Market Insights

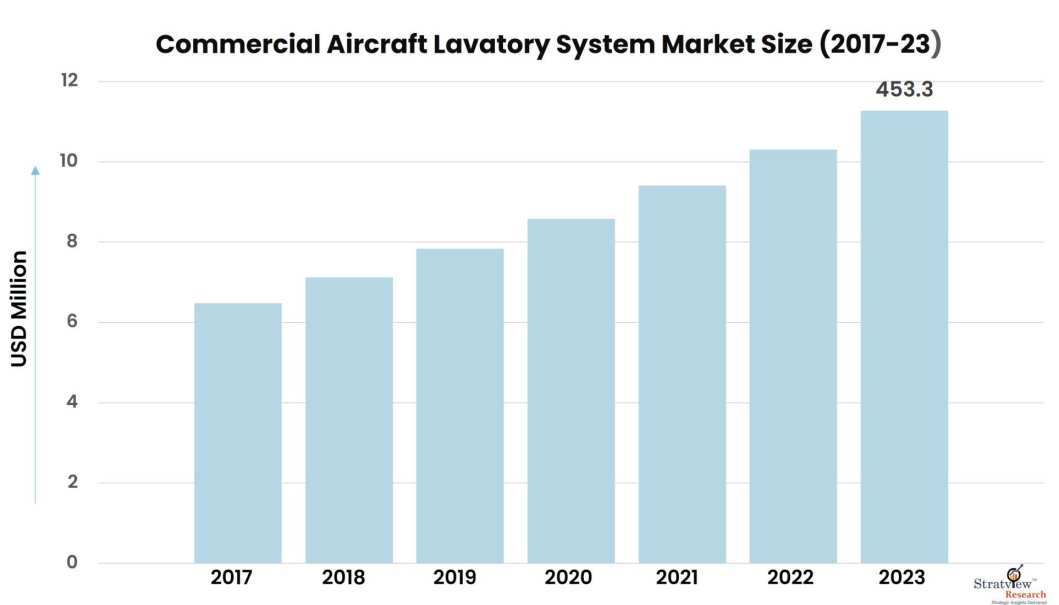

The commercial aircraft lavatory system market offers a healthy growth opportunity over the next five years to reach an estimated value of USD 453.3 million in 2023.

Want to know more about the market scope? Register Here

Market Dynamics

Introduction

Commercial aircraft lavatory systems refer to the integrated restroom facilities on commercial airplanes. These systems are designed to optimize space, provide comfort, and ensure hygiene for passengers during flights. They include features like efficient layouts, accessibility accommodations, and, in modern designs, touchless and eco-friendly technologies.

Market Drivers

The major factors driving the growth of the commercial aircraft lavatory system market are:

- Increasing commercial aircraft deliveries to support rising passenger and freight traffic.

- The introduction of fuel-efficient variants of major aircraft programs (B737 Max and A320neo).

- An advancement in lavatory design.

- Growing aircraft fleet size

Commercial aircraft is the biggest procurer of lavatory systems in the aircraft industry. The lavatory is one of the most important systems in an aircraft cabin interior and must withstand high velocities and abrasion without spilling a drop. It should also be durable and minimize water usage to make the plane lighter for higher fuel efficiency and can withstand frequent usage by the passengers. The lavatory design varies from aircraft to aircraft and airline to airline depending upon their requirements. Lavatory manufacturers have gradually improved their design, making it lightweight using advanced materials. They have also shrunk the lavatory size without sacrificing passenger comfort.

Want to have a closer look at this market report? Click Here.

Key Players

The supply chain of this market comprises raw material manufacturers, toilet manufacturers, lavatory system manufacturers, aircraft OEMs, and airline companies.

The key aerospace OEMs are-

- Boeing

- Airbus

- Bombardier

- Embraer

- ATR

- Mitsubishi Heavy Industries

and key airlines are-

- Lufthansa

- Delta Air

- Air China

- Singapore Airlines.

The key lavatory system manufacturers are-

- Zodiac Aerospace

- Jamco Corporation

- Rockwell Collins, Inc. (B/E Aerospace)

- Diehl Comfort Modules GmbH

- Yokohama Rubbers.

New product development, regional expansion, and long-term contracts are the key strategies adopted by the key players to gain a competitive edge in the market. All the players are developing a compact lavatory system to increase the cabin space for adjusting more seats per aircraft, advanced systems, such as bidet systems, and compact vacuum toilets.

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Write to us at sales@stratviewresearch.com

Segments Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High Growth Opportunity

|

|

Aircraft Type Analysis

|

Narrow-Body Aircraft, Wide-Body Aircraft, and Very Large Body Aircraft

|

Wide-body aircraft is projected to remain the largest aircraft segment of the market during the forecast period.

|

|

Toilet Type Analysis

|

Recirculating Toilet System and Vacuum Toilet System

|

Recirculating toilet systems to vacuum toilet systems in all the next-generation aircraft

|

|

Regional Analysis

|

North America, Europe, Asia-Pacific, and Rest of the World

|

North America is expected to remain the largest market for lavatory systems in the commercial aircraft industry.

|

By Aircraft Type

The commercial aircraft lavatory system market is segmented based on the aircraft type as Narrow-Body Aircraft, Wide-Body Aircraft, and Very Large Body Aircraft. Wide-body aircraft is projected to remain the largest aircraft segment of the market during the forecast period, driven by increasing production rates of B787 and A350XWB, upcoming fuel-efficient variants including B777x and A330neo, and advancement in lavatory technology. Narrow-body aircraft are also likely to witness healthy growth during the forecast period, driven by the introduction of fuel-efficient variants of the best-selling aircraft programs (A320neo and B737 Max).

By Toilet Type

Based on the toilet type, the market is segmented as Reusable Toilet Systems, Recirculating Toilet Systems, and Vacuum Toilet Systems. There has been a continuous shift from recirculating toilet systems to vacuum toilet systems in all the next-generation aircraft. Vacuum flush toilets are considered to be less odor-inducing and usually light in weight which helps in saving fuel by reducing the need to carry large reserves of blue recirculating water and minimizing the risk of Blue Ice due to the spilling of water. Major lavatory manufacturers are developing advanced vacuum toilet-based lavatory systems by making them lighter in weight using composite materials. It will reduce the overall maintenance cost and remove waste rapidly during the flush cycle.

The overall competition is fierce in the commercial aircraft lavatory system market with half a dozen companies extending their offerings in this market space. All of them are trying to develop advanced and modular lavatories meeting OEMs’ and airlines’ needs. In 2013, B/E Aerospace (now a part of Rockwell Collins, Inc.) developed an advanced lavatory system for B737 which is slightly more compact than the standard 3X3 foot size lavatory.

Regional Insights

Based on the regions, North America is expected to remain the largest market for lavatory systems in the commercial aircraft industry. The region is the manufacturing hub of the major commercial aircraft manufacturer, tier players, and raw material suppliers. Boeing is the largest procurer of lavatory systems in the region. Asia-Pacific is likely to be the fastest-growing market during the forecast period, driven by a host of factors including the opening of assembly plants of Boeing and Airbus in China, increasing demand for commercial aircraft to support rising passenger traffic, and indigenous development of commercial and regional aircraft (COMAC C919 and Mitsubishi MRJ).

Know which region offers the best growth opportunities. Register Here

Research Methodology

- This strategic assessment report from Stratview Research provides a comprehensive analysis that reflects commercial aircraft lavatory system market realities and future market possibilities for the forecast period.

- The report segments and analyzes the market in the most detailed manner in order to provide a panoramic view of the market.

- The vital data/information provided in the report can play a crucial role for market participants as well as investors in the identification of the low-hanging fruits available in the market as well as to formulate growth strategies to expedite their growth process.

- This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools.

- More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data.

- We conducted more than 15 detailed primary interviews with market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Report Features

This report provides market intelligence in the most comprehensive way. The report structure has been kept such that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market. The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

- COVID-19 impact and its recovery curve

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors.

Market Segmentation

This report studies the market covering a period of 12 years of trend and forecast. The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The commercial aircraft lavatory system market is segmented into the following categories:

By Aircraft Type

- Narrow-Body Aircraft

- Wide-Body Aircraft

- Very Large Body Aircraft

By Aircraft Program Type

- B737 Aircraft Program

- B777 Aircraft Program

- B787 Aircraft Program

- A320 Family Aircraft Program

- A330/A340 Aircraft Program

- A350XWB Aircraft Program

- A380 Aircraft Program

- B737 Max Aircraft Program

- B777x Aircraft Program

- A320neo Aircraft Program

- A330neo Aircraft Program

- C919 Aircraft Program

- Other Aircraft Programs

By Lavatory Type

- Standard Lavatory

- Modular Lavatory

- Customized Lavatory

By Toilet Type

- Recirculating Toilet System

- Vacuum Toilet System

By Fit Type

By Region

- North America (Country Analysis: the USA, Canada, and Mexico)

- Europe (Country Analysis: Germany, France, the UK, Italy, Spain, and the Rest of Europe)

- Asia-Pacific (Country Analysis: China, Japan, India, and the Rest of Asia-Pacific)

- Rest of the World (Sub-Region Analysis: The Middle East, Latin America, and Others)

Click Here, to learn the market segmentation details.

Report Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

- Detailed profiling of additional market players (up to 3 players)

- SWOT analysis of key players (up to 3 players)

Regional Segmentation

- Current market segmentation of any one of the regions by lavatory type.

Benchmarking of Key Competitors

- Benchmarking of the key players on the following parameters: Product portfolio, geographical reach, regional presence, and strategic alliances.

Custom Research: Stratview Research offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to sales@stratviewresearch.com.