage approvals, often requiring repeated design modifications. Navigating varying global regulatory standards further complicates product launches, slowing innovation and delaying the commercialization of advanced aircraft seating solutions.

Market Opportunities:

Advanced Seat Technologies and Connectivity

-

Advanced seat technologies and connectivity are emerging as a major growth opportunity in the aircraft seat market, as airlines integrate smart features such as wireless charging, IoT-enabled sensors, and personalized entertainment controls.

-

Connected aircraft seats enhance passenger comfort while enabling predictive maintenance and data-driven services, driving strong demand for digitally integrated and next-generation cabin seating solutions.

Segments' Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High Growth Opportunity

|

|

By Aircraft Type Analysis

|

Narrow-Body Aircraft, Wide-Body Aircraft, Regional Aircraft, and Business Jets

|

Narrow-body aircraft are anticipated to drive demand for the aircraft seats market, whereas wide-body aircraft are expected to experience the fastest growth rate in the coming years.

|

|

By Seat Class Type Analysis

|

First-Class, Business-Class, Premium-Economy-Class, and Economy-Class.

|

Business class seats are anticipated to remain the dominant segment of the aircraft seats market and premium economy seats are expected to witness the fastest growth in the coming years.

|

|

By Component Type Analysis

|

Soft Goods, Metals, Composites, and Electric

|

Metals are anticipated to maintain their dominance and soft goods are expected to achieve the fastest growth during the forecast period.

|

|

By Sales Channel Type Analysis

|

BFE and SFE

|

BFE is expected to maintain its dominance and achieve faster growth during the study period.

|

|

By End-User Type Analysis

|

OE and Aftermarket

|

Aftermarket is expected to maintain its dominance during the forecast period, whereas OE is likely to be the faster-growing end-user during the same period.

|

|

By Region Analysis

|

North America, Europe, Asia Pacific, and Rest of The World

|

North America is projected to retain its supremacy during the forecast period, whereas Asia-Pacific is expected to experience the fastest growth.

|

Aircraft Insights

"Narrow-body aircraft segment accounted for the largest market share."

-

The market is bifurcated into narrow-body aircraft, wide-body aircraft, regional aircraft, and business jets.

-

Narrow-body aircraft are expected to remain dominant and wide-body to be the fastest-growing aircraft type of the market during the forecast period. The demand for aircraft seats in narrow-body aircraft is expected to remain the largest in the foreseeable future, driven by factors such as new narrow-body aircraft programs, anticipated increases in production rates of key models, and a recovering aftermarket.

-

Over the past decade, newer generation narrow-body aircraft have seen significant demand, driven by growing air passenger traffic and the increasing popularity of the low-cost carrier business model. According to the International Air Transport Association (IATA), each new generation of aircraft offers a 20% improvement in fuel efficiency.

Seat-Class Insights

"The business class seat segment accounted for the largest market share."

-

The market is bifurcated into first-class, business-class, premium-economy-class, and economy-class.

-

Business class seats are projected to remain dominant in the aircraft seat market, while premium economy seats are anticipated to experience the fastest growth in the years ahead. Business class seats cater to corporate travelers, affluent individuals, and passengers seeking enhanced comfort. These groups are willing to pay a premium for added amenities.

-

Airlines are increasingly investing in upgrading their business class offers to differentiate themselves in a competitive market, fueling demand for these seats. Premium economy bridges the gap between economy and business class, offering more comfort at a slightly higher price. This makes it appealing to middle-income travelers seeking better experiences without the steep cost of business class.

Want to get a free sample? Register Here

Component Insights

"Metals segment accounted for the largest market share."

-

The market is segmented into soft goods, metals, composites, and electric.

-

Metals are expected to remain the dominant component of the aircraft seat market, and soft goods to be the fastest-growing component of the market during the forecast period. Metals are the dominant material in the aircraft seat market, particularly for various small and mid-sized parts used in seat construction.

-

Aircraft seat frames are typically constructed using aluminum alloys, which ensure durability and lightweight properties. For instance, Airbus and Boeing use metal frames in their economy and business class seats to maintain balance between weight and strength. Airlines are prioritizing comfort, especially in premium segments, by using advanced materials such as memory foam and moisture-wicking fabrics.

End-User Insights

"Aftermarket segment accounted for the largest market share."

-

The market is segmented as OE and aftermarket. Aftermarket is expected to remain dominant, and OE to be the faster-growing end-user type of the market during the forecast period.

-

High demand for new aircraft from developing nations, upcoming aircraft programs, and the rapid rebound in air passenger traffic are factors offering faster growth in the market at the OE level.

Regional Insights

"North America accounted for the largest market share."

-

The market is segmented as North America, Europe, Asia-Pacific, and Rest of the World.

-

North America is expected to remain the dominant region in the market, holding a share of more than 40%. Leading aircraft seat manufacturers have a strong presence in North America, both in terms of manufacturing and sales, to capitalize on market growth.

-

Asia-Pacific is expected to experience the highest growth in the aircraft seat market during the forecast period. Growth in the region is driven by indigenous commercial and regional aircraft programs, such as the COMAC C919. China, Japan, and India are the major markets in Asia-Pacific and will continue to drive growth in the region in the coming years.

