Market Insights

"The global air cargo containers market size was estimated USD 164.0 million in 2021 & is expected to grow at a healthy CAGR of 7.2% over the next five years to reach USD 269.2 million in 2028."

Want to get a free sample? Register Here

Air cargo container is a solid vessel made up of a storage unit to conform to the inside of an aircraft. The container should be compatible with aircraft equipment and cargo handling systems so that it can be used for air freight transportation.

|

Air Cargo Containers Market Report Overveiw

|

|

Market Size in 2021

|

USD 164 million

|

|

Market Size in 2028

|

USD 269.2 million

|

|

Market Growth (2022-2028)

|

7.2% CAGR

|

|

Base Year of Study

|

2021

|

|

Trend Period

|

2016-2020

|

|

Forecast Period

|

2022-2028

|

Market Dynamics

Market Drivers

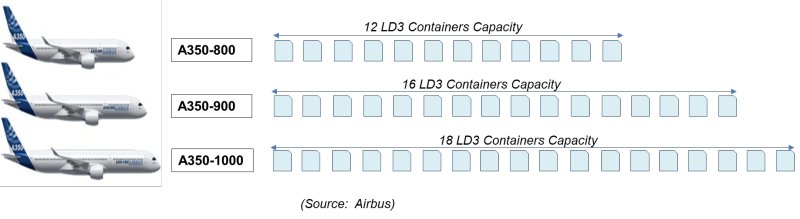

Containers are the most dominant devices in the global Air Cargo Unit Load Devices Market occupying more than three-fourth of the total market share. New variants of aircraft program are coming up with increased cargo containers carrying capacity. For instance, A30-800 aircraft has about 12 LD3 containers capacity whereas its newer variant A350-1000 has 18 LD3 containers capacity.

Increasing Cargo Container Capacity in the New Variants of Wide-Body Aircraft

Some of the major factors driving the growth of the market are-

- Increasing cargo traffic (freight tonne kilometers) owing to growing e-commerce, pharmaceutical and electronic industries

- Development of lightweight and more durable containers

- Advancement in the container technology

Increasing aircraft deliveries and higher demand for wide-body aircraft further elevate the demand for containers in the aviation industry.

COVID-19 Impact

The covid-19 outbreak posed significant challenges across verticals worldwide. It impacted the growth of the air cargo containers market negatively as supply disruptions affected the product availability in the market.

Segment Analysis

|

Segmentations

|

List of Sub-Segments

|

Dominant and Fastest-Growing Segments

|

|

Container-Type Analysis

|

LD-3, LD-6, LD-11, M-1, and Others

|

LD-3 is the most widely preferred container type in both passenger and cargo aircraft. It is expected to remain the largest and fastest-growing container type during the forecast period.

|

|

Material-Type Analysis

|

Composite Container, Metal Container, and Other Containers

|

Metal is expected to remain the largest material type in the market during the forecast period.

|

|

Application-Type Analysis

|

Passenger Aircraft and Freighter Aircraft

|

Passenger aircraft is expected to remain the largest and fastest-growing application type in the market during the forecast period.

|

|

Aircraft-Type Analysis

|

Narrow-Body Aircraft, Wide-Body Aircraft, Very Large Aircraft, and Military Aircraft

|

Wide-body aircraft is expected to remain the largest and fastest-growing aircraft type in the market during the forecast period.

|

|

Regional Analysis

|

North America, Europe, Asia-Pacific, and Rest of the World

|

Asia-pacific is expected to account for the largest market share during the forecast period.

|

By Container Type

"The LD-3 segment accounted for the largest market share."

The market is segmented based on the container type as LD-3, LD-6, LD-11, M-1, and other containers. LD-3 is the most widely preferred container type in both passenger and cargo aircraft. It is expected to remain the largest and fastest-growing container type during the forecast period as well. It is highly compatible with Boeing and Airbus wide-body aircraft, such as B747, B767, B777, B787, DC-10, MD-11, A330, A350XWB, and A380. It can also be interchangeably used by replacing other container types.

By Material Type

"The metal containers segment accounted for the largest market share."

The market is segmented as composite containers, metal containers, and other containers. Metal is expected to remain the largest material type in the market during the forecast period. Easy availability of metal containers, excellent track record, and low cost are some of the major growth drivers of the metal containers.

Composite containers segment is likely to witness the highest growth during the forecast period. Superior flame retardancy, higher corrosion resistance, and higher strength-to-weight ratio at a relatively low weight in comparison with metal containers are the major growth drivers of these versatile materials. Additionally, composite containers do not damage easily; thus, help ULD management companies and airlines to address the biggest challenge of reducing the container repair cost. Composites containers are about 20% to 40% lighter than that of aluminum containers.

By Application Type

"The passenger aircraft segment accounted for the largest market share."

The market is segmented as passenger aircraft and freighter aircraft. Passenger aircraft is expected to remain the largest and fastest-growing application type in the market during the forecast period. Increasing passenger and cargo traffic, introduction of variants of existing aircraft programs (B737 Max, A320neo, and B777x), market entry of new aircraft programs (C919 and MC-21), and rising aircraft fleet size are driving the production of aircraft; therefore, containers used in it. Passenger aircraft usually use its lower hold for carrying containers from one location to another location.

By Aircraft Type

"The wide-body aircraft segment accounted for the largest market share."

The market is segmented as the narrow-body aircraft, wide-body aircraft, very large aircraft, and military aircraft. Wide-body aircraft is expected to remain the largest and fastest-growing aircraft type in the market during the forecast period. High number of containers per aircraft, increasing deliveries of wide-body aircraft, and increasing demand for wide-body aircraft by cargo airlines are some of the major growth drivers of the segment.

Regional Analysis

"Asia-pacific accounted for the largest market share."

The market is segmented into North America, Asia-pacific, Europe and Rest of the world. Asia-pacific is expected to account for the largest market share during the forecast period. Increasing growth of the e-commerce industry in countries like India and China is the prime factor driving the growth of the market in the Asia-pacific region.

Want to get a free sample? Register Here

Key Players

The supply chain of this market comprises raw material suppliers, panel manufacturers, container manufacturers, distributors, ULD management companies, and airline companies.

The key air cargo container manufacturers are-

Development of lightweight containers, a partnership with ULD management companies, and regional expansion are the key strategies adopted by the major players to gain a competitive edge in the market.

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Write to us at [email protected]

Research Methodology

For calculating the market size, our analysts follow either Top-Bottom or Bottom-Top approach or both, depending upon the complexity or availability of the data points. Our reports offer high-quality insights and are the outcome of detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders and validation and triangulation with Stratview Research’s internal database and statistical tools. We leverage multitude of authenticated secondary sources, such as company annual reports, government sources, trade associations, journals, investor presentation, white papers, and articles to gather the data. More than 10 detailed primary interviews with the market players across the value chain in all four regions and industry experts are usually executed to obtain both qualitative and quantitative insights.

Report Features

This report, from Stratview Research, studies the market over the trend period of 2016 to 2020 and the forecast period of 2022 to 2028. The report provides detailed insights into the market dynamics to enable informed business decision making and growth strategy formulation based on the opportunities present in the market.

What Deliverables Will You Get in this Report?

|

Key questions this report answers

|

Relevant contents in the report

|

|

How big is the sales opportunity?

|

In-depth Analysis of the Air Cargo Containers Market

|

|

How lucrative is the future?

|

Market forecast and trend data and emerging trends

|

|

Which regions offer the best sales opportunities?

|

Global, regional, and country-level historical data and forecasts

|

|

Which are the most attractive market segments?

|

Market Segment Analysis and Forecast

|

|

Which are the top players and their market positioning?

|

Competitive landscape analysis, Market share analysis

|

|

How complex is the business environment?

|

Porter’s five forces analysis, PEST analysis, Life cycle analysis

|

|

What are the factors affecting the market?

|

Drivers & challenges

|

|

Will I get the information on my specific requirement?

|

10% free customization

|

The market is segmented in the following categories-

By Aircraft Type:

- LD-3

- LD-6

- LD-11

- M-1

- Others

By Deck Type:

By Material Type:

- Composite Containers

- Metal Containers

- Other Containers

By Application Type:

- Passenger Aircraft

- Freighter Aircraft

By Sales Type:

- Container Manufacturing

- Container Repair

By Aircraft Type:

- Narrow-Body Aircraft

- Wide-Body Aircraft

- Very Large Aircraft

- Military Aircraft

By Region:

- North America (Country Analysis: the USA, Canada, and Mexico)

- Europe (Country Analysis: Germany, France, the UK, Italy, Russia, and Rest of Europe)

- Asia-Pacific (Country Analysis: China, Japan, India, and Rest of Asia-Pacific)

- Rest of the World (Sub-Region Analysis: The Middle East, Latin America, and Others)

Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

- Detailed profiling of additional market players (up to 3 players)

- SWOT analysis of key players (up to 3 players)

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Product portfolio, geographical reach, regional presence, and strategic alliances

Custom Research: Stratview Research offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry at [email protected].

Recent Developments

Oct 2022: Saudia Cargo renews partnership with Unilode

Saudia Cargo has renewed its full-service ULD management partnership with Unilode Aviation Solutions for a further 5 years or until 2028. Over the past five years, Unilode has transitioned the carrier to new, 20-kilo lighter solid door containers. The new agreement will also see the replacement of standard AKE containers with lightweight units from Unilode’s ULD pool.

Oct 2022: Sonoco ThermoSafe Expands Pegasus ULD fleet

Sonoco ThermoSafe has announced a rapid expansion of the Pegasus ULD fleet accessible via direct lease from Sonoco or via the growing global network of strategic partner airlines and freight forwarders. The Pegasus unit load device (ULD) is the only advanced passive aircraft-certified temperature-controlled container (TCC).

Sep 2022: Air Transat renews ULD management agreement with Unilode

Air Transat and Unilode Aviation Solutions have extended their ULD management partnership until 2026. Under the terms of the renewed agreement, Unilode continues to supply, manage, digitalise and repair Air Transat’s lightweight containers and pallets in a pooled ULD management model.

Aug 2022: Lufthansa Cargo now offers Envirotainer’s Releye RAP air cargo container

Lufthansa Cargo is now offering Envirotainer’s Releye RAP temperature-controlled container to firms transporting pharmaceuticals. The RAP version of the Releye container is the largest model of the container and can hold five pallets, compared with the existing 2021 model’s three pallets.