Market Insights

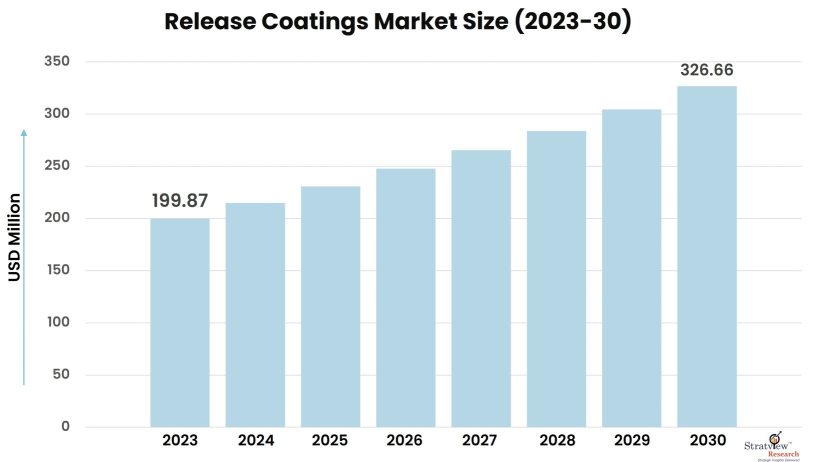

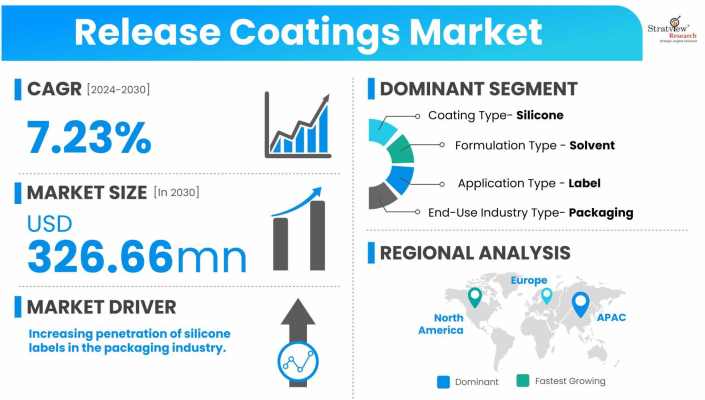

The release coatings market was estimated at USD 199.87 million in 2023 and is likely to grow at a CAGR of 7.23% during 2024-2030 to reach USD 326.66 million in 2030.

Want to know more about the market scope? Register Here

Market Dynamics

Introduction

Release coatings are specialized chemical coatings applied to surfaces to prevent materials from bonding or sticking to them. They create a non-stick layer, making it easier to remove adhesives, resins, or other materials during manufacturing processes. These coatings are widely used in industries like packaging, composites, and textiles to facilitate smooth separation of molded or laminated products. Common materials used for release coatings include silicone, fluoropolymers, and non-silicone compounds. By ensuring easy removal without damaging the product or mold, release coatings enhance efficiency and reduce wear in production processes.

Market Drivers

The major factors driving the growth of the release coatings market are:

- Increasing penetration of silicone labels in the packaging industry.

- Introduction of more stringent standards related to environment and safety.

- Organic growth of the end-use industries, such as transportation, aerospace & defense, and food & bakery.

Want to have a closer look at this market report? Click Here

Segment Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High Growth Opportunity

|

|

Coating Type Analysis

|

Silicone and Non-Silicone

|

Silicone is projected to remain the largest segment in the release coatings market during the forecast period.

|

|

Formulation Type Analysis

|

Solvent-based, Water-based, Emulsions, and Others

|

The solvent is the most commonly used formulation type in release coatings.

|

|

Application Type Analysis

|

Labels, Graphical, Film & Tapes, Hygiene, and Others

|

The label is projected to remain the most dominant application type in the global release coatings market during the forecast period.

|

|

End-Use Industry Type Analysis

|

Transportation, Aerospace & Defense, Medical, Food & Bakery, Packaging, Pulp & Paper, and Others

|

Packaging is expected to remain the largest end-use industry for release coatings during the forecast period.

|

|

Regional Analysis

|

North America, Europe, Asia-Pacific, and Rest of the World

|

Asia-Pacific is expected to remain the largest market during the forecast period.

|

By Coating Type

The release coatings market is segmented based on coating type as silicone and non-silicone. Silicone is projected to remain the largest segment in the release coatings market during the forecast period. It is also projected to grow at a faster rate during the forecast period. Silicone-release coatings are relatively inexpensive and offer better resistance to chemicals, abrasion, and moisture. It is gaining traction in many applications, such as barcode labels, diaper tabs, packaging tapes, and postage stamps.