Want to get a free sample? Register Here

Competitive Landscape

Among the aircraft industry value chain, interiors are believed to be the segment that recorded the highest numbers of M&As over the past decade, especially keeping the number of players in mind. Other aerospace industry stakeholders, especially the tier players, seemed interested in acquiring the key interior suppliers. As a result, both aerospace giants (Zodiac Aerospace and B/E Aerospace) were acquired by Safran and Collins Aerospace, respectively. The following are some of the key players in the aircraft seats market.

-

Collins Aerospace

-

Safran S.A.

-

Recaro Aircraft Seating GmbH & Co. KG

-

Airbus Atlantic (STELIA Aerospace)

-

AVIC Cabin Systems Limited

-

Haeco Cabin Solutions

-

Adient Aerospace LLC

-

Geven S.p.A.

-

Acro Aircraft Seating Ltd.

-

Aviointeriors S.p.A.

-

Expliseat SAS

-

Jamco Corporation

-

Mirus Aircraft Seating Ltd

-

Zim Flugsitz GmbH

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Write to us at [email protected]

Recent Developments/Mergers & Acquisitions:

-

In November 2025, Emirates Airlines and Safran Seats signed a Memorandum of Understanding (MoU) to establish a new aircraft seat manufacturing and assembly facility in Dubai by 2027. The facility will initially support business and economy class seat production for fleet retrofit programs, with future expansion into line-fit seat manufacturing, strengthening regional aircraft interior supply chains.

-

In November 2025, Jazeera Airways received Expliseat’s TiSeat 2X and TiSeat 2X Prime lightweight aircraft seats for its A320 fleet. The installation reduces aircraft weight by approximately 1.2 metric tons, improving fuel efficiency and cutting CO₂ emissions by up to 126 kg per flight hour, highlighting sustainability-driven seat innovation.

-

In October 2025, Astronics Corporation completed the acquisition of Bühler Motor Aviation, expanding its capabilities in seat actuation systems and motion control technologies for commercial aircraft seating. This strategic move strengthens Astronics’ position in the aircraft seat components and smart seating solutions market.

-

In May 2025, RECARO Aircraft Seating secured a line-fit agreement with Thai Airways International for its R3 economy-class aircraft seats on the Airbus A321neo fleet, with deliveries starting in late 2025. The seats feature enhanced ergonomics, lightweight structures, and improved passenger comfort, supporting fleet modernization initiatives.

Report Features

This report provides market intelligence most comprehensively. The report structure has been kept so that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market.

The following are the key features of the report:

-

Market structure: Overview, industry life cycle analysis, supply chain analysis.

-

Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

-

Market trend and forecast analysis.

-

Market segment trend and forecast.

-

Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

-

COVID-19 impact and its recovery curve.

-

Attractive market segments and associated growth opportunities.

-

Emerging trends.

-

Strategic growth opportunities for the existing and new players.

-

Key success factors.

|

Market Study Period

|

2019-2034

|

|

Base Year

|

2024

|

|

Forecast Period

|

2025-2034

|

|

Trend Period

|

2019-2023

|

|

Number of Tables & Figures

|

>100

|

|

Number of Segments Analysed

|

6 (Aircraft Type, Seat Class Type, Component Type, Sales Channel Type, End-User Type, and Region)

|

|

Number of Regions Analysed

|

4 (North America, Europe, Asia-Pacific, Rest of the World)

|

|

Countries Analysed

|

15 (The USA, Canada, Mexico, Germany, France, Italy, The UK, China, Japan, India, Brazil, Saudi Arabia, Rest of Europe, Rest of APAC, and Rest of the World)

|

|

Free Customization Offered

|

10%

|

|

After Sales Support

|

Unlimited

|

|

Report Presentation

|

Complimentary

|

|

Market Dataset

|

Complimentary

|

|

Further Deep Dive & Consulting Services

|

10% Discount

|

Market Segmentation

The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The aircraft seat market is segmented into the following categories:

Aircraft Seat Market, by Aircraft Type

-

Narrow-body aircraft

-

Wide-body aircraft

-

Regional Aircraft

-

Business Jet

Aircraft Seat Market, by Seat Class Type

Aircraft Seat Market, by Component Type

-

Soft Goods

-

Metals

-

Composites

-

Electric

Aircraft Seat Market, by Sales Channel Type

Aircraft Seat Market, by End-User Type

Aircraft Seat Market, by Region

-

North America (Country Analysis: The USA, Canada, and Mexico)

-

Europe (Country Analysis: Germany, France, The UK, Russia, and Rest of Europe)

-

Asia-Pacific (Country Analysis: China, Japan, India, and the Rest of Asia-Pacific

-

Rest of the World (Country Analysis: Brazil, Saudi Arabia, and Others)

Research Methodology

-

This strategic assessment report from Stratview Research provides a comprehensive analysis that reflects today’s aircraft seat market realities and future market possibilities for the forecast period

-

The report segments and analyzes the market in the most detailed manner to provide a panoramic view of the market.

-

The vital data/information provided in the report can play a crucial role for market participants and investors in identifying the low-hanging fruits available in the market and formulating growth strategies to expedite their growth process.

-

This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools.

-

More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data.

-

We conducted more than 15 detailed primary interviews with market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

Competitive Benchmarking

-

Benchmarking of key players on the following parameters: Product portfolio, geographical reach, regional presence, and strategic alliances

Custom Research: Stratview Research offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected]