Market Insights

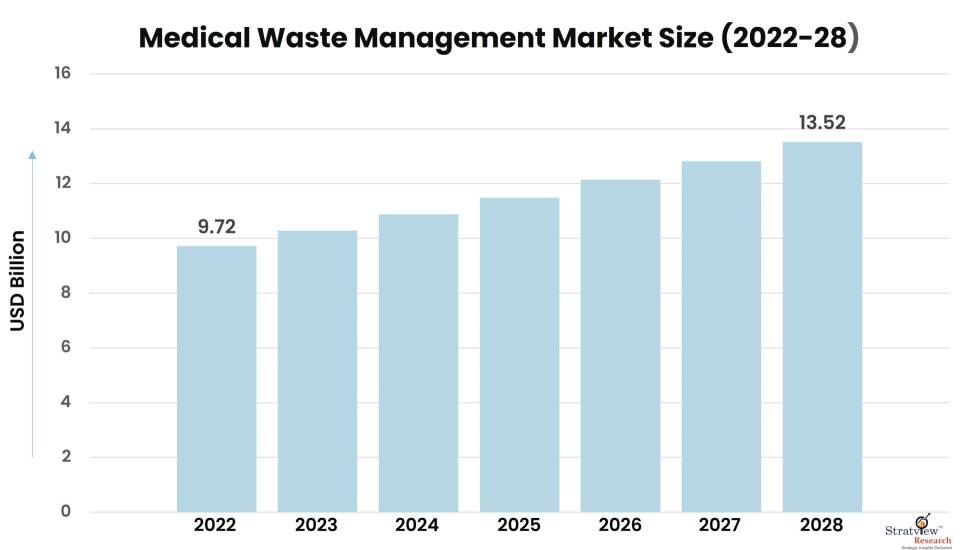

The medical waste management market was estimated at USD 9.72 billion in 2022 and is likely to grow at a CAGR of 5.63% during 2023-2028 to reach USD 13.52 billion in 2028.

Want to know more about the market scope? Register Here

What is medical waste management?

Medical waste management is the proper management and disposition of biomedical wastes to protect the environment, the general public, and workers, especially healthcare and sanitation workers who are at risk of exposure to biomedical waste as an occupational hazard.

Medical waste management of different types, such as hazardous and non-hazardous that are used for onsite and offsite treatments.

COVID-19 Impact

An increase in the number of covid affected people led to an increase in medical waste tremendously. The increase in medical waste positively affected the market and it led to healthy growth in the medical waste management market.

|

Medical Waste Management Market Report Highlights

|

|

Market Size in 2022

|

USD 9.72 billion

|

|

Market Size in 2028

|

USD 13.52 billion

|

|

Market Growth (2023-2028)

|

5.63% CAGR

|

|

Base Year of Study

|

2022

|

|

Trend Period

|

2017-2021

|

|

Forecast Period

|

2023-2028

|

Market Dynamics

The medical waste management market is set to rise in the coming years, due to several factors including -

- The rise in healthcare infrastructure, such as hospitals, laboratories, research centers, blood banks, etc. has spurred an increase in medical waste generation, necessitating demand for medical waste management services.

- The need for effective medical waste management amplifies during outbreaks of infectious diseases, such as Covid 19. A huge volume of medical waste is generated during such pandemics requiring effective waste management services.

- Governments of countries across the globe are implementing multiple large-scale medical waste initiatives. This, as a result, drives the demand for effective waste management.

- The increasing geriatric population, rising focus on healthcare, and increasing healthcare expenditure are also a few reasons behind the growth of medical waste management.

Want to have a closer look at this market report? Click Here

Segments Analysis

By Service Type

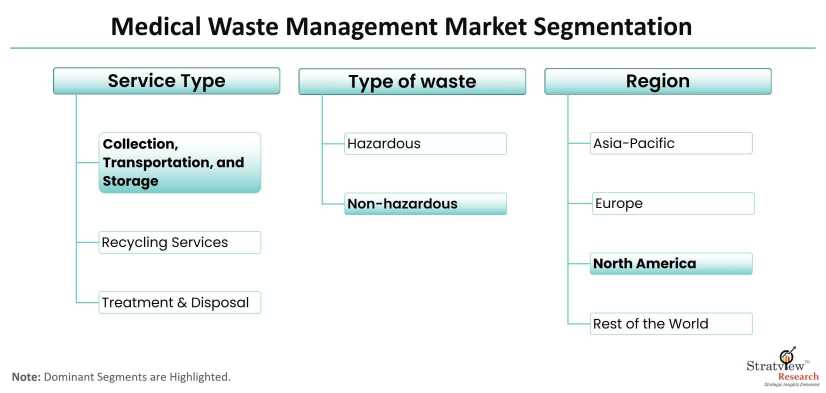

Based on the service type, the market is segmented as collection, transportation, and storage services; treatment & disposal services; and recycling services. The collection, transportation, and storage services segment held the largest share of the market in 2022 and is expected to remain dominant during the forecast period. The growth of the segment is triggered by the presence of stringent regulations for the collection, transportation, and storage of medical waste.

By Type of Waste

Based on the type of waste, the market is segmented as hazardous and non-hazardous. The non-hazardous waste dominates the market, owing to the large quantity of non-hazardous waste generated in healthcare facilities across the globe which creates a significant focus on its effective management.

Regional Insights

In terms of regions, North America is estimated to be the largest as well as the fastest-growing market during the forecast period, with lucrative growth opportunities. The growth of the market is driven by the growing aging population and stringent regulations in this region.

Know the high-growth countries in this report. Register Here

Market Segmentation

This report studies the market covering a period of 12 years of trend and forecast. The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The market is segmented into the following categories.

By Service Type

- Collection, Transportation, and Storage Services

- Treatment & Disposal Service

- Recycling Services

By Type of Waste

By Treatment Site Type

- Onsite Treatment

- Offsite Treatment

By Waste Generator Type

- Hospitals & Diagnostic Laboratories

- Others

By Region

- North America (Country Analysis: the USA, Canada, and Mexico)

- Europe (Country Analysis: Germany, France, the UK, Russia, Spain, and the Rest of Europe)

- Asia-Pacific (Country Analysis: China, Japan, India, South Korea, and the Rest of Asia-Pacific)

- Rest of the World (Sub-Region Analysis: Latin America, the Middle East, and Others)

Know more about various segments of this report. Click Here

Key Players

Some of the major players in the market are-

- Veolia Environnement S.A.

- Suez Environnement S.A.

- Sharps Compliance, Inc.

- Waste Management, Inc.

- Clean Harbors, Inc.

- Remondis Se & Co. Kg

- Republic Services, Inc.

- Biomedical Waste Solutions LLC

- Daniels Sharpsmart Inc.

- Ecomed Services.

Recent News & Developments

AUG 2022: Japan and UNDP Collaborate to Tackle Healthcare Waste Surge- In August 2022, Japan, in partnership with the United Nations Development Programme (UNDP), initiated a project to address the substantial increase in healthcare waste management challenges across Bangladesh, Bhutan, and the Maldives. This new project aims to provide support to national health agencies and other key stakeholders in these countries. The surge in infectious healthcare waste due to the COVID-19 pandemic has overwhelmed waste treatment facilities, making this collaborative effort crucial.

MAR 2022: Entrepreneur Launches Medical Waste Handling Business- In March 2022, Donte Hunt, a local entrepreneur with a family history in waste management, introduced MediWaste, a company specializes in handling biohazardous material on the island. MediWaste will transport, treat, and dispose of medical waste through two purpose-built incinerators. This venture will take over responsibilities previously managed by the Department of Health. MediWaste's clientele will encompass hospitals, pharmacies, labs, clinics, barber shops, tattoo parlors, doctor's offices, rest homes, and veterinary clinics.

FEB 2022: Republic Services to Acquire US Ecology- February 2022 witnessed Republic Services, Inc. (NYSE: RSG) and US Ecology, Inc. (NASDAQ-GS: ECOL) entering into a definitive agreement for Republic Services to purchase all outstanding shares of US Ecology at a cash price of $48 per share, totaling approximately $2.2 billion, including net debt of roughly $0.7 billion. This acquisition solidifies Republic Services' position as a leading environmental solutions company.

DEC 2021: Vigie Covid-19 and Veolia Monitor Omicron in Wastewater- In December 2021, Vigie Covid-19, in collaboration with Veolia and its partners, enhanced its solution to detect the presence of the Omicron variant in wastewater, offering faster detection to track the progress of the pandemic. This innovative approach, alongside clinical data, could become a valuable indicator for pandemic management. The French Ministries of Health and Ecological Transition, along with the National Reference Laboratory (LNR), have initiated efforts to standardize and consolidate surveillance methods for this purpose.

MAY 2021: Stericycle and UPS Join Forces for Medical Waste Logistics- In May 2021, UPS Healthcare embarked on a strategic partnership with Stericycle to manage the reverse logistics of medical waste, including its classification and disposal. This collaboration enables UPS and Stericycle to provide comprehensive logistical support to the healthcare industry. UPS not only delivers crucial healthcare packages but also connects partners with Stericycle to ensure responsible medical waste management. Conversely, Stericycle connects its customers with UPS for healthcare supply-chain support, offering customizable packaging, transportation, and monitoring services.

Research Methodology

This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools.

More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles have been leveraged to gather the data.

We conducted more than 10 detailed primary interviews with the market players across the value chain in all four regions and with industry experts to obtain both qualitative and quantitative insights.

Report Features

This report provides market intelligence in the most comprehensive way. The report structure has been kept such that it offers maximum business value. It provides critical insights into the market dynamics and will enable strategic decision-making for the existing market players as well as those willing to enter the market.

What Deliverables Will You Get in this Report?

|

Key questions this report answers

|

Relevant contents in the report

|

|

How big is the sales opportunity?

|

In-depth Analysis of the Medical Waste Management Market

|

|

How lucrative is the future?

|

Market forecast and trend data and emerging trends

|

|

Which regions offer the best sales opportunities?

|

Global, regional, and country-level historical data and forecasts

|

|

Which are the most attractive market segments?

|

Market segment analysis and Forecast

|

|

Which are the top players and their market positioning?

|

Competitive landscape analysis, Market share analysis

|

|

How complex is the business environment?

|

Porter’s five forces analysis, PEST analysis, Life cycle analysis

|

|

What are the factors affecting the market?

|

Drivers & challenges

|

|

Will I get the information on my specific requirement?

|

10% free customization

|

Report Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

- Detailed profiling of additional market players (up to 3 players)

- SWOT analysis of key players (up to 3 players)

Market Segmentation

- Current market segmentation of any one of the service types by treatment site type.

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Product portfolio, geographical reach, regional presence, and strategic alliances.

Custom Research: Stratview Research offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to sales@stratviewresearch.com.