By Formulation Type

The market is further segmented based on formulation type as solvent-based, water-based, emulsions, and others. The solvent is the most commonly used formulation type in release coatings, however, there would be a continuous shift from solvent-based to water-based, driven by safety, health, and environmental regulations. The usage of different release coating formations varies from region to region. For instance, water-based release coatings dominate North America and Europe, whereas solvent-based dominate Asia-Pacific.

By Application Type

The market is also segmented based on application type as labels, graphical, film & tapes, hygiene, and others. The label is projected to remain the most dominant application type in the global release coatings market during the forecast period, driven by the increasing use of self-adhesive labels in packaging applications. The label segment is also the fastest-growing application type in the release coatings market, driven by an increasing preference in the fast-moving consumer goods and packaging industries.

By End-Use Industry Type

The market is segmented based on end-use industry type as transportation, aerospace & defense, medical, food & bakery, packaging, pulp & paper, and others. Packaging is expected to remain the largest end-use industry for release coatings during the forecast period, whereas medical is expected to witness the fastest growth in the same period. The high use of release coatings in healthcare products and the increasing use of release coatings in surgical and analytical instruments will drive the demand for it in the medical industry.

Regional Insights

Asia-Pacific is expected to remain the largest market during the forecast period. It alone occupied more than 50% of the release coatings market in 2023. The region is also expected to witness the highest growth over the next five years. China, Japan, Korea, India, and Taiwan are acting as the growth engines of the Asia-Pacific release coatings market. There would be a good shift from solvent-based to water-based release coatings in the Asia-Pacific region in the same period.

Know the high-growth countries in this report. Click Here

Research Methodology

- This strategic assessment report from Stratview Research provides a comprehensive analysis that reflects release coatings market realities and future market possibilities for the forecast period.

- The report segments and analyzes the market in the most detailed manner in order to provide a panoramic view of the market.

- The vital data/information provided in the report can play a crucial role for market participants as well as investors in the identification of the low-hanging fruits available in the market as well as to formulate growth strategies to expedite their growth process.

- This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools.

- More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data.

- We conducted more than 15 detailed primary interviews with market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Key Players

Some of the major players in the market are:

- Dow Corning Corporation

- Momentive Performance Materials

- Evonik Industries AG

- Mayzo Inc

- OMNOVA Solutions Inc.

- Shin-Etsu Chemicals Co. Ltd.

- Wacker Chemie AG.

High investment in R&D activities to develop new products meeting unmet market needs, a wide geographical network, and collaboration with customers are some of the key strategies adopted by major companies to gain a competitive edge over others.

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Write to us at sales@stratviewresearch.com

Report Features

This report provides market intelligence in the most comprehensive way. The report structure has been kept such that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market. The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

- COVID-19 impact and its recovery curve

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors.

Market Segmentation

This report studies the market covering a period of 12 years of trend and forecast. The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The release coatings market is segmented in the following ways:

By Coating Type

By Formulation Type

- Solvent-based

- Water-based

- Emulsions

- Others

By Application Type

- Labels

- Graphical

- Film & Tapes

- Hygiene

- Others

By End-Use Industry Type

- Transportation

- Aerospace & Defense

- Medical

- Food & Bakery

- Pulp & Paper

- Packaging

- Others

By Region

- North America (Country Analysis: The USA, Canada, and Mexico)

- Europe (Country Analysis: Germany, France, The UK, Russia, and the Rest of Europe)

- Asia-Pacific (Country Analysis: China, Japan, India, and the Rest of Asia-Pacific)

- Rest of the world (Country Analysis: Brazil, Argentina, and Others)

Click Here, to know the market segmentation details.

Report Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

- Detailed profiling of additional market players (up to 3)

- SWOT analysis of key players (up to 3)

Market Segmentation

- Current market segmentation of any one of the application type by coating type

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Product portfolio, geographical reach, regional presence, and strategic alliances.

Custom Research: Stratview Research offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to sales@stratviewresearch.com.